Aviva Irl With Profit Fund Celebration Bond

Aviva Irl With Profit Fund Celebration Bond Aviva Irl With Profit Fund Celebration Bond

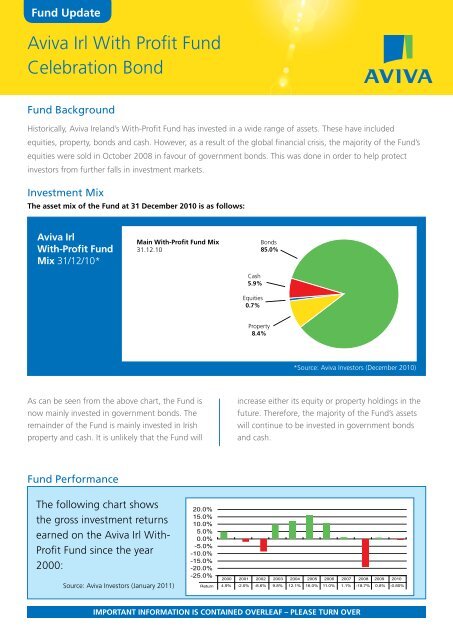

Fund Update Aviva Irl With Profit Fund Celebration Bond Fund Background Historically, Aviva Ireland’s With-Profit Fund has invested in a wide range of assets. These have included equities, property, bonds and cash. However, as a result of the global financial crisis, the majority of the Fund’s equities were sold in October 2008 in favour of government bonds. This was done in order to help protect investors from further falls in investment markets. Investment Mix The asset mix of the Fund at 31 December 2010 is as follows: Aviva Irl With-Profit Fund Mix 31/12/10* Main With-Profit Fund Mix 31.12.10 Cash 5.9% Bonds 85.0% Equities 0.7% Property 8.4% *Source: Aviva Investors (December 2010) As can be seen from the above chart, the Fund is now mainly invested in government bonds. The remainder of the Fund is mainly invested in Irish property and cash. It is unlikely that the Fund will increase either its equity or property holdings in the future. Therefore, the majority of the Fund’s assets will continue to be invested in government bonds and cash. Fund Performance The following chart shows the gross investment returns earned on the Aviva Irl With- Profit Fund since the year 2000: Source: Aviva Investors (January 2011) 20.0% 15.0% 10.0% 5.0% 0.0% -5.0% -10.0% -15.0% -20.0% -25.0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Return 4.9% -2.0% -8.6% 9.8% 12.1% 16.0% 11.0% 1.1% -18.7% 0.8% -0.80% IMPORTANT INFORMATION IS CONTAINED OVERLEAF – PLEASE TURN OVER

<strong>Fund</strong> Update<br />

<strong>Aviva</strong> <strong>Irl</strong> <strong>With</strong> <strong>Profit</strong> <strong>Fund</strong><br />

<strong>Celebration</strong> <strong>Bond</strong><br />

<strong>Fund</strong> Background<br />

Historically, <strong>Aviva</strong> Ireland’s <strong>With</strong>-<strong>Profit</strong> <strong>Fund</strong> has invested in a wide range of assets. These have included<br />

equities, property, bonds and cash. However, as a result of the global financial crisis, the majority of the <strong>Fund</strong>’s<br />

equities were sold in October 2008 in favour of government bonds. This was done in order to help protect<br />

investors from further falls in investment markets.<br />

Investment Mix<br />

The asset mix of the <strong>Fund</strong> at 31 December 2010 is as follows:<br />

<strong>Aviva</strong> <strong>Irl</strong><br />

<strong>With</strong>-<strong>Profit</strong> <strong>Fund</strong><br />

Mix 31/12/10*<br />

Main <strong>With</strong>-<strong>Profit</strong> <strong>Fund</strong> Mix<br />

31.12.10<br />

Cash<br />

5.9%<br />

<strong>Bond</strong>s<br />

85.0%<br />

Equities<br />

0.7%<br />

Property<br />

8.4%<br />

*Source: <strong>Aviva</strong> Investors (December 2010)<br />

As can be seen from the above chart, the <strong>Fund</strong> is<br />

now mainly invested in government bonds. The<br />

remainder of the <strong>Fund</strong> is mainly invested in Irish<br />

property and cash. It is unlikely that the <strong>Fund</strong> will<br />

increase either its equity or property holdings in the<br />

future. Therefore, the majority of the <strong>Fund</strong>’s assets<br />

will continue to be invested in government bonds<br />

and cash.<br />

<strong>Fund</strong> Performance<br />

The following chart shows<br />

the gross investment returns<br />

earned on the <strong>Aviva</strong> <strong>Irl</strong> <strong>With</strong>-<br />

