press release buyback announcement intesa ... - InvestireOggi

press release buyback announcement intesa ... - InvestireOggi

press release buyback announcement intesa ... - InvestireOggi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

PRESS RELEASE<br />

BUYBACK ANNOUNCEMENT<br />

INTESA SANPAOLO ANNOUNCES AN INVITATION TO HOLDERS OF<br />

SUBORDINATED NOTES AND SENIOR NOTES TO SUBMIT OFFERS<br />

TO SELL THEIR NOTES TO INTESA SANPAOLO<br />

Milan, Turin, July 18 th 2012 – Intesa Sanpaolo S.p.A. (“Intesa Sanpaolo” or the “Purchaser”) announced<br />

today an invitation to holders (the “Holders”) of the following Subordinated Notes and Senior Notes issued<br />

(or guaranteed) by Intesa Sanpaolo (together, the “Notes”) to submit offers to sell their Notes to the<br />

Purchaser for cash at the Purchase Price (the “Invitation”).<br />

The Invitation will enable Intesa Sanpaolo to optimise the composition of its regulatory capital through the<br />

increase in its Core Tier 1 capital as a result of the capital gain arising from the purchase of Notes tendered<br />

at prices below par. Furthermore the Invitation gives the Holders the possibility to realise their investments<br />

in the Notes at prices higher than the prevailing market prices during the period prior to <strong>announcement</strong> of<br />

the Invitation.<br />

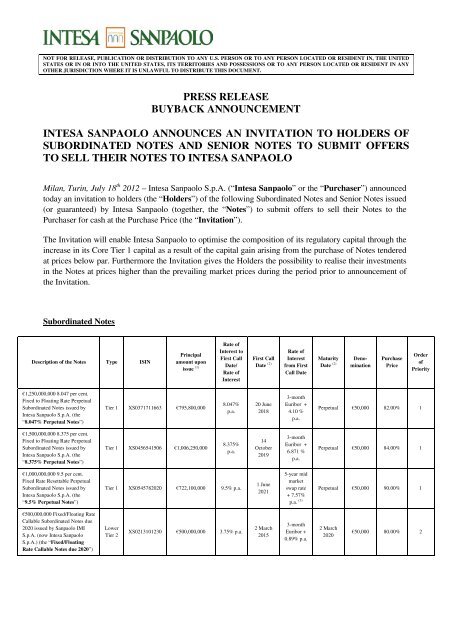

Subordinated Notes<br />

Description of the Notes Type ISIN<br />

Principal<br />

amount upon<br />

issue (1)<br />

Rate of<br />

Interest to<br />

First Call<br />

Date/<br />

Rate of<br />

Interest<br />

First Call<br />

Date (2)<br />

Rate of<br />

Interest<br />

from First<br />

Call Date<br />

Maturity<br />

Date (2)<br />

Denomination<br />

Purchase<br />

Price<br />

Order<br />

of<br />

Priority<br />

€1,250,000,000 8.047 per cent.<br />

Fixed to Floating Rate Perpetual<br />

Subordinated Notes issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“8.047% Perpetual Notes”)<br />

Tier 1 XS0371711663 €795,800,000<br />

8.047%<br />

p.a.<br />

20 June<br />

2018<br />

3-month<br />

Euribor +<br />

4.10 %<br />

p.a.<br />

Perpetual €50,000 82.00% 1<br />

€1,500,000,000 8.375 per cent.<br />

Fixed to Floating Rate Perpetual<br />

Subordinated Notes issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“8.375% Perpetual Notes”)<br />

Tier 1 XS0456541506 €1,006,250,000<br />

8.375%<br />

p.a.<br />

14<br />

October<br />

2019<br />

3-month<br />

Euribor +<br />

6.871 %<br />

p.a.<br />

Perpetual €50,000 84.00% 1<br />

€1,000,000,000 9.5 per cent.<br />

Fixed Rate Resettable Perpetual<br />

Subordinated Notes issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“9.5% Perpetual Notes”)<br />

