Annual Report and Accounts 2006 - Optos

Annual Report and Accounts 2006 - Optos

Annual Report and Accounts 2006 - Optos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

continued<br />

No other features of options granted were incorporated into the measurement of fair value.<br />

Other options <strong>and</strong> warrants falling outside the scope of IFRS2 comprise:<br />

A warrant instrument dated 17 December 1999 which entitled TBCC Funding Trust II to subscribe for up to 114,476 ordinary shares at a price of £1.30 per share in the<br />

event of a sale of the Company or its admission to a recognised stock exchange prior to 22 December <strong>2006</strong>. This warrant was not exercised during the year <strong>and</strong> has<br />

since lapsed.<br />

Two option agreements dated 17 May 2002, under which Brewin Dolphin Securities Limited had options to subscribe for up to 10,500 ordinary shares at a price of £0.80 per<br />

share in the event of a sale of the Company or its admission to a recognised stock exchange prior to 17 May 2009. These options were exercised during the year.<br />

An option <strong>and</strong> warrant agreement dated 26 July 2002, under which Amadeus II ‘‘A’’, Amadeus II ‘‘B’’, Amadeus II ‘‘C’’, Amadeus II Affiliates LLP <strong>and</strong> Amadeus II ‘‘D’’ GmbH<br />

& Co. KG had the right to subscribe for 557,797 ordinary shares at a price of £1.00 per share upon the earlier of 31 December 2007 <strong>and</strong> either a sale of the Company or its<br />

admission to a recognised stock exchange. This option <strong>and</strong> warrant agreement was exercised during the year.<br />

21 RELATED PARTY TRANSACTIONS<br />

During the year to 30 September <strong>2006</strong>, purchases totalling $92,472 (2005: $391,000) at normal market prices were made by Group companies from Crombie Anderson<br />

Limited, of which the D C Anderson is a Director <strong>and</strong> controlling shareholder, of which $Nil was outst<strong>and</strong>ing at 30 September <strong>2006</strong> (2005: $19,000). No guarantees have<br />

been given or received. No provisions have been made for doubtful debts in respect of the amounts owed by related parties.<br />

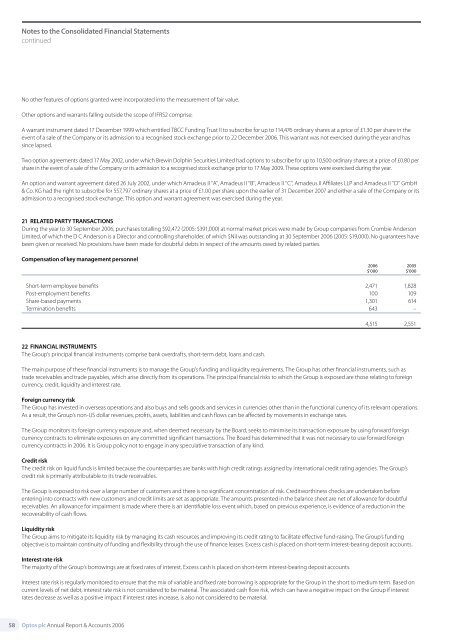

Compensation of key management personnel<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Short-term employee benefits 2,471 1,828<br />

Post-employment benefits 100 109<br />

Share-based payments 1,301 614<br />

Termination benefits 643 –<br />

4,515 2,551<br />

22 FINANCIAL INSTRUMENTS<br />

The Group’s principal financial instruments comprise bank overdrafts, short-term debt, loans <strong>and</strong> cash.<br />

The main purpose of these financial instruments is to manage the Group’s funding <strong>and</strong> liquidity requirements. The Group has other financial instruments, such as<br />

trade receivables <strong>and</strong> trade payables, which arise directly from its operations. The principal financial risks to which the Group is exposed are those relating to foreign<br />

currency, credit, liquidity <strong>and</strong> interest rate.<br />

Foreign currency risk<br />

The Group has invested in overseas operations <strong>and</strong> also buys <strong>and</strong> sells goods <strong>and</strong> services in currencies other than in the functional currency of its relevant operations.<br />

As a result, the Group’s non-US dollar revenues, profits, assets, liabilities <strong>and</strong> cash flows can be affected by movements in exchange rates.<br />

The Group monitors its foreign currency exposure <strong>and</strong>, when deemed necessary by the Board, seeks to minimise its transaction exposure by using forward foreign<br />

currency contracts to eliminate exposures on any committed significant transactions. The Board has determined that it was not necessary to use forward foreign<br />

currency contracts in <strong>2006</strong>. It is Group policy not to engage in any speculative transaction of any kind.<br />

Credit risk<br />

The credit risk on liquid funds is limited because the counterparties are banks with high credit ratings assigned by international credit rating agencies. The Group’s<br />

credit risk is primarily attributable to its trade receivables.<br />

The Group is exposed to risk over a large number of customers <strong>and</strong> there is no significant concentration of risk. Creditworthiness checks are undertaken before<br />

entering into contracts with new customers <strong>and</strong> credit limits are set as appropriate. The amounts presented in the balance sheet are net of allowance for doubtful<br />

receivables. An allowance for impairment is made where there is an identifiable loss event which, based on previous experience, is evidence of a reduction in the<br />

recoverability of cash flows.<br />

Liquidity risk<br />

The Group aims to mitigate its liquidity risk by managing its cash resources <strong>and</strong> improving its credit rating to facilitate effective fund-raising. The Group’s funding<br />

objective is to maintain continuity of funding <strong>and</strong> flexibility through the use of finance leases. Excess cash is placed on short-term interest-bearing deposit accounts.<br />

Interest rate risk<br />

The majority of the Group’s borrowings are at fixed rates of interest. Excess cash is placed on short-term interest-bearing deposit accounts.<br />

Interest rate risk is regularly monitored to ensure that the mix of variable <strong>and</strong> fixed rate borrowing is appropriate for the Group in the short to medium term. Based on<br />

current levels of net debt, interest rate risk is not considered to be material. The associated cash flow risk, which can have a negative impact on the Group if interest<br />

rates decrease as well as a positive impact if interest rates increase, is also not considered to be material.<br />

58<br />

<strong>Optos</strong> plc <strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2006</strong>