E-payment manual Postfinance payment methods for online shops

E-payment manual Postfinance payment methods for online shops

E-payment manual Postfinance payment methods for online shops

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

499.45 en (pf.ch/dok.pf) 04.2011 PF<br />

E-<strong>payment</strong> <strong>manual</strong><br />

PostFinance <strong>payment</strong> <strong>methods</strong><br />

<strong>for</strong> <strong>online</strong> <strong>shops</strong><br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 1/14

Contact details <strong>for</strong> PostFinance<br />

Are you interested in the PostFinance <strong>payment</strong> <strong>methods</strong>?<br />

PostFinance will be happy to advise you.<br />

Consulting & Sales Business Customers<br />

Tel. +41 (0)848 848 848 (regular rate)<br />

Do you already use the PostFinance <strong>payment</strong> <strong>methods</strong><br />

in your <strong>online</strong> shop?<br />

Our E-<strong>payment</strong> Customer Service team will be happy to answer<br />

your questions.<br />

Swiss Post<br />

PostFinance<br />

E-<strong>payment</strong> Customer Service<br />

3002 Berne<br />

Tel. +41 (0)848 382 423<br />

E-mail merchanthelp@postfinance.ch<br />

Would you like to offer your purchasers optimum support<br />

<strong>for</strong> problems encountered during the <strong>payment</strong> process with<br />

PostFinance <strong>payment</strong> <strong>methods</strong>?<br />

The PostFinance Customer Service <strong>for</strong> purchasers is open six days<br />

a week and will be happy to provide you with in<strong>for</strong>mation.<br />

Swiss Post<br />

PostFinance<br />

E-<strong>payment</strong> Customer Service<br />

3002 Berne<br />

Tel. +41 (0)848 880 470<br />

E-mail shopperhelp@postfinance.ch<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 2/14

Table of contents<br />

1. Introduction 4<br />

1.1 Purpose of this document 4<br />

1.2 Requirements 4<br />

1.3 Technical integration 4<br />

1.4 Functionality 4<br />

1.5 Individual settings 4<br />

2. PostFinance <strong>payment</strong> <strong>methods</strong> 5<br />

2.1 General 5<br />

2.2 Sales market Switzerland 5<br />

2.3 Target group 5<br />

2.4 Payment interface display 5<br />

2.5 Highest security standard 5<br />

2.6 Payment process 6<br />

2.7 PostFinance Card 7<br />

2.8 PostFinance e-finance 8<br />

3. Settings 9<br />

3.1 General 9<br />

3.2 Direct delivery 9<br />

3.3 Approval of <strong>payment</strong>s 9<br />

3.4 Delivery deadlines 9<br />

3.5 Initiating credits to purchasers 10<br />

3.6 PostFinance Card Alias – <strong>for</strong> simple and recurring transactions 10<br />

4. Notification of <strong>payment</strong> 11<br />

4.1 General 11<br />

4.2 Collective credits with PostFinance Card 11<br />

4.3 PostFinance e-finance credits 11<br />

5. Prices 12<br />

6. Further in<strong>for</strong>mation 13<br />

7. Reference customers 14<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 3/14

1. Introduction<br />

1.1 Purpose of this document<br />

This document is intended <strong>for</strong> merchants who operate an <strong>online</strong> shop and<br />

want to process <strong>payment</strong>s <strong>for</strong> their goods and/or services using PostFinance<br />

<strong>payment</strong> <strong>methods</strong>.<br />

1.2 Requirements<br />

In order <strong>for</strong> the PostFinance <strong>payment</strong> <strong>methods</strong> to be integrated into<br />

an <strong>online</strong> shop, you must have:<br />

• shop software which can communicate with the interface of your<br />

<strong>payment</strong> service provider,<br />

• an agreement with a <strong>payment</strong> service provider which offers the<br />

