Insurance comm annual report.indd - New York State Senate

Insurance comm annual report.indd - New York State Senate

Insurance comm annual report.indd - New York State Senate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2009/2010 Annual Report of<br />

The <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Senate</strong><br />

STANDING<br />

COMMITTEE<br />

ON<br />

INSURANCE<br />

senator neil D. Breslin<br />

Chairman

December 14, 2010<br />

Secretary of the <strong>Senate</strong><br />

<strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Senate</strong><br />

<strong>State</strong> Capitol<br />

Albany, <strong>New</strong> <strong>York</strong> 12247<br />

Dear Secretary of the <strong>Senate</strong>,<br />

I am pleased to submit to you a copy of the 2009/2010 <strong>annual</strong> <strong>report</strong> of the <strong>New</strong><br />

<strong>York</strong> <strong>State</strong> <strong>Senate</strong> Standing Committee on <strong>Insurance</strong>.<br />

This <strong>report</strong> outlines the Committee’s overall activity during the 2009/2010<br />

legislative cycle. In my first term as Chairman, I am pleased to <strong>report</strong> that the<br />

Committee approved landmark legislation to make all types of insurance more<br />

affordable and accessible to our <strong>comm</strong>unity. The Committee was active holding<br />

public hearings on subjects including, medical malpractice reform, no-fault<br />

automobile insurance fraud and the need to provide coverage for the diagnosis<br />

and treatment of autism spectrum disorder.<br />

These hearings provided us with vital information and helped the Committee<br />

develop legislation including <strong>Senate</strong> Bill 7000B which mandated that health<br />

insurance companies provide coverage for the treatment and diagnosis of autism<br />

spectrum disorder and <strong>Senate</strong> Bill 8414 “The Automobile Fraud Prevention Act<br />

of 2010.” The <strong>comm</strong>ittee also approved landmark legislation known as “Ian’s<br />

Law” which makes it illegal for insurers to drop entire classes of insurance as a<br />

pretext to deny coverage to individual policyholders. The following <strong>report</strong><br />

discusses in greater detail many of the issues the Committee was involved in,<br />

some of which will still be topics of discussion for the upcoming legislative cycle.<br />

In closing, I would like to thank each legislator and all staff members who have<br />

worked so hard to make many of these accomplishments possible, in particular<br />

Senator Seward my insurance partner. I am looking forward to an equally<br />

productive session in 2011.<br />

Sincerely,<br />

Neil D. Breslin<br />

Chairman<br />

2

Table of Contents<br />

Introduction ----------------------------------------------------------4<br />

Summary of Committee Activity----------------------------------6<br />

Property/ Casualty <strong>Insurance</strong>--------------------------------------10<br />

Health <strong>Insurance</strong>-----------------------------------------------------27<br />

Life <strong>Insurance</strong>--------------------------------------------------------36<br />

Public Hearing on Autism Spectrum Disorder-------------------41<br />

Public Hearing on Medical Malpractice Reform----------------46<br />

Public Hearing on No-Fault Fraud---------------------------------51<br />

3

Introduction<br />

This <strong>report</strong> is a synopsis of the activity of the <strong>Insurance</strong> Committee covering the 2009/ 2010<br />

legislative session. The <strong>comm</strong>ittee is chaired by Senator Neil D. Breslin, and is composed of 16<br />

senators plus the chair. The <strong>comm</strong>ittee provides oversight for all segments of the insurance<br />

industry: property/casualty, health, and life insurance. The <strong>report</strong> outlines all chaptered bills, bills<br />

which only passed the senate, public hearings, and <strong>comm</strong>ittee nominations. The <strong>comm</strong>ittee has<br />

the responsibility to regulate the growing insurance industry while at the same time ensuring the<br />

industry remains competitive.<br />

Many significant legislative initiatives were enacted into law during 2009/2010 legislative<br />

session to make health insurance more accessible and affordable. These initiatives run the gamut<br />

from extending COBRA to 36 months to making health care more affordable and available to<br />

volunteer firefighters and independent contractors. The <strong>comm</strong>ittee also approved landmark<br />

consumer protection measures such as a bill which would regulate the growing life settlement<br />

market in <strong>New</strong> <strong>York</strong> to ensure, among other things, that the medical and financial information of<br />

those who enter into a life settlement transaction is protected. These and many other noteworthy<br />

initiatives were taken during this legislative session, the rest of the <strong>report</strong> examines these and<br />

many other significant industry reforms.<br />

Senator Breslin and <strong>Insurance</strong><br />

Superintendent Wrynn<br />

Senator Breslin at the autism public hearing<br />

Troy Oechsner from the <strong>Insurance</strong><br />

Department at the autism public hearing<br />

Lorri Unumb from Autism Speaks at<br />

the autism public hearing<br />

4

The <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Senate</strong><br />

Standing Committee on <strong>Insurance</strong><br />

Honorable Neil D. Breslin<br />

Chairman<br />

Committee Members<br />

Honorable William T. Stachowski<br />

Honorable Carl Kruger<br />

Honorable Kevin S. Parker<br />

Honorable John L. Sampson<br />

Honorable Antoine M. Thompson<br />

Honorable Craig M. Johnson<br />

Honorable Pedro Espada Jr.<br />

Honorable Jose Peralta<br />

Honorable James L. Seward<br />

Honorable Kenneth P. LaValle<br />

Honorable William J. Larkin Jr.<br />

Honorable James S. Alesi<br />

Honorable Vincent L. Leibell<br />

Honorable Martin J. Golden<br />

Honorable Catharine M. Young<br />

Honorable Roy McDonald<br />

Ranking Minority Member<br />

Committee Staff<br />

Kate M. Powers<br />

Evan C. Schneider<br />

Juan Gabriel Genao<br />

David A. Rozen<br />

Counsel<br />

Committee Director<br />

Committee Clerk<br />

Legislative Fellow<br />

Central Staff<br />

Emily E. Whalen<br />

Gideon Grande<br />

Associate Counsel- Majority Counsel/ Program<br />

Fiscal Analyst- <strong>Senate</strong> Finance Committee/Majority<br />

5

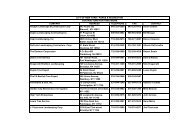

Summary of Committee Activity<br />

Total number of <strong>comm</strong>ittee meetings-----------------------------------------------------<br />

Total number of bills referred to <strong>comm</strong>ittee ---------------------------------------------<br />

Total number of bills <strong>report</strong>ed from <strong>comm</strong>ittee-----------------------------------------<br />

Total number of <strong>comm</strong>ittee bills that became law---------------------------------------<br />

Total number of <strong>comm</strong>ittee bills vetoed --------------------------------------------------<br />

2009 2010<br />

7 9<br />

188 256<br />

20 42<br />

13 20<br />

1 1<br />

Public Hearings<br />

The role of health insurance in the diagnosis and<br />

treatment of autism spectrum disorder<br />

October 23, 2009<br />

<strong>Senate</strong> Standing Committee on <strong>Insurance</strong><br />

<strong>Senate</strong> Standing Committee on Health<br />

<strong>Senate</strong> Standing Committee on Mental Health and Developmental Disabilities<br />

Medical Malpractice Reform<br />

December 1, 2009<br />

<strong>Senate</strong> Standing Committee on <strong>Insurance</strong><br />

<strong>Senate</strong> Standing Committee on Health<br />

<strong>Senate</strong> Standing Committee on Codes<br />

No-fault Fraud in <strong>New</strong> <strong>York</strong> <strong>State</strong><br />

February 2, 2010<br />

<strong>Senate</strong> Standing Committee on <strong>Insurance</strong><br />

2009-2010 Nominations<br />

<strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Insurance</strong> Department<br />

