Annual Report and Accounts 2006 - Optos

Annual Report and Accounts 2006 - Optos

Annual Report and Accounts 2006 - Optos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

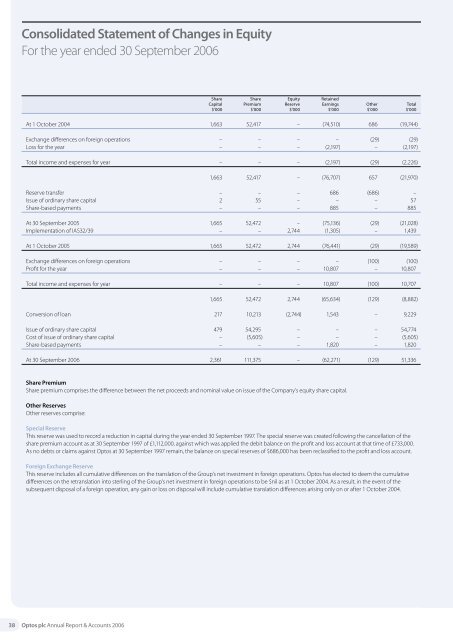

Consolidated Statement of Changes in Equity<br />

For the year ended 30 September <strong>2006</strong><br />

Share Share Equity Retained<br />

Capital Premium Reserve Earnings Other Total<br />

$’000 $’000 $’000 $’000 $’000 $’000<br />

At 1 October 2004 1,663 52,417 – (74,510) 686 (19,744)<br />

Exchange differences on foreign operations – – – – (29) (29)<br />

Loss for the year – – – (2,197) – (2,197)<br />

Total income <strong>and</strong> expenses for year – – – (2,197) (29) (2,226)<br />

1,663 52,417 – (76,707) 657 (21,970)<br />

Reserve transfer – – – 686 (686) –<br />

Issue of ordinary share capital 2 55 – – – 57<br />

Share-based payments – – – 885 – 885<br />

At 30 September 2005 1,665 52,472 – (75,136) (29) (21,028)<br />

Implementation of IAS32/39 – – 2,744 (1,305) – 1,439<br />

At 1 October 2005 1,665 52,472 2,744 (76,441) (29) (19,589)<br />

Exchange differences on foreign operations – – – – (100) (100)<br />

Profit for the year – – – 10,807 – 10,807<br />

Total income <strong>and</strong> expenses for year – – – 10,807 (100) 10,707<br />

1,665 52,472 2,744 (65,634) (129) (8,882)<br />

Conversion of loan 217 10,213 (2,744) 1,543 – 9,229<br />

Issue of ordinary share capital 479 54,295 – – – 54,774<br />

Cost of issue of ordinary share capital – (5,605) – – – (5,605)<br />

Share-based payments – – – 1,820 – 1,820<br />

At 30 September <strong>2006</strong> 2,361 111,375 – (62,271) (129) 51,336<br />

Share Premium<br />

Share premium comprises the difference between the net proceeds <strong>and</strong> nominal value on issue of the Company’s equity share capital.<br />

Other Reserves<br />

Other reserves comprise:<br />

Special Reserve<br />

This reserve was used to record a reduction in capital during the year ended 30 September 1997. The special reserve was created following the cancellation of the<br />

share premium account as at 30 September 1997 of £1,112,000, against which was applied the debit balance on the profit <strong>and</strong> loss account at that time of £733,000.<br />

As no debts or claims against <strong>Optos</strong> at 30 September 1997 remain, the balance on special reserves of $686,000 has been reclassified to the profit <strong>and</strong> loss account.<br />

Foreign Exchange Reserve<br />

This reserve includes all cumulative differences on the translation of the Group’s net investment in foreign operations. <strong>Optos</strong> has elected to deem the cumulative<br />

differences on the retranslation into sterling of the Group’s net investment in foreign operations to be $nil as at 1 October 2004. As a result, in the event of the<br />

subsequent disposal of a foreign operation, any gain or loss on disposal will include cumulative translation differences arising only on or after 1 October 2004.<br />

38<br />

<strong>Optos</strong> plc <strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2006</strong>