Annual report (20-F) - Ono

Annual report (20-F) - Ono

Annual report (20-F) - Ono

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group only records profits realized at the year end, while foreseeable risks and potential losses are<br />

recorded as soon as they are identified.<br />

Revenues are derived, mainly, from the sale of telecommunications and cable television services to<br />

residential and business customers and from network interconnection with other operators. Such<br />

revenues are recognized only when persuasive evidence of a sales arrangement exists, the related services<br />

have been rendered, the sales price to the customer is fixed and determinable and collectibility is<br />

reasonably assured.<br />

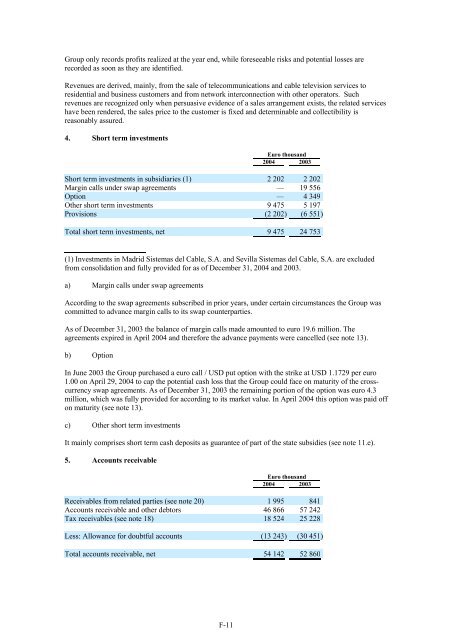

4. Short term investments<br />

Euro thousand<br />

<strong>20</strong>04 <strong>20</strong>03<br />

Short term investments in subsidiaries (1) 2 <strong>20</strong>2 2 <strong>20</strong>2<br />

Margin calls under swap agreements — 19 556<br />

Option — 4 349<br />

Other short term investments 9 475 5 197<br />

Provisions (2 <strong>20</strong>2) (6 551)<br />

Total short term investments, net 9 475 24 753<br />

(1) Investments in Madrid Sistemas del Cable, S.A. and Sevilla Sistemas del Cable, S.A. are excluded<br />

from consolidation and fully provided for as of December 31, <strong>20</strong>04 and <strong>20</strong>03.<br />

a) Margin calls under swap agreements<br />

According to the swap agreements subscribed in prior years, under certain circumstances the Group was<br />

committed to advance margin calls to its swap counterparties.<br />

As of December 31, <strong>20</strong>03 the balance of margin calls made amounted to euro 19.6 million. The<br />

agreements expired in April <strong>20</strong>04 and therefore the advance payments were cancelled (see note 13).<br />

b) Option<br />

In June <strong>20</strong>03 the Group purchased a euro call / USD put option with the strike at USD 1.1729 per euro<br />

1.00 on April 29, <strong>20</strong>04 to cap the potential cash loss that the Group could face on maturity of the crosscurrency<br />

swap agreements. As of December 31, <strong>20</strong>03 the remaining portion of the option was euro 4.3<br />

million, which was fully provided for according to its market value. In April <strong>20</strong>04 this option was paid off<br />

on maturity (see note 13).<br />

c) Other short term investments<br />

It mainly comprises short term cash deposits as guarantee of part of the state subsidies (see note 11.e).<br />

5. Accounts receivable<br />

Euro thousand<br />

<strong>20</strong>04 <strong>20</strong>03<br />

Receivables from related parties (see note <strong>20</strong>) 1 995 841<br />

Accounts receivable and other debtors 46 866 57 242<br />

Tax receivables (see note 18) 18 524 25 228<br />

Less: Allowance for doubtful accounts (13 243) (30 451)<br />

Total accounts receivable, net 54 142 52 860<br />

F-11