Position Nominated For: Superintendent of <strong>Insurance</strong><br />

Agency Description: The <strong>Insurance</strong> Department is charged with regulating the insurance industry<br />

and with balancing the interests of insurance consumers, companies and producers. Specific<br />

statutory responsibilities include: approving the formation, consolidation or merger of insurance<br />

organizations and all new insurance products, monitoring the financial stability of insurers,<br />

overseeing the testing and licensing of agents, adjusters, consultants and insurance intermediaries<br />

and disciplining licensees who violate the <strong>Insurance</strong> Law or regulations. The Department is<br />

headed by the Superintendent, who is appointed by the Governor with the advice and consent of<br />

the <strong>Senate</strong>, and serves at the Governor’s pleasure.<br />

6

* James J. Wrynn, J.D., ARM, ACI<br />

- Employment History:<br />

1992 – 2009: Founding Member, Mackay, Wrynn & Brady, LLP<br />

1995 – 2000: Counsel, Assemblyman Mark Weprin<br />

1982-1992: Trial Attorney, McCormick, Dunne & Foley<br />

- Education:<br />

1984: J.D., St. John’s University School of Law<br />

1981: B.S., St. John’s University College of Business Administration<br />

<strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Insurance</strong> Fund<br />

Position Nominated For: Commissioner<br />

Agency Description: The <strong>State</strong> <strong>Insurance</strong> Fund’s mission is to provide timely and appropriate<br />

indemnity and medical payments to injured workers; drive down the cost of workers’<br />

compensation insurance for businesses operating in the <strong>State</strong>; ensure that all NY businesses have<br />

a market for workers’’ compensation insurance available to them at a fair price; maintain a<br />

solvent state insurance fund that is always available for NY businesses; and be a competitive<br />

force in the marketplace and an industry leader in price, quality, and service. The Fund is<br />

administered by eight Commissioner’s all of whom are appointed by the Governor with the<br />

advice and consent of the <strong>Senate</strong>, and serve a term of three years, and shall serve until their<br />

successors are appointed and have qualified.<br />

* Theodore K. Cheng<br />

- Employment History:<br />

Senior Litigation Associate, Proskauer Pose, LLP<br />

Chair, <strong>New</strong> <strong>York</strong> <strong>State</strong> Commission on Increasing Diversity in the <strong>State</strong><br />

Government Workforce<br />

Special Assistant District Attorney, <strong>New</strong> <strong>York</strong> and Kings County District<br />

Attorney’s Offices<br />

Special Assistant Corporation Counsel, <strong>New</strong> <strong>York</strong> City Law Department<br />

- Education:<br />

1997: J.D., <strong>New</strong> <strong>York</strong> University School of Law<br />

1991: A.B., Harvard University<br />

* Eileen Frank<br />

- Employment History:<br />

President & CEO, JP West, Inc.<br />

Vice President & Director of Underwriting, Operations & Compliance, GAN<br />

North America <strong>Insurance</strong> Company.<br />

Officer, Commerce & Industry <strong>Insurance</strong> Co. (a division of AIG)<br />

Officer, Home <strong>Insurance</strong> Co.<br />

- Education:<br />

Dillard University<br />

* H. Sidney Holmes III<br />

- Employment History:<br />

Corporate Partner, Winston & Strawn, LLP<br />

Commissioner, Port Authority of <strong>New</strong> <strong>York</strong><br />

Board Member, <strong>New</strong> <strong>York</strong> Urban League<br />

Board Member, Brooklyn Navy Yard Development Corp.<br />

7

- Education:<br />

1979: J.D., Hofstra University School of Law<br />

1976: B.A., Columbia University<br />

* Robert H. Hurlbut<br />

- Employment History:<br />

1995: Reappointed Commissioner of the <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Insurance</strong> Fund<br />

1994: Formed and became President of Hurlbut Trust<br />

1989: Appointed Commissioner of the <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Insurance</strong> Fund<br />

1968: Founded and became President of Vari-Care, Inc.<br />

1964: Organized and became President of ROHM Services Corp.<br />

- Education:<br />

1957: Cornell University College of Hotel Administration<br />

* Steven P. Polivy<br />

- Employment History:<br />

2008 – 2010: Office Managaing Shareholder & Chair – Economic Development<br />

Practice Group, Akerman Senterfitt, LLP<br />

1996-2008: various positions (Managing Partner, Partner, Of Counsel),<br />

Stadtmauer Bailkin, LLP<br />

1995: Of Counsel, Dornbush Mensch, Madelstam & Shaeffer, LLP<br />

1986-1994: Partner/ Associate, Berger & Steingut, LLP<br />

1983-1986: Associate, Baskin & Steingut, PC<br />

1982-1983: Counsel to the Chairman, Mortgagee Affiliates Corp.<br />

1980-1982: Assistant District Attorney, Kings County District Attorney’s Office<br />

- Education:<br />

1980: J.D., Benjamin N. Cardozo School of Law<br />

1977: A.B., Vassar College<br />

* Kenneth R. Theobalds<br />

- Employment History:<br />

2002-2010: Vice President of Governmental Affairs, Entergy<br />

1992-1995: Deputy Executive Director, <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Insurance</strong> Fund<br />

1989-1992: Assistant Secretary to the Governor, Executive Chamber<br />

- Education:<br />

B.S., Cornell University<br />

Special Advisory Panel on Homeowners’ <strong>Insurance</strong>/ Catastrophe Coverage – CMAP<br />

Advisoy Council<br />

Council Description: To provide the association with advice and assistance with the operations<br />

of the coastal market assistance program.<br />

* Jeffrey H. Greenfield<br />

- Employment History:<br />

Managing Member, NGL <strong>Insurance</strong> Group, LLC<br />

Commissioner, Nassau County Planning Commission<br />

Past President, Council of <strong>Insurance</strong> Brokers of Greater <strong>New</strong> <strong>York</strong><br />

2004: President, Downstate <strong>Insurance</strong> Council<br />

1996: Chairman, BRACE (Coalition of IIAANY, PIANY and Life Underwriters)<br />

1994-1995: President, Professional <strong>Insurance</strong> Agents of <strong>New</strong> <strong>York</strong> Stat, Inc.<br />

8

* N. Stephen Ruchman<br />

- Employment History:<br />

2008 –present: Partner, B&B <strong>Insurance</strong><br />

1964-2008: Founder & Principle, Ruchman <strong>Insurance</strong> Agency<br />

1961-1964; Producer, Continental American Life <strong>Insurance</strong><br />

- Education:<br />

B.A., Michigan <strong>State</strong> University<br />

Temporary Panel on Homeowners’ <strong>Insurance</strong> Coverage<br />

Panel Description: The Temporary Panel on Homeowner’s <strong>Insurance</strong> Coverage was created to<br />

study the affordability and availability of homeowners’ insurance coverage in the Empire <strong>State</strong>,<br />

in particular to the market dynamics in the coastal homeowners' insurance market.<br />

* Floyd Holloway, Jr.<br />

Employment History:<br />

Counsel, <strong>State</strong> Farm <strong>Insurance</strong> Company<br />

2003-2005: Chairman, <strong>New</strong> <strong>York</strong> <strong>Insurance</strong> Association<br />

2001-2004: Commissioner, American Bar Association’s Minority Counsel<br />

Program<br />

Education:<br />

J.D., Georgetown University Law Center<br />

B.A., Georgetown University College of Arts and Sciences<br />

* Michael W. O’Malley<br />

Employment History:<br />

Manager, The Chubb Group of <strong>Insurance</strong> Companies<br />

Member, <strong>New</strong> <strong>York</strong> Property <strong>Insurance</strong> Underwriting Association Board of<br />

Directors<br />

Member, Florida Windstorm Underwriting Association Board of Directors<br />

Member, <strong>New</strong> Jersey <strong>Insurance</strong> Underwriting Association Board of Directors<br />

Member, Delaware and Pennsylvania Property <strong>Insurance</strong> Placement Facilities<br />

Board of Directors<br />

Education:<br />

Lehigh University<br />

* James D. Sutton<br />

Employment History:<br />

1992-present: President, James F. Sutton Agency Ltd.<br />

1982-1992: Vice President Sales and Marketing, James F. Sutton Agency Ltd.<br />

1978-1982: <strong>Insurance</strong> Underwriter, Maryland Casualty, American International<br />

