Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Eurosystem Secures Price Stability<br />

Monetary policy<br />

framework adjusted<br />

To ensure the smooth implementation<br />

of monetary policy operations,<br />

the Governing Council of the ECB<br />

introduced two changes to the monetary<br />

policy framework in March <strong>2004</strong>.<br />

In a first step, the timing of the<br />

reserve maintenance periods was<br />

adjusted to start on the settlement<br />

day of the main refinancing operation<br />

(MRO) following the first Governing<br />

Council meeting of a given month.<br />

This aligned the reserve maintenance<br />

period with the cycle for interest<br />

rate decision making, ensuring that<br />

changes in key interest rates always<br />

take effect at the beginning of a minimum<br />

reserve period. This measure<br />

eliminated expectations of changes<br />

in key interest rates within a minimum<br />

reserve period and their destabilizing<br />

impact on counterpartiesÕ<br />

bidding behavior in the MRO.<br />

In a second step, the maturity of<br />

the MROs was shortened from two<br />

weeks to one week. Thus, MROs<br />

settled in one reserve period no<br />

longer extend into the subsequent<br />

reserve maintenance period. The<br />

implementation of both changes was<br />

smooth. Halving the MRO maturity<br />

to one week led to a doubling in<br />

the size of each MRO.<br />

Austria —<br />

Export-Led Recovery<br />

Powerful export demand buoyed economic<br />

activity in Austria in the first<br />

half of <strong>2004</strong>. Despite dampening<br />

effects induced by the appreciation<br />

of the euro, Austrian exporters succeeded<br />

in boosting deliveries abroad<br />

significantly. Domestic demand, by<br />

contrast, was sluggish. With disposable<br />

income making little headway<br />

and energy prices high, consumer<br />

spending did not take off. In the first<br />

half of <strong>2004</strong>, investment did not pick<br />

up speed either, but the pronounced<br />

improvement of capacity utilization<br />

and the results of the Investment<br />

Survey conducted by WIFO, the Austrian<br />

Institute of Economic Research,<br />

signaled a growing propensity to invest<br />

toward the end of the year.<br />

Moreover, the expiration of the special<br />

investment tax credit at the end<br />

of <strong>2004</strong> may have prompted investors<br />

to frontload investment. Investment<br />

became noticeably more animated in<br />

the second half of <strong>2004</strong>. GDP growth<br />

surged from 0.8% in 2003 to 2.0% in<br />

<strong>2004</strong>.<br />

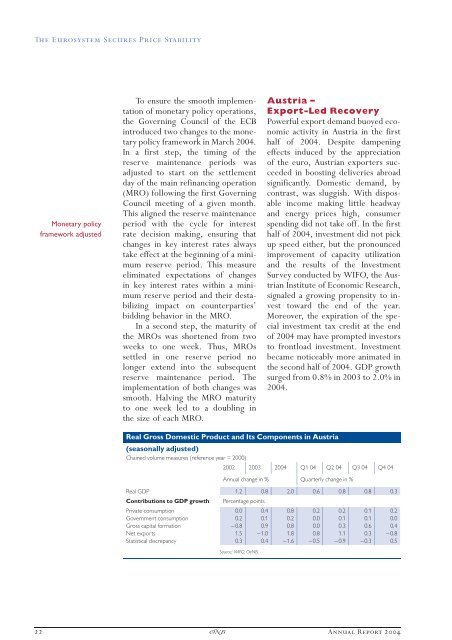

Real Gross Domestic Product and Its Components in Austria<br />

(seasonally adjusted)<br />

Chained volume measures (reference year = 2000)<br />

2002 2003 <strong>2004</strong> Q1 04 Q2 04 Q3 04 Q4 04<br />

<strong>Annual</strong> change in % Quarterly change in %<br />

Real GDP 1.2 0.8 2.0 0.6 0.8 0.8 0.3<br />

Contributions to GDP growth Percentage points<br />

Private consumption 0.0 0.4 0.8 0.2 0.2 0.1 0.2<br />

Government consumption 0.2 0.1 0.2 0.0 0.1 0.1 0.0<br />

Gross capital formation 0.8 0.9 0.8 0.0 0.3 0.6 0.4<br />

Net exports 1.5 1.0 1.8 0.8 1.1 0.3 0.8<br />

Statistical discrepancy 0.3 0.4 1.6 0.5 0.9 0.3 0.5<br />

Source: WIFO, OeNB.<br />

22 ×<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2004</strong>