Manual Debit Direct 499.33

Manual Debit Direct 499.33

Manual Debit Direct 499.33

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>499.33</strong> en (pf.ch/dok.pf) 12.2011 PF<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong><br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 1/27

<strong>Debit</strong> <strong>Direct</strong> Customer Service<br />

Advcice and Sales<br />

Telephone 0848 888 900 (regular rate)<br />

Customer service<br />

Telephone 0848 848 424<br />

Fax 058 667 66 00<br />

E-Mail postfinance @ postfinance.ch<br />

Withdrawal requests<br />

Swiss Post<br />

PostFinance<br />

Input Electronic Services<br />

Freiburgstrasse 453<br />

3002 Bern<br />

Telephone 058 667 97 68<br />

Fax 058 667 62 03<br />

Inquiries<br />

Swiss Post<br />

PostFinance<br />

National Enquiries<br />

3002 Bern<br />

Telephone 058 667 97 61<br />

Fax 058 667 62 74<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 2/27

Table of Contents<br />

1. General Information 5<br />

1.1 Valid Regulations and Handbooks 5<br />

1.2 Transaction Types (TR) 5<br />

a. Data submission 5<br />

b. Data delivery 5<br />

1.3 Data Media 5<br />

1.4 Test Runs 5<br />

2. Service Description 6<br />

2.1 Order Placing 6<br />

a. Customer identification 6<br />

b. Account for crediting 6<br />

c. Sender-ID 6<br />

d. Data integrity 6<br />

e. Order identification 6<br />

f. Total record 6<br />

g. Grouping of orders 7<br />

h. Customer side data reconstruction 7<br />

i. Permitted characters 7<br />

j. Cancellation of faulty <strong>Debit</strong> <strong>Direct</strong> orders through PostFinance 7<br />

k. Cancellation of faulty transactions through PostFinance 7<br />

l. Written debit authorization 7<br />

2.2 Due Date 9<br />

a. Definition 9<br />

b. Postal working day 9<br />

c. Approval deadline 9<br />

d. Multiple charge attempts 9<br />

e. Delayed receipt of data 9<br />

2.3 Data Submission Deadlines 9<br />

a. Transfer via e-finance and file transfer 10<br />

b. Express orders via transfer via e-finance and file transfer 10<br />

2.4 E-finance and File Transfer Approval 10<br />

2.5 Revocations/Mutations 10<br />

a. By customer 10<br />

b. By PostFinance 11<br />

c. Cancellations by multiple charge attempts 11<br />

2.6 Order Handling 11<br />

a. Credits 11<br />

b. Protestations 11<br />

c. Reversals 11<br />

2.7 Documentation Offer 12<br />

a. Order confirmation – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 4) 12<br />

b. Execution confirmation – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 5) 12<br />

c. Processing message – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 6/7) 12<br />

d. Reversals list – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 8) 13<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 3/27

2.8 Data Delivery 13<br />

a. Test runs 13<br />

b. Data delivery 14<br />

c. Rejections and reversal codes 14<br />

d. Record types 14<br />

e. Data sorting 15<br />

f. Delivery periodicity 15<br />

g. Transfer via e-finance and file transfer 16<br />

h. Copy/reconstruction of delivered data 16<br />

2.9 Mutations 17<br />

2.10 Researches/Inquiries 17<br />

Appendices<br />

Sample of <strong>Debit</strong> <strong>Direct</strong> authorization card Appendix 1<br />

Sample of <strong>Debit</strong> <strong>Direct</strong>/LSV+ authorization card Appendix 2<br />

Sample of <strong>Debit</strong> <strong>Direct</strong> and <strong>Debit</strong> <strong>Direct</strong>/LSV+<br />

authorization card in PDF format Appendix 3<br />

Order confirmation Appendix 4<br />

Execution confirmation Appendix 5<br />

Processing message Appendix 6<br />

Processing message (portrait) Appendix 7<br />

Reversals list Appendix 8<br />

Price overview: <strong>Debit</strong> <strong>Direct</strong> Appendix 9<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 4/27

1. General Information<br />

1.1 Valid Regulations and Handbooks<br />

Unless otherwise specified in the manual and appendix, the following<br />

conditions apply to transactions:<br />

– Subscriber Conditions Electronic services<br />

– General Terms and Conditions and Subscriber Conditions of PostFinance<br />

The Subscriber Conditions Electronic services and the handbook <strong>Debit</strong><br />

<strong>Direct</strong> can be found on w ww.postfinance.ch/dd. The General Terms<br />

and Conditions and Subscriber Conditions of PostFinance can be downloaded<br />

at w ww.postfinance.ch.<br />

1.2 Transaction Types (TR)<br />

<strong>Debit</strong> <strong>Direct</strong> can be used for the following types of transactions:<br />

a. Data submission<br />

TR code Description<br />

47 Record for charges to a postal account<br />

in Switzerland<br />

b. Data delivery<br />

TR codes Description<br />

81 Record for credit out-deliveries<br />

84 Record for reject/reversal out-deliveries<br />

The manual “Record Description Electronic services” can be downloaded at<br />

w ww.postfinance.ch/manuals.<br />

1.3 Data Media<br />

<strong>Debit</strong> <strong>Direct</strong> orders can be submitted/delivered via the following media:<br />

– E-finance<br />

– File transfer for business customers<br />

<strong>Direct</strong> Net connection (FDS = File Delivery Services)<br />

Partner network (FDS)<br />

H-Net ®<br />

Telebanking Server<br />

E-mail (relates only to data delivery)<br />

1.4 Test Runs<br />

An operational test is recommended as it serves to verify the record<br />

description and the entire DD routing process. Do not submit collective<br />

orders containing more than 100 transactions. Please consult the<br />

Customer service at 0848 848 424 when desiring to submit or retrieve<br />

test data.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 5/27

2. Service Description<br />

2.1 Order Placing<br />

a. Customer identification<br />

Customers are assigned a 6-digit <strong>Debit</strong> <strong>Direct</strong> customer number (5-digit<br />

customer number plus control digit) for electronic order processing.<br />

b. Account for crediting<br />

The <strong>Debit</strong> <strong>Direct</strong> order can be submitted in CHF or EUR. Requirement for<br />

this is an account for crediting in CHF or EUR. The order must be sub mitted<br />

in one currency which must match the designated currency of the <strong>Debit</strong><br />

