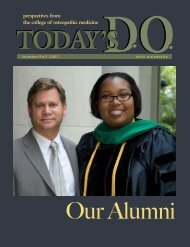

DO - Ohio University College of Osteopathic Medicine

DO - Ohio University College of Osteopathic Medicine

DO - Ohio University College of Osteopathic Medicine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WWhen Mary Kruszewski, D.O. (‘88), began her practice in 1993, she paid $6,000 for insurance. This<br />

year, her total malpractice insurance premiums exceed $107,000. Money, however, has not been<br />

the only cost.<br />

Skyrocketing costs <strong>of</strong> medical malpractice insurance spell ominous warnings for the future <strong>of</strong><br />

health care and physicians’ practices. Kruszewski is feeling it firsthand like so many<br />

physicians, including other graduates <strong>of</strong> <strong>Ohio</strong> <strong>University</strong>’s <strong>College</strong> <strong>of</strong> <strong>Osteopathic</strong><br />

<strong>Medicine</strong>, who are speaking up.<br />

Recent studies, surveys, papers and reports reveal in ever-increasing frequency how<br />

the issue is impacting decisions physicians make, not only about how they treat patients<br />

but where and even if they practice. The field <strong>of</strong> obstetrics remains especially hard hit.<br />

An <strong>Ohio</strong> Department <strong>of</strong> Insurance report issued in February 2005 from a survey <strong>of</strong><br />

<strong>Ohio</strong> physicians concluded that the rising cost <strong>of</strong> malpractice insurance has significantly<br />

impacted physician behavior and their future plans in the state. The survey included<br />

answers from 1,359 physicians from across <strong>Ohio</strong>, 10 percent <strong>of</strong> whom were osteopathic<br />

physicians.<br />

Nearly four out <strong>of</strong> 10 respondents surveyed say they have retired or plan to retire by<br />

2008 because <strong>of</strong> rising insurance expenses. “This finding is all the more sobering since<br />

just 9 percent <strong>of</strong> the respondents were over the age <strong>of</strong> 64,” the report says.<br />

Among osteopathic physicians, 11 percent say they planned to retire during 2005, and<br />

15 percent say they planned to seek employment outside patient care.<br />

Kruszewski, who practices in Du Bois, Pa.–a rural town in a state considered in crisis because <strong>of</strong><br />

high premiums–has been affiliated with several insurance companies and named a defendant in<br />

lawsuits. “I’ve gone to two trials, both <strong>of</strong> which turned out in my favor,” she says. But her hefty<br />

insurance premiums have affected how she practices, including ordering more tests, but as <strong>of</strong><br />

yet, she has not considered moving her practice or leaving patient care. “I’m not ready to<br />

give it up because I like what I do,” she says.<br />

A paper issued by the <strong>University</strong> <strong>of</strong> Michigan Health System warned that increasing<br />

premiums are forcing many physicians to rethink how they practice, from reducing<br />

staff to quitting patient care altogether.<br />

“The hard cost <strong>of</strong> malpractice premiums is beginning to lead providers to drop or reduce<br />

obstetrical services,” says Scott B. Ransom, D.O., senior author <strong>of</strong> a research paper published<br />

in the June 2005 issue <strong>of</strong> the journal Obstetrics & Gynecology. “Our study shows that there<br />

is legitimate reason for concern about patients’ access to obstetric care and prenatal care in<br />

the future,” he warned.<br />

“It is frustrating,” says Michelle Wright, D.O. (‘95), who moved her obstetrics practice<br />

from Athens in rural <strong>Ohio</strong> to Sharon, Pa., for a variety <strong>of</strong> reasons, not the<br />

least <strong>of</strong> which was yearly double-digit rate increases for her malpractice<br />

insurance. Before relocating from Athens, Wright saw her premiums<br />

jump from $18,000 to $65,000 in just two years.<br />

“I can’t work without it; it’s a necessary evil.”<br />

The primary breadwinner in her household, Wright took a job at a federally funded clinic in<br />

western Pennsylvania mainly for economic reasons. Although Pennsylvania ranks close to<br />

<strong>Ohio</strong> for some <strong>of</strong> the highest medical malpractice insurance rates in the country, her clinic is<br />

covered under the federal court and tort system, keeping Wright’s insurance rates–and<br />

any possible malpractice claims–somewhat moderated. With family ties and roots in western<br />

Pennsylvania, the pr<strong>of</strong>essional change made more sense.<br />

Did malpractice insurance rates drive her out? Certainly in part. “Leaving Athens<br />

was difficult, but I had to find a stable climate and not worry about a paycheck at the end<br />

<strong>of</strong> the day,” Wright says.<br />

summer 2006 15