PostFinance <strong>payment</strong> <strong>methods</strong> including the additional options<br />

requested by the merchant (e.g. PostFinance Card Alias),<br />

• a PostFinance business account.<br />

1.3 Technical integration<br />

Technical integration of the PostFinance <strong>payment</strong> <strong>methods</strong> into the <strong>online</strong><br />

shop is effected through your <strong>payment</strong> service provider. You can find all<br />

the technical in<strong>for</strong>mation on our <strong>payment</strong> <strong>methods</strong> in your <strong>payment</strong> service<br />

provider’s technical documentation.<br />

1.4 Functionality<br />

This document describes all the options available with the PostFinance<br />

<strong>payment</strong> <strong>methods</strong>. To benefit from the full functionality offered, it is<br />

important that the upstream interface to your <strong>payment</strong> service provider<br />

supports the relevant options. If in doubt, please contact your <strong>payment</strong><br />

service provider.<br />

1.5 Individual settings<br />

The <strong>manual</strong> provides basic in<strong>for</strong>mation about default settings. However,<br />

PostFinance offers many additional functions, such as customized reporting<br />

of processing results per transaction, electronic notices of <strong>payment</strong>,<br />

etc. We will be pleased to advise you in person of the many possibilities.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 4/14

2. PostFinance <strong>payment</strong> <strong>methods</strong><br />

2.1 General<br />

PostFinance offers two <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>payment</strong> using the postal<br />

account in the <strong>online</strong> shop. The main differences lie in the speed of processing,<br />

the length of the <strong>payment</strong> guarantee and the <strong>payment</strong> notification.<br />

2.2 Sales market Switzerland<br />

Visa, MasterCard and the PostFinance <strong>payment</strong> <strong>methods</strong> are the e-<strong>payment</strong><br />

<strong>payment</strong> <strong>methods</strong> with the biggest market shares in Switzerland. The majority<br />

of all e-<strong>payment</strong> transactions in the Swiss sales market are processed<br />

using these <strong>payment</strong> <strong>methods</strong>. Our <strong>payment</strong> <strong>methods</strong> are thus extremely<br />

well suited <strong>for</strong> <strong>online</strong> <strong>shops</strong> seeking to sell goods and services in Switzerland.<br />

PostFinance enjoys an excellent reputation in Switzerland, and purchasers<br />

are happy to use our <strong>payment</strong> <strong>methods</strong>. Thanks to the PostFinance<br />

<strong>payment</strong> <strong>methods</strong>, you can create extra trust among your customers in the<br />

sensitive <strong>payment</strong> process of e-<strong>payment</strong>.<br />

2.3 Target group<br />

The PostFinance <strong>payment</strong> <strong>methods</strong> are used by all merchant segments. The<br />

PostFinance <strong>payment</strong> <strong>methods</strong> are popular with SMEs as PostFinance’s prices<br />

are very attractive. Major customers value the PostFinance <strong>payment</strong> <strong>methods</strong><br />

as an alternative to credit cards, especially on account of the huge customer<br />

potential of approx. 3 million purchasers, the <strong>payment</strong> guarantee and the<br />

possibility of real-time booking immediately after successful authorization of<br />

the <strong>payment</strong> transaction.<br />

2.4 Payment interface display<br />

The <strong>payment</strong> interface is displayed in a window that fills the screen or in<br />

an iFrame, depending on implementation. Pop-up windows are not used.<br />

PostFinance offers two interface sizes and presentation layers which the<br />

merchant can select via its <strong>payment</strong> service provider with the <strong>payment</strong><br />

interface query:<br />

• standard display,<br />

• iPhone-optimized display.<br />

2.5 Highest security standard<br />

The shopper always enters the elements in the PostFinance server environment,<br />

where extremely high security standards apply. Third parties cannot<br />

view the entered data.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 5/14

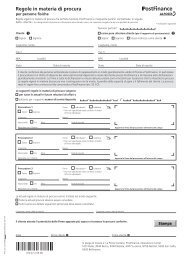

2.6 Payment process<br />

1. The purchaser enters the <strong>payment</strong> in<strong>for</strong>mation in the secure <strong>payment</strong><br />

interface.<br />

2. PostFinance checks that the in<strong>for</strong>mation is correct and that sufficient<br />

funds are available in the purchaser’s account.<br />

3. Assuming a positive outcome, the purchaser is automatically returned<br />

to the last page accessed in the <strong>online</strong> shop.<br />

In the event of an error, a message is displayed on the PostFinance <strong>payment</strong><br />

screen and the purchaser is not automatically returned to the last page<br />

accessed in the <strong>online</strong> shop.<br />

A reader is required to pay amounts over CHF 100.00/EUR 65.00.<br />

Shopper<br />

authentication step 1<br />

[PostFinance URL]<br />

Shopper<br />

authentication step 2<br />

[PostFinance URL]<br />

12345678<br />

BERNASCONI MARIA<br />

24-9779-8<br />

ID: 110 234 249 778<br />

PlatzhalterOBERTHUR 0000<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 6/14