<strong>Direct</strong> account for crediting.<br />

<strong>Debit</strong> <strong>Direct</strong> orders are credited to the account designated for credits, and<br />

any reversals debited. Only orders where the customer’s name and sender-ID<br />

match can be credited to the <strong>Debit</strong> <strong>Direct</strong> customer’s account.<br />

Each credits account will only be assigned one customer number. For this<br />

reason, an account change will result in the assignment of a new customer<br />

number. This will require organizational arrangements with PostFinance.<br />

The customer must therefore contact his customer advisor beforehand.<br />

c. Sender-ID<br />

The name on the account for crediting serves as sender-ID. This name<br />

appears on the debit memorandum in 4 lines of 30 positions. When<br />

a submission record’s “Order Giver” field contains numbers, the value is<br />

applied as sender-ID in place of the name on the account.<br />

d. Data integrity<br />

The customer is responsible for the accuracy of his submitted data.<br />

For example, the decisive booking-identifier for debit transactions is the<br />

postal account number (in either postal account or IBAN format); not<br />

the account name.<br />

e. Order identification<br />

A <strong>Debit</strong> <strong>Direct</strong> order is identified by the following data:<br />

– <strong>Debit</strong> <strong>Direct</strong> customer number<br />

– Due date<br />

– Order number<br />

It is not possible to automatically process several orders with the same<br />

identification. These orders will be processed and cancelled in case of doubt<br />

(duplicate scanning check).<br />

f. Total record<br />

The order must be submitted in one currency which must match the<br />

designated currency of the <strong>Debit</strong> <strong>Direct</strong> account for crediting. Sufficient<br />

funds are to be deposited, amount and frequency wise, to cover all<br />

submitted transactions. If discrepancies appear in the total record data<br />

during a Post Finance verification check, the order will be rejected for<br />

security reasons.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 6/27

g. Grouping of orders<br />

A data transmission via e-finance or file transfer may contain multiple<br />

orders. These can originate from the same or from different <strong>Debit</strong> <strong>Direct</strong><br />

customers.<br />

h. Customer side data reconstruction<br />

The customer must be prepared to duplicate data submitted to PostFinance<br />

up to the time he/she is certain that the orders could be correctly scanned<br />

and processed.<br />

i. Permitted characters<br />

PostFinance uses character set ISO 8859-1. This set converts other character<br />

sets, replacing values that cannot be converted with SPACES so as not to<br />

adversely affect in-house processing.<br />

j. Cancellation of faulty <strong>Debit</strong> <strong>Direct</strong> orders through PostFinance<br />

Entire collective orders are cancelled if<br />

– the top record is missing<br />

– errors are present in the control area of the top record<br />

– an invalid currency code is used in the total record<br />

– the currency code in the total record does not match the credit account<br />

– the total of the number of transactions and/or the amount does not<br />

match<br />

An order file may contain several collective orders. Each collective order<br />

begins with a top record and ends with a total record. Correctly structured<br />

collective orders will be sent to processing, erroneous ones will be cancelled.<br />

It is therefore possible that not all collective orders in an order file<br />

will be processed.<br />

Orders with errors are reported on the processing message (see chapter<br />

Documentation Offer).<br />

k. Cancellation of faulty transactions through PostFinance<br />

Individual transactions will be cancelled if<br />

– their structure does not correspond to the established standard<br />

– the control area does not match that of the top record<br />

– the minimum information (mandatory fields) is incomplete<br />

Transactions that contain field errors are reported on the processing<br />

message (see chapter Documentation Offer).<br />

The structural requirements of <strong>Debit</strong> <strong>Direct</strong> can be referred to in the<br />

“Record Description Electronic services” at w ww.postfinance.ch/manuals.<br />

l. Written debit authorization<br />

Text specification<br />

The wording used in accordance with the samples in Appendices 1 to 3<br />

must not be altered. The only exception is the word “Creditor” where the<br />

latter’s name can be mentioned. Multilingual wording is optional. It is<br />

recommended to indicate the creditor’s address for the return of the debit<br />

authorization.<br />

In case of individual creations of debit authorizations or of differing presentations<br />

of the debit authorization with regard to the prescribed wording,<br />

such forms are to be submitted to the respective account manager for verification.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 7/27

The wording of the <strong>Debit</strong> <strong>Direct</strong> authorization must not be mixed with the<br />

wording of “LSV+”, the direct debiting system of the Swiss Banks. The<br />

wordings of debiting system <strong>Debit</strong> <strong>Direct</strong> and of LSV+ are to be presented<br />

separately.<br />

Forms available<br />

The following forms are available on request:<br />

– <strong>Debit</strong> authorization form <strong>Debit</strong> <strong>Direct</strong><br />

– <strong>Debit</strong> authorization form <strong>Debit</strong> <strong>Direct</strong>/LSV+<br />

Forms in hard copy (cards): The customer can obtain the debit authorization<br />

card from his account manager (see Appendices 1 and 2). Apart<br />

from blank cards, it is possible to order cards with individual imprints starting<br />

from 100 items. Price on request from your account manager.<br />

Forms in PDF format: Under w ww.postfinance.ch/dd, you will find a<br />

writable version of the forms in PDF format (see Appendix 3). The company<br />

logo can be inserted with Adobe Acrobat Professional.<br />

<strong>Debit</strong> authorization process<br />

The creditor must be in possession of a written debit authorization by the<br />

debtor.<br />

1<br />

1<br />

2<br />

2<br />

The creditor provides Customer the debtor with the debit authorization.<br />

The debit authorization (Debtor) can be provided in physical or in electronic form<br />

