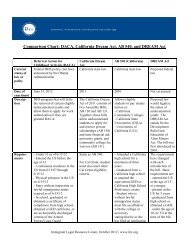

quick reference chart and notes for determining immigration - ILRC

quick reference chart and notes for determining immigration - ILRC

quick reference chart and notes for determining immigration - ILRC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Cali<strong>for</strong>nia Quick Reference Chart <strong>and</strong> Notes<br />

February 2010<br />

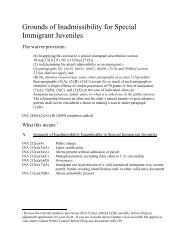

Crime involving moral turpitude. Burglary is a crime involving moral turpitude to the<br />

extent of the underlying intent. Entry with intent to commit larceny involves moral turpitude,<br />

while entry with intent to a specified offense that does not involve moral turpitude (or, assuming<br />

the government has the burden of proof, an unspecified offense) is not. Under Matter of Silva-<br />

Trevino, however, it may be difficult to ensure that a given offense does not involve moral<br />

turpitude. In addition, burglary will be held a crime involving moral turpitude if it involves an<br />

unlawful entry into a dwelling.<br />

4. Theft instead of fraud, <strong>and</strong> other measures to avoid the aggravated felony of an offense<br />

involving fraud or deceit in which the loss to the victim exceeds $10,000.<br />

A fraud or tax fraud offense in which the loss to the victims/government is more than<br />

$10,000 is an aggravated felony under 8 USC § 1101(a)(43)(M). In 2009 the Supreme Court<br />

exp<strong>and</strong>ed the kind of evidence that can be used to establish the amount of loss to the victim,<br />

although it found that the categorical approach must be used to establish that the offense<br />

involved fraud or deceit. Nijhawan v. Holder, 129 S. Ct. 2294 (2009). The most secure plea<br />

option is to an offense that does not involve fraud or deceit, <strong>for</strong> example, to theft under P.C. §<br />

484. This means specifically to a theft offense, or at least to § 484 in general; not to<br />

embezzlement, fraud or other theft by deceit in § 484.<br />

A theft offense will become an aggravated felony if a sentence of a year or more is<br />

imposed, but not based upon a loss to the victim of over $10,000. There<strong>for</strong>e a plea to a theft<br />

offense under § 484 can include restitution to the victim of over $10,000, but the sentence<br />

imposed must be 364 days or less <strong>for</strong> any single count.<br />

If you must plead to an offense involving fraud or deceit (<strong>and</strong> deceit is broadly defined),<br />

or to welfare fraud, see additional advice at N. 13 Fraud, supra. See also Brady, “Preliminary<br />

Advisory: Nijhawan v. Holder” at www.ilrc.org/criminal.php.<br />

For the Defendant: A conviction <strong>for</strong> a fraud or deceit offense in which the loss to the victim or<br />

victims was over $10,000 is an aggravated felony. A theft offense under P.C. § 484 is not an<br />

offense involving fraud or deceit. There<strong>for</strong>e proof of a loss to the victim/s exceeding $10,000<br />

does not make the offense an aggravated felony. Matter of Garcia-Madruga, 24 I&N Dec. 436,<br />

440 (BIA 2008).<br />

5. Receipt of Stolen Property is not categorically a crimes involving moral turpitude<br />

A conviction <strong>for</strong> receipt of stolen property under P.C. § 496(a) is a categorical aggravated<br />

felony conviction if a sentence of a year or more is imposed. 216 However, the offense is<br />

divisible as a crime involving moral turpitude.<br />

216 Matter of Cardiel-Guerrero, 25 I&N Dec. 12 (BIA 2009), Verduga-Gonzalez v.Holder, 581 F.3d 1059 (9 th Cir.<br />

2009).<br />

N-136 Immigrant Legal Resource Center