2.7 PostFinance Card<br />

With the PostFinance Card you reach a potential customer base of around<br />

3 million card holders.<br />

PostFinance guarantees <strong>payment</strong> (<strong>payment</strong> guarantee) as long as the<br />

delivery period set out in section 3.4 is observed.<br />

There is no need <strong>for</strong> debt collection procedures as there is no credit risk<br />

with the <strong>payment</strong> guarantee.<br />

Payments are settled according to the Swiss EFT/POS-2000 standard (ep2).<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 7/14

2.8 PostFinance e-finance<br />

With PostFinance e-finance, you can reach a target audience of about one<br />

million purchasers who manage their postal accounts <strong>online</strong>. To execute<br />

the <strong>payment</strong>, purchasers identify themselves by means of the e-finance ID<br />

elements.<br />

As with the PostFinance Card, PostFinance guarantees <strong>payment</strong> (<strong>payment</strong><br />

guarantee) as long as the delivery deadline, as described in section 3.4, is<br />

observed. This means that you do not need to initiate collection procedures<br />

and there is no risk of bad debts (credit risk). This is the case even if the<br />

<strong>payment</strong> only arrives three months after the purchase amount was authorized.<br />

This <strong>payment</strong> method is particularly popular with <strong>shops</strong> that deliver<br />

immediate services to the purchaser (ticketing, music downloads, etc.).<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 8/14

3. Settings<br />

3.1 General<br />

This chapter explains the various settings and possibilities of our <strong>payment</strong><br />

<strong>methods</strong>. The settings described can be made separately <strong>for</strong> each individual<br />

<strong>payment</strong>.<br />

3.2 Direct delivery<br />

If you choose direct execution (immediate delivery), the <strong>payment</strong> is sent<br />

automatically to PostFinance <strong>for</strong> same-day processing without your<br />

having to do anything. Payment cannot be prevented through cancellation,<br />

nor can the amount to be booked be amended downwards.<br />

3.3 Approval of <strong>payment</strong>s<br />

You have the option of checking <strong>payment</strong>s be<strong>for</strong>e delivering them to<br />

PostFinance (deferred delivery). In this case the purchase amount authorized<br />

by the purchaser is only noted and stored temporarily. You can approve<br />

<strong>payment</strong>s <strong>for</strong> execution or cancel them via either an Internet back office or<br />

a computerized interface belonging to your <strong>payment</strong> service provider.<br />

In this way you can influence when the purchase amount will be debited<br />

to the purchaser or prevent the purchaser from being charged by cancelling<br />

the transaction. It is also possible to deliver a lower amount than the<br />

purchase amount originally authorized by the purchaser. This can be useful<br />

if you have to make new arrangements at short notice because you<br />

cannot deliver an article from the shopping cart. If you have not approved<br />

a <strong>payment</strong> within 90 days of authorization of the purchase amount by<br />

the purchaser, it will expire. To make use of the full potential of our <strong>payment</strong><br />

<strong>methods</strong>, it is important to observe the recommendations made in section<br />

3.4, irrespective of the 90-day technical execution deadline.<br />

3.4 Delivery deadlines<br />

If you comply with our recommendations <strong>for</strong> delivery deadlines, you will<br />

also benefit from the <strong>payment</strong> guarantee with PostFinance Card and<br />

PostFinance e-finance.<br />

• To benefit from the PostFinance <strong>payment</strong> guarantee, PostFinance Card<br />

<strong>payment</strong>s must be executed within three days of the purchase amount<br />

being authorized.<br />

• With PostFinance e-finance <strong>payment</strong>s, you enjoy the full technical<br />

execution deadline of 90 days after authorization of the purchase<br />

amount, while still benefiting from the <strong>payment</strong> guarantee.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 9/14

3.5 Initiating credits to purchasers<br />

Should you need to refund part or all of the purchase amount to your<br />

purchaser after the purchase amount has been booked, you can do this<br />

<strong>manual</strong>ly in the Internet back office or automatically, using your <strong>payment</strong><br />

service provider‘s computerized interface. This is useful in cases where<br />

the purchaser returns the goods (e.g. mail order business). You do not need<br />

any in<strong>for</strong>mation about the purchaser’s account, and the account that was<br />

used <strong>for</strong> the <strong>payment</strong> process is automatically credited.<br />

