publication order form - New York State Museum

publication order form - New York State Museum

publication order form - New York State Museum

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

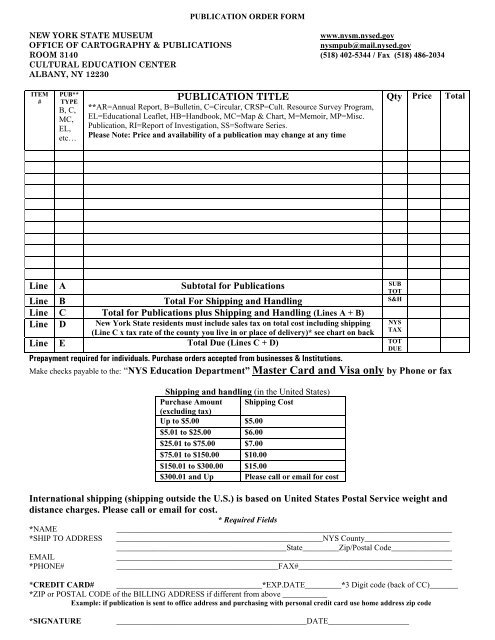

PUBLICATION ORDER FORM<br />

NEW YORK STATE MUSEUM<br />

www.nysm.nysed.gov<br />

OFFICE OF CARTOGRAPHY & PUBLICATIONS<br />

nysmpub@mail.nysed.gov<br />

ROOM 3140 (518) 402-5344 / Fax (518) 486-2034<br />

CULTURAL EDUCATION CENTER<br />

ALBANY, NY 12230<br />

ITEM<br />

#<br />

PUB**<br />

TYPE<br />

B, C,<br />

MC,<br />

EL,<br />

etc…<br />

PUBLICATION TITLE<br />

**AR=Annual Report, B=Bulletin, C=Circular, CRSP=Cult. Resource Survey Program,<br />

EL=Educational Leaflet, HB=Handbook, MC=Map & Chart, M=Memoir, MP=Misc.<br />

Publication, RI=Report of Investigation, SS=Software Series.<br />

Please Note: Price and availability of a <strong>publication</strong> may change at any time<br />

Qty Price Total<br />

Line A Subtotal for Publications<br />

SUB<br />

TOT<br />

Line B Total For Shipping and Handling<br />

S&H<br />

Line C Total for Publications plus Shipping and Handling (Lines A + B)<br />

Line D <strong>New</strong> <strong>York</strong> <strong>State</strong> residents must include sales tax on total cost including shipping<br />

(Line C x tax rate of the county you live in or place of delivery)* see chart on back<br />

Line E Total Due (Lines C + D) TOT<br />

DUE<br />

Prepayment required for individuals. Purchase <strong>order</strong>s accepted from businesses & Institutions.<br />

Make checks payable to the: “NYS Education Department” Master Card and Visa only by Phone or fax<br />

Shipping and handling (in the United <strong>State</strong>s)<br />

Purchase Amount Shipping Cost<br />

(excluding tax)<br />

Up to $5.00 $5.00<br />

$5.01 to $25.00 $6.00<br />

$25.01 to $75.00 $7.00<br />

$75.01 to $150.00 $10.00<br />

$150.01 to $300.00 $15.00<br />

$300.01 and Up Please call or email for cost<br />

International shipping (shipping outside the U.S.) is based on United <strong>State</strong>s Postal Service weight and<br />

distance charges. Please call or email for cost.<br />

* Required Fields<br />

*NAME<br />

___________________________________________________________________________________<br />

*SHIP TO ADDRESS ___________________________________________________NYS County_____________________<br />

__________________________________________<strong>State</strong>_________Zip/Postal Code_______________<br />

EMAIL<br />

___________________________________________________________________________________<br />

*PHONE#<br />

________________________________________FAX#______________________________________<br />

*CREDIT CARD# ____________________________________*EXP.DATE_________*3 Digit code (back of CC)_______<br />

*ZIP or POSTAL CODE of the BILLING ADDRESS if different from above ___________<br />

Example: if <strong>publication</strong> is sent to office address and purchasing with personal credit card use home address zip code<br />

NYS<br />

TAX<br />

*SIGNATURE<br />

_______________________________________________DATE____________________

The following list includes the state tax rate combined<br />

with any county and city sales tax currently in effect<br />

and the reporting codes used on sales tax returns.<br />

Jurisdictions whose rates or codes have changed from<br />

the previous versions are noted in boldface italics.<br />

<strong>New</strong> <strong>York</strong> City comprises five counties. These counties<br />

are also boroughs whose names are more widely<br />

known. The counties, with borough names shown in<br />

parentheses, are Bronx (Bronx), Kings (Brooklyn),<br />

<strong>New</strong> <strong>York</strong> (Manhattan), Queens (Queens), and<br />

Richmond (<strong>State</strong>n Island).<br />

<strong>New</strong> <strong>York</strong> <strong>State</strong> Sales and Use Tax<br />