Tier 1 XS0545782020 €722,100,000 9.5% p.a.<br />

1 June<br />

2021<br />

5-year mid<br />

market<br />

swap rate<br />

+ 7.57%<br />

p.a. (3) Perpetual €50,000 90.00% 1<br />

€500,000,000 Fixed/Floating Rate<br />

Callable Subordinated Notes due<br />

2020 issued by Sanpaolo IMI<br />

S.p.A. (now Intesa Sanpaolo<br />

S.p.A.) (the “Fixed/Floating<br />

Rate Callable Notes due 2020”)<br />

Lower<br />

Tier 2<br />

XS0213101230 €500,000,000 3.75% p.a.<br />

2 March<br />

2015<br />

3-month<br />

Euribor +<br />

0.89% p.a.<br />

2 March<br />

2020<br />

€50,000 80.00% 2

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

£165,000,000 Lower Tier II Fix<br />

Floater Callable Subordinated<br />

Notes due 2024 issued by<br />

Sanpaolo IMI S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “Fix<br />

Floater Callable Notes due<br />

2024”)<br />

Lower<br />

Tier 2<br />

XS0188046543 £165,000,000<br />

5.625%<br />

p.a.<br />

18 March<br />

2019<br />

3-month<br />

Sterling<br />

Libor +<br />

1.125%<br />

p.a.<br />

18 March<br />

2024<br />

£1,000 84.00% 2<br />

€1,500,000,000 5.00 per cent.<br />

Lower Tier II Subordinated Notes<br />

due 2019 issued by Intesa<br />

Sanpaolo S.p.A. (the “5.00%<br />

Notes due 2019”)<br />

Lower<br />

Tier 2<br />

XS0452166324 €1,500,000,000 5.00% p.a. n.a. n.a.<br />

23<br />

September<br />

2019<br />

€50,000 93.00% 2<br />

€1,250,000,000 5.15 per cent.<br />

Lower Tier II Subordinated Notes<br />

due 16 July 2020 issued by Intesa<br />

Sanpaolo S.p.A. (the “5.15%<br />

Notes due 2020”)<br />

Lower<br />

Tier 2<br />

XS0526326334 €1,250,000,000 5.15% p.a. n.a. n.a.<br />

16 July<br />

2020<br />

€50,000 92.50% 2<br />

€1,250,000,000 6.625 per cent.<br />

Upper Tier II Subordinated Notes<br />

due 2018 issued by Intesa<br />

Sanpaolo S.p.A. (the “6.625%<br />

Notes due 2018”)<br />

Upper<br />

Tier 2 XS0360809577 €1,250,000,000<br />

6.625%<br />

p.a.<br />

n.a.<br />

n.a.<br />

8 May<br />

2018<br />

€50,000 98.50% 2<br />

£250,000,000 Lower Tier II<br />

Subordinated Fixed to Floating<br />

Rate Notes due November 2017<br />

issued by Intesa Sanpaolo S.p.A.<br />

(the “Fixed to Floating Rate<br />

Notes due 2017”)<br />

Lower<br />

Tier 2<br />

XS0324790657 £250,000,000<br />

6.375%<br />

p.a.<br />

12<br />

November<br />

2012<br />

3-month<br />

Sterling<br />

Libor +<br />

1.35% p.a<br />

12<br />

November<br />

2017<br />

£50,000 96.50% 3<br />

€750,000,000 Floating Rate<br />

Subordinated Notes due 2018<br />

issued by Sanpaolo IMI S.p.A.<br />

(now Intesa Sanpaolo S.p.A.) (the<br />

“Floating Rate Notes due 2018”)<br />

Lower<br />

Tier 2<br />

XS0243399556 €750,000,000<br />

3-month<br />

Euribor +<br />

0.25% p.a.<br />

20<br />

February<br />

2013<br />

3-month<br />

Euribor +<br />

0.85% p.a.<br />

20<br />

February<br />

2018<br />

€50,000 (4) 86.00% 3<br />

€1,000,000,000 Lower Tier II<br />

Subordinated Fixed to Floating<br />

Rate Notes due 2018 issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“Fixed to Floating Rate Notes<br />

