Issues in Corporate Taxation. - jb nagar cpe study circle of wirc of icai

Issues in Corporate Taxation. - jb nagar cpe study circle of wirc of icai

Issues in Corporate Taxation. - jb nagar cpe study circle of wirc of icai

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

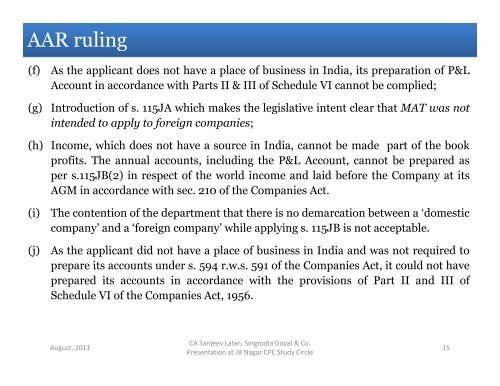

AAR rul<strong>in</strong>g<br />

(f)<br />

(g)<br />

As the applicant does not have a place <strong>of</strong> bus<strong>in</strong>ess <strong>in</strong> India, its preparation <strong>of</strong> P&L<br />

Account <strong>in</strong> accordance with Parts II & III <strong>of</strong> Schedule VI cannot be complied;<br />

Introduction <strong>of</strong> s. 115JA which makes the legislative <strong>in</strong>tent clear that MAT was not<br />

<strong>in</strong>tended to apply to foreign companies;<br />

(h) Income, which does not have a source <strong>in</strong> India, cannot be made part <strong>of</strong> the book<br />

pr<strong>of</strong>its. The annual accounts, <strong>in</strong>clud<strong>in</strong>g the P&L Account, cannot be prepared as<br />

per s.115JB(2) <strong>in</strong> respect <strong>of</strong> the world <strong>in</strong>come and laid before the Company at its<br />

AGM <strong>in</strong> accordance with sec. 210 <strong>of</strong> the Companies Act.<br />

(i)<br />

(j)<br />

The contention <strong>of</strong> the department that there is no demarcation between a ‘domestic<br />

company’ and a ‘foreign company’ while apply<strong>in</strong>g s. 115JB is not acceptable.<br />

As the applicant did not have a place <strong>of</strong> bus<strong>in</strong>ess <strong>in</strong> India and was not required to<br />

prepare its accounts under s. 594 r.w.s. 591 <strong>of</strong> the Companies Act, it could not have<br />

prepared its accounts <strong>in</strong> accordance with the provisions <strong>of</strong> Part II and III <strong>of</strong><br />

Schedule VI <strong>of</strong> the Companies Act, 1956.<br />

August, 2011<br />

CA Sanjeev Lalan, S<strong>in</strong>grodia Goyal & Co.<br />

Presentation at JB Nagar CPE Study Circle<br />

15