Rates by Jurisdiction<br />

Effective August 1, 2009<br />

Publication 718<br />

(7/09)<br />

Reporting codes, rather than ZIP codes, should be<br />

used for identifying customer location. (Postal zones<br />

usually do not coincide with political boundaries, and<br />

the use of ZIP codes for tax collection results in a high<br />

degree of inaccurate tax reporting.) Use our Sales Tax<br />

Jurisdiction and Rate Lookup Service on our Web site<br />

at www.nystax.gov to determine the correct local taxing<br />

jurisdiction, combined state and local sales tax rate,<br />

and the local jurisdictional reporting code to use when<br />

filing <strong>New</strong> <strong>York</strong> <strong>State</strong> sales tax returns.<br />

For sales tax rates previously in effect, see<br />

Publication 718‐A, Enactment and Effective Dates of<br />

Sales and Use Tax Rates.<br />

County or<br />

other locality<br />

<strong>New</strong> <strong>York</strong> <strong>State</strong> — only 4 0021<br />

Albany 8 0181<br />

Allegany 8½ 0221<br />

*Bronx—see <strong>New</strong> <strong>York</strong> City<br />

Tax<br />

rate %<br />

Reporting<br />

code<br />

*Brooklyn—see <strong>New</strong> <strong>York</strong> City<br />

Broome 8 0321<br />

Cattaraugus—except 8 0481<br />

Olean (city) 8 0441<br />

Salamanca (city) 8 0431<br />

Cayuga—except 8 0511<br />

Auburn (city) 8 0561<br />

Chautauqua 7¾ 0641<br />

Chemung 8 0711<br />

Chenango—except 8 0861<br />

Norwich (city) 8 0831<br />

Clinton 8 0921<br />

Columbia 8 1021<br />

Cortland 8 1131<br />

Delaware 8 1221<br />

*Dutchess 8 1 /8 1311<br />

Erie 8¾ 1451<br />

Essex 7¾ 1521<br />

Franklin 8 1621<br />

Fulton—except 8 1791<br />

Gloversville (city) 8 1741<br />

Johnstown (city) 8 1751<br />

Genesee 8 1811<br />

Greene 8 1911<br />

Hamilton 7 2011<br />

County or<br />

other locality<br />

Tax<br />

rate %<br />

Reporting<br />

code<br />

Herkimer 8¼ 2121<br />

Jefferson 7¾ 2221<br />

*Kings (Brooklyn)—see <strong>New</strong> <strong>York</strong> City<br />

Lewis 7¾ 2321<br />

Livingston 8 2411<br />

Madison—except 8 2511<br />

Oneida (city) 8 2541<br />

*Manhattan—see <strong>New</strong> <strong>York</strong> City<br />

Monroe 8 2611<br />

Montgomery 8 2781<br />

*Nassau 8 5 /8 2811<br />

*<strong>New</strong> <strong>York</strong> (Manhattan)— see <strong>New</strong> <strong>York</strong> City<br />

*<strong>New</strong> <strong>York</strong> City 8 7 /8 8081<br />

Niagara 8 2911<br />

Oneida—except 8¾ 3010<br />

Rome (city) 8¾ 3015<br />

Utica (city) 8¾ 3018<br />

Onondaga 8 3121<br />

Ontario 7 1 /8 3201<br />

*Orange 8 1 /8 3321<br />

Orleans 8 3481<br />

Oswego—except 8 3501<br />

Oswego (city) 8 3561<br />

Otsego 8 3621<br />

*Putnam 8 3 /8 3731<br />

*Queens—see <strong>New</strong> <strong>York</strong> City<br />

Rensselaer 8 3881<br />

*Richmond (<strong>State</strong>n Island) — see <strong>New</strong> <strong>York</strong> City<br />

*Rockland 8 3 /8 3921<br />

County or<br />

other locality<br />

Tax Reporting<br />

rate % code<br />

St. Lawrence 7 4091<br />

Saratoga—except 7 4111<br />

Saratoga Springs (city) 7 4131<br />

Schenectady 8 4241<br />

Schoharie 8 4321<br />

Schuyler 8 4411<br />

Seneca 8 4511<br />

*<strong>State</strong>n Island—see <strong>New</strong> <strong>York</strong> City<br />

Steuben—except 8 4691<br />

Corning (city) 8 4611<br />

Hornell (city) 8 4641<br />

*Suffolk 8 5 /8 4711<br />

Sullivan 8 4821<br />

Tioga 8 4921<br />

Tompkins—except 8 5081<br />

Ithaca (city) 8 5021<br />

Ulster 8 5111<br />

Warren—except 7 5281<br />

Glens Falls (city) 7 5211<br />

Washington 7 5311<br />

Wayne 8 5421<br />

*Westchester—except 7 3 /8 5581<br />

*Mount Vernon (city) 8 3 /8 5521<br />

*<strong>New</strong> Rochelle (city) 8 3 /8 6861<br />

*White Plains (city) 8 1 /8 6521<br />

*Yonkers (city) 8 3 /8 6511<br />

Wyoming 8 5621<br />

Yates 8 5721<br />

*Rates in these jurisdictions include 3 /8% imposed for the benefit of the Metropolitan Commuter Transportation District.