ANNUAL REPORTS

ANNUAL REPORTS

ANNUAL REPORTS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

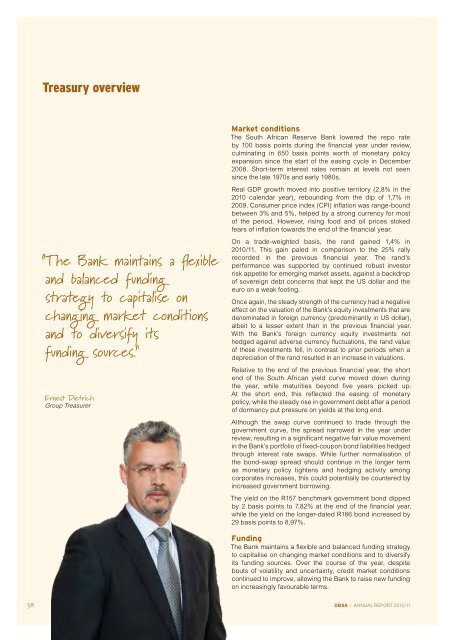

Treasury overview<br />

Market conditions<br />

The South African Reserve Bank lowered the repo rate<br />

by 100 basis points during the financial year under review,<br />

culminating in 650 basis points worth of monetary policy<br />

expansion since the start of the easing cycle in December<br />

2008. Short-term interest rates remain at levels not seen<br />

since the late 1970s and early 1980s.<br />

Real GDP growth moved into positive territory (2,8% in the<br />

2010 calendar year), rebounding from the dip of 1,7% in<br />

2009. Consumer price index (CPI) inflation was range-bound<br />

between 3% and 5%, helped by a strong currency for most<br />

of the period. However, rising food and oil prices stoked<br />

fears of inflation towards the end of the financial year.<br />

“The Bank maintains a flexible<br />

and balanced funding<br />

strategy to capitalise on<br />

changing market conditions<br />

and to diversify its<br />

funding sources.”<br />

Ernest Dietrich<br />

Group Treasurer<br />

On a trade-weighted basis, the rand gained 1,4% in<br />

2010/11. This gain paled in comparison to the 25% rally<br />

recorded in the previous financial year. The rand’s<br />

performance was supported by continued robust investor<br />

risk appetite for emerging market assets, against a backdrop<br />

of sovereign debt concerns that kept the US dollar and the<br />

euro on a weak footing.<br />

Once again, the steady strength of the currency had a negative<br />

effect on the valuation of the Bank’s equity investments that are<br />

denominated in foreign currency (predominantly in US dollar),<br />

albeit to a lesser extent than in the previous financial year.<br />

With the Bank’s foreign currency equity investments not<br />

hedged against adverse currency fluctuations, the rand value<br />

of these investments fell, in contrast to prior periods when a<br />

depreciation of the rand resulted in an increase in valuations.<br />

Relative to the end of the previous financial year, the short<br />

end of the South African yield curve moved down during<br />

the year, while maturities beyond five years picked up.<br />

At the short end, this reflected the easing of monetary<br />

policy, while the steady rise in government debt after a period<br />

of dormancy put pressure on yields at the long end.<br />

Although the swap curve continued to trade through the<br />

government curve, the spread narrowed in the year under<br />

review, resulting in a significant negative fair value movement<br />

in the Bank’s portfolio of fixed-coupon bond liabilities hedged<br />

through interest rate swaps. While further normalisation of<br />

the bond-swap spread should continue in the longer term<br />

as monetary policy tightens and hedging activity among<br />

corporates increases, this could potentially be countered by<br />

increased government borrowing.<br />

The yield on the R157 benchmark government bond dipped<br />

by 2 basis points to 7,82% at the end of the financial year,<br />

while the yield on the longer-dated R186 bond increased by<br />

29 basis points to 8,97%.<br />

Funding<br />

The Bank maintains a flexible and balanced funding strategy<br />

to capitalise on changing market conditions and to diversify<br />

its funding sources. Over the course of the year, despite<br />

bouts of volatility and uncertainty, credit market conditions<br />

continued to improve, allowing the Bank to raise new funding<br />

on increasingly favourable terms.<br />

38 DBSA | <strong>ANNUAL</strong> REPORT 2010/11