(via Internet or e-mail). The debit authorization must not be requested<br />

Customer<br />

in electronic form. (Debtor)<br />

The debtor receives the form or, in case of electronic delivery, prints<br />

it out and sends the completed form signed by his/her own hand back<br />

to the creditor through the post.<br />

Creditor<br />

1<br />

2<br />

Customer<br />

(Debtor)<br />

Requests by PostFinance of debit authorizations<br />

PostFinance reserves the right to request any debit authorizations from the<br />

creditor for verification. The customer is obliged to submit to PostFinance<br />

on demand the debit authorizations for a dispatched order for verification<br />

within the period stipulated. The debit authorizations requested must be<br />

available to PostFinance for verification prior to execution of the order. In<br />

case of missing or incorrect debit authorizations, the respective <strong>Debit</strong> <strong>Direct</strong><br />

order may experience a delay in execution of the order or can be cancelled<br />

directly by PostFinance.<br />

Creditor’s obligation to provide proof of debit authorizations<br />

The creditor is required to retain the debit authorization and to present it<br />

to PostFinance upon request (for at least 14 months after the last debit).<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 8/27

2.2 Due Date<br />

a. Definition<br />

The due date must fall on a postal workday. On the order’s due date:<br />

– the debtor’s postal account is debited, and<br />

– the due amount is credited to the <strong>Debit</strong> <strong>Direct</strong> customer’s postal account.<br />

<strong>Debit</strong> <strong>Direct</strong> orders may be submitted to PostFinance up to one year in<br />

advance. Large collective orders containing more than 1000 transactions are<br />

exceptions – these are to be submitted not more than 90 days prior to<br />

falling due.<br />

b. Postal working day<br />

A postal working day is defined as the weekdays Monday through Friday,<br />

and also the last calendar day of a month. Exceptions are the general<br />

holidays.<br />

If the due date specified by the customer is not a postal working day and<br />

does not fall on the last day of the month, the <strong>Debit</strong> <strong>Direct</strong> order will be<br />

executed on the next valid working day.<br />

c. Approval deadline<br />

Orders that have not been approved or only partially approved on the<br />

foreseen execution date remain pending for a further five postal working<br />

days. The order may still be approved during this time, otherwise it will<br />

be cancelled.<br />

d. Multiple charge attempts<br />

This optional service, subject to fee, automatically makes multiple attempts<br />

to charge the account in cases where “insufficient funds” or a “blocked<br />

postal account” result in a failed execution the first time. The following variations<br />

may be selected from:<br />

– 3 days a fter due date and/or<br />

– 5 days after due date and/or<br />

– 10 days after due date.<br />

Charge orders sent as “Express” are not included in this multiple charge<br />

attempt offer, but are rather processed and closed immediately.<br />

e. Delayed receipt of data<br />

If data sent by e-finance or file transfer arrive at PostFinance too late, they<br />

will be incorporated into the next available processing cycle, so long<br />

as the due date has been passed by not more than 90 calendar days. Older<br />

orders can not be processed.<br />

Advice of the new execution date is provided on the customer’s processing<br />

notification.<br />

Eventual research requests are to always indicate the order’s original due<br />

date.<br />

2.3 Data Submission Deadlines<br />

PostFinance recommends submitting data as early as possible to permit<br />

time for the handling of flagged errors; allowing for flawed transactions<br />

to be newly submitted and still executed on the required date.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 9/27

a. Transfer via e-finance and file transfer<br />

The data transfer via e-finance and file transfer, including approval, must<br />

be completed at the latest on the day prior to the due date and no later<br />

than 12 p.m.<br />

b. Express orders via transfer via e-finance and file transfer<br />

Express orders can be submitted on postal working days from Monday<br />

to Friday via e-finance and file transfer. The express delivery is not available<br />

for Telebanking Server. Should the customer, however, have additionally<br />

an e-finance connection, the order can be mutated and be executed with<br />

priority “express”.<br />

This optional service, subject to fee, executes a charge order immediately<br />

and simultaneously books the resulting credit to the <strong>Debit</strong> <strong>Direct</strong> customer’s<br />

account. Please note the applicable amount and time restrictions below:<br />

Maximum no. of transactions<br />

per order<br />

1000 11 a.m.<br />

100 13 p.m.<br />

10 18 p.m.<br />

Latest upload and<br />

release time<br />

Sidenote: Express orders have no need for multiple processing attempts,<br />

but are immediately processed and closed.<br />

2.4 E-finance and File Transfer Approval<br />

Different provisions apply for orders issued via e-finance and file transfer:<br />

– E-finance: <strong>Debit</strong> <strong>Direct</strong> orders must be approved after transfer.<br />

Exception: orders submitted by a user with single signature authority are<br />

considered signed/approved and flow directly into processing.<br />

– <strong>Direct</strong> Net connection FDS, Partner network FDS, H-Net ® : <strong>Debit</strong><br />

<strong>Direct</strong> orders must be “release confirmed” via e-finance after transmittal.<br />

Exception: orders submitted by a user with single signature authority are<br />

considered signed/confirmed and flow directly into processing.<br />

– Telebanking Server: No release confirmation is necessary; the security<br />

elements are checked and verified during transmission.<br />

2.5 Revocations/Mutations<br />

a. By customer<br />

With e-finance and file transfer for business customers (only if the customer<br />

has an additional e-finance connection) the user can make the following<br />

cancellations and modifications up to one day prior to the due date, no later<br />

than midnight:<br />

– delete individual payments and/or entire collective orders<br />

– change an order’s due date<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 10/27