due 2018”)<br />

Lower<br />

Tier 2<br />

XS0365303675 €1,000,000,000 5.75% p.a<br />

28 May<br />

2013<br />

3-month<br />

Euribor +<br />

1.98% p.a.<br />

28 May<br />

2018<br />

€50,000 91.50% 3<br />

€500,000,000 Fixed/Floating Rate<br />

Callable Lower Tier II<br />

Subordinated Notes due 2018<br />

issued by Sanpaolo IMI S.p.A.<br />

(now Intesa Sanpaolo S.p.A.) (the<br />

“Fixed/Floating Rate Callable<br />

Notes due 2018”)<br />

Lower<br />

Tier 2<br />

XS0258143477 €500,000,000<br />

4.375%<br />

p.a.<br />

26 June<br />

2013<br />

3-month<br />

Euribor +<br />

1.00% p.a.<br />

26 June<br />

2018<br />

€50,000 86.50% 3<br />

(1) In the case of the Tier 1 Notes only, represents their principal amount upon issue less such Tier 1 Notes purchased and in case cancelled pursuant to<br />

their terms and conditions in the context of the cash tender offer carried out by the Purchaser in February 2012. To the best of its knowledge, the<br />

Purchaser and its subsidiary Banca IMI S.p.A. beneficially owned, as of 17 July 2012, approximately €284,050,000 (equivalent) in aggregate<br />

principal amount of Subordinated Notes.<br />

(2) Subject to business day adjustment, in accordance with the terms and conditions of the relevant Notes.<br />

(3) Commencing on 1 June 2016, interest rate reset every five years to 5-year mid market swap rate + 7.57% p.a..<br />

(4) For so long as the Notes are represented by a Global Note, the Notes shall be tradable in minimum nominal amounts of €50,000 and integral multiples<br />

of €1,000 in addition thereto.<br />

2

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Senior Notes<br />

Description of the Notes<br />

ISIN<br />

Principal<br />

amount upon<br />

issue (1)<br />

Rate of<br />

Interest<br />

Maturity<br />

Date (2)<br />

Denomination<br />

Purchase<br />

Price<br />

Order<br />

of<br />

Priority<br />

€1,250,000,000 Floating Rate Notes due 2013<br />

issued by Sanpaolo IMI S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “FRNs due March<br />

2013)<br />

XS0246688435 €1,250,000,000<br />

3-month<br />

Euribor +<br />

0.10% p.a.<br />

15 March<br />

2013<br />

€50,000 (3) 98.45% 1<br />

€1,000,000,000 Floating Rate Notes due 2013<br />

issued by Banca Intesa S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “FRNs due April<br />

