Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

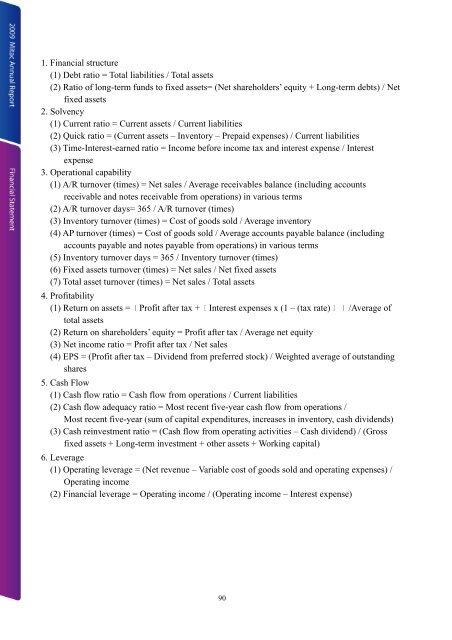

1. Financial structure<br />

(1) Debt ratio = <strong>To</strong>tal liabilities / <strong>To</strong>tal assets<br />

(2) Ratio of long-term funds to fixed assets= (Net shareholders’ equity + Long-term debts) / Net<br />

fixed assets<br />

2. Solvency<br />

(1) Current ratio = Current assets / Current liabilities<br />

(2) Quick ratio = (Current assets – Inventory – Prepaid expenses) / Current liabilities<br />

(3) Time-Interest-earned ratio = Income before income tax and interest expense / Interest<br />

expense<br />

3. Operational capability<br />

(1) A/R turnover (times) = Net sales / Average receivables balance (including accounts<br />

receivable and notes receivable from operations) in various terms<br />

(2) A/R turnover days= 365 / A/R turnover (times)<br />

(3) Inventory turnover (times) = Cost of goods sold / Average inventory<br />

(4) AP turnover (times) = Cost of goods sold / Average accounts payable balance (including<br />

accounts payable and notes payable from operations) in various terms<br />

(5) Inventory turnover days = 365 / Inventory turnover (times)<br />

(6) Fixed assets turnover (times) = Net sales / Net fixed assets<br />

(7) <strong>To</strong>tal asset turnover (times) = Net sales / <strong>To</strong>tal assets<br />

4. Profitability<br />

(1) Return on assets ={Profit after tax +〔Interest expenses x (1 – (tax rate)〕}/Average of<br />

total assets<br />

(2) Return on shareholders’ equity = Profit after tax / Average net equity<br />

(3) Net income ratio = Profit after tax / Net sales<br />

(4) EPS = (Profit after tax – Dividend from preferred stock) / Weighted average of outstanding<br />

shares<br />

5. Cash Flow<br />

(1) Cash flow ratio = Cash flow from operations / Current liabilities<br />

(2) Cash flow adequacy ratio = Most recent five-year cash flow from operations /<br />

Most recent five-year (sum of capital expenditures, increases in inventory, cash dividends)<br />

(3) Cash reinvestment ratio = (Cash flow from operating activities – Cash dividend) / (Gross<br />

fixed assets + Long-term investment + other assets + Working capital)<br />

6. Leverage<br />

(1) Operating leverage = (Net revenue – Variable cost of goods sold and operating expenses) /<br />

Operating income<br />

(2) Financial leverage = Operating income / (Operating income – Interest expense)<br />

90