. By PostFinance<br />

The customer may recall/cancel entire collective orders or individual transactions<br />

up to one postal working day prior to the due date and no later<br />

than 10 p.m.<br />

Cancellation instructions are to be submitted to Input Electronic Services,<br />

in writing. Requests submitted by telephone or fax will also be processed<br />

if an agreement has been deposited for this purpose.<br />

For entire orders the following particulars must be provided:<br />

– <strong>Debit</strong> <strong>Direct</strong> customer number<br />

– Due date<br />

– Order number<br />

For individual transactions, the transaction serial number is also required.<br />

If an order or transaction cannot be identified on the basis of the listed<br />

particulars, the cancellation will not be processed.<br />

c. Cancellations by multiple charge attempts<br />

If the multiple charge attempt option is activated in the master file, then<br />

order cancellation is also possible after expiration of the due date for:<br />

– All non-executed transactions collectively, or<br />

– Individual transactions not yet executed.<br />

2.6 Order Handling<br />

a. Credits<br />

The sum total of a customer’s executed <strong>Debit</strong> <strong>Direct</strong> transactions is credited<br />

to the debtor’s account on the day designated for charges. Ordinarily, this<br />

date corresponds to the order’s due date.<br />

If the charge follows through the multiple attempts option and is first<br />

successful on the third attempt, for example, then the transaction’s credit<br />

booking is likewise correspondingly delayed.<br />

b. Protestations<br />

<strong>Debit</strong> <strong>Direct</strong> only permits charge authorizations with right of recall. A protesting<br />

debtor can request a charge reversal within 30 days by notifying<br />

his assigned Processing Center in writing and attaching the debit memorandum<br />

when possible.<br />

After 30 days from the mailing of the account statement, the debtor must<br />

deal directly with the creditor.<br />

c. Reversals<br />

The <strong>Debit</strong> <strong>Direct</strong> customer agrees without reservation that already credited<br />

amounts be charged back from his credit account on the agreed value date.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 11/27

2.7 Documentation Offer<br />

All documents are delivered electronically via e-finance, file transfer or<br />

on paper. For changes we kindly ask you to contact the Customer service.<br />

a. Order confirmation – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 4)<br />

– Receipt of the order is acknowledged with an order confirmation, insofar<br />

as the date of execution is at least two days out. If the order falls due<br />

immediately, receipt will be acknowledged on the execution confirmation.<br />

– The order confirmation compiles a list of transactions. It also shows the<br />

number of transactions undertaken and whether erroneous/cancelled<br />

payments had to be rejected. These are detailed in a separate pro cessing<br />

message.<br />

– The document may be suppressed at the customer’s request. The electronic<br />

delivery is free of charge. The delivery on paper is subject to a fee.<br />

b. Execution confirmation – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 5)<br />

– The customer receives a confirmation of execution at the com pletion of<br />

the <strong>Debit</strong> <strong>Direct</strong> order. This compilation shows the daily number of<br />

processed payments as well as the sum total. Any erroneous or cancelled<br />

transactions found during this processing stage will be listed in a<br />

separate processing message.<br />

– The order’s total for the day is credited on its due date to the customer’s<br />

designated account for crediting.<br />

– Total relevant fees are also noted.<br />

– The document may be suppressed at the customer’s request. The electronic<br />

delivery is free of charge. The delivery on paper is subject to a fee.<br />

c. Processing message – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 6/7)<br />

– Orders with errors or transactions that contain field errors are reported on<br />

the processing message. Rejected transactions cannot be cor rected and<br />

must therefore be newly submitted in a subsequent order.<br />

– It is not possible to suppress the processing message because notification<br />

of identified errors is made without exception. Error notification is made<br />

even when the customer has elected to waive the order and execution<br />

con firmations.<br />

– The processing message is free of charge (electronic/on paper).<br />

– If an order containing payment errors is delivered at least two days prior<br />

to falling due, the processing message will still be generated and mailed.<br />

Once executed, earlier advised errors are listed in a processing message<br />

with eventual others discovered during processing. A star marks the transactions<br />

for which notification has already been made. If the customer<br />

so requests, it is possible to arrange that any errors already reported in the<br />

processing report are not notified a second time upon execution.<br />

– The processing message is sectioned as follows:<br />

1. Executed transactions containing irregularities<br />

2. Transactions not executed<br />

3. Cancelled transactions<br />

4. Rejections<br />

The list shows the total number of not executed and/or cancelled transactions.<br />

With rejections, the sum total is shown as well.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 12/27

The customer can choose whether he wants rejection details to appear on<br />

the processing message, and/or if he wants to retrieve them electronically.<br />

The following incidences incur charge rejection:<br />

– Insufficient cover funds<br />

– The debtor’s account and address do not match<br />

– Postal account closed<br />

– Postal account blocked/frozen<br />

– Postal account holder deceased<br />

– Postal account number non-existent<br />

– To make payment identification easier, the following information is<br />

re-listed next to the transaction serial number – some of it in abbreviated<br />

form: account to be debited, debtor, add-on text, currency and order<br />

amount.<br />

– The relevant error message is found to the right of the incorrect data field.<br />

If a field contains more than one error, only the first instance is noted.<br />

d. Reversals list – <strong>Debit</strong> <strong>Direct</strong> (DD)<br />

(see Appendix 8)<br />

A debtor protesting a charge has 30 days in which to submit a revocation,<br />

which results in a charge reversal. If the <strong>Debit</strong> <strong>Direct</strong> customer wishes to<br />

have the debits that he/she has not accepted on paper or by e-mail, the<br />

reversals list will be sent. The list shows cancelled transactions per <strong>Debit</strong> <strong>Direct</strong><br />

order in the current period. The account number to be debited, debtor’s<br />

name, add-on text, date of reverse entry, currency and amount are listed<br />

next to the transaction serial number.<br />

2.8 Data Delivery<br />

The customer can obtain credit, reject and reverse entry information via<br />

e-finance or file transfer. Records are available in <strong>Debit</strong> <strong>Direct</strong> or <strong>Debit</strong> <strong>Direct</strong><br />