<strong>Profit</strong> <strong>Fund</strong> since the year<br />

2000:<br />

Source: <strong>Aviva</strong> Investors (January 2011)<br />

20.0%<br />

15.0%<br />

10.0%<br />

5.0%<br />

0.0%<br />

-5.0%<br />

-10.0%<br />

-15.0%<br />

-20.0%<br />

-25.0%<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Return 4.9% -2.0% -8.6% 9.8% 12.1% 16.0% 11.0% 1.1% -18.7% 0.8% -0.80%<br />

IMPORTANT INFORMATION IS CONTAINED OVERLEAF – PLEASE TURN OVER

The investment returns achieved in recent years<br />

have been influenced by a number of factors. The<br />

unprecedented falls in the world’s financial markets<br />

in 2008 resulted in a gross return for that year of<br />

–18.7%. In order to help protect the <strong>Fund</strong> from<br />

further investment losses, the <strong>Fund</strong>’s equities were<br />

sold in favour of bonds as discussed above. Over<br />

the long-term, bonds have historically tended to<br />

produce lower investment returns than equities<br />

and property. In 2009, the <strong>Fund</strong>’s bond holding<br />

did achieve a reasonably stable investment return,<br />

but this was offset by further falls in Irish property<br />

values. In 2010, the poor performance of Irish<br />

government bonds offset the positive performance<br />

of French and German bonds, while, a further fall<br />

in property values resulted in an overall slightly<br />

negative return. As the <strong>Fund</strong>’s investment strategy<br />

is now to invest predominantly in bonds, it is<br />

expected that relatively low investment returns will<br />

be earned for the foreseeable future.<br />

Market Value Adjustments<br />

For Unitised <strong>With</strong>-<strong>Profit</strong> (UWP) investments such as<br />

your <strong>Celebration</strong> <strong>Bond</strong>, a Market Value Adjustment<br />

(MVA) currently applies. The purpose of an MVA<br />

is to ensure that withdrawals or switches from<br />

the <strong>Fund</strong> do not receive more than their share of<br />

the <strong>Fund</strong>’s underlying assets. If an MVA were not<br />

applied then investors who exit the <strong>Fund</strong> would<br />

be benefiting at the expense of those who remain.<br />

The level of the MVA is regularly reviewed. Please<br />

contact us on the telephone number provided at<br />

the end of this document if you require further<br />

information.<br />

Annual Bonus Rates<br />

Premiums paid into <strong>Celebration</strong> <strong>Bond</strong> policies were<br />

used to purchase units in the Unitised <strong>With</strong>-<strong>Profit</strong><br />

<strong>Fund</strong>. Each year, the aim is to increase the price<br />

of these units through the addition of an annual<br />

bonus. However, an annual bonus of 0% currently<br />

applies to all <strong>Aviva</strong> <strong>Irl</strong> <strong>With</strong>-<strong>Profit</strong> investments.<br />

This means that guarantees remain unchanged<br />

from their level at the end of 2008. Although the<br />

rate of bonus for future years has not yet been<br />

determined, it is unlikely in the short-term that<br />

there will be any significant increase in annual<br />

bonuses.<br />

Terminal Bonus Rates<br />

The aim of a terminal bonus is to pay out any<br />

profits that have been earned over the lifetime<br />

of an investment that have not yet been added<br />

through annual bonuses. We regularly review<br />

terminal bonus rates and aim to update them at<br />

least twice a year. Terminal bonus rates are not<br />

guaranteed and may be changed at any time<br />

during the year. Since the end of 2008 there have<br />

been reductions in terminal bonus rates. This<br />

reflects the impact on the <strong>Fund</strong>’s assets of the<br />

negative return earned in 2008, and the relatively<br />

low returns that have subsequently been achieved.<br />

For further details<br />

contact your Financial Adviser<br />

or our Customer Services Department<br />

Phone 1890 64 64 64 or<br />

E-mail: csc@aviva.ie<br />

All information correct as at January 2011.<br />

Warning: Past performance is not a reliable guide to future performance.<br />

Warning: The value of your investment may go down as well as up.<br />

Warning: The income you get from this investment may go down as well as up.<br />

Warning: This product may be affected by changes in currency exchange rates.<br />

Warning: <strong>With</strong>drawals and switches from this fund may be deferred for up to 3 months.<br />

<strong>Aviva</strong> Life & Pensions Ireland Limited. A private company limited by shares.<br />

Registered in Ireland No. 252737 Registered Office One Park Place, Hatch Street, Dublin 2.<br />

Member of the Irish Insurance Federation. <strong>Aviva</strong> Life & Pensions Ireland Limited is regulated by the Central Bank of Ireland.<br />

<strong>Aviva</strong> Life & Pensions Ireland Limited is a subsidiary of <strong>Aviva</strong> Life Holdings Ireland Limited, a joint venture company between <strong>Aviva</strong> Group Ireland plc and Allied Irish Banks, p.l.c.<br />

Life & Pensions One Park Place, Hatch Street, Dublin 2. Phone (01) 898 7000 Fax (01) 898 7329<br />

www.aviva.ie<br />

Telephone calls may be recorded for quality assurance purposes.<br />

1.303.01.11