3.6 PostFinance Card Alias – <strong>for</strong> simple and recurring transactions<br />

The <strong>online</strong> shop operator has the option of processing PostFinance Card<br />

transactions with a PostFinance Card Alias. The purchaser defines<br />

PostFinance Card as the default <strong>payment</strong> method in his profile with the<br />

<strong>online</strong> shop. After registering once with the reader, the <strong>online</strong> shop<br />

operator can debit the purchaser‘s postal account repeatedly, as with a<br />

standing order. Moreover, the <strong>online</strong> shop operator can offer <strong>payment</strong><br />

processes suitable <strong>for</strong> various channels (e.g. iApps). One click is all the purchaser<br />

needs to initiate a postal account <strong>payment</strong>.<br />

In order to use PostFinance Card Alias, the <strong>online</strong> shop has to request<br />

activation of the Alias option from PostFinance Customer Service.<br />

The <strong>online</strong> shop operator bears the reversal risk only <strong>for</strong> PostFinance Card<br />

Alias transactions if the card holder disputes the transaction.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 10/14

4. Notification of <strong>payment</strong><br />

4.1 General<br />

• You receive credits to your PostFinance business account each day <strong>for</strong><br />

each PostFinance <strong>payment</strong> method.<br />

• The purchaser is notified of the details of the individual transactions <strong>for</strong><br />

each PostFinance <strong>payment</strong> method on the debit account.<br />

• The account notification can be adpated by Customer Service if requested.<br />

4.2 Collective credits with PostFinance Card<br />

PostFinance books the PostFinance Card <strong>payment</strong>s to your account on a<br />

daily basis with a single collective credit.<br />

Lines 1–4 of the notification example given below are supplied by PostFinance.<br />

You can define the fifth line as you wish. It will be included on the purchaser’s<br />

account statement as a message <strong>for</strong> the debit. PostFinance recommends<br />

that the <strong>online</strong> shop operator’s home page be used, as the origin<br />

of the <strong>payment</strong> will then be immediately apparent to the purchaser.*<br />

Using the execution date, you can assign the collective booking from<br />

PostFinance to the individual <strong>payment</strong>s received by your shop. You receive<br />

a list of the individual <strong>payment</strong>s via the Internet back office or the computerized<br />

interface of your <strong>payment</strong> service provider.<br />

E-<strong>payment</strong> transaction credit<br />

Delivery on [delivery date]<br />

[Merchant name]<br />

[Merchant ID]<br />

*[individual text, max. 25 characters]<br />

4.3 PostFinance e-finance credits<br />

With the PostFinance e-finance <strong>payment</strong> method, your individual explanatory<br />

text is not included on the credit. However, this in<strong>for</strong>mation does<br />

appear on the purchaser’s account statement as the explanatory text that<br />

goes with the debit.<br />

As you are shown the individual PostFinance e-finance <strong>payment</strong>s, you can<br />

allocate them right away on the basis of the account statement to your<br />

<strong>payment</strong> service provider. Depending on the setting (see sections 3.2 and<br />

3.3), the <strong>payment</strong> is marked DEFERRED or IMMEDIATE.<br />

Further in<strong>for</strong>mation about the notification service such as „e-com-<br />

merce list“ is available from our Customer Service by e-mail at<br />

merchanthelp@postfinance.ch or by telephone on +41 (0)848 382 423.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 11/14

5. Prices<br />

See separate price list.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 12/14

6. Further in<strong>for</strong>mation<br />

See our website w ww.postfinance.ch/e-<strong>payment</strong> <strong>for</strong> further details<br />

under „PostFinance <strong>payment</strong> <strong>methods</strong>“.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 13/14

7. Reference customers<br />

Several thousand <strong>online</strong> <strong>shops</strong> use the PostFinance <strong>payment</strong> <strong>methods</strong><br />

to collect <strong>payment</strong>s. Here are a few reference customers.<br />

Manual PostFinance <strong>payment</strong> <strong>methods</strong> <strong>for</strong> <strong>online</strong> <strong>shops</strong> Version April 2011 14/14