JPMorgan - KASE

JPMorgan - KASE JPMorgan - KASE

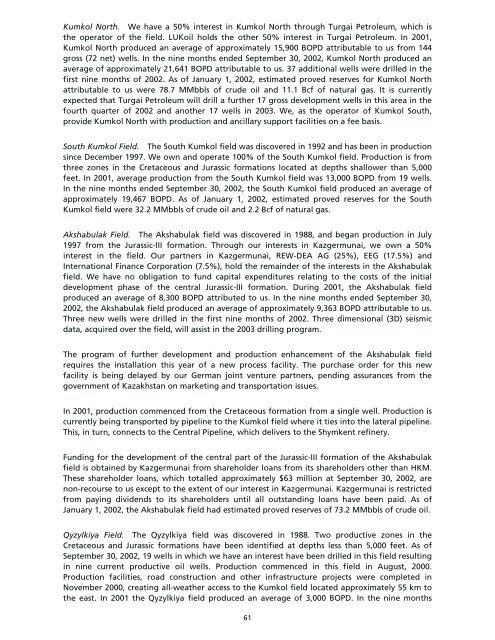

The following tables set forth our estimated proved plus probable and proved oil and natural gas reserves and the present worth value of estimated future net pre-tax cash flows of those reserves for each of our oil and gas fields as of January 1, 2002, on an escalating price assumption basis. Name of Field Our Interest Proved Plus Probable Crude oil Reserves Proved Plus Probable Natural Gas Reserves Estimated Present Worth Value (Discounted at 10%) of Future Net Pre-tax Cash Flow Field Operator (%) (MMbbls) (1) (Bcf) (1) ($000’s) (2) Kumkol South .......... 100 134.8 29.4 707,227 HKM KumkolNorth.......... 50 111.2 16.2 641,343 Turgai Petroleum South Kumkol .......... 100 42.5 3.1 256,400 HKM Akshabulak ............ 50 108.1 — 627,959 Kazgermunai Qyzylkiya .............. 100 37.7 — 201,361 HKM Aryskum .............. 100 28.4 — 139,560 HKM Maybulak ............. 100 20.8 — 94,874 HKM Nurali................. 50 10.5 — 43,533 Kazgermunai Aksai ................. 50 7.5 — 25,767 Kazgermunai EastKumkol ........... n/a (3) 10.8 — 59,144 HKM/Turgai Petroleum NorthNurali ........... 100 (3) — — — HKM Total ................. 512.3 48.7 2,797,168 Name of Field Our Interest Proved Crude oil Reserves Proved Natural Gas Reserves Estimated Present Worth Value (Discounted at 10%) of Future Net Pre-tax Cash Flow Field Operator (%) (MMbbls) (1) (Bcf) (1) ($000’s) (1) Kumkol South .......... 100 110.2 19.5 565,157 HKM KumkolNorth.......... 50 78.7 11.1 457,436 Turgai Petroleum South Kumkol .......... 100 32.2 2.2 184,784 HKM Akshabulak ............ 50 73.2 — 445,931 Kazgermunai Qyzylkiya .............. 100 20.6 — 99,128 HKM Aryskum .............. 100 9.9 — 40,299 HKM Maybulak ............. 100 11.9 — 45,103 HKM Nurali................. 50 4.0 — 14,389 Kazgermunai Aksai ................. 50 2.1 — 4,685 Kazgermunai EastKumkol ........... n/a (3) 5.3 — 25,674 HKM/Turgai Petroleum NorthNurali ........... 100 (3) — — — HKM Total ................. 348.1 32.8 1,882,586 (1) Estimates of our crude oil and natural gas reserves in the Kumkol South, Kumkol North and South Kumkol fields were prepared by McDaniel. In addition, McDaniel consolidated data prepared by others relating to estimates of crude oil reserves in the other fields in order to produce estimates of our crude oil reserves. See “Business and Properties — Oil and Gas Exploration and Development Operations — Estimates of Proved and Proved Plus Probable Reserves and Present Worth Values”. (2) Probable reserves have been reduced by us by 50% to account for risk. McDaniel, in the McDaniel Reports, did not risk-adjust the probable reserve, but reduced the estimated present value of the future cash flows on an escalating price basis by 50% to account for risk. See “Business and Properties — Oil and Gas Exploration and Development Operations — Estimates of Proved and Proved Plus Probable Reserves and Present Worth Values”. (3) Production license and hydrocarbon contract are in the initial stage of negotiation. Kumkol Field. The Kumkol field, which was discovered in 1984 and has been producing since 1990, is our principal producing property. We are producing from eight horizons, in the Cretaceous and Jurassic formations, located at depths shallower than 4,500 feet. The field is divided into two operating areas, Kumkol South and Kumkol North. Kumkol South. We own and operate 100% of Kumkol South, which has been fully developed. In 2001, Kumkol South produced an average of approximately 59,200 BOPD from 152 producing wells. In the nine months ended September 30, 2002, Kumkol South produced an average of approximately 65,502 BOPD. As of January 1, 2002, estimated proved reserves for Kumkol South were 110.2 MMbbls of crude oil and 19.5 Bcf of natural gas. 60

