Annual Report and Accounts 2006 - Optos

Annual Report and Accounts 2006 - Optos

Annual Report and Accounts 2006 - Optos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

continued<br />

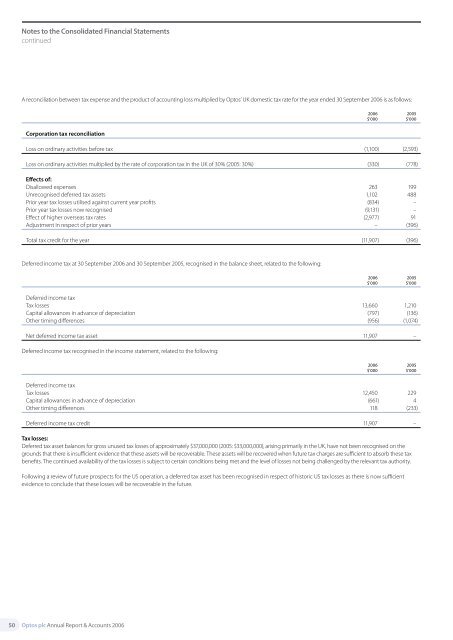

A reconciliation between tax expense <strong>and</strong> the product of accounting loss multiplied by <strong>Optos</strong>’ UK domestic tax rate for the year ended 30 September <strong>2006</strong> is as follows:<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Corporation tax reconciliation<br />

Loss on ordinary activities before tax (1,100) (2,593)<br />

Loss on ordinary activities multiplied by the rate of corporation tax in the UK of 30% (2005: 30%) (330) (778)<br />

Effects of:<br />

Disallowed expenses 263 199<br />

Unrecognised deferred tax assets 1,102 488<br />

Prior year tax losses utilised against current year profits (834) –<br />

Prior year tax losses now recognised (9,131) –<br />

Effect of higher overseas tax rates (2,977) 91<br />

Adjustment In respect of prior years – (396)<br />

Total tax credit for the year (11,907) (396)<br />

Deferred income tax at 30 September <strong>2006</strong> <strong>and</strong> 30 September 2005, recognised in the balance sheet, related to the following:<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Deferred income tax<br />

Tax losses 13,660 1,210<br />

Capital allowances in advance of depreciation (797) (136)<br />

Other timing differences (956) (1,074)<br />

Net deferred income tax asset 11,907 –<br />

Deferred income tax recognised in the income statement, related to the following:<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Deferred income tax<br />

Tax losses 12,450 229<br />

Capital allowances in advance of depreciation (661) 4<br />

Other timing differences 118 (233)<br />

Deferred income tax credit 11,907 –<br />

Tax losses:<br />

Deferred tax asset balances for gross unused tax losses of approximately $37,000,000 (2005: $33,000,000), arising primarily in the UK, have not been recognised on the<br />

grounds that there is insufficient evidence that these assets will be recoverable. These assets will be recovered when future tax charges are sufficient to absorb these tax<br />

benefits. The continued availability of the tax losses is subject to certain conditions being met <strong>and</strong> the level of losses not being challenged by the relevant tax authority.<br />

Following a review of future prospects for the US operation, a deferred tax asset has been recognised in respect of historic US tax losses as there is now sufficient<br />

evidence to conclude that these losses will be recoverable in the future.<br />

50<br />

<strong>Optos</strong> plc <strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2006</strong>