Philippine Tariff Commission

Philippine Tariff Commission

Philippine Tariff Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

An n u a l Re p o r t 2009<br />

IV.<br />

SECTION 1313-a - TARIFF COMMODITY CLASSIFICATION<br />

The ASEAN Harmonized <strong>Tariff</strong> Nomenclature (AHTN) <strong>Tariff</strong> and Customs<br />

Code of the <strong>Philippine</strong>s (TCCP) classifies articles imported into the <strong>Philippine</strong>s.<br />

However, when the proper tariff classification of a commodity intended to be<br />

imported cannot be ascertained, the interested party may file with the <strong>Tariff</strong><br />

<strong>Commission</strong> a request for a commodity classification ruling pursuant to Section<br />

1313-a of the Code.<br />

The applicant is required to submit in triplicate a notarized and duly<br />

accomplished TC Form 1a (Request for <strong>Tariff</strong> Classification Ruling). Likewise,<br />

the applicant is required to submit a sample or samples of the product (if<br />

available), technical brochures/catalogues indicating its specifications, its<br />

material or chemical composition and other relevant information.<br />

The <strong>Commission</strong> is a permanent representative (together with the<br />

Bureau of Customs and the Bureau of Import Services) to the Valuation and<br />

Classification Review Committee (VCRC). This committee meets once a week<br />

to resolve issues involving valuation and tariff classification.<br />

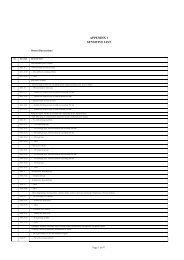

During the year, the <strong>Commission</strong> received two hundred twenty-four (224)<br />

requests for tariff classification, and issued one hundred ninety-nine (199)<br />

rulings (see Annex A).<br />

ASEAN Harmonized <strong>Tariff</strong> Nomenclature (AHTN) and the World Trade Organization (WCO)<br />

Harmonized System (HS) Nomenclature – 2007 Amendment<br />

The Harmonized Commodity Description and Coding System (commonly<br />

known as the HS) is an international nomenclature of goods used by more than<br />

200 countries as the basis in classification and coding merchandise for purposes<br />

of customs tariffs collection and for gathering international trade statistics.<br />

After the implementation of the HS in 1988, major reviews were undertaken<br />

which resulted in the 1996, 2002 and 2007 versions. The third major revision<br />

entered into force on January 1, 2007. The <strong>Philippine</strong>s implemented these<br />

amendments in January 2008 in accordance with the decision of the NEDA<br />

Board in its meeting on September 18, 2007.<br />

The ASEAN member countries adopted the Protocol Governing the<br />

Implementation of the ASEAN Harmonized <strong>Tariff</strong> Nomenclature (the AHTN<br />

Protocol)to harmonize the tariff nomenclature based on the HS among member<br />

countries. The AHTN adopted the HS up to the six-digit commodity classification<br />

codes and used the eight-digit commodity classification code for the ASEAN<br />

27