Kumkol North. We have a 50% interest in Kumkol North through Turgai Petroleum, which is the operator of the field. LUKoil holds the other 50% interest in Turgai Petroleum. In 2001, Kumkol North produced an average of approximately 15,900 BOPD attributable to us from 144 gross (72 net) wells. In the nine months ended September 30, 2002, Kumkol North produced an average of approximately 21,641 BOPD attributable to us. 37 additional wells were drilled in the first nine months of 2002. As of January 1, 2002, estimated proved reserves for Kumkol North attributable to us were 78.7 MMbbls of crude oil and 11.1 Bcf of natural gas. It is currently expected that Turgai Petroleum will drill a further 17 gross development wells in this area in the fourth quarter of 2002 and another 17 wells in 2003. We, as the operator of Kumkol South, provide Kumkol North with production and ancillary support facilities on a fee basis. South Kumkol Field. The South Kumkol field was discovered in 1992 and has been in production since December 1997. We own and operate 100% of the South Kumkol field. Production is from three zones in the Cretaceous and Jurassic formations located at depths shallower than 5,000 feet. In 2001, average production from the South Kumkol field was 13,000 BOPD from 19 wells. In the nine months ended September 30, 2002, the South Kumkol field produced an average of approximately 19,467 BOPD. As of January 1, 2002, estimated proved reserves for the South Kumkol field were 32.2 MMbbls of crude oil and 2.2 Bcf of natural gas. Akshabulak Field. The Akshabulak field was discovered in 1988, and began production in July 1997 from the Jurassic-III formation. Through our interests in Kazgermunai, we own a 50% interest in the field. Our partners in Kazgermunai, REW-DEA AG (25%), EEG (17.5%) and International Finance Corporation (7.5%), hold the remainder of the interests in the Akshabulak field. We have no obligation to fund capital expenditures relating to the costs of the initial development phase of the central Jurassic-III formation. During 2001, the Akshabulak field produced an average of 8,300 BOPD attributed to us. In the nine months ended September 30, 2002, the Akshabulak field produced an average of approximately 9,363 BOPD attributable to us. Three new wells were drilled in the first nine months of 2002. Three dimensional (3D) seismic data, acquired over the field, will assist in the 2003 drilling program. The program of further development and production enhancement of the Akshabulak field requires the installation this year of a new process facility. The purchase order for this new facility is being delayed by our German joint venture partners, pending assurances from the government of Kazakhstan on marketing and transportation issues. In 2001, production commenced from the Cretaceous formation from a single well. Production is currently being transported by pipeline to the Kumkol field where it ties into the lateral pipeline. This, in turn, connects to the Central Pipeline, which delivers to the Shymkent refinery. Funding for the development of the central part of the Jurassic-III formation of the Akshabulak field is obtained by Kazgermunai from shareholder loans from its shareholders other than HKM. These shareholder loans, which totalled approximately $63 million at September 30, 2002, are non-recourse to us except to the extent of our interest in Kazgermunai. Kazgermunai is restricted from paying dividends to its shareholders until all outstanding loans have been paid. As of January 1, 2002, the Akshabulak field had estimated proved reserves of 73.2 MMbbls of crude oil. Qyzylkiya Field. The Qyzylkiya field was discovered in 1988. Two productive zones in the Cretaceous and Jurassic formations have been identified at depths less than 5,000 feet. As of September 30, 2002, 19 wells in which we have an interest have been drilled in this field resulting in nine current productive oil wells. Production commenced in this field in August, 2000. Production facilities, road construction and other infrastructure projects were completed in November 2000, creating all-weather access to the Kumkol field located approximately 55 km to the east. In 2001 the Qyzylkiya field produced an average of 3,000 BOPD. In the nine months 61

