English - IRIS

English - IRIS

English - IRIS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

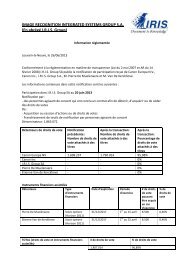

COMMENT ON THE FIGURES<br />

I.R.I.S. is a technological company that develops and markets professional applications and office products<br />

that cover the entire document chain – from the acquisition, identification and recognition of documents to<br />

their management and archiving. These productivity tools address both the “large accounts” and the<br />

individual users. The professional applications generate about 80% of the sales. This explains why I.R.I.S.<br />

books a dominant part of its sales during the second half-year, and why the profitability of the first half-year<br />

does not reflect the objectives for the entire fiscal year.<br />

During the first six months of 2002, I.R.I.S. increased the sales by 40% to 21.1 million Euro. The gross<br />

margin for that period increased by 26.5%, exceeding the budget forecast for 2002. As I.R.I.S. did not<br />

expand its consolidation sphere since the beginning of this year, the progress is particularly remarkable. The<br />

strong internal growth is definitely a very positive element.<br />

In compliance with the growth strategy and the 2002 budget, I.R.I.S. continued its considerable R&D effort<br />

and its investments in marketing and sales to strengthen the technological advance and enter new markets.<br />

This led to increased expenses in the first half-year compared with 2001. The cash flow from operations<br />

shows a profit of 493,317 EUR (-25%). The income from operations is 101,240 EUR (-67%). These figures<br />

are again better than the budget, that foresaw an operational loss of 180,000 EUR.<br />

Amos Monétique and Amos Inc - both companies were acquired in october 2001, have contributed to the<br />

group’s results as follows : sales of 1,369,175 EUR and a loss from operations of 91,269 EUR.<br />

The net income after 6 months is a loss of 641,878 EUR. Two important elements influenced this figure:<br />

- I.R.I.S. booked an exchange and conversion loss, with some other non recurring financial costs,<br />

of 299,985 EUR. This was caused by the brutal change in the dollar-euro exchange rate during<br />

the first half-year. I.R.I.S. realises a significant part of its turnover in the United States and<br />

recorded a conversion loss on its assets on June 30 2002, when the exchange rate was at its<br />

highest (1 Euro = 0.991 dollar). Since June 30, I.R.I.S. booked a conversion profit on the assets<br />

in dollars (accounts receivables, inventories and cash).<br />

- Substantial but non-recurring expenses were incurred to integrate Amos and to make the sales,<br />

development and support teams leaner. These expenses comprise severance payments and are<br />

estimated to amount 200,000 EUR. Although the costs are one-time, we decided to record them<br />

as operational charges.<br />

On the whole, I.R.I.S.’s management expects that the group’s fixed expenses will decrease somewhat in the<br />

second half-year of 2002.<br />

The net current result (before goodwill) on June 30 exceeds the expected figure slightly: a loss of 226,494<br />

EUR vs a budgeted loss of 255,000 EUR. When we exclude the loss caused by the dollar-euro exchange<br />

rate, the net current result is positive. The main indicator is a stronger than expected increase of the gross<br />

margin. Also note that some deliveries of hardware for certain large documentary projects (such as the<br />

automatic reading of VAT forms for the Belgian Ministry of Finance) caused the sales figure to increase even<br />

more than the gross margin. Indeed, the gross margin on software licences and services is substantially<br />

higher than it is for hardware (peripherals such as scanners etc.).<br />

The financial income comprises the following elements:<br />

- Revenues from financial investments: 42,573 EUR.<br />

- Amortisation of the acquisition goodwill: 429,310 EUR.<br />

- Negative conversion differences and exchange losses caused by the weak dollar, and some other<br />

non recurring financial costs: 299,985 EUR (reminder: the dollar lost 12% of its value between<br />

January 1 and June 30 2002)<br />

- Interest expenses on bank loans: 149,992 EUR (interests and reservation costs for “stand-by” credit<br />

lines).<br />

I.R.I.S. Group sa – Half-Year Results 30 June 2002 – Press release 2

The extraordinary income includes the following elements:<br />

- The reduction of provisions thanks to the successful termination of a minor litigation in France:<br />

22,846 EUR.<br />

- Other extraordinary income: 6,814 EUR.<br />

- Other extraordinary expenses: 15,734 EUR.<br />

COMMENTS ON THE BUSINESS<br />

I.R.I.S. Group has met its main objectives:<br />

- I.R.I.S. is a major “player” on the “Document to Knowledge” market in Europe. We were able to<br />

satisfy all our clients and have conquered new “large accounts” that make our client reference roster<br />

even more impressive. A dynamic sales effort allowed to increase the client prospection and led to<br />

further growth despite a globally depressed market.<br />

- Thanks to our two offices in the United States, the company was able to sell more office products and<br />

increase its presence on the market for professional applications. I.R.I.S. expects a significant<br />

increase of the sales in the United States.<br />

- I.R.I.S. has introduced Formiris Pro 4.0 in the first half of September. This product combines all<br />

automatic reading and document recognition technologies that the group has developed so far. A<br />

new range of office products was introduced for the Mac OS platform, and some other product<br />

launches are planned before the end of the year.<br />

- The major partnerships with Hewlett Packard, Kodak, IBM etc. continue in a harmonious atmosphere.<br />