ISR record format.<br />

a. Test runs<br />

If the customer wishes to carry out a test run data delivery, customer service<br />

will provide one test file free of charge. The records consist of customer<br />

supplied test-data.<br />

To dry run cases of error, every fifth trans action will be flagged for rejection<br />

and the order’s last five bookings will be likewise marked for reverse bookings.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 13/27

. Data delivery<br />

A data transfer via e-finance or file transfer conveyance can contain reverse<br />

entries for multiple <strong>Debit</strong> <strong>Direct</strong> orders.<br />

Customers select from the following data delivery options:<br />

Credit entries<br />

electronic<br />

Rejections<br />

electronic<br />

Reversals (electronic and/or paper)<br />

electronic: File with transaction type 84 and/or<br />

Reversals list by e-mail<br />

Paper: Reversals list via post<br />

Faulty transactions are cancelled and not delivered as rejections (see chapter<br />

Order Placing, Cancellation of faulty transactions through PostFinance).<br />

c. Rejections and reversal codes<br />

Electronically delivered rejections with transaction 84 are flagged with one<br />

of the underlying code numbers, indicating why the transaction failed:<br />

Rejection codes Rejection reasons<br />

01 Insufficient cover funds<br />

03 Debtor’s account number and address do<br />

not match<br />

04 Postal account closed<br />

05 Postal account blocked/frozen<br />

06 Postal account holder deceased<br />

07 Postal account number non-existent<br />

Reversal codes Reversal reason<br />

02 Debtor protestation<br />

d. Record types<br />

TR codes Descriptions<br />

81 Outdelivery record for credits<br />

84 Outdelivery record for rejections and reversals<br />

97 Total record<br />

Record type format is described in the <strong>Manual</strong> “Record Description Electronic<br />

Services”.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 14/27

e. Data sorting<br />

Data within each <strong>Debit</strong> <strong>Direct</strong> customer number is grouped by credits/<br />

rejections and reversals according to the following sample:<br />

• Outdelivery number<br />

• <strong>Debit</strong> <strong>Direct</strong> customer number ascending<br />

• Due date descending<br />

• <strong>Debit</strong> <strong>Direct</strong> order number ascending<br />

• TR type 81/credits<br />

• TR serial numbers ascending<br />

• TR type 84/rejections<br />

• TR serial numbers ascending<br />

• TR type 97/total record<br />

• Due date descending<br />

• <strong>Debit</strong> <strong>Direct</strong> order number ascending<br />

• TR type 84/reverse entries<br />

• TR serial numbers ascending<br />

• TR type 97/total record<br />

The pattern repeats itself within the outdelivery number for each <strong>Debit</strong><br />

<strong>Direct</strong> customer number.<br />

f. Delivery periodicity<br />

Credit and rejection data is delivered upon settlement of each order,<br />

as follows:<br />

– normal cases = on due date<br />

– by actived multiple attempt option = on the last booking attempt date<br />

For eventually occurring reverse entries, customers can select between<br />

the following outdelivery options:<br />

– daily<br />

– weekly<br />

– bimonthly<br />

– monthly<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 15/27

g. Transfer via e-finance and file transfer<br />

Customers using e-finance and file transfer generally have access to<br />

their data after 6.30 p.m. (E-mail the next day as of 6 a.m.). Data can<br />

be downloaded as follows:<br />

– E-finance Files remain available over a period of<br />

15 months; data which have been<br />

downloaded are deleted after 30 days.<br />

– <strong>Direct</strong> Net connection<br />

(FDS)<br />

– Partner network (FDS)<br />

– H-Net ®<br />

Files (whether downloaded or not) remain<br />

available for 9 calendar days. The customer<br />

can delete files that have been downloaded.<br />

– Telebanking Server The file remains available to the customer.<br />

Data which have been downloaded are<br />

deleted.<br />

– E-mail Files are sent to the recipient’s e-mail<br />

address.<br />

h. Copy/reconstruction of delivered data<br />

Copies of data (reconstructions) can be ordered via customer services.<br />

Please specify as many original delivery details as possible when ordering.<br />

Copy files are labeled for outdelivery as follows:<br />

– E-finance Download screen is subdivided between<br />

“Production” and “Copy”<br />

– <strong>Direct</strong> Net connection (FDS)<br />

– Partner network (FDS)<br />

– H-Net ®<br />

– Telebanking Server Not visible<br />

Apparent in the file name<br />

– E-mail E-mail is marked “Copy”<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 16/27

2.9 Mutations<br />

Customer service is to be informed of any mutations 3 postal workdays<br />

prior to the changes taking effect.<br />

In writing: – account for debiting fees<br />

– change of data medium<br />

By phone: – change of address<br />

– to activate multiple charge attempt option<br />

– to deactivate multiple charge attempt option<br />

2.10 Researches/Inquiries<br />

All research inquiries are to utilize Post form “<strong>Debit</strong> <strong>Direct</strong> Research<br />

Inquiries”.<br />

The <strong>Debit</strong> <strong>Direct</strong> customer is to complete the form and mail it to:<br />

PostFinance<br />

National Enquiries<br />

3002 Bern<br />

Post forms can be reordered from Input Electronic Services.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 17/27

Appendix 1<br />

Sample of <strong>Debit</strong> <strong>Direct</strong> authorization card<br />

<strong>Debit</strong> authorization with right of contestation<br />

for the PostFinance postal account (<strong>Debit</strong> <strong>Direct</strong>)<br />

