Ottawa ON K1A 0E4

Ottawa ON K1A 0E4

Ottawa ON K1A 0E4

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

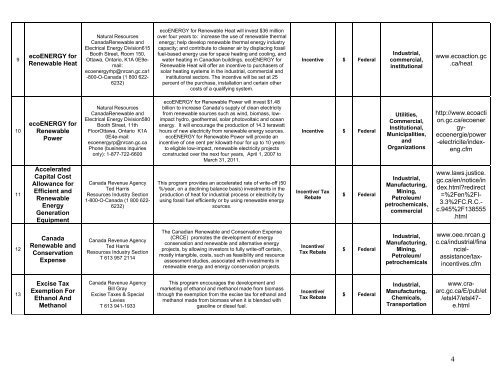

9<br />

ecoENERGY for<br />

Renewable Heat<br />

Natural Resources<br />

CanadaRenewable and<br />

Electrical Energy Division615<br />

Booth Street, Room 150,<br />

<strong>Ottawa</strong>, Ontario, <strong>K1A</strong> 0E9email:<br />

ecoenergyrhp@nrcan.gc.ca1<br />

-800-O-Canada (1 800 622-<br />

6232)<br />

ecoENERGY for Renewable Heat will invest $36 million<br />

over four years to: increase the use of renewable thermal<br />

energy; help develop renewable thermal energy industry<br />

capacity; and contribute to cleaner air by displacing fossil<br />

fuel-based energy use for space heating and cooling, and<br />

water heating in Canadian buildings. ecoENERGY for<br />

Renewable Heat will offer an incentive to purchasers of<br />

solar heating systems in the industrial, commercial and<br />

institutional sectors. The incentive will be set at 25<br />

percent of the purchase, installation and certain other<br />

costs of a qualifying system.<br />

Incentive $ Federal<br />

Industrial,<br />

commercial,<br />

institutional<br />

www.ecoaction.gc<br />

.ca/heat<br />

10<br />

11<br />

ecoENERGY for<br />

Renewable<br />

Power<br />

Accelerated<br />

Capital Cost<br />

Allowance for<br />

Efficient and<br />

Renewable<br />

Energy<br />

Generation<br />

Equipment<br />

Natural Resources<br />

CanadaRenewable and<br />

Electrical Energy Division580<br />

Booth Street, 11th<br />

Floor<strong>Ottawa</strong>, Ontario <strong>K1A</strong><br />

<strong>0E4</strong>e-mail:<br />

ecoenergyrp@nrcan.gc.ca<br />

Phone (business inquiries<br />

only): 1-877-722-6600<br />

Canada Revenue Agency<br />

Ted Harris<br />

Resources Industry Section<br />

1-800-O-Canada (1 800 622-<br />

6232)<br />

ecoENERGY for Renewable Power will invest $1.48<br />

billion to increase Canada’s supply of clean electricity<br />

from renewable sources such as wind, biomass, lowimpact<br />

hydro, geothermal, solar photovoltaic and ocean<br />

energy. It will encourage the production of 14.3 terawatt<br />

hours of new electricity from renewable energy sources.<br />

ecoENERGY for Renewable Power will provide an<br />

incentive of one cent per kilowatt-hour for up to 10 years<br />

to eligible low-impact, renewable electricity projects<br />

constructed over the next four years, April 1, 2007 to<br />

March 31, 2011.<br />

This program provides an accelerated rate of write-off (50<br />

%/year, on a declining balance basis) investments in the<br />

production of heat for industrial process or electricity by<br />

using fossil fuel efficiently or by using renewable energy<br />

sources.<br />

Incentive $ Federal<br />

Incentive/ Tax<br />

Rebate<br />

$ Federal<br />

Utilities,<br />

Commercial,<br />

Institutional,<br />

Municipalities,<br />

and<br />

Organizations<br />

Industrial,<br />

Manufacturing,<br />

Mining,<br />

Petroleum/<br />

petrochemicals,<br />

commercial<br />

http://www.ecoacti<br />

on.gc.ca/ecoener<br />

gyecoenergie/power<br />

-electricite/indexeng.cfm<br />

www.laws.justice.<br />

gc.ca/en/notice/in<br />

dex.html?redirect<br />

=%2Fen%2FI-<br />

3.3%2FC.R.C.-<br />

c.945%2F138555<br />

.html<br />

12<br />

Canada<br />

Renewable and<br />

Conservation<br />

Expense<br />

Canada Revenue Agency<br />

Ted Harris<br />

Resources Industry Section<br />

T 613 957 2114<br />

The Canadian Renewable and Conservation Expense<br />

(CRCE) promotes the development of energy<br />

conservation and renewable and alternative energy<br />

projects, by allowing investors to fully write-off certain,<br />

mostly intangible, costs, such as feasibility and resource<br />

assessment studies, associated with investments in<br />

renewable energy and energy conservation projects.<br />

Incentive/<br />

Tax Rebate<br />

$ Federal<br />

Industrial,<br />

Manufacturing,<br />

Mining,<br />

Petroleum/<br />

petrochemicals<br />

www.oee.nrcan.g<br />

c.ca/industrial/fina<br />

ncialassistance/taxincentives.cfm<br />

13<br />

Excise Tax<br />

Exemption For<br />

Ethanol And<br />

Methanol<br />

Canada Revenue Agency<br />

Bill Gray<br />

Excise Taxes & Special<br />

Levies<br />

T 613 941-1933<br />

This program encourages the development and<br />

marketing of ethanol and methanol made from biomass<br />

through the exemption from the excise tax for ethanol and<br />

methanol made from biomass when it is blended with<br />

gasoline or diesel fuel.<br />

Incentive/<br />

Tax Rebate<br />

$ Federal<br />

Industrial,<br />

Manufacturing,<br />

Chemicals,<br />

Transportation<br />

www.craarc.gc.ca/E/pub/et<br />

/etsl47/etsl47-<br />

e.html<br />

4