KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

120 ➔121<br />

Consolidated Financial Statements<br />

under IFRS<br />

Notes to the Consolidated Financial Statements<br />

under IFRS as of 31 December 2003<br />

1. Principal activities<br />

The Financial Group of <strong>Komerční</strong> <strong>banka</strong>, a. s. (the “Group”) consists of <strong>Komerční</strong> <strong>banka</strong>, a. s. (the “Bank”) and 11 subsidiaries and<br />

associated undertakings. The parent enterprise of the Group is the Bank which is incorporated in the Czech Republic as a joint stock<br />

company. The principal activities of the Bank are as follows:<br />

I. Providing loans, advances and guarantees in Czech Crowns and foreign currencies;<br />

II. Acceptance and placement of deposits in Czech Crowns and foreign currencies;<br />

III. Providing current and term deposit accounts in Czech Crowns and foreign currencies;<br />

IV. Providing banking services through an extensive branch network in the Czech Republic;<br />

V. Treasury operations in the interbank market;<br />

VI. Servicing foreign trade transactions;<br />

VII. Investment banking.<br />

The Bank generates a substantial proportion of the Group’s income and represents substantially all of the assets and liabilities of the Group.<br />

The registered office address of the Bank is Na Příkopě 33/969, 114 07 Praha 1, Czech Republic.<br />

In addition to its operations in the Czech Republic, the Group has operations in Slovakia through its subsidiary <strong>Komerční</strong> <strong>banka</strong><br />

Bratislava, a. s. and in the Netherlands through its subsidiary Komercni Finance, B. V. (a special purpose vehicle used to raise funds<br />

for the Group on the international financial markets).<br />

The Bank’s ordinary shares are publicly traded on the Prague Stock Exchange. Société Générale is the Bank’s majority shareholder,<br />

holding 60.35 percent (2002: 60.35 percent) of the Bank’s issued share capital.<br />

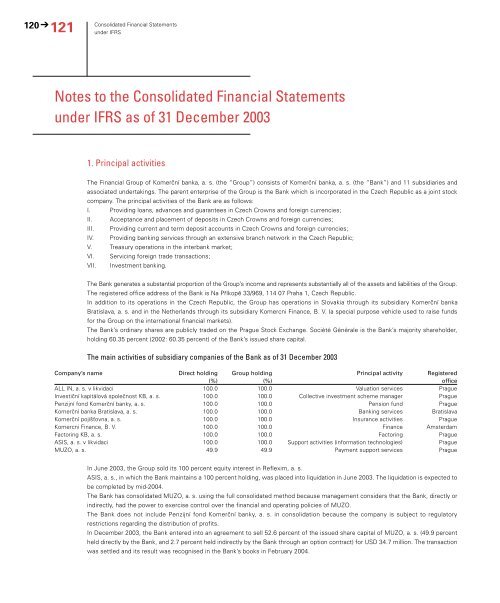

The main activities of subsidiary companies of the Bank as of 31 December 2003<br />

Company’s name Direct holding Group holding Principal activity Registered<br />

(%) (%) office<br />

ALL IN, a. s. v likvidaci 100.0 100.0 Valuation services Prague<br />

Investiční kapitálová společnost <strong>KB</strong>, a. s. 100.0 100.0 Collective investment scheme manager Prague<br />

Penzijní fond <strong>Komerční</strong> banky, a. s. 100.0 100.0 Pension fund Prague<br />

<strong>Komerční</strong> <strong>banka</strong> Bratislava, a. s. 100.0 100.0 Banking services Bratislava<br />

<strong>Komerční</strong> pojišťovna, a. s. 100.0 100.0 Insurance activities Prague<br />

Komercni Finance, B. V. 100.0 100.0 Finance Amsterdam<br />

Factoring <strong>KB</strong>, a. s. 100.0 100.0 Factoring Prague<br />

ASIS, a. s. v likvidaci 100.0 100.0 Support activities (information technologies) Prague<br />

MUZO, a. s. 49.9 49.9 Payment support services Prague<br />

In June 2003, the Group sold its 100 percent equity interest in Reflexim, a. s.<br />

ASIS, a. s., in which the Bank maintains a 100 percent holding, was placed into liquidation in June 2003. The liquidation is expected to<br />

be completed by mid-2004.<br />

The Bank has consolidated MUZO, a. s. using the full consolidated method because management considers that the Bank, directly or<br />

indirectly, had the power to exercise control over the financial and operating policies of MUZO.<br />

The Bank does not include Penzijní fond <strong>Komerční</strong> banky, a. s. in consolidation because the company is subject to regulatory<br />

restrictions regarding the distribution of profits.<br />

In December 2003, the Bank entered into an agreement to sell 52.6 percent of the issued share capital of MUZO, a. s. (49.9 percent<br />

held directly by the Bank, and 2.7 percent held indirectly by the Bank through an option contract) for USD 34.7 million. The transaction<br />

was settled and its result was recognised in the Bank’s books in February 2004.