Creditor<br />

<strong>Debit</strong> <strong>Direct</strong> subscriber no.<br />

With my signature, I hereby authorize the creditor to debit the due amounts to my postal<br />

account until such time as this authorization is revoked.<br />

Customer reference no.<br />

Postal account no.<br />

Last name, first name<br />

Company<br />

Street, no.<br />

Postcode, town<br />

Tel. no. (home) Tel. no. (work)<br />

E-mail<br />

Place, date<br />

Signature/s*<br />

* Signature of the grantor of power of attorney or authorized person for the postal account. For collective signatures,<br />

two signatures are required.<br />

PostFinance is not obliged to execute the debit should the funds available in my account<br />

be insufficient. The <strong>Debit</strong> <strong>Direct</strong> debits are free of charge for me. I reserve the right to reverse<br />

debit transactions by sending written instructions to my Operations Center within 30 days<br />

of dispatch of the account statement.<br />

Please return the completed debit authorization to the aforementioned creditor’s address.<br />

Creditor<br />

1<br />

2<br />

Customer<br />

<strong>Debit</strong> <strong>Direct</strong><br />

Save time and money!<br />

Pay your bills with the PostFinance <strong>Debit</strong> <strong>Direct</strong> service.<br />

1. The creditor provides the customer with the debit<br />

authorization.<br />

2. The customer returns the completed debit<br />

authorization to the Creditor.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 18/27

Appendix 2<br />

Sample of <strong>Debit</strong> <strong>Direct</strong>/LSV+ authorization card<br />

<strong>Debit</strong> <strong>Direct</strong> / LSV+<br />

Save time and money!<br />

Pay your bills with the PostFinance <strong>Debit</strong> <strong>Direct</strong><br />

service or with the Swiss banks’ direct debit plus<br />

scheme (LSV+).<br />

<strong>Debit</strong> authorization with right of contestation<br />

for the bank account (LSV+)<br />

<strong>Debit</strong> authorization with right of contestation<br />

for the PostFinance postal account (<strong>Debit</strong> <strong>Direct</strong>)<br />

Creditor<br />

<strong>Debit</strong> <strong>Direct</strong> subscriber no.<br />

With my signature, I hereby authorize the creditor to debit the due amounts to my postal<br />

account until such time as this authorization is revoked.<br />

Customer reference no.<br />

Postal account no.<br />

Last name, first name<br />

Company<br />

Street, no.<br />

Postcode, town<br />

Tel. no. (home) Tel. no. (work)<br />

E-mail<br />

Place, date<br />

Signature/s*<br />

* Signature of the grantor of power of attorney or authorized person for the postal account. For collective signatures,<br />

two signatures are required.<br />

PostFinance is not obliged to execute the debit should the funds available in my account<br />

be insufficient. The <strong>Debit</strong> <strong>Direct</strong> debits are free of charge for me. I reserve the right to reverse<br />

Creditor Customer debit transactions CHFby<br />

sending written instructions to my Operations Center within 30 days<br />

of dispatch of the account statement.<br />

LSV ID. Ref. no.<br />

Creditor<br />

I hereby authorize my bank to execute the debits (in CHF) from the above creditor to<br />

my account until such time as this authorization is revoked.<br />

Name of bank<br />

Postcode, town<br />

IBAN<br />

or account no.<br />

Bank clearing no. (if known)<br />

If there are insufficient funds in my account, my bank is not obliged to execute the debit.<br />

I will be notified of all debits to my account. The amount debited will be reimbursed if<br />

I submit a binding contestation to my bank within 30 days of the notification date. I hereby<br />

authorize my bank to inform the creditor in Switzerland or abroad of the content of this<br />

debit authorization and of its subsequent cancellation (if applicable) by whatever means it<br />

deems suitable.<br />

Place, date Signature<br />

Amendment (leave blank, to be completed by the bank)<br />

BC no.<br />

IBAN<br />

Bank’s stamp<br />

Date and initials<br />

1<br />

Creditor Customer<br />

3<br />

Bank<br />

2<br />

Please return the completed debit authorization to the aforementioned creditor’s<br />

address.<br />

1. The creditor provides the customer with the debit<br />

authorization.<br />

2. The customer returns the completed debit<br />

authorization to his bank.<br />

3. The creditor receives confirmation once the debit<br />

has been activated by the bank.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 19/27<br />

1<br />

2<br />

Customer<br />

1. The creditor provides the customer with<br />

the debit authorization.<br />

2. The customer returns the completed debit<br />

authorization to the Creditor.

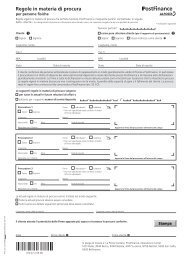

Appendix 3<br />

Sample of <strong>Debit</strong> <strong>Direct</strong> and <strong>Debit</strong> <strong>Direct</strong>/LSV+ authorization card in PDF format<br />

460.59 en (pf.ch/dok.pf) 02.2010 PF<br />

<strong>Debit</strong> authorization with right of contestation<br />

for the PostFinance postal account (<strong>Debit</strong> <strong>Direct</strong>)<br />

Creditor<br />

<strong>Debit</strong> <strong>Direct</strong> subscriber no.<br />

Customer<br />

With my signature, I hereby authorize the creditor to debit the due amounts to my postal account until such time as this authorization is revoked.<br />

Customer reference no.<br />

Postal account no.<br />

Last name, first name<br />

Company<br />

Street, no.<br />

Postcode, town<br />

Tel. no. (home) Tel. no. (work) Creditor<br />

E-mail<br />

Place, date Signature/s*<br />

*Signature of the grantor of power of attorney or authorized person for the postal account. For collective signatures, two signatures are required.<br />

PostFinance is not obliged to execute the debit should the funds available in my account be insufficient. The <strong>Debit</strong> <strong>Direct</strong> debits are free of charge<br />

for me. I reserve the right to reverse debit transactions by sending written instructions to my Customer Operations reference Center no. within 30 days of dispatch of the<br />