- Page 19 and 20: Organizational Structure The follow

- Page 21 and 22: Nine Months Ended Year Ended Decemb

- Page 23 and 24: Year Ended December 31, 2001 Nine M

- Page 25 and 26: construction of the plant, anticipa

- Page 27 and 28: Inadequate infrastructure could adv

- Page 29 and 30: fully prohibit us from doing so. In

- Page 31 and 32: Kazakhstan’s foreign investment,

- Page 33 and 34: subsoil user and the Kazakhstani go

- Page 35 and 36: In general, estimates of economical

- Page 37 and 38: thereon and any other amounts owed

- Page 39 and 40: Selected Historical Consolidated Fi

- Page 41 and 42: Management’s Discussion and Analy

- Page 43 and 44: (11,642 tonnes per day) in Septembe

- Page 45 and 46: Adoption of Certain Accounting Stan

- Page 47 and 48: The following table sets out the so

- Page 49 and 50: The total royalty and tax expense f

- Page 51 and 52: perform a quarterly ceiling test. T

- Page 53 and 54: The increase in FCA differentials p

- Page 55 and 56: In addition, we incurred production

- Page 57 and 58: plan. The CCAA plan was implemented

- Page 59 and 60: Royalties Royalties increased from

- Page 61 and 62: Cash is managed centrally through t

- Page 63 and 64: Š completion of the gas utilizatio

- Page 65 and 66: Competitive Strengths We believe th

- Page 67 and 68: Š refurbishing and recommissioning

- Page 69: The daily business of Kazgermunai i

- Page 73 and 74: are currently five producing wells.

- Page 75 and 76: Estimated Reserves and Present Wort

- Page 77 and 78: The following table sets forth a re

- Page 79 and 80: The following tables show our avera

- Page 81 and 82: amended in April 1999, required Kaz

- Page 83 and 84: price we paid for the shares of HKM

- Page 85 and 86: expenditures or investments. The ag

- Page 87 and 88: Several investments with high profi

- Page 89 and 90: In addition, we have opened new rou

- Page 91 and 92: On January 8, 2003, the President o

- Page 93 and 94: As a result of these discussions, H

- Page 95 and 96: Management Directors and Senior Man

- Page 97 and 98: and managerial positions. In 1992,

- Page 99 and 100: approved by our shareholders in Nov

- Page 101 and 102: Related Party Transactions Set fort

- Page 103 and 104: Indebtedness of Directors and Senio

- Page 105 and 106: Prepayments HKM may voluntarily pre

- Page 107 and 108: guarantees any Indebtedness of an O

- Page 109 and 110: will also (i) make such withholding

- Page 111 and 112: The Change of Control Offer will re

- Page 113 and 114: shown on the most recent balance sh

- Page 115 and 116: (a) no Default or Event of Default

- Page 117 and 118: Disqualified Stock and will not per

- Page 119 and 120: transaction are at least equal to t

Kumkol North. We have a 50% interest in Kumkol North through Turgai Petroleum, which is<br />

the operator of the field. LUKoil holds the other 50% interest in Turgai Petroleum. In 2001,<br />