The I.R.I.S. management remains optimistic for the second half-year, despite the very difficult ICT market.<br />

The company maintains its profit forecast and expects a significant increase of the gross margin (above<br />

20%).<br />

The group’s costs should decrease somewhat during the second half-year. The company disposes of a<br />

healthy number of orders in France, Belgium and Luxembourg. Our large clients and our partners have more<br />

confidence in I.R.I.S. than ever before. The upcoming launch of new products will help to increase the sales<br />

figure.<br />

ANALYSIS OF THE BALANCE SHEET<br />

I.R.I.S. Group is a very healthy company, with a very solid balance sheet structure. The net equity was<br />

increased up to 25,691,556 EUR on June 30 2002.<br />

The major indicators on June 30 2002 show the company’s strong solvability and liquidity:<br />

- ratio “net equity / total balance” : 57 %<br />

- ratio “current assets / short term liabilities” : 1.6.<br />

I.R.I.S.’s long-term debt (more than 1 year before maturity) dropped to 895,627 EUR. This debt was actually<br />

inherited from companies that were acquired in the year 2000 and is largely insignificant given the net equity.<br />

On June 30 2002, no more than 2.9 million Euro of the credit lines were taken up, even if the need for<br />

working capital amounted 10.5 million Euro (a necessity given the fast growth of the sales figure) and the<br />

available cash amounted 1.6 million Euro. Remind that I.R.I.S. can count on “stand-by” credit lines for 12<br />

million Euro, 8.7 million of which are non-revokable for a period of 4 years.<br />

This clean bill of financial health allows the group to roll out its development plan for the years 2002 and<br />

2003.<br />

I.R.I.S. Group sa – Half-Year Results 30 June 2002 – Press release 3

MAJOR EVENTS<br />

The company purchased the remaining 40% of the shares of I.R.I.S. B2B Technologies that still belonged to<br />

the former owners of the company. As a result, I.R.I.S. owns all the shares of every subsidiary. There are no<br />

longer any minority shares in the consolidating enterprise.<br />

Furthermore, the S.A. I.R.I.S. has absorbed the S.A. I.R.I.S. B2B Technologies, as of January 1 2002. This<br />

merger completes the integration not only of the operational and commercial management but also of the<br />

development and support teams. On the French territory, and inspired by the same wish to keep the<br />

organisation transparent and rational, SEPSI-<strong>IRIS</strong> France has absorbed Amos Monétique as of January 1<br />

2002. The R&D team of Amos has joined SEPSI’s team in Massy, while the after sales support and hotline<br />

services were concentrated in Rueil-Malmaison.<br />

I.R.I.S. has continued its R&D effort and put strategic emphasis on form reading and ADR (“Automatic<br />

Document Recognition”), which allowed to launch the new product Formiris Pro 4.0. I.R.I.S. maintains its<br />

technological mission in every segment of its activities. New versions of the company’s wide product range<br />

are being prepared.<br />

The group’s capital was increased by 774,061 EUR. These capital increases were reserved for the former<br />

owners of I.R.I.S. B2B Technologies and Paperless (as last variable segment of the purchase price) and for<br />

employees that participate in the “stock option programme” of April 1999.<br />

OUTLOOK FOR THE FISCAL YEAR<br />

The expected sales figure was met on June 30 2002; even better, the figures are ahead of the predicted<br />

bugdet. As usually, it is the second half-year that determines the global result for the fiscal year: it accounts<br />

for the major part of the sales figure and the gross margin but only takes about half of the fixed charges.<br />

Given the current prospects and the on-going deliveries, we confirm the expected turnover for the fiscal year<br />

2002 and a 20% increase of the gross margin compared with 2001.<br />

Given the uncertain economic environment, the management has decided to adopt a careful policy. The<br />

evolution of the on-going orders will be followed closely, which will allow to correct the fixed expenses rapidly<br />

should this prove necessary. We remind that the fixed expenses should decrease in the second half-year of<br />

2002 and the first half-year of 2003.<br />

Visit www.irislink.com to learn more about I.R.I.S.<br />

Register on the financial section of our web site to receive our “Investor’s newsletter”<br />

IMAGE RECOGNITION INTEGRATED SYSTEMS GROUP S.A.<br />

Rue du Bosquet 10, Parc Scientifique of Louvain-la-Neuve<br />

1435 Mont Saint-Guibert (Belgium)<br />

Tel.: +32-10-45 13 64<br />

E-mail: etienne.vdk@irislink.com<br />

I.R.I.S. Group sa – Half-Year Results 30 June 2002 – Press release 4