Guide to Using International Standards on Auditing in - IFAC

Guide to Using International Standards on Auditing in - IFAC Guide to Using International Standards on Auditing in - IFAC

108

109

- Page 57 and 58: 57 Guide t

- Page 59 and 60: 59 Guide t

- Page 61 and 62: 61 Guide t

- Page 63 and 64: 63 Guide t

- Page 65 and 66: 65 Guide t

- Page 67 and 68: 67 Guide t

- Page 69 and 70: 69 Guide t

- Page 71 and 72: 71 Guide t

- Page 73 and 74: 73 Guide t

- Page 75 and 76: 75 Guide t

- Page 77 and 78: 77 6. Financial Statement Assertion

- Page 79 and 80: 79 Guide t

- Page 81 and 82: 81 Guide t

- Page 83 and 84: 83 Guide t

- Page 85 and 86: 85 Guide t

- Page 87 and 88: 87 Guide t

- Page 89 and 90: 89 Guide t

- Page 91 and 92: 91 Guide t

- Page 93 and 94: 93 Guide t

- Page 95 and 96: 95 Guide t

- Page 97 and 98: 97 Guide t

- Page 99 and 100: 99 Guide t

- Page 101 and 102: 101 Guide

- Page 103 and 104: 103 Guide

- Page 105 and 106: 105 Guide

- Page 107: 107 Guide

- Page 111 and 112: 111 Guide

- Page 113 and 114: 113 Guide

- Page 115 and 116: 115 10. Further Audit Procedures Ch

- Page 117 and 118: 117 Guide

- Page 119 and 120: 119 Guide

- Page 121 and 122: 121 Guide

- Page 123 and 124: 123 Guide

- Page 125 and 126: 125 Guide

- Page 127 and 128: 127 Guide

- Page 129 and 130: 129 Guide

- Page 131 and 132: 131 Guide

- Page 133 and 134: 133 Guide

- Page 135 and 136: 135 Guide

- Page 137 and 138: 137 Guide

- Page 139 and 140: 139 Guide

- Page 141 and 142: 141 Guide

- Page 143 and 144: 143 Guide

- Page 145 and 146: 145 12. Related Parties Chapter Con

- Page 147 and 148: 147 Guide

- Page 149 and 150: 149 Guide

- Page 151 and 152: 151 Guide

- Page 153 and 154: 153 Guide

- Page 155 and 156: 155 Guide

- Page 157 and 158: 157 Guide

109<br />

<str<strong>on</strong>g>Guide</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>Us<strong>in</strong>g</str<strong>on</strong>g> <str<strong>on</strong>g>Internati<strong>on</strong>al</str<strong>on</strong>g> <str<strong>on</strong>g>Standards</str<strong>on</strong>g> <strong>on</strong> <strong>Audit<strong>in</strong>g</strong> <strong>in</strong> the Audits of Small- and Medium-Sized Entities Volume 1—Core C<strong>on</strong>cepts<br />

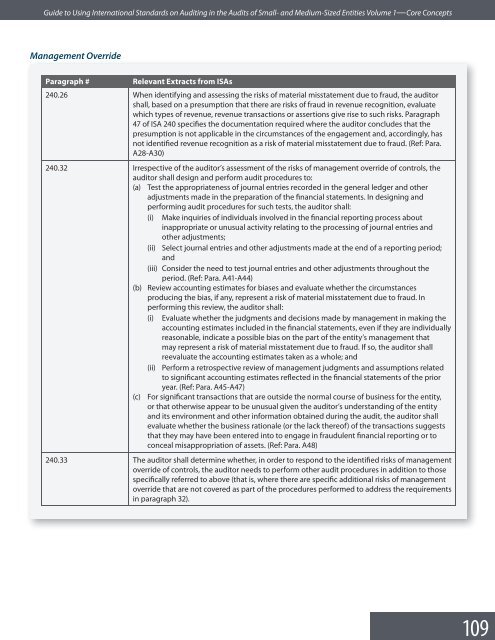

Management Override<br />

Paragraph #<br />

Relevant Extracts from ISAs<br />

240.26 When identify<strong>in</strong>g and assess<strong>in</strong>g the risks of material misstatement due <str<strong>on</strong>g>to</str<strong>on</strong>g> fraud, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r<br />

shall, based <strong>on</strong> a presumpti<strong>on</strong> that there are risks of fraud <strong>in</strong> revenue recogniti<strong>on</strong>, evaluate<br />

which types of revenue, revenue transacti<strong>on</strong>s or asserti<strong>on</strong>s give rise <str<strong>on</strong>g>to</str<strong>on</strong>g> such risks. Paragraph<br />

