Guide to Using International Standards on Auditing in - IFAC

Guide to Using International Standards on Auditing in - IFAC Guide to Using International Standards on Auditing in - IFAC

152

153

- Page 101 and 102: 101 Guide

- Page 103 and 104: 103 Guide

- Page 105 and 106: 105 Guide

- Page 107 and 108: 107 Guide

- Page 109 and 110: 109 Guide

- Page 111 and 112: 111 Guide

- Page 113 and 114: 113 Guide

- Page 115 and 116: 115 10. Further Audit Procedures Ch

- Page 117 and 118: 117 Guide

- Page 119 and 120: 119 Guide

- Page 121 and 122: 121 Guide

- Page 123 and 124: 123 Guide

- Page 125 and 126: 125 Guide

- Page 127 and 128: 127 Guide

- Page 129 and 130: 129 Guide

- Page 131 and 132: 131 Guide

- Page 133 and 134: 133 Guide

- Page 135 and 136: 135 Guide

- Page 137 and 138: 137 Guide

- Page 139 and 140: 139 Guide

- Page 141 and 142: 141 Guide

- Page 143 and 144: 143 Guide

- Page 145 and 146: 145 12. Related Parties Chapter Con

- Page 147 and 148: 147 Guide

- Page 149 and 150: 149 Guide

- Page 151: 151 Guide

- Page 155 and 156: 155 Guide

- Page 157 and 158: 157 Guide

- Page 159 and 160: 159 Guide

- Page 161 and 162: 161 14. Going Concern Chapter Conte

- Page 163 and 164: 163 Guide

- Page 165 and 166: 165 Guide

- Page 167 and 168: 167 Guide

- Page 169 and 170: 169 Guide

- Page 171 and 172: 171 15. Summary of Other ISA Requir

- Page 173 and 174: 173 Guide

- Page 175 and 176: 175 Guide

- Page 177 and 178: 177 Guide

- Page 179 and 180: 179 Guide

- Page 181 and 182: 181 Guide

- Page 183 and 184: 183 Guide

- Page 185 and 186: 185 Guide

- Page 187 and 188: 187 Guide

- Page 189 and 190: 189 Guide

- Page 191 and 192: 191 Guide

- Page 193 and 194: 193 Guide

- Page 195 and 196: 195 Guide

- Page 197 and 198: 197 Guide

- Page 199 and 200: 199 Guide

- Page 201 and 202: 201 Guide

152<br />

<str<strong>on</strong>g>Guide</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>Us<strong>in</strong>g</str<strong>on</strong>g> <str<strong>on</strong>g>Internati<strong>on</strong>al</str<strong>on</strong>g> <str<strong>on</strong>g>Standards</str<strong>on</strong>g> <strong>on</strong> <strong>Audit<strong>in</strong>g</strong> <strong>in</strong> the Audits of Small- and Medium-Sized Entities Volume 1—Core C<strong>on</strong>cepts<br />

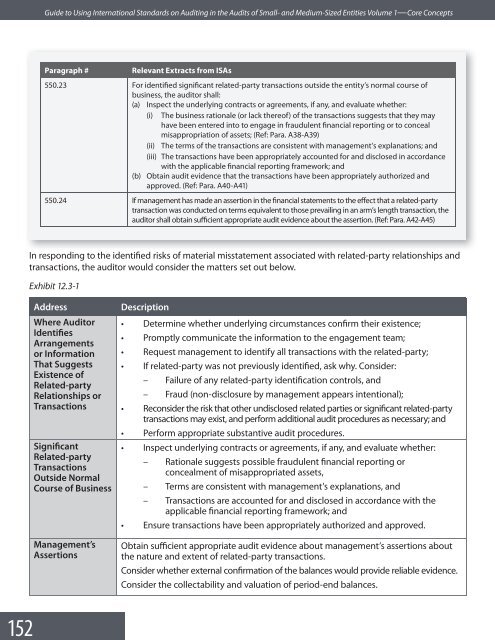

Paragraph #<br />

Relevant Extracts from ISAs<br />

550.23 For identified significant related-party transacti<strong>on</strong>s outside the entity’s normal course of<br />

bus<strong>in</strong>ess, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall:<br />

(a) Inspect the underly<strong>in</strong>g c<strong>on</strong>tracts or agreements, if any, and evaluate whether:<br />

