Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

Letter To Shareholders - Mitac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

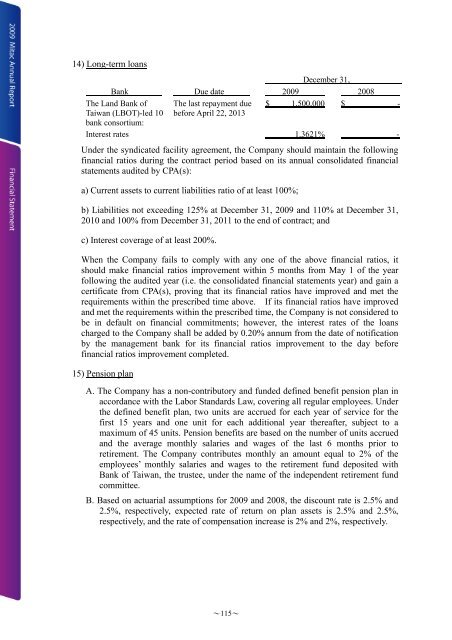

14) Long-term loans<br />

December 31,<br />

Bank Due date 2009 2008<br />

The Land Bank of<br />

Taiwan (LBOT)-led 10<br />

bank consortium:<br />

The last repayment due<br />

before April 22, 2013<br />

$ 1,500,000 $ -<br />

Interest rates 1.3621% -<br />

Under the syndicated facility agreement, the Company should maintain the following<br />

financial ratios during the contract period based on its annual consolidated financial<br />

statements audited by CPA(s):<br />

a) Current assets to current liabilities ratio of at least 100%;<br />

b) Liabilities not exceeding 125% at December 31, 2009 and 110% at December 31,<br />

2010 and 100% from December 31, 2011 to the end of contract; and<br />

c) Interest coverage of at least 200%.<br />

When the Company fails to comply with any one of the above financial ratios, it<br />

should make financial ratios improvement within 5 months from May 1 of the year<br />

following the audited year (i.e. the consolidated financial statements year) and gain a<br />

certificate from CPA(s), proving that its financial ratios have improved and met the<br />

requirements within the prescribed time above. If its financial ratios have improved<br />

and met the requirements within the prescribed time, the Company is not considered to<br />

be in default on financial commitments; however, the interest rates of the loans<br />

charged to the Company shall be added by 0.20% annum from the date of notification<br />

by the management bank for its financial ratios improvement to the day before<br />

financial ratios improvement completed.<br />

15) Pension plan<br />

A. The Company has a non-contributory and funded defined benefit pension plan in<br />

accordance with the Labor Standards Law, covering all regular employees. Under<br />

the defined benefit plan, two units are accrued for each year of service for the<br />

first 15 years and one unit for each additional year thereafter, subject to a<br />

maximum of 45 units. Pension benefits are based on the number of units accrued<br />

and the average monthly salaries and wages of the last 6 months prior to<br />

retirement. The Company contributes monthly an amount equal to 2% of the<br />

employees’ monthly salaries and wages to the retirement fund deposited with<br />

Bank of Taiwan, the trustee, under the name of the independent retirement fund<br />

committee.<br />

B. Based on actuarial assumptions for 2009 and 2008, the discount rate is 2.5% and<br />

2.5%, respectively, expected rate of return on plan assets is 2.5% and 2.5%,<br />

respectively, and the rate of compensation increase is 2% and 2%, respectively.<br />

~115~