THE CORE CONUNDRUM - Guggenheim Partners

THE CORE CONUNDRUM - Guggenheim Partners

THE CORE CONUNDRUM - Guggenheim Partners

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

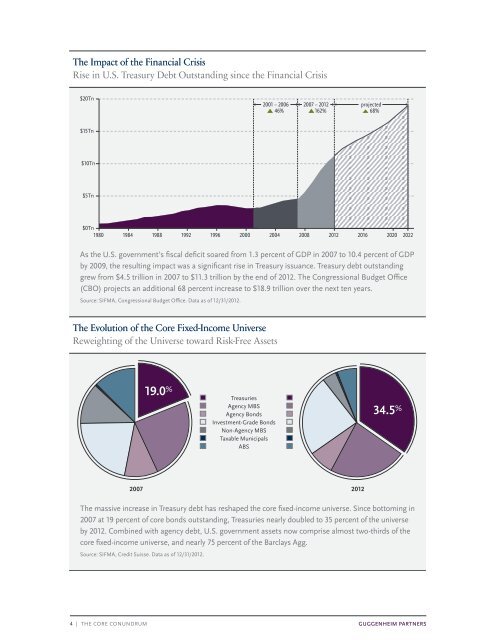

The Impact of the Financial Crisis<br />

Rise in U.S. Treasury Debt Outstanding since the Financial Crisis<br />

$20Tn<br />

2001 – 2006 2007 – 2012<br />

46%<br />

162%<br />

projected<br />

68%<br />

$15Tn<br />

$10Tn<br />

$5Tn<br />

$0Tn<br />

1980<br />

1984 1988 1992 1996 2000 2004 2008 2012 2016 2020 2022<br />

As the U.S. government’s fiscal deficit soared from 1.3 percent of GDP in 2007 to 10.4 percent of GDP<br />

by 2009, the resulting impact was a significant rise in Treasury issuance. Treasury debt outstanding<br />

grew from $4.5 trillion in 2007 to $11.3 trillion by the end of 2012. The Congressional Budget Office<br />

(CBO) projects an additional 68 percent increase to $18.9 trillion over the next ten years.<br />

Source: SIFMA, Congressional Budget Office. Data as of 12/31/2012.<br />

The Evolution of the Core Fixed-Income Universe<br />

Reweighting of the Universe toward Risk-Free Assets<br />

19.0 %<br />

Treasuries<br />

Agency MBS<br />

Agency Bonds<br />

Investment-Grade Bonds<br />

Non-Agency MBS<br />

Taxable Municipals<br />

ABS<br />

34.5 %<br />

2007<br />

2012<br />

The massive increase in Treasury debt has reshaped the core fixed-income universe. Since bottoming in<br />

2007 at 19 percent of core bonds outstanding, Treasuries nearly doubled to 35 percent of the universe<br />

by 2012. Combined with agency debt, U.S. government assets now comprise almost two-thirds of the<br />

core fixed-income universe, and nearly 75 percent of the Barclays Agg.<br />

Source: SIFMA, Credit Suisse. Data as of 12/31/2012.<br />

4 | <strong>THE</strong> <strong>CORE</strong> <strong>CONUNDRUM</strong> GUGGENHEIM PARTNERS