KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Methods for measuring market risk and defining limits<br />

<strong>Komerční</strong> <strong>banka</strong> market risk assessment is based on three main indicators that are used to define exposure limits:<br />

– Value at Risk historical simulation method, calculated to a 99% confidence level and one-day time scope, which allows the<br />

Bank to consolidate its market risks into SG Financial Group’s Value at Risk.<br />

– Stress-Test measurement, to take into account low probability events not covered by Value at Risk. The Bank performs<br />

several types of stress tests for foreign exchange and interest rate exposures. Shock scenarios consist of very significant<br />

movements in parameters, usually with a one-in-ten probability of occurrence. Another kind of Stress Test on interest rate<br />

exposure is based on “what if” scenarios, where a flip of interest rate curves at pivot points is simulated.<br />

– Complementary limits (sensitivity, FX position, credit spread risk, holding period, etc.). These limits monitor market risks<br />

which are only partially captured by VaR and Stress Tests.<br />

Value at Risk (VaR) method<br />

The new VaR method (“historical simulation”) was implemented at <strong>Komerční</strong> <strong>banka</strong> in 2002 for foreign exchange and interest<br />

rate risk. Last year, the Bank introduced this method for equity risk. It takes into account the correlation between all markets<br />

and the characteristics, whereby the repeating of market parameters is not evenly distributed. Scenarios of one-day variations<br />

of market parameters over a period of the last 250 business days are used. The 99% Value at Risk is the loss that would be<br />

incurred after eliminating the top 1% most unfavourable occurrences; with 250 scenarios this corresponds to the average of<br />

the second and third largest potential losses computed.<br />

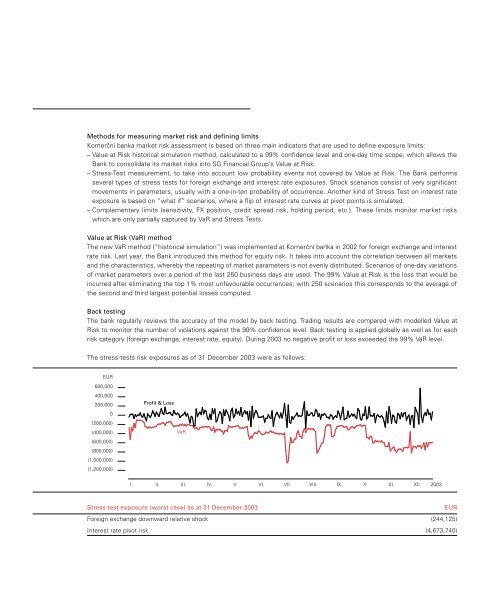

Back testing<br />

The bank regularly reviews the accuracy of the model by back testing. Trading results are compared with modelled Value at<br />

Risk to monitor the number of violations against the 99% confidence level. Back testing is applied globally as well as for each<br />

risk category (foreign exchange, interest rate, equity). During 2003 no negative profit or loss exceeded the 99% VaR level.<br />

The stress-tests risk exposures as of 31 December 2003 were as follows:<br />

EUR<br />

600,000<br />

400,000<br />

200,000<br />

0<br />

(200,000)<br />

(400,000)<br />

(600,000)<br />

(800,000)<br />

(1,000,000)<br />

(1,200,000)<br />

Profit & Loss<br />

VaR<br />

I.<br />

II.<br />

III.<br />

IV.<br />

V.<br />

VI.<br />

VII.<br />

VIII.<br />

IX.<br />

X.<br />

XI.<br />

XII. 2003<br />

Stress-test exposure (worst case) as at 31 December 2003<br />

EUR<br />

Foreign exchange downward relative shock (244,125)<br />

Interest rate pivot risk (4,673,740)