Underwriters, Chubb & Son, INA International<br />

Education:<br />

B.A., Hofstra University<br />

9

PROPERTY/CASUALTY<br />

Property/Casualty insurance covers damage to or loss of policyholders’ property and legal<br />

liability for damages caused to other people or their property. It is just one segment of the<br />

insurance industry which includes auto, homeowners’ and <strong>comm</strong>ercial insurance. The property/<br />

casualty sector is a cyclical business with wide fluctuations in competition, profits, premiums,<br />

and amounts of coverage.<br />

This <strong>report</strong> encompasses the 2009 though 2010 legislative session. During these two years the<br />

<strong>comm</strong>ittee considered a wealth of legislation pertaining to property/ casualty insurance. Most<br />

notably the <strong>comm</strong>ittee approved legislation such as S. 7845, which prohibits an insurer from<br />

denying benefits for certain emergency services rendered as a result of the insured being<br />

intoxicated or under the influence of narcotics. This piece of legislation will not only ensure that<br />

health care providers are properly compensated for rendering these services, but it will also<br />

improve the level of care <strong>New</strong> <strong>York</strong>ers will receive, ultimately leading to fewer drug or alcoholrelated<br />

injuries.<br />

In the following sections we have outlined all pieces of legislation pertaining to property/<br />

casualty insurance which were either enacted into law or only passed the senate. All of these<br />

pieces of legislation sought to create a balance between the regulatory environment and<br />

consumer protection, while fostering the health of the insurance industry in <strong>New</strong> <strong>York</strong> <strong>State</strong>.<br />

2009<br />

LEGISLATION ENACTED INTO LAW<br />

Bill No./ Sponsor Chapter Title<br />

S3635B/ Breslin 293 Revises the standards relating to incorporation of stock/<br />

mutual insurance companies in <strong>New</strong> <strong>York</strong> <strong>State</strong>.<br />

S3628/ Breslin 48 Authorizes foreign insurance companies to transfer their<br />

corporate domicile to <strong>New</strong> <strong>York</strong>.<br />

S4768/ Breslin 289 Relates to establishing risk-based capital requirements<br />

applicable to fraternal benefit societies and to repeal<br />

paragraph 2 of subsection (b) of section 4530 of such<br />

laws relating thereto.<br />

S4602/ Breslin 447 Authorizes superintendent of insurance to approve a<br />

demonstration program where an eligible insurer issues<br />

group health insurance policies to eligible associations<br />

LEGISLATION WHICH PASSED THE SENATE ONLY<br />

Bill No./ Sponsor<br />

Title<br />

S5980/ Klein Requires insurers to provide victims of domestic violence with the<br />

option of providing alternative contact information<br />

10

LEGISLATION VETOED<br />

Bill No./ Sponsor<br />

Title<br />

S3577/ Breslin Relates to authorizing the issuance of limited licenses to self-service<br />

storage companies for the sale of insurance coverage on personal<br />

property stored in self-service storage spaces<br />

S3635B/ Chapter 293/ Breslin<br />

This bill revises the standards relating to the incorporation of stock or mutual insurance<br />

companies so that the incorporators of an insurance corporation need only list their city and state<br />

of residence in newspapers and the company charter. Additionally, this bill reduces the number<br />

of directors from thirteen to seven and removes the requirement that not less than two directors<br />

be residents of <strong>New</strong> <strong>York</strong> <strong>State</strong>. Lastly, this legislation reduces the number of officers who must<br />

be directors from two to one.<br />

S3628/ Chapter 48/ Breslin<br />

This law extends the scope of the existing insurer re-domestication law (Section 7120 of the<br />

<strong>Insurance</strong> Law) to apply to non-life insurance companies domiciled in another state, but<br />

authorized to do insurance business in <strong>New</strong> <strong>York</strong>. Under the bill, a foreign non-life insurance<br />

company that is authorized in <strong>New</strong> <strong>York</strong> would have the ability to change its domicile to <strong>New</strong><br />

<strong>York</strong>, with the approval of the <strong>New</strong> <strong>York</strong> Superintendent of insurance and the ranking insurance<br />

official of the foreign non-life insurer's current state of domicile.<br />

S4768/ Chapter 289/ Breslin<br />

This legislation amends the insurance law to make all authorized fraternal benefit societies<br />

subject to the risk-based capital ("RBC") requirements of insurance Law §1322. Currently, a<br />

fraternal benefit society must file an RBC <strong>report</strong> only if it provides the benefits set forth in<br />

<strong>Insurance</strong> Law §4527, or makes optional investments set forth in <strong>Insurance</strong> Law §4530. Only<br />

four fraternal benefit societies are currently subject to the RBC requirements set forth in<br />

<strong>Insurance</strong> Law §1322.<br />

Risk-based capital is a formula which looks at the volatility of an insurer’s assets to determine<br />

the health and solvency of the insurer and to better predict when a company is showing signs of<br />

financial stress.<br />

This bill amends the insurance law to make all authorized fraternal benefit societies subject to<br />

the risk-based capital requirements of <strong>Insurance</strong> Law § 1322. This would facilitate the <strong>Insurance</strong><br />

Department's ability to assess their capitalization levels as related to their insurance operations<br />

and to require implementation of remedial actions, if appropriate. As is the case for societies that<br />

are currently subject to the RBC <strong>report</strong>ing requirements pursuant to <strong>Insurance</strong> Law § 4527 and<br />

§4530, filings would be made using a form approved by the Superintendent, which may include<br />

the form and instructions developed and approved by the National Association of <strong>Insurance</strong><br />

Commissioners specifically for fraternal benefit societies.<br />

11

S4602/ Chapter 447/ Breslin<br />

This bill authorizes the superintendent of <strong>Insurance</strong> to permit a health insurance company<br />

primarily owned or controlled by a tax exempt association of independent workers to provide<br />

group health insurance coverage exclusively to the association's members.<br />

Independent contractors, part-time workers, temporary workers and other individuals who<br />

perform work outside the scope of a full-time employment relationship with an employer<br />

frequently lack access to employment-based group health insurance coverage. As a result, these<br />

independent workers, who comprise a growing portion of the workforce, are more likely than<br />

traditional employees to be uninsured.<br />

The demonstration program authorized by this bill is intended to test new models for enabling<br />

independent workers to create their own health insurance programs that meet their special needs,<br />

while ensuring compliance with solvency requirements, benefit mandates and other obligations<br />

imposed on insurers under this chapter and any regulations issued by the superintendent. The<br />

demonstration program will enable the legislature and the superintendent to evaluate whether<br />

these new models for delivering health insurance benefits to independent workers are effective<br />

and should be expanded to other segments of the population that lack access to employment<br />

based health insurance.<br />

S5980/ Passed <strong>Senate</strong>/ Klein<br />

This legislation allows victims of domestic violence to seek medical and mental health services<br />

and to use their health insurance and other insurance coverage to pay for those services without<br />

fear that insurance correspondence will be sent to the address of the policyholder, who may be<br />

the alleged abuser. Instead, this bill will allow victims of domestic violence to designate<br />

alternative contact information so they can receive insurance correspondence related to their<br />

health care or other related insurance claims in a safe location of their own choosing, such as the<br />

home of a friend or family member, a post office box or a shelter.<br />

S3577/ Veto Message No. 27 / Breslin<br />

<strong>Insurance</strong> Law Section 2131 authorizes the Superintendent of <strong>Insurance</strong> ("Superintendent") to<br />

issue limited licenses to franchisees of vehicle rental companies and wireless <strong>comm</strong>unications<br />

equipment vendors. The limited licenses authorize the franchisees and vendors to act as agents of<br />

insurance companies and sell insurance to customers in connection with the sale or lease of<br />

their products. This bill would amend the <strong>Insurance</strong> Law to permit the Superintendent to<br />

issue similar licenses to self-service storage companies. This would allow such companies to<br />

sell insurance to their customers for property placed in storage units.<br />

While the intent of this bill is laudable - to facilitate the purchase of insurance by consumers<br />

