Issues in Corporate Taxation. - jb nagar cpe study circle of wirc of icai

Issues in Corporate Taxation. - jb nagar cpe study circle of wirc of icai

Issues in Corporate Taxation. - jb nagar cpe study circle of wirc of icai

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

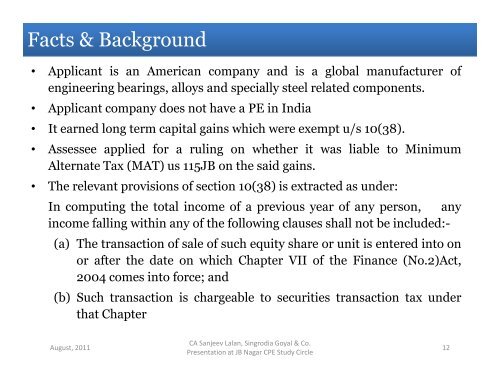

Facts & Background<br />

• Applicant is an American company and is a global manufacturer <strong>of</strong><br />

eng<strong>in</strong>eer<strong>in</strong>g bear<strong>in</strong>gs, alloys and specially steel related components.<br />

• Applicant company does not have a PE <strong>in</strong> India<br />

• It earned long term capital ga<strong>in</strong>s which were exempt u/s 10(38).<br />

• Assessee applied for a rul<strong>in</strong>g on whether it was liable to M<strong>in</strong>imum<br />

Alternate Tax (MAT) us 115JB on the said ga<strong>in</strong>s.<br />

• The relevant provisions <strong>of</strong> section 10(38) is extracted as under:<br />

In comput<strong>in</strong>g the total <strong>in</strong>come <strong>of</strong> a previous year <strong>of</strong> any person, any<br />

<strong>in</strong>come fall<strong>in</strong>g with<strong>in</strong> any <strong>of</strong> the follow<strong>in</strong>g clauses shall not be <strong>in</strong>cluded:-<br />

(a) The transaction <strong>of</strong> sale <strong>of</strong> such equity share or unit is entered <strong>in</strong>to on<br />

or after the date on which Chapter VII <strong>of</strong> the F<strong>in</strong>ance (No.2)Act,<br />

2004 comes <strong>in</strong>to force; and<br />

(b) Such transaction is chargeable to securities transaction tax under<br />

that Chapter<br />

August, 2011<br />

CA Sanjeev Lalan, S<strong>in</strong>grodia Goyal & Co.<br />

Presentation at JB Nagar CPE Study Circle<br />

12