quick reference chart and notes for determining immigration - ILRC

quick reference chart and notes for determining immigration - ILRC

quick reference chart and notes for determining immigration - ILRC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

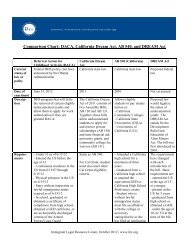

Cali<strong>for</strong>nia Quick Reference Chart <strong>and</strong> Notes<br />

February 2010<br />

held to involve moral turpitude even under the exp<strong>and</strong>ed evidentiary rules in Matter of Silva-<br />

Trevino. See § N.7 Crimes Involving Moral Turpitude.<br />

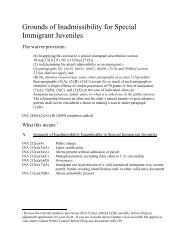

A single theft conviction <strong>and</strong> the CMT deportability/inadmissibility grounds. A<br />

single conviction of a CMT committed within five years of last admission will make a noncitizen<br />

deportable only if the offense has a maximum possible sentence of a year or more. 8 USC §<br />

1227(a)(2)(A). Conviction <strong>for</strong> petty theft or attempted gr<strong>and</strong> theft reduced to a misdemeanor<br />

(both with a six-month maximum sentence) as opposed to misdemeanor gr<strong>and</strong> theft (with a oneyear<br />

maximum) will avoid deportability.<br />

A single conviction of a CMT will make a noncitizen inadmissible <strong>for</strong> moral turpitude,<br />

unless he or she comes within an exception. Under the “petty offense” exception, the noncitizen<br />

is not inadmissible if (a) she has committed only one CMT in her life <strong>and</strong> (b) the offense has a<br />

maximum sentence of a year <strong>and</strong> (c) a sentence of six months or less was imposed. 8 USC §<br />

1182(a)(2)(A). To create eligibility <strong>for</strong> the exception, reduce felony gr<strong>and</strong> theft to a<br />

misdemeanor under PC § 17. Immigration authorities will consider the conviction to have a<br />

potential sentence of one year <strong>for</strong> purposes of the petty offense exception. LaFarga v. INS, 170<br />

F.3d 1213 (9 th Cir. 1999). See also § N.7, supra, or Defending Immigrants in the Ninth Circuit,<br />

Chapter 4.<br />

C. Fraud<br />

An offense that involves fraud or deceit in which the loss to the victim or victims exceeds<br />

$10,000 is an aggravated felony, regardless of sentence imposed. 194 Tax fraud where the loss to<br />

the government exceeds $10,000, <strong>and</strong> money laundering or illegal monetary transactions<br />

involving $10,000, also are aggravated felonies. 195<br />

In Nijhawan v. Holder, 129 S.Ct. 2294 (2009) the Supreme Court loosened the<br />

restrictions on how the government may prove that the amount of loss exceeded $10,000. The<br />

Court held that the categorical approach does not apply to this part of the definition. There<strong>for</strong>e,<br />

financial loss to the victim need not be an element of the fraud or deceit offense, <strong>and</strong> the<br />

government may prove the amount of the loss using evidence that is not permitted under the<br />

categorical approach. This decision reverses Ninth Circuit precedent which had held that only<br />

evidence under the categorical approach may be used, <strong>and</strong> that only an offense with financial<br />

loss as an element. 196 The categorical approach does apply to proof that the offense involved<br />

fraud or deceit.<br />

Under Nijhawan, how can counsel protect a noncitizen defendant who, <strong>for</strong> example,<br />

committed credit card fraud or welfare fraud of over $10,000?<br />

194 8 USC §§ 1101(a)(43) (M)(ii), INA § 101(a)(43) (M)(ii).<br />

195 8 USC §§ 1101(a)(43)(D), (M)(i), INA § 101(a)(43)(D), (M)(i).<br />

196 Nijhawan v. Holder reversed the approach taken in cases such as Kawashima v. Mukasey (“Kawashima II”), 530<br />

F.3d 1111 (9 th Cir. 2008) (offense must have financial loss as an element); Kawashima v. Gonzales (Kawashima I”),<br />

503 F.3d 997 (9th Cir. 2007) (offense need not have financial loss as an element, but categorical approach applies to<br />

evidence; overturned by Kawashima II); Li v. Ashcroft, 389 F. 3d 892 (9 th Cir. 2004) (similar to Kawashima I).<br />

N-116 Immigrant Legal Resource Center