FCC Proudreed Properties 2005 HSBC SG CORPORATE ...

FCC Proudreed Properties 2005 HSBC SG CORPORATE ...

FCC Proudreed Properties 2005 HSBC SG CORPORATE ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GENERAL INFORMATION<br />

1. The Issuer will issue the Notes pursuant to the Issuer Regulations. The issue of the Notes will be<br />

authorised by the Management Company on behalf of the Issuer pursuant to the Issuer Regulations<br />

on the Closing Date. It is expected that the admission of the Notes to listing on the Irish Stock<br />

Exchange’s market for listed securities will be granted on or about the Closing Date, subject only to<br />

issue of the Notes. The listing of the Notes will be cancelled if the Notes are not issued. Transactions<br />

will normally be effected for settlement in euro and for delivery on the third working day after the<br />

day of the transaction. Prior to official listing and admission to trading, however, dealings in the<br />

Notes will be permitted by the Irish Stock Exchange in accordance with its rules.<br />

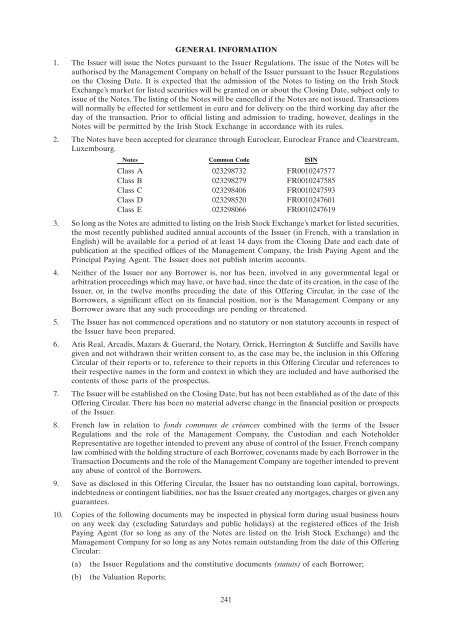

2. The Notes have been accepted for clearance through Euroclear, Euroclear France and Clearstream,<br />

Luxembourg.<br />

Notes Common Code ISIN<br />

Class A 023298732 FR0010247577<br />

Class B 023298279 FR0010247585<br />

Class C 023298406 FR0010247593<br />

Class D 023298520 FR0010247601<br />

Class E 023298066 FR0010247619<br />

3. So long as the Notes are admitted to listing on the Irish Stock Exchange’s market for listed securities,<br />

the most recently published audited annual accounts of the Issuer (in French, with a translation in<br />

English) will be available for a period of at least 14 days from the Closing Date and each date of<br />

publication at the specified offices of the Management Company, the Irish Paying Agent and the<br />

Principal Paying Agent. The Issuer does not publish interim accounts.<br />

4. Neither of the Issuer nor any Borrower is, nor has been, involved in any governmental legal or<br />

arbitration proceedings which may have, or have had, since the date of its creation, in the case of the<br />

Issuer, or, in the twelve months preceding the date of this Offering Circular, in the case of the<br />

Borrowers, a significant effect on its financial position, nor is the Management Company or any<br />

Borrower aware that any such proceedings are pending or threatened.<br />

5. The Issuer has not commenced operations and no statutory or non statutory accounts in respect of<br />

the Issuer have been prepared.<br />

6. Atis Real, Arcadis, Mazars & Guerard, the Notary, Orrick, Herrington & Sutcliffe and Savills have<br />

given and not withdrawn their written consent to, as the case may be, the inclusion in this Offering<br />

Circular of their reports or to, reference to their reports in this Offering Circular and references to<br />

their respective names in the form and context in which they are included and have authorised the<br />

contents of those parts of the prospectus.<br />

7. The Issuer will be established on the Closing Date, but has not been established as of the date of this<br />

Offering Circular. There has been no material adverse change in the financial position or prospects<br />

of the Issuer.<br />

8. French law in relation to fonds communs de créances combined with the terms of the Issuer<br />

Regulations and the role of the Management Company, the Custodian and each Noteholder<br />

Representative are together intended to prevent any abuse of control of the Issuer. French company<br />

law combined with the holding structure of each Borrower, covenants made by each Borrower in the<br />

Transaction Documents and the role of the Management Company are together intended to prevent<br />

any abuse of control of the Borrowers.<br />

9. Save as disclosed in this Offering Circular, the Issuer has no outstanding loan capital, borrowings,<br />

indebtedness or contingent liabilities, nor has the Issuer created any mortgages, charges or given any<br />

guarantees.<br />

10. Copies of the following documents may be inspected in physical form during usual business hours<br />

on any week day (excluding Saturdays and public holidays) at the registered offices of the Irish<br />

Paying Agent (for so long as any of the Notes are listed on the Irish Stock Exchange) and the<br />

Management Company for so long as any Notes remain outstanding from the date of this Offering<br />

Circular:<br />

(a) the Issuer Regulations and the constitutive documents (statuts) of each Borrower;<br />

(b) the Valuation Reports;<br />

241