who may not otherwise be covered for a loss the bill raises several policy and technical concerns<br />

that warrant its disapproval.<br />

12

First, as noted in the sponsor's memorandum, "self-storage companies require that renters of<br />

storage space have insurance coverage to protect their stored personal property as a condition of<br />

renting storage space." However, consumers are often unaware of whether their homeowners’<br />

or renters policy already provides coverage for such losses. As such, and perhaps as a result of<br />

imprudent advice from potentially untrained or improperly trained storage space<br />

counterpersons, consumers might purchase unnecessary and expensive insurance, or fall prey<br />

to overly aggressive sales tactics.<br />

Second, while this bill requires self-service storage companies to provide brochures and other<br />

written materials to prospective customers, it does not require that such brochures and materials<br />

be filed with the <strong>Insurance</strong> Department for review prior to their use. This requirement is<br />

currently applicable to wireless <strong>comm</strong>unication equipment vendors who sell insurance and the<br />

same standards should also be applicable to self- service storage companies in order to properly<br />

protect consumers.<br />

Third, this bill does not amend <strong>Insurance</strong> Law Sections 3425 and 3426, which set forth<br />

requirements for the cancellation and nonrenewal of personal and <strong>comm</strong>ercial lines insurance<br />

policies. These lines of coverage include most self-service storage insurance policies, such as<br />

those at issue here. If left un-amended, these sections would not provide appropriate<br />

protections for self-service storage customers, and would foster confusion, errors and<br />

unnecessary expense in regard to the coverage provided by this legislation. For example,<br />

<strong>Insurance</strong> Law Section 3425, which applies to personal lines policies, mandates a minimum<br />

three-year renewal policy period, while <strong>Insurance</strong> Law Section 3426, which applies to<br />

<strong>comm</strong>ercial lines policies, mandates only a one-year renewal policy period. Both these time<br />

periods make little sense in regard to the coverage at issue, since self-storage customers seek<br />

protection only while the property is stored within the storage unit, unlike the more permanent<br />

protection provided by <strong>Insurance</strong> Law Sections 3425 and 3426.<br />

Finally, this bill provides for an immediate effective date. This will make it extremely difficult<br />

for the <strong>Insurance</strong> Department to implement the provisions of this bill in a manner that adequately<br />

protects consumers.<br />

2010<br />

LEGISLATION ENACTED INTO LAW<br />

Bill No./ Sponsor Chapter Title<br />

S638A/ Larkin 11 Requires <strong>report</strong> due the governor and legislature to<br />

include the incidence of misrepresentation by insured of<br />

the principal place where vehicles are driven and stored.<br />

S2088A/ Breslin 25 Relates to standard fire insurance policies.<br />

S5110/ Breslin 389 Authorizes municipal reciprocal insurers to offer full<br />

faith and credit surety bonds for public officers<br />

S6948/ Breslin 404 Enacts provisions relating to reciprocal insurers having a<br />

corporate attorney-in-fact wholly owned by subscribers<br />

at the reciprocal insurers.<br />

13

S6954C/ Breslin 470 Eliminates the board of fire underwriters; repealer<br />

S6949A/ Breslin 210 Relates to the listing of group policyholders in a<br />

directory.<br />

S7772/ Breslin 448 Expands definition of an independent worker and<br />

requirements for an eligible insurer's application.<br />

S1700B/ Breslin 277 Increases from $1,000 to $2,000 the property damage<br />

threshold after which a motor vehicle accident <strong>report</strong><br />

must be filed with the <strong>comm</strong>issioner of motor vehicles.<br />

S4651/ Sampson 322 Establishes that insurers providing rental vehicle<br />

reimbursement coverage shall not require an insured to<br />

utilize a particular rental vehicle company; requires an<br />

insurer writing automobile insurance which includes<br />

rental vehicle reimbursement coverage to inform the<br />

consumer of his or her right to choose a rental vehicle<br />

company to utilize in the event he or she utilizes such<br />

coverage.<br />

S7773A/ Breslin 544 Enacts provisions providing sponsored group personal<br />

insurance and allows such insurance to be written by<br />

authorized insurers.<br />

S7845/ Breslin 303 Relates to insurance losses as a result of the insured<br />

being intoxicated or under the influence of narcotics<br />

S7118A/ Breslin 368 Authorizes limited licenses to self-storage companies for<br />

the sale of insurance on personal property stored at<br />

storage facilities.<br />

LEGISLATION WHICH PASSED THE SENATE ONLY<br />

Bill No./ Sponsor<br />

Title<br />

S2092/ Breslin Relates to service contracts<br />

S3554/ Breslin Relates to insurance losses as a result of the insured being intoxicated<br />

or under the influence of narcotics<br />

S4116/ Breslin Relates to allowable investments and activities of employees of the<br />

department of insurance<br />

S5203/ Breslin Relates to requiring certain polices of insurance for public vessels<br />

which carry passengers<br />

S5203/ Breslin Requires the owners of public vessels intending to operate on navigable<br />

waters of the state to obtain marine protection and indemnity insurance<br />

S5980/ Klein Requires insurers to provide victims of domestic violence with the<br />

option of providing alternative contact information<br />

S6270A/ Breslin Authorizes the superintendent of insurance to suspend the risk to<br />

capital requirement for writing new mortgage guaranty insurance risks<br />

S7674/ Breslin Permits unauthorized foreign or alien insurers to contact nonresident<br />

persons, firms, associations or corporations to make insurance<br />

contracts.<br />

S4869B/ Breslin Establishes the "Interstate insurance product regulation compact" to<br />

14

egulate certain insurance products among member states and to<br />

promote and protect the interest of consumers of individual and group<br />

annuity, life insurance, disability income and long-term care insurance<br />

products.<br />

S7220/ Breslin Exempts large <strong>comm</strong>ercial insureds from certain rate and policy form<br />

requirements.<br />

S7794A/ Breslin Permits certain agreements by domestic mutual insurance corporations.<br />

S638A/ Chapter 11/ Larkin<br />

Within the Metro areas of <strong>New</strong> <strong>York</strong> <strong>State</strong>, automobile insurance is appropriately higher in<br />

relation to the more rural, less populated areas of <strong>New</strong> <strong>York</strong> <strong>State</strong>. The reasons for higher rates<br />

of automobile insurance in Metro areas include higher incidents of accidents, theft, and damage.<br />

The practice of misrepresenting the place where an automobile is garaged or driven is a<br />

dishonest way of reducing the costs paid for insurance. Residents of areas where insurance costs<br />

are higher should not be permitted to pay lower rates for automobile insurance based simply on<br />

documentation that states their motor vehicle is garaged in an area where insurance costs are<br />

lower. This act is causing an imbalance in the insurance pool of some regions in less populated<br />

areas of <strong>New</strong> <strong>York</strong> <strong>State</strong>, causing rates for less populated regions to be artificially inflated. This<br />

legislation seeks to <strong>report</strong> on these incidents in order to combat these abuses and make such<br />

misrepresentation a fraudulent insurance act.<br />

S2088A/ Chapter 25/ Breslin<br />

The appraisal provision required by law in the standard fire insurance policy is a vehicle to assist<br />

in quickly settling contract disputes between the insured and insurer, rather than more time<br />

consuming litigation. Without the appraisal process the insured is forced to accept an offer from<br />

the carrier that they think is deficient or to pursue recovery through litigation which is made cast<br />

prohibitive by the expenses of bringing the action. A 2002 decision of the Supreme Court,<br />

Appellate Division, Fourth Department (THOMAS H. FAHRENHOLZ V. SECURITY<br />

MUTUAL INSURANCE COMPANY AND THE KREINER COMPANY, INC), pointed out<br />

that further legislative action is required to eliminate the prohibition set forth in CPLR 7601<br />

against seeking specific performance of the appraisal provision in the standard fire insurance<br />

policy Section 7601 of the Civil Practice Law and Rules which now allows an individual to start<br />

a special proceeding to enforce a contract or agreement, exempts fire insurance policies from<br />

such proceedings.<br />

This bill amends the problems inherent in CPLR 7601 by providing clear language to allow<br />

either party to utilize the appraisal process more frequently and thereby avoid the high costs and<br />

delays inherent in protracted litigation.<br />

S2092/ Passed <strong>Senate</strong> Only/ Breslin<br />

Service contracts are popular products with consumers because it gives them peace of mind,<br />

knowing that they have managed the cost of future repairs of their vehicles. Allowing the<br />