Company<br />

account statement.<br />

Last name First name<br />

Please return the completed debit authorization to the aforementioned creditor’s address. Street, no. Postcode, town<br />

Tel. no. (home) Tel. no. (work)<br />

E-mail<br />

Creditor<br />

1<br />

2<br />

Customer<br />

LOGO<br />

<strong>Debit</strong> authorization with right of contestation<br />

for the PostFinance postal account (<strong>Debit</strong> <strong>Direct</strong>)<br />

and for the bank account (LSV+)<br />

<strong>Debit</strong> authorization for my postal account (<strong>Debit</strong> <strong>Direct</strong>)<br />

1. The creditor provides the customer with the debit authorization.<br />

2. The customer returns With the my signature, completed I debit hereby authorization authorize the to creditor the creditor. to debit the due amounts to my postal account until such time as this authorization is revoked.<br />

Postal account no.<br />

PostFinance is not obliged to execute the debit should the funds available in my account be insufficient. The <strong>Debit</strong> <strong>Direct</strong> debits are free of charge<br />

for me. I reserve the right to reverse debit transactions by sending written instructions to my Operations Center within 30 days of dispatch of the<br />

account statement.<br />

Please return the completed debit authorization to the aforementioned creditor’s address.<br />

Place, date Signature/s*<br />

*Signature of the grantor of power of attorney or authorized person for the postal account. For collective signatures, two signatures are required.<br />

460.31 en (pf.ch/dok.pf) 02.2010 PF<br />

<strong>Debit</strong> <strong>Direct</strong> subscriber no. LSV IDENT.<br />

Customer<br />

Amendment (leave blank, to be completed by the bank)<br />

BC no. IBAN<br />

Bank’s stamp<br />

Date and initials<br />

LOGO<br />

<strong>Debit</strong> authorization for my bank account (LSV+) CHF<br />

I hereby authorize my bank to execute the debits (in CHF) from the above creditor to my account until such time as this authorization<br />

is revoked.<br />

Name of bank Postcode, town<br />

IBAN<br />

or account no. Bank clearing no. (if known)<br />

If there are insufficient funds in my account, my bank is not obliged to execute the debit. I will be notified of all debits to my account. The amount<br />

debited will be reimbursed if I submit a binding contestation to my bank within 30 days of the notification date. I hereby authorize my bank to<br />

inform the creditor in Switzerland or abroad of the content of this debit authorization and of its subsequent cancellation (if applicable) by whatever<br />

means it deems suitable.<br />

Please return the completed debit authorization to the bank.<br />

Place, date Signature<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 20/27

Appendix 4<br />

Swiss Post<br />

PostFinance<br />

Your account is handled by<br />

Belin Noma and team<br />

Telephone 058 338 99 77<br />

Fax 058 338 99 77<br />

www.postfinance.ch<br />

Robert Schneider SA<br />

Grands magasins<br />

Biel/Bienne<br />

P.P.<br />

502301221<br />

CH-4808 Zofingen A-PRIORITY<br />

Robert Schneider SA<br />

Ruelle du Lac 177<br />

2503 Biel/Bienne<br />

Order confirmation Page:<br />

<strong>Debit</strong> <strong>Direct</strong> (DD)<br />

1 / 1<br />

Date: 01.06.2011<br />

Credit account: 25-9034-2 Due date: 07.06.2011<br />

Fee debit account: 25-9034-2 Execution date: 07.06.2011<br />

Order identification: 20110601.0008.00.621729755 E-finance number: 112212784<br />

Order reference: Auftrag Juni Transmission per: Online file transfer<br />

Order number: 3 DD customer number: 100585<br />

Number Initial currency Amount<br />

Transactions delivered 40<br />

Non-executable transactions 1<br />

Transactions deleted 1<br />

Rejections 1<br />

Transactions to be booked 37 CHF 30 163.95<br />

Not all transactions could be considered.<br />

Please note the attached processing message!<br />

Yours sincerely<br />

Swiss Post<br />

PostFinance<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 21/27

Appendix 5<br />

Swiss Post<br />

PostFinance<br />

Your account is handled by<br />

Ursula Müller and team<br />

Telephone 058 338 99 77<br />

Fax 058 338 99 77<br />

www.postfinance.ch<br />

Robert Schneider SA<br />

Grands magasins<br />

Biel/Bienne<br />

P.P.<br />

502301221<br />

CH-4808 Zofingen A-PRIORITY<br />

Robert Schneider SA<br />

Ruelle du Lac 177<br />

2503 Biel/Bienne<br />

Execution confirmation Page:<br />

<strong>Debit</strong> <strong>Direct</strong> (DD)<br />

1 / 1<br />

Date: 07.06.2011<br />

Credit account: 25-9034-2 Due date: 07.06.2011<br />

Fee debit account: 25-9034-2 E-finance number: 112212784<br />

Order identification: 20110601.0008.00.621729755 Transmission per: Online file transfer<br />

Order reference: Auftrag Juni DD customer number: 100585<br />

Order number: 3<br />

Execution date Multiple charge attempts Number Initial currency Amount<br />

07.06.2011 - 36 CHF 29 009.35<br />

Transactions delivered 40<br />

Transactions non-executed 1<br />

Transactions deleted 1<br />

Rejections 2<br />

Transactions booked 36 CHF 29 009.35<br />

Price CHF 1.00<br />

Not all transactions could be considered.<br />

Please note the attached processing message!<br />

Yours sincerely<br />

Swiss Post<br />

PostFinance<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 22/27

Appendix 6<br />

Processing message<br />

<strong>Debit</strong> <strong>Direct</strong> (DD)<br />

Date: 01.06.2011<br />

Page 1 / 2<br />

Credit account: 25-9034-2 Due date: 07.06.2011 Robert Schneider SA<br />

Fee debit account: 25-9034-2 Execution date: 07.06.2011<br />

Ruelle du Lac 177<br />

Order identification: 20110601.0008.00.621729755 E-finance number: 112212784<br />