Kumkol North produced an average of approximately 15,900 BOPD attributable to us from 144<br />

gross (72 net) wells. In the nine months ended September 30, 2002, Kumkol North produced an<br />

average of approximately 21,641 BOPD attributable to us. 37 additional wells were drilled in the<br />

first nine months of 2002. As of January 1, 2002, estimated proved reserves for Kumkol North<br />

attributable to us were 78.7 MMbbls of crude oil and 11.1 Bcf of natural gas. It is currently<br />

expected that Turgai Petroleum will drill a further 17 gross development wells in this area in the<br />

fourth quarter of 2002 and another 17 wells in 2003. We, as the operator of Kumkol South,<br />

provide Kumkol North with production and ancillary support facilities on a fee basis.<br />

South Kumkol Field. The South Kumkol field was discovered in 1992 and has been in production<br />

since December 1997. We own and operate 100% of the South Kumkol field. Production is from<br />

three zones in the Cretaceous and Jurassic formations located at depths shallower than 5,000<br />

feet. In 2001, average production from the South Kumkol field was 13,000 BOPD from 19 wells.<br />

In the nine months ended September 30, 2002, the South Kumkol field produced an average of<br />

approximately 19,467 BOPD. As of January 1, 2002, estimated proved reserves for the South<br />

Kumkol field were 32.2 MMbbls of crude oil and 2.2 Bcf of natural gas.<br />

Akshabulak Field. The Akshabulak field was discovered in 1988, and began production in July<br />

1997 from the Jurassic-III formation. Through our interests in Kazgermunai, we own a 50%<br />

interest in the field. Our partners in Kazgermunai, REW-DEA AG (25%), EEG (17.5%) and<br />

International Finance Corporation (7.5%), hold the remainder of the interests in the Akshabulak<br />

field. We have no obligation to fund capital expenditures relating to the costs of the initial<br />

development phase of the central Jurassic-III formation. During 2001, the Akshabulak field<br />

produced an average of 8,300 BOPD attributed to us. In the nine months ended September 30,<br />

2002, the Akshabulak field produced an average of approximately 9,363 BOPD attributable to us.<br />

Three new wells were drilled in the first nine months of 2002. Three dimensional (3D) seismic<br />

data, acquired over the field, will assist in the 2003 drilling program.<br />

The program of further development and production enhancement of the Akshabulak field<br />

requires the installation this year of a new process facility. The purchase order for this new<br />

facility is being delayed by our German joint venture partners, pending assurances from the<br />

government of Kazakhstan on marketing and transportation issues.<br />

In 2001, production commenced from the Cretaceous formation from a single well. Production is<br />

currently being transported by pipeline to the Kumkol field where it ties into the lateral pipeline.<br />

This, in turn, connects to the Central Pipeline, which delivers to the Shymkent refinery.<br />

Funding for the development of the central part of the Jurassic-III formation of the Akshabulak<br />

field is obtained by Kazgermunai from shareholder loans from its shareholders other than HKM.<br />

These shareholder loans, which totalled approximately $63 million at September 30, 2002, are<br />

non-recourse to us except to the extent of our interest in Kazgermunai. Kazgermunai is restricted<br />

from paying dividends to its shareholders until all outstanding loans have been paid. As of<br />

January 1, 2002, the Akshabulak field had estimated proved reserves of 73.2 MMbbls of crude oil.<br />

Qyzylkiya Field. The Qyzylkiya field was discovered in 1988. Two productive zones in the<br />

Cretaceous and Jurassic formations have been identified at depths less than 5,000 feet. As of<br />

September 30, 2002, 19 wells in which we have an interest have been drilled in this field resulting<br />

in nine current productive oil wells. Production commenced in this field in August, 2000.<br />

Production facilities, road construction and other infrastructure projects were completed in<br />

November 2000, creating all-weather access to the Kumkol field located approximately 55 km to<br />

the east. In 2001 the Qyzylkiya field produced an average of 3,000 BOPD. In the nine months<br />

61