15

provision of windshield repair and paint less dent removal service contracts be sellers and<br />

suppliers of such services will give consumers the option of purchasing such coverage<br />

in lieu of bearing the risk of repair. Through the purchase of these contracts, consumers will not<br />

have to bear the cost of repairing cracks or chips in their vehicle windshields, or removing small<br />

dents, dings or creases from their motor vehicles.<br />

This bill expands the definition of service contracts to include contracts made by a supplier or<br />

seller of a service for repair of cracks or chips in a motor vehicle windshield and for repair or<br />

removal of dents, dings or creases from a motor vehicle without affecting the existing paint<br />

finish.<br />

S3554/ Passed <strong>Senate</strong> Only/ Breslin<br />

Under the Public Health Law and the federal Emergency Medical Treatment and Active Labor<br />

Act, health services providers are required to provide emergency medical services to persons in<br />

need of such care. The <strong>Insurance</strong> Law, however, permits no-fault insurers to deny coverage<br />

where the insured person is injured while operating a vehicle in an intoxicated state. As a result,<br />

health services providers are sometimes not compensated for services they are required to render<br />

to stabilize their patients in emergency situations. This is both inequitable to doctors and, by<br />

leading doctors to avoid blood alcohol and other tests for intoxication or drug use for fear they<br />

will lead to denial of compensation, undermines medically appropriate screening procedures.<br />

This bill provides for a narrow amendment to <strong>Insurance</strong> Law § 5103(b)(2). This amendment<br />

would prohibit a no-fault insurer from excluding from coverage a person who sustains injuries as<br />

a result of operating a motor vehicle while intoxicated, with respect to necessary emergency<br />

health services rendered in a general hospital, as defined in Public Health Law § 2801(10),<br />

including ambulance services attendant thereto and related medical screening. This amendment<br />

is intended to permit a health service provider to obtain reimbursement for any necessary<br />

emergency services performed in a general hospital or by an ambulance worker outside of a<br />

general hospital, on a person who has sustained injuries as a result of operating a motor vehicle<br />

while intoxicated or drug impaired. This bill also would permit reimbursement for necessary<br />

related medical screening, such as blood alcohol and drug tests, performed in a general hospital<br />

or by an ambulance worker outside of a general hospital.<br />

S4116/ Passed <strong>Senate</strong> Only/ Breslin<br />

Section 204 of the <strong>Insurance</strong> Law was designed to ensure that the <strong>Insurance</strong> Department and its<br />

employees regulate the insurance industry in a disinterested and ethical manner. As a general<br />

matter, the statute continues to serve the legislative purposes underpinning its predecessor's<br />

enactment nearly one hundred and fifty years ago when the <strong>Insurance</strong> Department was first<br />

established, which included precluding not only impropriety but also the appearance of<br />

impropriety. Significant changes in the financial world and the nature of investments since the<br />

statute's reenactment in 1939 have raised questions as to the reach of Section 204.<br />

Section 204 was not intended to prohibit passive investment in investment companies that<br />

incidentally own a securities of insurance companies or in securities of issuers that own licensees<br />

with insurance operations that are not material to the business of the issuers taken as a whole.<br />

16

Accordingly, this bill amends Section 204 in a reasonable manner that maintains the statutory<br />

intent.<br />

The bill also provides an important safeguard in that it prohibits employees of the <strong>Insurance</strong><br />

Department from investing in mutual funds that are designed to primarily or exclusively invest in<br />

the securities of licensees of the Department. Specialty funds, sometimes call "Sector Funds,"<br />

may be designed to invest primarily in life insurance companies. An investment in such a fund<br />

by a Department employee would be prohibited by this bill.<br />

Finally, Section 16(3)(d) of the <strong>New</strong> <strong>York</strong> <strong>State</strong> banking law as amended by Chapter 318 of the<br />

laws of 1995 to make changes similar to this bill for employees of the Banking Department. The<br />

employees of the two agencies should be treated in a similar matter, and this bill accomplishes<br />

those goals.<br />

S5203/ Passed <strong>Senate</strong> Only/ Breslin<br />

On October 2, 2005, the ship, the Ethan Allen, capsized on Lake George resulting in the deaths<br />

of twenty individuals. This tragedy brought to light the fact that there is no requirement that<br />

public vessels carry liability insurance. This legislation will enhance the safety and security of<br />

the public who utilize <strong>comm</strong>ercial watercraft for recreational and business purposes.<br />

This bill requires public vessels operating in <strong>New</strong> <strong>York</strong> <strong>State</strong> to carry marine protection and<br />

indemnity insurance, permits excess line brokers to provide marine liability insurance, and<br />

allows owners of public vessels to be self-insured upon approval of the <strong>comm</strong>issioner of parks,<br />

recreation and historic preservation.<br />

S5980/ Passed <strong>Senate</strong> Only/ Klein<br />

This legislation allows victims of domestic violence to seek medical and mental health services<br />

and to use their health insurance and other insurance coverage to pay for those services without<br />

fear that insurance correspondence will be sent to the address of the policyholder, who may be<br />

the alleged abuser. Instead, this bill will allow victims of domestic violence to designate<br />

alternative contact information so they can receive insurance correspondence related to their<br />

health care or process other related insurance claims in a safe location of their own choosing,<br />

such as the home of a friend or family member, a post office box or a shelter.<br />

This bill will help protect the privacy and safety of domestic abuse victims regardless of whether<br />

they remain in the same household with their abuser. Victims who leave abusive environments<br />

will be better able to access important medical and mental health care services if they can use<br />

their existing health insurance without fear that claim and billing correspondence will reveal<br />

their location or other sensitive information. Similarly, individuals living in abusive situations<br />

will also be more likely to seek necessary treatment if their privacy can be assured, and that<br />

treatment may be able to help them connect with the resources available in their <strong>comm</strong>unities to<br />

help victims of domestic violence.<br />

17

S6270A/ Passed <strong>Senate</strong> Only/ Breslin<br />

Mortgage guaranty insurance companies are forbidden from writing business when the ratio of<br />

their total policy liability to their policyholder's surplus exceeds a ratio of 25 to 1. This standard<br />

was developed in the 1960s when the modern mortgage guaranty insurance industry was in its<br />

early stages and no risk-to-capital ratio requirement existed. Given the nascent state of the<br />

industry, the 25 to 1 rule was reasonable, but by its very nature was inflexible and not reflective<br />

of changing or special circumstances. In particular, a mortgage guaranty insurer is likely to reach<br />

the 25 to 1 standard in the midst of a high claims paying cycle (as the industry is currently<br />

experiencing), but may have more than enough capital to pay expected claims on its insurance in<br />

force. If mortgage guaranty insurers are compelled to cease writing new business as Section<br />

6502 currently dictates, the ability of those insurers to remain viable <strong>comm</strong>ercial entities, and to<br />

write insurance after the end of this high claims-paying cycle, will be impaired.<br />

Under the amendment to section 6502 (b) (1), the Superintendent is authorized to evaluate<br />

whether the risk to capital requirement should be suspended for a particular insurer and to<br />

determine the period of time and conditions under which the suspension of that requirement will<br />

apply. Permitting a mortgage guaranty insurer to operate above the 25 to 1 requirement for a<br />

limited period would allow the insurer to increase its capital base for paying claims and insuring<br />

loans in the future. Furthermore, if mortgage guaranty insurers are required to cease writing<br />

new business as triggered by the current risk to capital requirement, fewer loans will be insured<br />

in <strong>New</strong> <strong>York</strong>, further fueling pressures on the availability of mortgage finance credit. As a<br />

consequence, the housing recovery in <strong>New</strong> <strong>York</strong> (and elsewhere) will likely be impeded, with a<br />

concomitant adverse impact on the state's economic recovery.<br />

S7674/ Passed <strong>Senate</strong> Only/ Breslin<br />

Under current law, an entity cannot act on behalf of an unauthorized insurer from offices in the<br />

