Manual E-bill 499.41

Manual E-bill 499.41

Manual E-bill 499.41

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

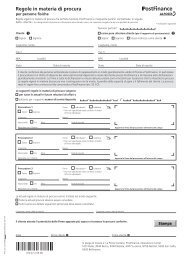

Example of PDFOnly <strong>bill</strong>ing<br />

Electronic processing of <strong>bill</strong>s via PostFinance differs in a number<br />

of respects from physical dispatch of <strong>bill</strong>s. Besides the standard infor -<br />

mation, additional data are needed for automatic processing.<br />

At the technical level, a number of other points have to be taken into<br />

account when creating a PDF and forwarding it to PostFinance.<br />

Here is an example of how the data can be positioned on the <strong>bill</strong>.<br />

Necessary information<br />

4<br />

1<br />

2 3<br />

5 6<br />

Technical requirements<br />

• The use of standard typefaces is recommended.<br />

• The PDFs should not be larger than 150 KB on average.<br />

• The layout and therefore the positioning of all information must<br />

always be the same.<br />

• Naming the PDFs: <br />

7<br />

1 The PDF must clearly indicate whether<br />

it is a <strong>bill</strong> or a credit. In addition,<br />

each <strong>bill</strong> must bear a unique, non-recurring<br />

iden tification number.<br />

2 The <strong>bill</strong> must indicate the VAT numbers<br />

of both the issuer and the recipient.<br />

3 Each <strong>bill</strong> recipient has an identification<br />

number with PostFinance (eBillAccountID).<br />

This must be clearly stated on the <strong>bill</strong>.<br />

4 The payment information (ISR customer<br />

number and ISR reference number)<br />

normally printed on the inpayment slip<br />

must be indicated on the <strong>bill</strong>.<br />

5 For every line item the customer must<br />

indicate a position number and state<br />

the maximum number of lines permissible<br />

for the description of the item.<br />

6 It is absolutely essential for VAT rates to<br />

be indicated in detail, i. e. per <strong>bill</strong> position<br />

and in total (Amount incl./Amount excl./<br />

VAT rate).<br />

7 Any discount granted must be stated<br />

as such on the <strong>bill</strong>.<br />

<strong>Manual</strong> E-<strong>bill</strong> Version October 2010 61/64