2503 Biel/Bienne<br />

Order reference: Auftrag Juni Transmission per: Online file transfer<br />

Order number: 3 DD customer number: 100585<br />

Transactions not executed<br />

No. <strong>Debit</strong> account Debtor Additional information Currency Initial amount<br />

422.70<br />

0000000000123456789 CHF<br />

4 10-33333-2 Verena Hinterbacher<br />

BERN<br />

Data field Error<br />

40N000013<br />

Debtor’s account number invalid<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 23/27<br />

Transactions deleted<br />

No. <strong>Debit</strong> account Debtor Additional information Currency Initial amount<br />

647.90<br />

0000000000123456789 CHF<br />

12 10-333-2 PostFinance Fachdienst/Support<br />

3030 Bern<br />

Note<br />

Single order cancelled by customer<br />

Rejections<br />

No. <strong>Debit</strong> account Debtor Additional information Currency Initial amount<br />

1 154.60<br />

114555 CHF<br />

1 407.95<br />

0000000000123456789 CHF<br />

30 30-234567-5 Maria Bernasconi<br />

Biel/Bienne<br />

Data field Note<br />

32500023<br />

Postal account number non-existent<br />

356 30-456789-5 PostFinance Fachdienst/Support<br />

3030 Bern<br />

Note<br />

Insufficient cover funds

Processing message<br />

<strong>Debit</strong> <strong>Direct</strong> (DD)<br />

Page 2 / 2<br />

Credit account: 25-9034-2 Due date: 07.06.2011<br />

Order number: 3 E-finance number: 112212784<br />

DD customer number: 100585<br />

Total non-executed or deleted transactions 2<br />

Total rejections 2 CHF 2 562.55<br />

Yours sincerely<br />

Swiss Post<br />

PostFinance<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 24/27

Appendix 7<br />

Swiss Post<br />

PostFinance<br />

Your account is handled by<br />

Belin Noma and team<br />

Telephone 058 338 99 77<br />

Fax 058 338 99 77<br />

www.postfinance.ch<br />

Robert Schneider SA<br />

Grands magasins<br />

Biel/Bienne<br />

P.P.<br />

502301221<br />

CH-4808 Zofingen A-PRIORITY<br />

Robert Schneider SA<br />

Ruelle du Lac 177<br />

2503 Biel/Bienne<br />

Processing message Page:<br />

<strong>Debit</strong> <strong>Direct</strong> (DD)<br />

1 / 1<br />

Date: 01.06.2011<br />

Credit account: 25-9034-2 Due date: 07.06.2010<br />

Fee debit account: 25-9034-2 Execution date: 07.06.2011<br />

Order identification: 20110601.0008.00.6217297998 E-finance number: 112212784<br />

Order reference: Auftrag Juni Transmission per: Online file transfer<br />

Order number: 3 DD customer number: 100585<br />

Order not executed<br />

Note Number of transactions Currency Total amount<br />

Collective order with same key term exists 1 CHF<br />

18 952.85<br />

Yours sincerely<br />

Swiss Post<br />

PostFinance<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 25/27

Appendix 8<br />

Swiss Post<br />

PostFinance<br />

Your account is handled by<br />

Patrick Schmid and team<br />

Telephone 058 338 99 77<br />

Fax 058 338 99 77<br />

www.postfinance.ch<br />

Robert Schneider SA<br />

Grands magasins<br />

Biel/Bienne<br />

P.P.<br />

502301221<br />

CH-4808 Zofingen A-PRIORITY<br />

Robert Schneider SA<br />

Ruelle du Lac 177<br />

2503 Biel/Bienne<br />

Reversals list Page:<br />

<strong>Debit</strong> <strong>Direct</strong> (DD)<br />

1 / 1<br />

Date: 14.06.2011<br />

Credit account: 25-9034-2 Due date: 07.06.2011<br />

Fee debit account: 25-9034-2 Delivery number: 3218435135<br />

Order number: 3 DD customer number: 100585<br />

No. <strong>Debit</strong><br />

account<br />

Debtor protestation Additional information Date Curr<br />

Initial<br />

amount<br />

356 10-333-2 Verena Vonlanthen 14.06.2011 CHF 1 000.00<br />

Yours sincerely<br />

Swiss Post<br />

PostFinance<br />

Total Price CHF 0.70<br />

Total 1 reversed transaction CHF 200.90<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 26/27

Appendix 9<br />

Price overview: <strong>Debit</strong> <strong>Direct</strong><br />

Rejects<br />

Fee per rejection CHF –.50 per transaction<br />

Reversals<br />

Fee per revocation CHF –.70 je TA<br />

Multiple charge attempts<br />

Each additional charge attempt, per transaction CHF –.20<br />

Express<br />

Price per transaction CHF 3.–<br />

Incoming data delivery<br />

E-finance, file transfer for business customers free of charge<br />

Outgoing data delivery<br />

Reversals list on paper free of charge<br />

electronically free of charge<br />

<strong>Debit</strong> <strong>Direct</strong> file electronically free of charge<br />

Confirmation of order/execution on paper CHF 1.– per document<br />

electronically free of charge<br />

Processing message on paper free of charge<br />

electronically free of charge<br />

Inquiries/Researches<br />

Researches are cost incurring, except where Swiss Post<br />

is responsible for the reason of research. CHF 15.– per 1 /4 hour<br />

<strong>Debit</strong>ing of fees<br />

<strong>Debit</strong> <strong>Direct</strong> fees are charged to the account designated for fees,<br />

together with other applicable PostFinance service fees, at month’s end.<br />

The customer is responsible for maintaining adequate cover funds<br />

in the relevant account at all times.<br />

<strong>Manual</strong> <strong>Debit</strong> <strong>Direct</strong> Version December 2011 27/27