Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Eurosystem Secures Price Stability<br />

Euro Area Key Interest<br />

Rates Unchanged in <strong>2004</strong><br />

Following two years of subdued<br />

growth (2002: 0.9%; 2003: 0.5%),<br />

euro area GDP expanded by 2.1%<br />

in <strong>2004</strong>. The growth momentum that<br />

gained a foothold in the second half of<br />

2003 was maintained at the beginning<br />

of <strong>2004</strong> but subsequently dampened<br />

by surging oil prices in the second<br />

half. Investment remained moderate<br />

throughout <strong>2004</strong>. Despite low interest<br />

rates and a pickup in profitability,<br />

investment in plant and equipment<br />

merely edged up. Construction investment,<br />

in fact, even diminished<br />

marginally. While consumer spendingpickedupsomewhattowardthe<br />

end of the year, it provided hardly<br />

any impulses. The revival in world<br />

trade lifted AustriaÕs current account<br />

surplus slightly compared with 2003,<br />

bringing it to 0.5% of GDP. The upturn<br />

hardly had a perceptible impact<br />

on the labor market yet in <strong>2004</strong>: Employment<br />

rose by 0.5% and unemployment<br />

persisted at 8.9% in <strong>2004</strong>.<br />

Euro area inflationary pressure<br />

remainedsubduedeventhoughdemand<br />

recovered in the first half of<br />

<strong>2004</strong>, above all because wage in-<br />

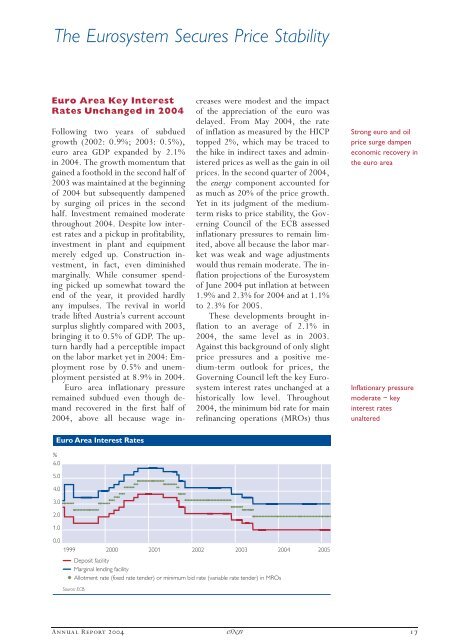

Euro Area Interest Rates<br />

%<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

creases were modest and the impact<br />

of the appreciation of the euro was<br />

delayed. From May <strong>2004</strong>, the rate<br />

of inflation as measured by the HICP<br />

topped 2%, which may be traced to<br />

the hike in indirect taxes and administeredpricesaswellasthegaininoil<br />

prices. In the second quarter of <strong>2004</strong>,<br />

the energy component accounted for<br />

as much as 20% of the price growth.<br />

Yet in its judgment of the mediumterm<br />

risks to price stability, the Governing<br />

Council of the ECB assessed<br />

inflationary pressures to remain limited,<br />

above all because the labor market<br />

was weak and wage adjustments<br />

would thus remain moderate. The inflation<br />

projections of the Eurosystem<br />

of June <strong>2004</strong> put inflation at between<br />

1.9% and 2.3% for <strong>2004</strong> and at 1.1%<br />

to 2.3% for 2005.<br />

These developments brought inflation<br />

to an average of 2.1% in<br />

<strong>2004</strong>, the same level as in 2003.<br />

Against this background of only slight<br />

price pressures and a positive medium-term<br />

outlook for prices, the<br />

Governing Council left the key Eurosystem<br />

interest rates unchanged at a<br />

historically low level. Throughout<br />

<strong>2004</strong>, the minimum bid rate for main<br />

refinancing operations (MROs) thus<br />

0.0<br />

1999 2000 2001 2002 2003 <strong>2004</strong><br />

Deposit facility<br />

Marginal lending facility<br />

Allotment rate (fixed rate tender) or minimum bid rate (variable rate tender) in MROs<br />

Source: ECB.<br />

2005<br />

Strong euro and oil<br />

price surge dampen<br />

economic recovery in<br />

the euro area<br />

Inflationary pressure<br />

moderate — key<br />

interest rates<br />

unaltered<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2004</strong> ×<br />

17