2013”)<br />

XS0249278655 €1,000,000,000<br />

3-month<br />

Euribor +<br />

0.175% p.a.<br />

11 April<br />

2013<br />

€50,000 98.30% 1<br />

€1,500,000,000 4.000 per cent. Senior Notes<br />

due 8 August 2013 issued by Intesa Sanpaolo<br />

Bank Ireland Plc and guaranteed by Intesa<br />

Sanpaolo S.p.A. (the “4.000% Notes due<br />

2013”)<br />

XS0742590739 €1,500,000,000 4.000% p.a.<br />

8 August<br />

2013<br />

€100,000 100.35% 1<br />

€800,000,000 3.5 per cent. Senior Notes due<br />

27 November 2013 issued by Intesa Sanpaolo<br />

S.p.A. (the “3.5% Notes due 2013”)<br />

XS0630360997 €800,000,000 3.5% p.a.<br />

27<br />

November<br />

2013<br />

€100,000 99.75% 1<br />

€1,250,000,000 5.375 per cent. Notes due<br />

2013 issued by Intesa Sanpaolo S.p.A. (the<br />

“5.375% Notes due 2013”)<br />

XS0405713883 €1,250,000,000 5.375% p.a.<br />

19<br />

December<br />

2013<br />

€50,000 102.25% 1<br />

€1,000,000,000 Floating Rate Notes due 2014<br />

issued by Intesa Sanpaolo S.p.A. (the “FRNs<br />

due 2014”)<br />

XS0291639440 €1,000,000,000<br />

3-month<br />

Euribor +<br />

0.12% p.a.<br />

19 March<br />

2014<br />

€50,000 94.50% 1<br />

€2,000,000,000 Floating Rate Notes due May<br />

2014 issued by Intesa Sanpaolo S.p.A. (the<br />

“FRNs due May 2014”)<br />

XS0624833421 €2,000,000,000<br />

3-month<br />

Euribor +<br />

1.10% p.a.<br />

12 May<br />

2014<br />

€100,000 94.45% 1<br />

€1,100,000,000 Floating Rate Notes due<br />

October 2014 issued by Banca Intesa S.p.A.<br />

(now Intesa Sanpaolo S.p.A.) (the “FRNs due<br />

October 2014”)<br />

XS0201271045 €1,100,000,000<br />

3-month<br />

Euribor +<br />

0.20% p.a.<br />

1 October<br />

2014<br />

€1,000 92.45% 1<br />

€1,000,000,000 3.375 per cent. Notes due 19<br />

January 2015 issued by Intesa Sanpaolo<br />

S.p.A. (the 3.375% Notes due 2015)<br />

XS0478285389 €1,000,000,000 3.375% p.a.<br />

19 January<br />

2015<br />

€50,000 97.10% 1<br />

€650,000,000 3.875% Notes due 2015 issued<br />

by Banca Intesa S.p.A. (now Intesa Sanpaolo<br />

S.p.A.) (the “3.875% Notes due 2015”)<br />

XS0215743252 €650,000,000 3.875% p.a.<br />

1 April<br />

2015<br />

€50,000 97.85% 1<br />

€500,000,000 Floating Rate Notes due 2015<br />

issued by Banca Intesa S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the FRNs due 2015)<br />

XS0233436731 €500,000,000<br />

3-month<br />

Euribor +<br />

0.175% p.a.<br />

27<br />

October<br />

2015<br />

€50,000 86.65% 2<br />

€1,200,000,000 4.125 per cent. Senior Notes<br />

due 14 January 2016 issued by Intesa<br />

Sanpaolo S.p.A. (the “4.125% Notes due<br />

2016”)<br />

XS0577347528 €1,200,000,000 4.125% p.a.<br />

14 January<br />

2016<br />

€100,000 97.30% 2<br />

€1,500,000,000 3.75 per cent. Notes due 23<br />

November 2016 issued by Intesa Sanpaolo<br />

S.p.A. (the “3.75% Notes due 2016”)<br />

XS0467864160 €1,500,000,000 3.75% p.a.<br />

23<br />

November<br />

2016<br />

€50,000 94.60% 2<br />

3

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

€750,000,000 Floating Rate Notes due 2016<br />

issued by Banca Intesa S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “FRNs due 2016”)<br />

