BOC Report and accounts 2005 - Alle jaarverslagen

BOC Report and accounts 2005 - Alle jaarverslagen

BOC Report and accounts 2005 - Alle jaarverslagen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

134 The <strong>BOC</strong> Group plc Annual report <strong>and</strong> <strong>accounts</strong> <strong>2005</strong> Notes to the financial statements<br />

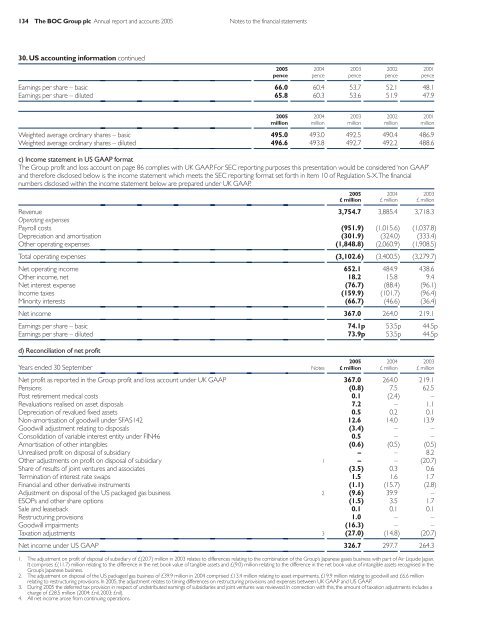

30. US accounting information continued<br />

<strong>2005</strong> 2004 2003 2002 2001<br />

pence pence pence pence pence<br />

Earnings per share – basic 66.0 60.4 53.7 52.1 48.1<br />

Earnings per share – diluted 65.8 60.3 53.6 51.9 47.9<br />

<strong>2005</strong> 2004 2003 2002 2001<br />

million million million million million<br />

Weighted average ordinary shares – basic 495.0 493.0 492.5 490.4 486.9<br />

Weighted average ordinary shares – diluted 496.6 493.8 492.7 492.2 488.6<br />

c) Income statement in US GAAP format<br />

The Group profit <strong>and</strong> loss account on page 86 complies with UK GAAP. For SEC reporting purposes this presentation would be considered ‘non GAAP’<br />

<strong>and</strong> therefore disclosed below is the income statement which meets the SEC reporting format set forth in Item 10 of Regulation S-X.The financial<br />

numbers disclosed within the income statement below are prepared under UK GAAP.<br />

<strong>2005</strong> 2004 2003<br />

£ million £ million £ million<br />

Revenue 3,754.7 3,885.4 3,718.3<br />

Operating expenses<br />

Payroll costs (951.9) (1,015.6) (1,037.8)<br />

Depreciation <strong>and</strong> amortisation (301.9) (324.0) (333.4)<br />

Other operating expenses (1,848.8) (2,060.9) (1,908.5)<br />

Total operating expenses (3,102.6) (3,400.5) (3,279.7)<br />

Net operating income 652.1 484.9 438.6<br />

Other income, net 18.2 15.8 9.4<br />

Net interest expense (76.7) (88.4) (96.1)<br />

Income taxes (159.9) (101.7) (96.4)<br />

Minority interests (66.7) (46.6) (36.4)<br />

Net income 367.0 264.0 219.1<br />

Earnings per share – basic 74.1p 53.5p 44.5p<br />

Earnings per share – diluted 73.9p 53.5p 44.5p<br />

d) Reconciliation of net profit<br />

<strong>2005</strong> 2004 2003<br />

Years ended 30 September Notes £ million £ million £ million<br />

Net profit as reported in the Group profit <strong>and</strong> loss account under UK GAAP 367.0 264.0 219.1<br />

Pensions (0.8) 7.5 62.5<br />

Post retirement medical costs 0.1 (2.4) –<br />

Revaluations realised on asset disposals 7.2 – 1.1<br />

Depreciation of revalued fixed assets 0.5 0.2 0.1<br />

Non-amortisation of goodwill under SFAS142 12.6 14.0 13.9<br />

Goodwill adjustment relating to disposals (3.4) – –<br />

Consolidation of variable interest entity under FIN46 0.5 – –<br />

Amortisation of other intangibles (0.6) (0.5) (0.5)<br />

Unrealised profit on disposal of subsidiary – – 8.2<br />

Other adjustments on profit on disposal of subsidiary 1 – – (20.7)<br />

Share of results of joint ventures <strong>and</strong> associates (3.5) 0.3 0.6<br />

Termination of interest rate swaps 1.5 1.6 1.7<br />

Financial <strong>and</strong> other derivative instruments (1.1) (15.7) (2.8)<br />

Adjustment on disposal of the US packaged gas business 2 (9.6) 39.9 –<br />

ESOPs <strong>and</strong> other share options (1.5) 3.5 1.7<br />

Sale <strong>and</strong> leaseback 0.1 0.1 0.1<br />

Restructuring provisions 1.0 – –<br />

Goodwill impairments (16.3) – –<br />

Taxation adjustments 3 (27.0) (14.8) (20.7)<br />

Net income under US GAAP 326.7 297.7 264.3<br />

1. The adjustment on profit of disposal of subsidiary of £(20.7) million in 2003 relates to differences relating to the combination of the Group’s Japanese gases business with part of Air Liquide Japan.<br />

It comprises £(11.7) million relating to the difference in the net book value of tangible assets <strong>and</strong> £(9.0) million relating to the difference in the net book value of intangible assets recognised in the<br />

Group’s Japanese business.<br />

2. The adjustment on disposal of the US packaged gas business of £39.9 million in 2004 comprised £13.4 million relating to asset impairments, £19.9 million relating to goodwill <strong>and</strong> £6.6 million<br />

relating to restructuring provisions. In <strong>2005</strong>, the adjustment relates to timing differences on restructuring provisions <strong>and</strong> expenses between UK GAAP <strong>and</strong> US GAAP.<br />

3. During <strong>2005</strong> the deferred tax provision in respect of undistributed earnings of subsidiaries <strong>and</strong> joint ventures was reviewed. In connection with this, the amount of taxation adjustments includes a<br />

charge of £28.5 million (2004: £nil, 2003: £nil).<br />

4. All net income arose from continuing operations.