<strong>State</strong> even if the actions including the solicitation, negotiation or underwriting of risks do not<br />

involve <strong>New</strong> <strong>York</strong> residents. Thus, business that could otherwise be transacted in <strong>New</strong> <strong>York</strong><br />

must take place outside of the state. By forcing these companies beyond the <strong>State</strong>'s borders, the<br />

existing law drives jobs and the benefits related thereto out of the <strong>State</strong>.<br />

This legislation would allow these entities which are part of the holding company system of a<br />

domestic insurer and the unauthorized insurer, along with the employees that support them, to<br />

come into the <strong>State</strong> and set up office facilities within its borders. It would allow such entities to<br />

operate from an office in the <strong>State</strong> so that it may provide those services necessary to support an<br />

unauthorized insurer's overseas operations. Such services would include underwriting,<br />

negotiating contract terms and quoting premiums with respect to non-<strong>New</strong> <strong>York</strong> residents. This<br />

legislation would allow these entities to undertake those support functions necessary to operate<br />

their business, from within the <strong>State</strong>, without affecting <strong>New</strong> <strong>York</strong> policyholders. The protections<br />

afforded <strong>New</strong> <strong>York</strong> policyholders will be unimpaired by the proposed legislation.<br />

Importantly, this will allow jobs to be established in <strong>New</strong> <strong>York</strong> related to the conduct of business<br />

in <strong>New</strong> <strong>York</strong> that has no nexus to citizens of the <strong>State</strong> and will not affect the regulation of<br />

insurance as it relates to <strong>New</strong> <strong>York</strong> residents.<br />

18

S4869B/ Passed <strong>Senate</strong> Only/ Breslin<br />

In general, interstate compacts are used to establish the framework for cooperative solutions to<br />

multi-state challenges. There are over two hundred interstate compacts currently in existence<br />

covering a wide variety of subjects. Every state belongs to at least fourteen such compacts.<br />

This bill is based on the NAIC Model Act.<br />

The bill provides for a single point of product and rate filings subject to uniform national<br />

standards, which provides the following benefits:<br />

a. Regulatory efficiency/effectiveness: more effective use of limited regulatory resources.<br />

b. Single high-quality review of increasingly complex products.<br />

c. Leverage collective expertise of states in setting uniform standards.<br />

d. opportunity to redirect resources to other areas of consumer protection.<br />

e. Meet industry's need for single point of filing.<br />

f. Meet industry's need to get products to market in a more timely manner.<br />

g. Permit industry to compete more effectively with financial institutions such as banks and<br />

security firms.<br />

h. Provide consumers with a broader choice of products in a more timely manner.<br />

<strong>State</strong>s would still retain control over the insurance regulatory process even if a state elects to join<br />

the compact. If a state disagrees with a product standard developed by the Commission, it may<br />

opt-out of the uniform standard either by regulation or legislation. The bill would also allow<br />

companies to continue to file products in the individual states through the existing form filing<br />

process.<br />

S7220/ Passed <strong>Senate</strong> Only/ Breslin<br />

Commercial policyholders do not require the same level of regulatory protection as is warranted<br />

for personal lines insurance. Commercial policyholders often have risk management<br />

professionals on staff and possess a higher level of knowledge and sophistication relative to<br />

insurance options. Rather, <strong>comm</strong>ercial insureds need flexibility so that policies can be tailored to<br />

their particular needs. Commercial insureds also need to be able to respond rapidly to<br />

competitive forces, economic conditions and the needs of their customers. The current system in<br />

<strong>New</strong> <strong>York</strong> can hinder the ability of insurers to respond to the needs of their <strong>comm</strong>ercial<br />

customers, which has led many <strong>comm</strong>ercial insureds to utilize alternate insurance mechanisms to<br />

satisfy their insurance needs. These alternate insurance mechanisms are often unregulated or<br />

subject to minimal regulation, leaving <strong>comm</strong>ercial insureds utilizing such mechanisms without<br />

the protection of the guarantee funds, adequate solvency regulation, or other valuable regulatory<br />

protections.<br />

The attached legislation would modernize the regulation of <strong>comm</strong>ercial insurance in <strong>New</strong> <strong>York</strong><br />

and would help make <strong>New</strong> <strong>York</strong> a more attractive place for insurers to do business. This<br />

legislation would also facilitate operations and reduce costs for <strong>comm</strong>ercial policyholders<br />

because it would promote competition among carriers which would drive down premiums. In<br />

19

addition, this legislation would allow the <strong>Insurance</strong> Department to focus its resources on<br />

solvency and personal lines regulation which will, in turn, speed approvals in those areas.<br />

S7794A/ Passed <strong>Senate</strong> Only/ Breslin<br />

Existing law prohibits domestic mutual insurance companies (except those organized before<br />

January 1, 1940 to do only marine protection and indemnity insurance) from entering into an<br />

agreement with any of the company's officers or directors, or with any firm or corporation in<br />

which any such officer or director is pecuniarily interested directly or indirectly, whereby the<br />

insurance corporation agrees to pay, for the acquisition of business, any <strong>comm</strong>ission or other<br />

compensation which under the agreement is increased or diminished by the amount of such<br />

business or by the insurance corporation's earnings on such business.<br />

The <strong>Insurance</strong> Department has interpreted this law as prohibiting a mutual insurance company<br />

from entering into a profit sharing <strong>comm</strong>ission agreement with an insurance agency simply<br />

because one of the insurance company's officers also served as a director of a corporation that<br />

owned the insurance agency. The <strong>Insurance</strong> Department found that the insurance company<br />

officer had an "indirect" pecuniary interest in the insurance agency.<br />

The existing prohibition is an outdated and overly restrictive limitation put in place nearly a<br />

century ago. It serves no legitimate purpose today and is no longer practical in today's business<br />

environment. In today's business <strong>comm</strong>unity, many directors and officers of insurance<br />

companies also serve on the board of directors of various other, non-insurance business<br />

corporations. Today, many corporations are part of a larger holding company structure, and it is<br />

quite possible that a corporation where an insurance company officer serves as director, would<br />

have affiliates or subsidiaries that engage in insurance activities. This provision unnecessarily<br />

prohibits a mutual insurance company from entering into certain compensation agreements with<br />

these insurance agency affiliates and discourages mutual insurance company officers and<br />

directors from sharing their talents and serving as directors and officers of various other<br />

corporations.<br />

This bill permits domestic mutual insurance corporations to enter into certain compensation<br />

agreements with firms and corporations in which an officer or director has only an "indirect"<br />

pecuniary interest.<br />

S5110/ Chapter 389 / Breslin<br />

One of the fundamental insurance coverages that all municipalities need is full faith and credit<br />

bonds for their public officers. This is a required coverage by virtue of Public Officers law, § 11<br />

and 30, and parallel provisions of the Town, Village and General City laws. Failure to acquire<br />

such coverage for municipal officials who handle financial transactions of a municipality results<br />

in the office being vacated by operation of law.<br />

Current law puts NYMIR and the local brokers and agents in a very difficult position when<br />

trying to place these coverages. Elected officials need this coverage in order to qualify for office.<br />

They have only 30 days from the <strong>comm</strong>encement of their term to acquire it, or they are deemed<br />

20

to have vacated the office to which they were just elected. Yet even markets that continue to<br />

offer this essential coverage are now requiring credit checks and in some cases declining to<br />

extend coverage if a satisfactory credit history is not forthcoming. As the largest underwriter of<br />

local government risk in the <strong>State</strong>, this is exactly the reason NYMIR was formed, to insure that<br />

