Endeavour Energy Annual Performance Report - Parliament of New ...

Endeavour Energy Annual Performance Report - Parliament of New ...

Endeavour Energy Annual Performance Report - Parliament of New ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

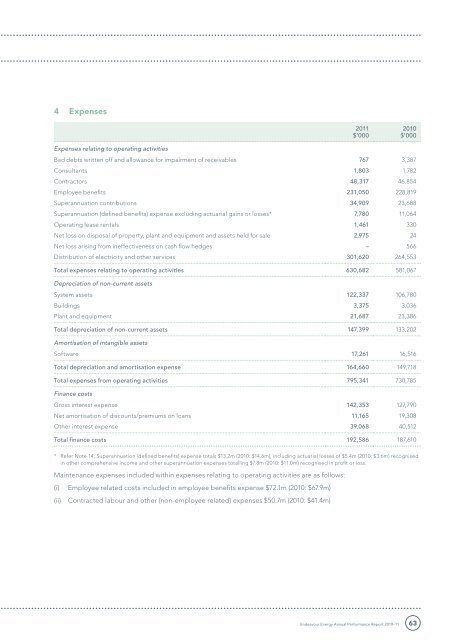

4 Expenses<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

Expenses relating to operating activities<br />

Bad debts written <strong>of</strong>f and allowance for impairment <strong>of</strong> receivables 767 3,387<br />

Consultants 1,803 1,782<br />

Contractors 48,317 46,854<br />

Employee benefits 231,050 228,819<br />

Superannuation contributions 34,909 23,688<br />

Superannuation (defined benefits) expense excluding actuarial gains or losses* 7,780 11,064<br />

Operating lease rentals 1,461 330<br />

Net loss on disposal <strong>of</strong> property, plant and equipment and assets held for sale 2,975 24<br />

Net loss arising from ineffectiveness on cash flow hedges – 566<br />

Distribution <strong>of</strong> electricity and other services 301,620 264,553<br />

Total expenses relating to operating activities 630,682 581,067<br />

Depreciation <strong>of</strong> non-current assets<br />

System assets 122,337 106,780<br />

Buildings 3,375 3,036<br />

Plant and equipment 21,687 23,386<br />

Total depreciation <strong>of</strong> non-current assets 147,399 133,202<br />

Amortisation <strong>of</strong> intangible assets<br />

S<strong>of</strong>tware 17,261 16,516<br />

Total depreciation and amortisation expense 164,660 149,718<br />

Total expenses from operating activities 795,341 730,785<br />

Finance costs<br />

Gross interest expense 142,353 127,790<br />

Net amortisation <strong>of</strong> discounts/premiums on loans 11,165 19,308<br />

Other interest expense 39,068 40,512<br />

Total finance costs 192,586 187,610<br />

* Refer Note 14. Superannuation (defined benefits) expense totals $13.2m (2010: $14.6m), including actuarial losses <strong>of</strong> $5.4m (2010: $3.6m) recognised<br />

in other comprehensive income and other superannuation expenses totalling $7.8m (2010: $11.0m) recognised in pr<strong>of</strong>it or loss.<br />

Maintenance expenses included within expenses relating to operating activities are as follows:<br />

(i)<br />

(ii)<br />

Employee related costs included in employee benefits expense $72.1m (2010: $67.9m)<br />

Contracted labour and other (non-employee related) expenses $50.7m (2010: $41.4m)<br />

<strong>Endeavour</strong> <strong>Energy</strong> <strong>Annual</strong> <strong>Performance</strong> <strong>Report</strong> 2010–11<br />

63