CII Communique - December, 2010

CII Communique - December, 2010

CII Communique - December, 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

eview<br />

in the rise of currency growth over deposits growth<br />

which in turn has lowered the money multiplier, thereby<br />

lowering M3 growth. This has led to the diversion of<br />

resources toward cash accumulation and investment<br />

in non-financial assets, including gold and real estate,<br />

whose prices have shown significant increases over the<br />

course of the current year.<br />

The credit growth rate has accelerated moderately<br />

mainly in the non-food category, particularly to the<br />

infrastructure sector, especially power, telecom and<br />

housing. Besides bank credit to the commercial sector,<br />

there has been a higher flow of funds from other<br />

sources, showing significant improvement as compared<br />

to last year. This mismatch between credit and deposit<br />

growth rates has led to a rise in the credit-deposit<br />

ratio (72.7). Any pick-up in credit growth is likely to<br />

put further pressure on liquidity and therefore on<br />

interest rates. On the other hand, the second round<br />

of quantitative easing in the US will ease interest rates<br />

abroad, making it more attractive for Indian firms to<br />

go in for overseas borrowing.<br />

Trends in Credit- Deposit Ratio and<br />

Bank Credit<br />

Source: CMIE<br />

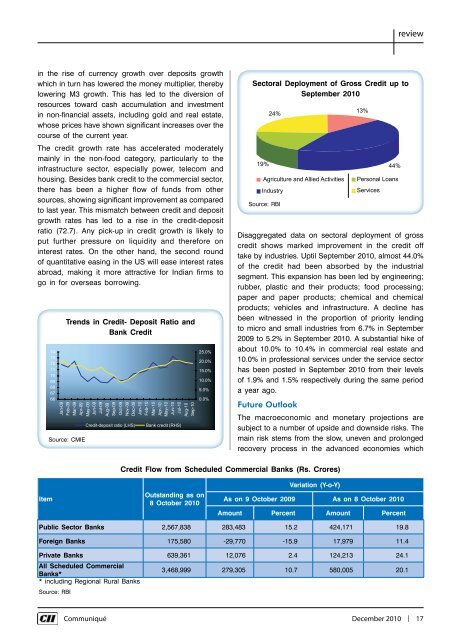

Sectoral Deployment of Gross Credit up to<br />

September <strong>2010</strong><br />

Source: RBI<br />

Disaggregated data on sectoral deployment of gross<br />

credit shows marked improvement in the credit off<br />

take by industries. Uptil September <strong>2010</strong>, almost 44.0%<br />

of the credit had been absorbed by the industrial<br />

segment. This expansion has been led by engineering;<br />

rubber, plastic and their products; food processing;<br />

paper and paper products; chemical and chemical<br />

products; vehicles and infrastructure. A decline has<br />

been witnessed in the proportion of priority lending<br />

to micro and small industries from 6.7% in September<br />

2009 to 5.2% in September <strong>2010</strong>. A substantial hike of<br />

about 10.0% to 10.4% in commercial real estate and<br />

10.0% in professional services under the service sector<br />

has been posted in September <strong>2010</strong> from their levels<br />

of 1.9% and 1.5% respectively during the same period<br />

a year ago.<br />

Future Outlook<br />

The macroeconomic and monetary projections are<br />

subject to a number of upside and downside risks. The<br />

main risk stems from the slow, uneven and prolonged<br />

recovery process in the advanced economies which<br />

Credit Flow from Scheduled Commercial Banks (Rs. Crores)<br />

Item<br />

Outstanding as on<br />

8 October <strong>2010</strong><br />

Variation (Y-o-Y)<br />

As on 9 October 2009 As on 8 October <strong>2010</strong><br />

Amount Percent Amount Percent<br />

Public Sector Banks 2,567,838 283,483 15.2 424,171 19.8<br />

Foreign Banks 175,580 -29,770 -15.9 17,979 11.4<br />

Private Banks 639,361 12,076 2.4 124,213 24.1<br />

All Scheduled Commercial<br />

Banks*<br />

3,468,999 279,305 10.7 580,005 20.1<br />

* including Regional Rural Banks<br />

Source: RBI<br />

Communiqué <strong>December</strong> <strong>2010</strong> | 17