47 of ISA 240 specifies the documentati<strong>on</strong> required where the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r c<strong>on</strong>cludes that the<br />

presumpti<strong>on</strong> is not applicable <strong>in</strong> the circumstances of the engagement and, accord<strong>in</strong>gly, has<br />

not identified revenue recogniti<strong>on</strong> as a risk of material misstatement due <str<strong>on</strong>g>to</str<strong>on</strong>g> fraud. (Ref: Para.<br />

A28-A30)<br />

240.32 Irrespective of the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r’s assessment of the risks of management override of c<strong>on</strong>trols, the<br />

audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall design and perform audit procedures <str<strong>on</strong>g>to</str<strong>on</strong>g>:<br />

(a) Test the appropriateness of journal entries recorded <strong>in</strong> the general ledger and other<br />

adjustments made <strong>in</strong> the preparati<strong>on</strong> of the f<strong>in</strong>ancial statements. In design<strong>in</strong>g and<br />

perform<strong>in</strong>g audit procedures for such tests, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall:<br />

(i) Make <strong>in</strong>quiries of <strong>in</strong>dividuals <strong>in</strong>volved <strong>in</strong> the f<strong>in</strong>ancial report<strong>in</strong>g process about<br />

<strong>in</strong>appropriate or unusual activity relat<strong>in</strong>g <str<strong>on</strong>g>to</str<strong>on</strong>g> the process<strong>in</strong>g of journal entries and<br />

other adjustments;<br />

(ii) Select journal entries and other adjustments made at the end of a report<strong>in</strong>g period;<br />

and<br />

(iii) C<strong>on</strong>sider the need <str<strong>on</strong>g>to</str<strong>on</strong>g> test journal entries and other adjustments throughout the<br />

period. (Ref: Para. A41-A44)<br />

(b) Review account<strong>in</strong>g estimates for biases and evaluate whether the circumstances<br />

produc<strong>in</strong>g the bias, if any, represent a risk of material misstatement due <str<strong>on</strong>g>to</str<strong>on</strong>g> fraud. In<br />

perform<strong>in</strong>g this review, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall:<br />

(i) Evaluate whether the judgments and decisi<strong>on</strong>s made by management <strong>in</strong> mak<strong>in</strong>g the<br />

account<strong>in</strong>g estimates <strong>in</strong>cluded <strong>in</strong> the f<strong>in</strong>ancial statements, even if they are <strong>in</strong>dividually<br />

reas<strong>on</strong>able, <strong>in</strong>dicate a possible bias <strong>on</strong> the part of the entity’s management that<br />

may represent a risk of material misstatement due <str<strong>on</strong>g>to</str<strong>on</strong>g> fraud. If so, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall<br />

reevaluate the account<strong>in</strong>g estimates taken as a whole; and<br />

(ii) Perform a retrospective review of management judgments and assumpti<strong>on</strong>s related<br />

<str<strong>on</strong>g>to</str<strong>on</strong>g> significant account<strong>in</strong>g estimates reflected <strong>in</strong> the f<strong>in</strong>ancial statements of the prior<br />

year. (Ref: Para. A45-A47)<br />

(c) For significant transacti<strong>on</strong>s that are outside the normal course of bus<strong>in</strong>ess for the entity,<br />

or that otherwise appear <str<strong>on</strong>g>to</str<strong>on</strong>g> be unusual given the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r’s understand<strong>in</strong>g of the entity<br />

and its envir<strong>on</strong>ment and other <strong>in</strong>formati<strong>on</strong> obta<strong>in</strong>ed dur<strong>in</strong>g the audit, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall<br />

evaluate whether the bus<strong>in</strong>ess rati<strong>on</strong>ale (or the lack thereof) of the transacti<strong>on</strong>s suggests<br />

that they may have been entered <strong>in</strong><str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g> engage <strong>in</strong> fraudulent f<strong>in</strong>ancial report<strong>in</strong>g or <str<strong>on</strong>g>to</str<strong>on</strong>g><br />

c<strong>on</strong>ceal misappropriati<strong>on</strong> of assets. (Ref: Para. A48)<br />

240.33 The audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r shall determ<strong>in</strong>e whether, <strong>in</strong> order <str<strong>on</strong>g>to</str<strong>on</strong>g> resp<strong>on</strong>d <str<strong>on</strong>g>to</str<strong>on</strong>g> the identified risks of management<br />

override of c<strong>on</strong>trols, the audi<str<strong>on</strong>g>to</str<strong>on</strong>g>r needs <str<strong>on</strong>g>to</str<strong>on</strong>g> perform other audit procedures <strong>in</strong> additi<strong>on</strong> <str<strong>on</strong>g>to</str<strong>on</strong>g> those<br />

specifically referred <str<strong>on</strong>g>to</str<strong>on</strong>g> above (that is, where there are specific additi<strong>on</strong>al risks of management<br />

override that are not covered as part of the procedures performed <str<strong>on</strong>g>to</str<strong>on</strong>g> address the requirements<br />

<strong>in</strong> paragraph 32).