JPMorgan - KASE

JPMorgan - KASE

JPMorgan - KASE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Selling<br />

Selling expenses are comprised of the costs of operating the seven distribution centres of our<br />

Downstream operations that sell refined products, and certain costs associated with the sale and<br />

export of crude oil. Selling expenses increased $3.6 million from $15.1 million for the nine<br />

months ended September 30, 2001 to $18.7 million for the nine months ended September 30,<br />

2002, as a result of the significant increase in sales volumes. Upstream selling expenses for the<br />

nine months ended September 30, 2002 were $7.4 million as compared to $4.3 million in the<br />

comparable period in 2001. Downstream selling expenses were $11.3 million in the nine month<br />

period ended September 30, 2002 compared to $10.7 million in the comparable period of 2001.<br />

General and Administrative<br />

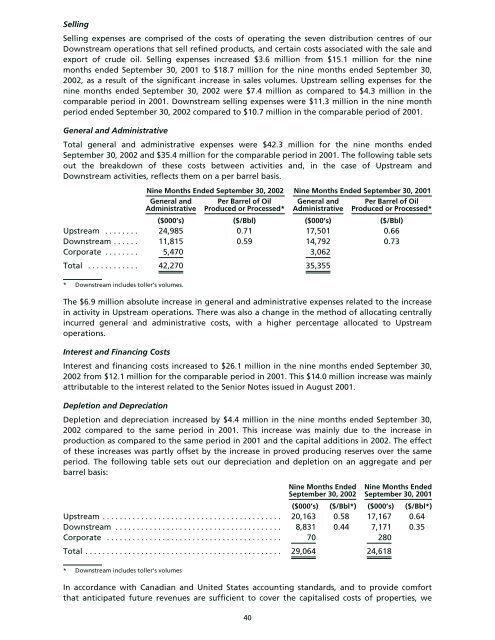

Total general and administrative expenses were $42.3 million for the nine months ended<br />

September 30, 2002 and $35.4 million for the comparable period in 2001. The following table sets<br />

out the breakdown of these costs between activities and, in the case of Upstream and<br />

Downstream activities, reflects them on a per barrel basis.<br />

Nine Months Ended September 30, 2002 Nine Months Ended September 30, 2001<br />

General and<br />

Administrative<br />

Per Barrel of Oil<br />

Produced or Processed*<br />

General and<br />

Administrative<br />

Per Barrel of Oil<br />

Produced or Processed*<br />

($000’s) ($/Bbl) ($000’s) ($/Bbl)<br />

Upstream ........ 24,985 0.71 17,501 0.66<br />

Downstream...... 11,815 0.59 14,792 0.73<br />

Corporate ........ 5,470 3,062<br />

Total ............ 42,270 35,355<br />

* Downstream includes toller’s volumes.<br />

The $6.9 million absolute increase in general and administrative expenses related to the increase<br />

in activity in Upstream operations. There was also a change in the method of allocating centrally<br />

incurred general and administrative costs, with a higher percentage allocated to Upstream<br />

operations.<br />

Interest and Financing Costs<br />

Interest and financing costs increased to $26.1 million in the nine months ended September 30,<br />

2002 from $12.1 million for the comparable period in 2001. This $14.0 million increase was mainly<br />

attributable to the interest related to the Senior Notes issued in August 2001.<br />

Depletion and Depreciation<br />

Depletion and depreciation increased by $4.4 million in the nine months ended September 30,<br />

2002 compared to the same period in 2001. This increase was mainly due to the increase in<br />

production as compared to the same period in 2001 and the capital additions in 2002. The effect<br />

of these increases was partly offset by the increase in proved producing reserves over the same<br />

period. The following table sets out our depreciation and depletion on an aggregate and per<br />

barrel basis:<br />

Nine Months Ended<br />

September 30, 2002<br />

Nine Months Ended<br />

September 30, 2001<br />

($000’s) ($/Bbl*) ($000’s) ($/Bbl*)<br />

Upstream .......................................... 20,163 0.58 17,167 0.64<br />

Downstream ....................................... 8,831 0.44 7,171 0.35<br />

Corporate ......................................... 70 280<br />

Total .............................................. 29,064 24,618<br />

* Downstream includes toller’s volumes<br />

In accordance with Canadian and United States accounting standards, and to provide comfort<br />

that anticipated future revenues are sufficient to cover the capitalised costs of properties, we<br />

40