KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

134 ➔135<br />

Consolidated Financial Statements<br />

under IFRS<br />

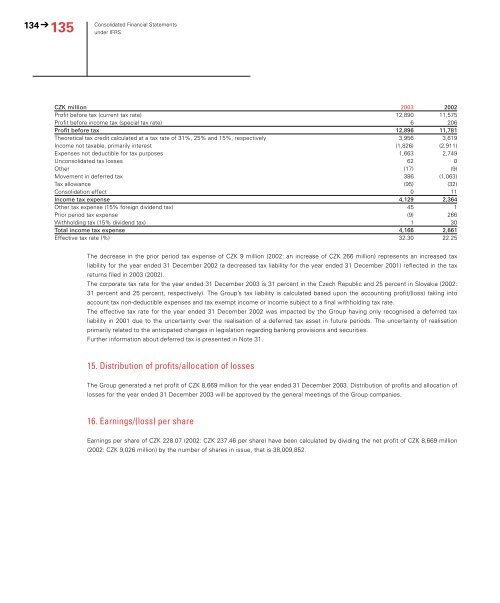

CZK million 2003 2002<br />

Profit before tax (current tax rate) 12,890 11,575<br />

Profit before income tax (special tax rate) 6 206<br />

Profit before tax 12,896 11,781<br />

Theoretical tax credit calculated at a tax rate of 31%, 25% and 15%, respectively 3,956 3,619<br />

Income not taxable, primarily interest (1,826) (2,911)<br />

Expenses not deductible for tax purposes 1,663 2,749<br />

Unconsolidated tax losses 62 0<br />

Other (17) (9)<br />

Movement in deferred tax 386 (1,063)<br />

Tax allowance (95) (32)<br />

Consolidation effect 0 11<br />

Income tax expense 4,129 2,364<br />

Other tax expense (15% foreign dividend tax) 45 1<br />

Prior period tax expense (9) 266<br />

Withholding tax (15% dividend tax) 1 30<br />

Total income tax expense 4,166 2,661<br />

Effective tax rate (%) 32.30 22.25<br />

The decrease in the prior period tax expense of CZK 9 million (2002: an increase of CZK 266 million) represents an increased tax<br />

liability for the year ended 31 December 2002 (a decreased tax liability for the year ended 31 December 2001) reflected in the tax<br />

returns filed in 2003 (2002).<br />

The corporate tax rate for the year ended 31 December 2003 is 31 percent in the Czech Republic and 25 percent in Slovakia (2002:<br />

31 percent and 25 percent, respectively). The Group’s tax liability is calculated based upon the accounting profit/(loss) taking into<br />

account tax non-deductible expenses and tax exempt income or income subject to a final withholding tax rate.<br />

The effective tax rate for the year ended 31 December 2002 was impacted by the Group having only recognised a deferred tax<br />

liability in 2001 due to the uncertainty over the realisation of a deferred tax asset in future periods. The uncertainty of realisation<br />

primarily related to the anticipated changes in legislation regarding banking provisions and securities.<br />

Further information about deferred tax is presented in Note 31.<br />

15. Distribution of profits/allocation of losses<br />

The Group generated a net profit of CZK 8,669 million for the year ended 31 December 2003. Distribution of profits and allocation of<br />

losses for the year ended 31 December 2003 will be approved by the general meetings of the Group companies.<br />

16. Earnings/(loss) per share<br />

Earnings per share of CZK 228.07 (2002: CZK 237.46 per share) have been calculated by dividing the net profit of CZK 8,669 million<br />

(2002: CZK 9,026 million) by the number of shares in issue, that is 38,009,852.