(i) The bus<strong>in</strong>ess rati<strong>on</strong>ale (or lack thereof) of the transacti<strong>on</strong>s suggests that they may<br />

have been entered <strong>in</strong><str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g> engage <strong>in</strong> fraudulent f<strong>in</strong>ancial report<strong>in</strong>g or <str<strong>on</strong>g>to</str<strong>on</strong>g> c<strong>on</strong>ceal<br />

misappropriati<strong>on</strong> of assets; (Ref: Para. A38-A39)<br />

(ii) The terms of the transacti<strong>on</strong>s are c<strong>on</strong>sistent with management’s explanati<strong>on</strong>s; and<br />

(iii) The transacti<strong>on</strong>s have been appropriately accounted for and disclosed <strong>in</strong> accordance<br />

with the applicable f<strong>in</strong>ancial report<strong>in</strong>g framework; and<br />

(b) Obta<strong>in</strong> audit evidence that the transacti<strong>on</strong>s have been appropriately authorized and<br />

approved. (Ref: Para. A40-A41)<br />

550.24 If management has made an asserti<strong>on</strong> <strong>in</strong> the f<strong>in</strong>ancial statements <str<strong>on</strong>g>to</str<strong>on</strong>g> the effect that a related-party<br />

transacti<strong>on</strong> was c<strong>on</strong>ducted <strong>on</strong> terms equivalent <str<strong>on</strong>g>to</str<strong>on</strong>g> those prevail<strong>in</strong>g <strong>in</strong> an arm’s length transacti<strong>on</strong>, the<br />

audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall obta<strong>in</strong> sufficient appropriate audit evidence about the asserti<strong>on</strong>. (Ref: Para. A42-A45)<br />

In resp<strong>on</strong>d<strong>in</strong>g <str<strong>on</strong>g>to</str<strong>on</strong>g> the identified risks of material misstatement associated with related-party relati<strong>on</strong>ships and<br />

transacti<strong>on</strong>s, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r would c<strong>on</strong>sider the matters set out below.<br />

Exhibit 12.3-1<br />

Address<br />

Where Audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r<br />

Identifies<br />

Arrangements<br />

or Informati<strong>on</strong><br />

That Suggests<br />

Existence of<br />

Related-party<br />

Relati<strong>on</strong>ships or<br />

Transacti<strong>on</strong>s<br />

Significant<br />

Related-party<br />

Transacti<strong>on</strong>s<br />

Outside Normal<br />

Course of Bus<strong>in</strong>ess<br />

Management’s<br />

Asserti<strong>on</strong>s<br />

Descripti<strong>on</strong><br />

• Determ<strong>in</strong>e whether underly<strong>in</strong>g circumstances c<strong>on</strong>firm their existence;<br />

• Promptly communicate the <strong>in</strong>formati<strong>on</strong> <str<strong>on</strong>g>to</str<strong>on</strong>g> the engagement team;<br />

• Request management <str<strong>on</strong>g>to</str<strong>on</strong>g> identify all transacti<strong>on</strong>s with the related-party;<br />

• If related-party was not previously identified, ask why. C<strong>on</strong>sider:<br />

– Failure of any related-party identificati<strong>on</strong> c<strong>on</strong>trols, and<br />

– Fraud (n<strong>on</strong>-disclosure by management appears <strong>in</strong>tenti<strong>on</strong>al);<br />

• Rec<strong>on</strong>sider the risk that other undisclosed related parties or significant related-party<br />

transacti<strong>on</strong>s may exist, and perform additi<strong>on</strong>al audit procedures as necessary; and<br />

• Perform appropriate substantive audit procedures.<br />

• Inspect underly<strong>in</strong>g c<strong>on</strong>tracts or agreements, if any, and evaluate whether:<br />

– Rati<strong>on</strong>ale suggests possible fraudulent f<strong>in</strong>ancial report<strong>in</strong>g or<br />

c<strong>on</strong>cealment of misappropriated assets,<br />

– Terms are c<strong>on</strong>sistent with management’s explanati<strong>on</strong>s, and<br />

– Transacti<strong>on</strong>s are accounted for and disclosed <strong>in</strong> accordance with the<br />

applicable f<strong>in</strong>ancial report<strong>in</strong>g framework; and<br />

• Ensure transacti<strong>on</strong>s have been appropriately authorized and approved.<br />

Obta<strong>in</strong> sufficient appropriate audit evidence about management’s asserti<strong>on</strong>s about<br />

the nature and extent of related-party transacti<strong>on</strong>s.<br />

C<strong>on</strong>sider whether external c<strong>on</strong>firmati<strong>on</strong> of the balances would provide reliable evidence.<br />

C<strong>on</strong>sider the collectability and valuati<strong>on</strong> of period-end balances.