KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

KB prezent. angl - Komerční banka

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

106 ➔107<br />

Unconsolidated Financial Statements<br />

under CAS<br />

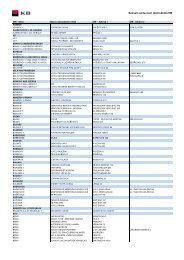

28. Contingencies and off balance sheet commitments<br />

Legal disputes<br />

The Bank conducted a review of legal proceedings outstanding against it as of 31 December 2003. Pursuant to the review of<br />

significant litigation matters in terms of the risk of losses and litigated amounts, the Bank has recorded a provision of CZK 435 million<br />

(2002: CZK 458 million, 2001: CZK 75 million) for these legal disputes. The Bank has also recorded an accrual of CZK 92 million (2002:<br />

CZK 64 million, 2001: CZK 24 million) for costs associated with a potential payment of interest on one of the pursued claims.<br />

As of 31 December 2003, the Bank assessed legal actions filed against other entities. The Bank has been notified that certain parties<br />

against which it is taking legal action may file counterclaims against it. The Bank will contest any such claims and, taking into<br />

consideration the opinion of its internal and external legal counsel, believes that any asserted claims made will not materially affect<br />

its financial position. No provision has been made in respect of these matters.<br />

Commitments arising from the issuance of guarantees<br />

Commitments from guarantees represent irrevocable assurances that the Bank will make payments in the event that a customer<br />

cannot meet its obligations to third parties. These assurances carry the same credit risk as loans and therefore the Bank makes<br />

provisions against these instruments on the same basis as is applicable to loans.<br />

Capital commitments<br />

As of 31 December 2003, the Bank had capital commitments of CZK 84 million (2002: CZK 202 million, 2001: CZK 88 million) in respect<br />

of current capital investment projects. Management is confident that future net revenues and funding will be sufficient to cover this<br />

commitment.<br />

Commitments arising from the issuance of letters of credit<br />

Documentary letters of credit, which are written irrevocable undertakings by the Bank on behalf of a customer (mandatory)<br />

authorising a third party (beneficiary) to draw drafts on the Bank up to a stipulated amount under specific terms and conditions, are<br />

collateralised by the underlying shipments of goods to which they relate. The Bank records provisions against these instruments on<br />

the same basis as is applicable to loans.<br />

Commitments to extend credit, undrawn loan commitments, unutilised overdrafts and approved overdraft loans<br />

Principal off balance sheet exposures include unutilised overdrafts and approved overdraft loans, undrawn loan commitments, issued<br />

commitments to extend credit and unutilised facilities. The primary purpose of commitments to extend credit is to ensure that funds<br />

are available to a customer as required. Commitments to extend credit represent unused portions of authorisations to extend credit<br />

in the form of loans, guarantees or stand-by letters of credit. Commitments to extend credit issued by the Bank represent issued loan<br />

commitments or guarantees, undrawn portions of and approved overdrafts loans. Commitments to extend credit or guarantees<br />

issued by the Bank which are contingent upon customers maintaining specific credit standards (including the condition that<br />

a customer’s solvency does not deteriorate) are revocable commitments. Irrevocable commitments represent undrawn portions of<br />

authorised loans and approved overdraft facilities because they result from contractual terms and conditions in the credit<br />

agreements.