<strong>New</strong> <strong>York</strong>'s local governments will be able to acquire the insurance protections that their<br />

taxpayers require.<br />

This bill authorizes municipal reciprocal insurers the ability to offer full faith and credit surety<br />

bonds for public officers.<br />

S6948/ Chapter 404 / Breslin<br />

This legislation reinserts into section 6106 the language previously existing in the prerecodification<br />

section 415, referring to reciprocals having a corporate attorney in fact wholly<br />

owned by the subscribers of the reciprocal.<br />

In addition, the proposed bill includes a new provision in insurance law section 6107 to avoid<br />

transition difficulties that would otherwise ensue for insurers who have attorneys-in-fact wholly<br />

owned by their subscribers, but who currently are not expressly authorized to issue renewal<br />

insurance policies with the notice that the acceptance of the policy with the subscribers'<br />

agreement attached constitutes the signing of the subscribers agreement.<br />

The new procedure allows such reciprocals (and reciprocals authorized to issue non-assessable<br />

policies) to transmit to the subscribers changes to the subscribers’ agreement together with the<br />

entire subscribers’ agreement in force. In addition, the proposed change must be submitted to the<br />

subscribers with a notice stating that the failure to object to the amendment within sixty days<br />

constitutes the acceptance of the agreement as amended.<br />

All reciprocal insurer subscribers' agreement amendments must be approved by the<br />

Superintendent pursuant to subdivision (b) of section 6107 of the insurance law, and by the<br />

advisory <strong>comm</strong>ittee of the reciprocal pursuant to subdivision (d) of section 6107. Therefore, the<br />

new procedure provides essentially the same safeguards and efficiencies recognized in the<br />

procedures authorized by prior sections 415 and 416 of the insurance law before the 1984<br />

recodification<br />

S6954C/ Chapter 470 / Breslin<br />

The Board of Fire Underwriters (the "Board") was created at the request of the insurance<br />

industry in the late 1800's, to assist them in protecting insured's property in the City of <strong>New</strong><br />

<strong>York</strong>. To attain this goal, the Board created the Fire Patrol, the purpose of which was to respond<br />

to fires at or near an insured's location and attempt to remove, preserve or otherwise protect<br />

property contained therein from such fire, or other harmful effects such as smoke or water<br />

damage. The Fire Patrol was funded by self-assessments on Board members.<br />

21

However, over time the Board found that the Fire Patrol was unable to adequately protect<br />

property from fires or related damage (e.g. modern electronics, prevalent throughout residences<br />

and offices, are often damaged beyond use despite Patrol efforts). As such, the effectiveness<br />

and use of the Fire Patrol diminished to the point where it was determined by the Board that it<br />

was no longer necessary and the self-assessments were burdening member companies with<br />

unnecessary costs that only increased the eventual cost to the consumer. The result was that the<br />

Fire Patrol was disbanded in 2006.<br />

Given that the original purpose of the Board is no longer relevant, it is appropriate to provide for<br />

its dissolution.<br />

S6949A/ Chapter 210 / Breslin<br />

This legislation is necessary in order to allow the SuperGuarantee Program, or programs similar<br />

to it, to continue to operate in <strong>New</strong> <strong>York</strong> <strong>State</strong>. Through the SuperGuarantee Program, if a<br />

consumer (1) uses a service provider identified as a SuperGuarantee service provider in the<br />

yellow page directory and (2) registers for the program on the SuperGuarantee website, then in<br />

the event that the consumer encounters a problem with the service of such provider, the yellow<br />

pages publisher would initiate a dispute resolution process between the consumer and the<br />

provider. If the consumer is not satisfied with the outcome of that process, the yellow pages<br />

publisher would provide payment to the consumer. Payment would be for the lowest estimate of<br />

two other service providers to correct the problem or the amount charged under the contract<br />

between the consumer and the original SuperGuarantee service provider, not to exceed $500.<br />

There is no cost to the consumer for participating in the Program.<br />

The <strong>Insurance</strong> Department has made the determination that the SuperGuarantee Program<br />

constitutes the business of insurance under <strong>New</strong> <strong>York</strong> law. Enactment of this legislation is<br />

necessary in order for the Program to continue operating in <strong>New</strong> <strong>York</strong>. The SuperGuarantee<br />

Program provides a legitimate benefit to the consumer at no extra cost. At a time<br />

when both the time and finances of many <strong>New</strong> <strong>York</strong>ers are limited, the SuperGuarantee Program<br />

can help to ensure that <strong>New</strong> <strong>York</strong> consumers are able to resolve disputes with service providers<br />

satisfactorily, while minimizing the time and hassle involved.<br />

S7772/ Chapter 448 / Breslin<br />

Independent workers such as part-time workers, temps, freelancers and independent contractors<br />

have a particularly difficult time finding affordable health insurance because they cannot get<br />

coverage on a group basis through their employer. To address this problem, the legislature<br />

enacted A.7949-A (Silver)/S.4602A (Breslin) that creates special demonstration authority for the<br />

<strong>Insurance</strong> Department to permit a health insurer owned by a tax-exempt association of<br />

independent workers to offer coverage solely to the association's members, without having to<br />

serve the employer-based group health insurance market. A health insurer participating in this<br />

program is required to follow all insurance law, including benefit mandates, and <strong>report</strong> to the<br />

<strong>Insurance</strong> Department which will analyze the impact of the program.<br />

22

An administrator of this health insurance plan is permitted to charge a reasonable fixed fee for<br />

assessing an applicant’s eligibility for coverage. This fee is necessary to ensure that the<br />

administrator can process the applications and will only be assessed when an application is<br />

submitted.<br />

This bill amends <strong>Insurance</strong> Law §1123, to clarify the definition of "independent worker" to<br />

include (1) individuals who work full-time for a single employer on a temporary basis and (2)<br />

domestic workers such as nannies. This would insure that all independent workers have access to<br />

uninterrupted and affordable health insurance.<br />

S1700/ Chapter 277 / Breslin<br />

Prohibits insurers from imposing a surcharge for accidents where the property damage does not<br />

exceed two thousand dollars and where no physical injury resulted.<br />

This legislation amends Section 2335 of the insurance law by adding a new subsection (a),<br />

raising from one thousand to two thousand dollars the amount of property damage which, if<br />

exceeded in a motor vehicle accident, would allow an insurer to impose a policy premium<br />

surcharge.<br />

<strong>New</strong> <strong>York</strong> is always in danger of becoming the highest cost state in the nation for auto insurance.<br />

This legislation would help contain premium costs by preventing auto insurance surcharges for<br />

minor accidents.<br />

The amount of property damage for which insurers may impose a premium surcharge is currently<br />

based on the amount ($1,000) set in V&T section 605, which requires accident <strong>report</strong>ing to the<br />

Department of Motor Vehicles(See 11 NYCRR 169.1(a)). Changes in accident costs since 1991,<br />

when the current <strong>report</strong>ing threshold was enacted, mean that the most minor accidents now result<br />

in an insurance surcharge. Sometimes, the amount paid in surcharges over three years can equal<br />

or exceed the amount of the original insurance benefit. This is unfair to consumers and leads<br />

many to pay out-of-pocket for claims which they could legitimately collect from insurers.<br />

This bill prohibits insurer surcharges for accidents with property damage less than $2,000. (All<br />

accidents causing any type of injury would remain surchargeable.) The accident <strong>report</strong>ing<br />

threshold was last raised effective August 1, 1991, to $1,000 from $600. This bill, as amended,<br />

would still require minor accidents to be <strong>report</strong>ed so statistics can be kept, but would adjust the<br />

insurance premium surcharge threshold to a fairer and more reasonable amount.<br />

S4651/ Chapter 322 / Sampson<br />

There have been instances of insurers steering their customers with rental vehicle reimbursement<br />

coverage to use one particular rental vehicle company. Oftentimes, these customers are unaware<br />

of the availability of other rental vehicle companies, some of which may offer less expensive<br />

rentals than the company favored by the insurer. Consumers should not be forced to use one<br />

particular rental vehicle company or be in any way limited in their ability to utilize the coverage<br />

they purchased. When insurers re<strong>comm</strong>end only one rental vehicle company without telling the<br />

