Annual report (20-F) - Ono

Annual report (20-F) - Ono

Annual report (20-F) - Ono

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

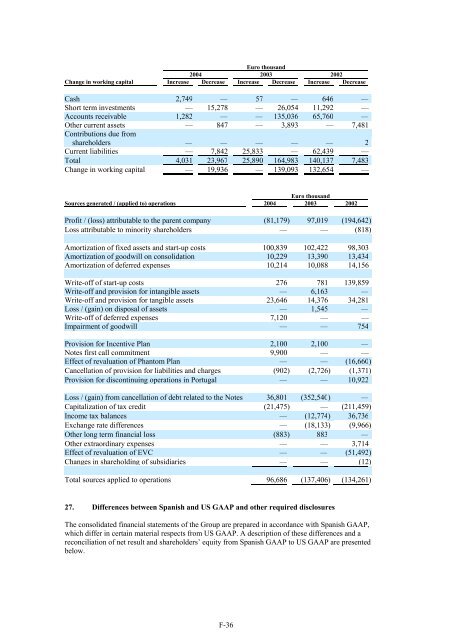

Euro thousand<br />

<strong>20</strong>04 <strong>20</strong>03 <strong>20</strong>02<br />

Change in working capital Increase Decrease Increase Decrease Increase Decrease<br />

Cash 2,749 — 57 — 646 —<br />

Short term investments — 15,278 — 26,054 11,292 —<br />

Accounts receivable 1,282 — — 135,036 65,760 —<br />

Other current assets — 847 — 3,893 — 7,481<br />

Contributions due from<br />

shareholders — — — — — 2<br />

Current liabilities — 7,842 25,833 — 62,439 —<br />

Total 4,031 23,967 25,890 164,983 140,137 7,483<br />

Change in working capital — 19,936 — 139,093 132,654 —<br />

Euro thousand<br />

Sources generated / (applied to) operations <strong>20</strong>04 <strong>20</strong>03 <strong>20</strong>02<br />

Profit / (loss) attributable to the parent company (81,179) 97,019 (194,642)<br />

Loss attributable to minority shareholders — — (818)<br />

Amortization of fixed assets and start-up costs 100,839 102,422 98,303<br />

Amortization of goodwill on consolidation 10,229 13,390 13,434<br />

Amortization of deferred expenses 10,214 10,088 14,156<br />

Write-off of start-up costs 276 781 139,859<br />

Write-off and provision for intangible assets — 6,163 —<br />

Write-off and provision for tangible assets 23,646 14,376 34,281<br />

Loss / (gain) on disposal of assets — 1,545 —<br />

Write-off of deferred expenses 7,1<strong>20</strong> — —<br />

Impairment of goodwill — — 754<br />

Provision for Incentive Plan 2,100 2,100 —<br />

Notes first call commitment 9,900 — —<br />

Effect of revaluation of Phantom Plan — — (16,660)<br />

Cancellation of provision for liabilities and charges (902) (2,726) (1,371)<br />

Provision for discontinuing operations in Portugal — — 10,922<br />

Loss / (gain) from cancellation of debt related to the Notes 36,801 (352,540) —<br />

Capitalization of tax credit (21,475) — (211,459)<br />

Income tax balances — (12,774) 36,736<br />

Exchange rate differences — (18,133) (9,966)<br />

Other long term financial loss (883) 883 —<br />

Other extraordinary expenses — — 3,714<br />

Effect of revaluation of EVC — — (51,492)<br />

Changes in shareholding of subsidiaries — — (12)<br />

Total sources applied to operations 96,686 (137,406) (134,261)<br />

27. Differences between Spanish and US GAAP and other required disclosures<br />

The consolidated financial statements of the Group are prepared in accordance with Spanish GAAP,<br />

which differ in certain material respects from US GAAP. A description of these differences and a<br />

reconciliation of net result and shareholders’ equity from Spanish GAAP to US GAAP are presented<br />

below.<br />

F-36