Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to Consolidated Financial Statements<br />

<strong>Komatsu</strong> Ltd. and Consolidated Subsidiaries<br />

Information with respect to the plans is as follows:<br />

Measurement date<br />

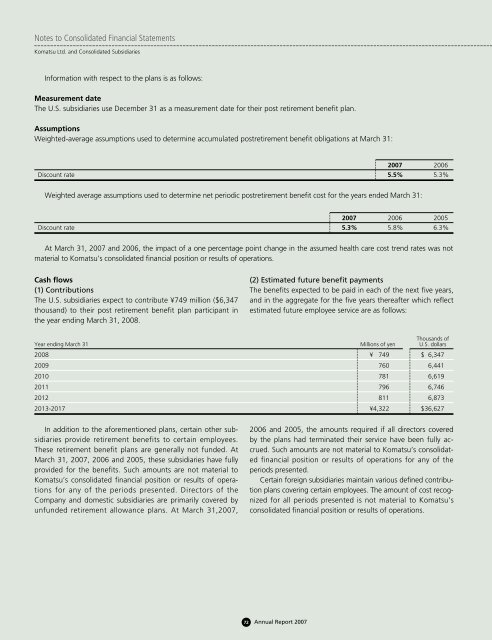

The U.S. subsidiaries use December 31 as a measurement date for their post retirement benefit plan.<br />

Assumptions<br />

Weighted-average assumptions used to determine accumulated postretirement benefit obligations at March 31:<br />

<strong>2007</strong> 2006<br />

Discount rate 5.5% 5.3%<br />

Weighted average assumptions used to determine net periodic postretirement benefit cost for the years ended March 31:<br />

<strong>2007</strong> 2006 2005<br />

Discount rate 5.3% 5.8% 6.3%<br />

At March 31, <strong>2007</strong> and 2006, the impact of a one percentage point change in the assumed health care cost trend rates was not<br />

material to <strong>Komatsu</strong>’s consolidated financial position or results of operations.<br />

Cash flows<br />

(1) Contributions<br />

The U.S. subsidiaries expect to contribute ¥749 million ($6,347<br />

thousand) to their post retirement benefit plan participant in<br />

the year ending March 31, 2008.<br />

(2) Estimated future benefit payments<br />

The benefits expected to be paid in each of the next five years,<br />

and in the aggregate for the five years thereafter which reflect<br />

estimated future employee service are as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2008 ¥ 749 $ 6,347<br />

2009 760 6,441<br />

2010 781 6,619<br />

2011 796 6,746<br />

2012 811 6,873<br />

2013-2017 ¥4,322 $36,627<br />

In addition to the aforementioned plans, certain other subsidiaries<br />

provide retirement benefits to certain employees.<br />

These retirement benefit plans are generally not funded. At<br />

March 31, <strong>2007</strong>, 2006 and 2005, these subsidiaries have fully<br />

provided for the benefits. Such amounts are not material to<br />

<strong>Komatsu</strong>’s consolidated financial position or results of operations<br />

for any of the periods presented. Directors of the<br />

Company and domestic subsidiaries are primarily covered by<br />

unfunded retirement allowance plans. At March 31,<strong>2007</strong>,<br />

2006 and 2005, the amounts required if all directors covered<br />

by the plans had terminated their service have been fully accrued.<br />

Such amounts are not material to <strong>Komatsu</strong>’s consolidated<br />

financial position or results of operations for any of the<br />

periods presented.<br />

Certain foreign subsidiaries maintain various defined contribution<br />

plans covering certain employees. The amount of cost recognized<br />

for all periods presented is not material to <strong>Komatsu</strong>’s<br />

consolidated financial position or results of operations.<br />

72 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>