23

consumer they have the option to use any company, consumers (many of whom are distressed<br />

from suffering an accident) often hastily agree to rent from the re<strong>comm</strong>ended company,<br />

regardless of the fact that other, possibly less expensive and more convenient, options are<br />

available. This bill would ensure that consumers are afforded the opportunity to make an<br />

informed decision.<br />

This bill is based on <strong>Insurance</strong> Law section 2610, which prohibits insurers providing collision or<br />

comprehensive coverage from requiring an insured to utilize a particular repair shop, or, in<br />

processing any such claim, re<strong>comm</strong>ending or suggesting that the insured utilize a particular<br />

repair shop.<br />

S7773A/ Chapter 544 / Breslin<br />

<strong>New</strong> <strong>York</strong>'s current Employer Sponsored Group Personal Excess law (section 3445*2) permits<br />

the sale of group personal excess insurance but only to designated employees of an employer that<br />

sponsors the group. This bill:<br />

(1) Permits officers and directors to be members of an employer sponsored groups in addition to<br />

just employees, as well as the spouses and immediate family members and household members<br />

of employees.<br />

(2) Allows other types of groups, clubs or associations (not just employers) to sponsor a group<br />

insurance program. Examples include groups like stamp or coin collectors club sponsoring a<br />

group insurance program for personal property floaters covering valuable stamp or coin<br />

collections a vintage auto enthusiast club sponsoring programs for antique auto insurance, etc.<br />

Additionally, banks and other financial institutions that own large portfolios of residential<br />

properties (e.g., foreclosed homes), that are renting out such properties, could sponsor a program<br />

for renters insurance for their tenants.<br />

(3) Consistent with the examples outlined above, permit group insurance for a few new types of<br />

insurance in addition to group personal excess. specifically group personal property floaters (as<br />

in our stamp/coin collection example), group vintage vehicle insurance (as in our antique<br />

auto enthusiast club example) and group renters insurance (as in our foreclosed properties<br />

example).<br />

(4) Set standards for groups that can sponsor group programs. The standards in our proposed<br />

draft are similar to standards found in other state laws or regulations -- e.g.. a sponsor group<br />

cannot be a fictitious group, cannot have been formed for the purpose of buying or selling<br />

insurance, must involve members engaged in a <strong>comm</strong>on pursuit or enterprise, must have 25 or<br />

more members, have been in existence for at least three years, have adopted by-laws and a<br />

method to enroll or register members.<br />

(5) Adopt consumer safeguards with respect to the cancellation or nonrenewal of a group policy<br />

and with regard to premium payments collected by the sponsor group acting on behalf of the<br />

insurer.<br />

24

The rest of the law remains unchanged -- in particular, the law still clearly states that no member<br />

of a group is ever obligated to buy any insurance.<br />

These types of group insurance programs can be beneficial to the public in a number of ways.<br />

With respect to valuable collections, such as coins. stamps and other collectibles, we believe that<br />

many collectors are under-insured. There are sub limits in typical homeowners’ policies<br />

applicable to such items. So, group programs for collectors could increase their awareness of this<br />

coverage and, by grouping such homogeneous collectors, make such insurance products more<br />

affordable, too. Similarly, group programs can raise the awareness of renters insurance<br />

among tenants.<br />

The market for antique and collectible auto insurance is dominated by a few Managing General<br />

Agents. Permitting group antique auto programs could inject some additional competition into<br />

this market. And, members of antique auto clubs also have homogeneous risk characteristics -<br />

e.g., vehicles typically are garaged, driven very little, often towed to shows instead of being<br />

driven, kept in mint condition, and clubs often are formed around owning a specific type or<br />

model of car.<br />

S7845/ Chapter 303 / Breslin<br />

Under the Public Health Law and the federal Emergency Medical Treatment and Active Labor<br />

Act, health services providers are required to provide emergency medical services to persons in<br />

need of such care. The <strong>Insurance</strong> Law, however, permits no-fault insurers to deny coverage<br />

where the insured person is injured while operating a vehicle in an intoxicated state. As a result,<br />

health services providers are sometimes not compensated for services they are required to render<br />

to stabilize their patients in emergency situations. This is both inequitable to doctors and, by<br />

leading doctors to avoid blood alcohol and other tests for intoxication or drug use for fear they<br />

will lead to denial of compensation, undermines medically appropriate screening procedures.<br />

In 2008, a bill was introduced to address this situation (A.10000/S.8294-A), but it was vetoed by<br />

Governor Paterson because it was not limited to emergency care, but rather would have required<br />

no-fault carriers to have reimbursed providers for virtually all health services given to<br />

intoxicated individuals. By permitting reimbursement for necessary related medical screenings,<br />

such as blood alcohol and drug tests, more screenings will occur, underlying drug or alcohol<br />

problems will be more frequently identified and addressed, and ultimately fewer drug or alcoholrelated<br />

injuries will occur.<br />

S7118A/ Chapter 368 / Breslin<br />

Self-service storage companies require that renters of storage space have insurance coverage to<br />

protect their stored personal property as a condition of renting storage space. While some<br />

consumers have a homeowner's or renter's policy that will provide coverage for their stored<br />

property, many others lack the required insurance coverage. If self-service storage companies are<br />

permitted to obtain a limited license to offer personal effects insurance to renters of storage<br />

space, consumers will have the opportunity to obtain the required coverage to protect their<br />

valuable property.<br />

25

Personal effects insurance would cover the loss of, or damage to a renters stored personal<br />

property for events beyond the self-service storage company's control. A number of other states<br />

currently permit the issuance of limited insurance licenses to self-service storage companies<br />

authorizing them to offer personal effects insurance in connection with the rental of storage<br />

space. Existing insurance law currently provides for the issuance of a limited license to rental<br />

vehicle companies and wireless <strong>comm</strong>unications equipment vendors. A limited license<br />

authorizes these entities to offer certain types of insurance only in connection with the rental of<br />

motor vehicles or the sale of wireless <strong>comm</strong>unications equipment.<br />

This bill permits the Superintendent to issue a limited license to a self-service storage company<br />

that would permit it to offer personal effects insurance only in connection with the rental of<br />

storage space at a storage facility. Just as rental vehicle companies and wireless <strong>comm</strong>unications<br />

equipment vendors are currently required to do when offering insurance, self-service storage<br />

companies would be required to provide brochures and other written materials to prospective<br />

renters that: summarize the insurance already provided by a renter's/homeowner's insurance<br />

policy or other source of coverage, state that the purchase of insurance is not required<br />

to rent storage space, describe the process for filing a claim if insurance is purchased, contain the<br />

price, deductible, benefits, exclusions and conditions of the policy; and state that the customer<br />

may cancel the insurance at any time and any unearned premium will be refunded in accordance<br />

with applicable law.<br />

Self-service storage companies also would be required to conduct training programs for their<br />

employees and sale representatives offering insurance pursuant to the limited license that must<br />

meet the minimum standards that currently apply to training programs required by rental vehicle<br />

companies and wireless <strong>comm</strong>unications equipment vendors that offer insurance pursuant to a<br />

limited license. These training programs also must be approved by the Superintendent.<br />

Senator Breslin at the medical<br />

malpractice reform public hearing<br />

Judith Ursitti from Autism Speaks at the press<br />

conference for senate bill 7000B<br />

26

HEALTH INSURANCE<br />

The <strong>Senate</strong> <strong>Insurance</strong> Committee studied, <strong>report</strong>ed, and made re<strong>comm</strong>endations on health care<br />

provisions, regulations, insurance, liability, licensing, and delivery of services. In so doing, the<br />

Committee endeavored to ensure that <strong>New</strong> <strong>York</strong> <strong>State</strong> as provider, financier, and regulator<br />

adopts the most cost-effective means of delivery of health care services so that the greatest<br />

number of <strong>New</strong> <strong>York</strong>er’s receive quality health care.<br />

The <strong>Senate</strong> <strong>Insurance</strong> Committee also focused on assisting consumers to make informed<br />