XS0278803712 €750,000,000<br />

3-month<br />

Euribor +<br />

0.175% p.a.<br />

20<br />

December<br />

2016<br />

€50,000 82.40% 2<br />

€1,000,000,000 5.000 per cent. Senior Notes<br />

due 28 February 2017 issued by Intesa<br />

Sanpaolo S.p.A. (the “5.000% Notes due<br />

2017”)<br />

XS0750763806 €1,000,000,000 5.000% p.a.<br />

28<br />

February<br />

2017<br />

€100,000 98.95% 2<br />

€1,250,000,000 Floating Rate Notes due 2017<br />

issued by Intesa Sanpaolo S.p.A. (the “FRNs<br />

due 2017”)<br />

XS0300196879 €1,250,000,000<br />

3-month<br />

Euribor +<br />

0.15% p.a.<br />

18 May<br />

2017<br />

€50,000 80.50% 2<br />

€1,450,000,000 4.75 per cent. Notes due 2017<br />

issued by Intesa Sanpaolo S.p.A. (the “4.75%<br />

Notes due 2017”)<br />

XS0304508921 €1,450,000,000 4.75% p.a.<br />

15 June<br />

2017<br />

€50,000 97.70% 2<br />

€1,500,000,000 4.00 per cent. Senior Notes<br />

due 8 November 2018 issued by Intesa<br />

Sanpaolo S.p.A. (the “4.00% Notes due<br />

2018”)<br />

XS0555977312 €1,500,000,000 4.00 % p.a.<br />

8<br />

November<br />

2018<br />

€100,000 91.60% 2<br />

€1,500,000,000 4.125 per cent. Notes due 14<br />

April 2020 issued by Intesa Sanpaolo S.p.A.<br />

(the “4.125% Notes due 2020”)<br />

XS0500187843 €1,500,000,000 4.125 % p.a.<br />

14 April<br />

2020<br />

€50,000 89.10% 2<br />

£350,000,000 5.25 per cent. Notes due 28<br />

January 2022 issued by Intesa Sanpaolo<br />

S.p.A. (the “5.25% Notes due 2022”)<br />

XS0481342896 £350,000,000 5.25% p.a.<br />

28 January<br />

2022<br />

£50,000 84.65% 2<br />

(1) To the best of its knowledge, the Purchaser and its subsidiary Banca IMI S.p.A. beneficially owned, as of 17 July 2012, approximately €957,715,385<br />

(equivalent) in aggregate principal amount of Senior Notes.<br />

(2) Subject to business day adjustment, in accordance with the terms and conditions of the relevant Notes.<br />

(3) And integral multiples of €1,000 in addition thereto.<br />

The Invitation – already approved by the Bank of Italy in respect of the repurchase of the Subordinated<br />

Notes – is carried out in Italy as an exempt offer pursuant to article 101-bis, paragraph 3-bis, of Legislative<br />

Decree No. 58 of 24 February 1998, as amended and supplemented, and article 35-bis, paragraph 4 of<br />

CONSOB Regulation No. 11971 of 14 May 1999, as amended and supplemented.<br />

The terms and conditions of the Invitation are indicated in the invitation for offers dated 18 July 2012 (the<br />

“Invitation for Offers”). Copies of the Invitation for Offers are available from the Tender Agent whose<br />

contact details are indicated below.<br />

Summary details of the Invitation are set forth below.<br />

4

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Purchase Price and Accrued Amount<br />

The price to be paid by the Purchaser to each Holder who validly submits an offer to sell its Notes<br />

pursuant to the Invitation and whose Offer is – subject to application of the relevant Order of Priority and<br />

scaling of the Offers, if applicable - accepted by the Purchaser (such amount, in respect of each Series of<br />

Notes, the “Purchase Price”) is set out in the tables above.<br />

In addition, Holders whose Notes are accepted for purchase will receive, on the Settlement Date, an<br />

amount in cash equal to the accrued interest in respect of such Notes from (and including) the interest<br />

payment date immediately preceding the Settlement Date of the Invitation to (but excluding) the<br />

Settlement Date of the Invitation.<br />

Final Acceptance Amount, Order of Priority and scaling of Offers<br />

The Purchaser currently proposes to accept to purchase pursuant to the Invitation:<br />

- up to an amount to be determined taking into account the Purchase Price of the Subordinated Notes of<br />

each relevant Series, such that the Total Purchase Price to be paid by the Purchaser for all Subordinated<br />

Notes accepted for purchase by the Purchaser shall not exceed €1,000,000,000 (calculated using the<br />

Sterling equivalent, as applicable) (the final aggregate principal amount of all Subordinated Notes<br />

accepted for purchase pursuant to the Invitation being the “Subordinated Notes Final Acceptance<br />

Amount”); and<br />

- up to an amount to be determined taking into account the Purchase Price of the Senior Notes of each<br />

relevant Series, such that the Total Purchase Price to be paid by the Purchaser for all Senior Notes<br />

accepted for purchase by the Purchaser shall not exceed the sum of (a) €500,000,000 and (b) the<br />

Adjustment Amount(as defined below), if any (calculated using the Sterling equivalent, as applicable)<br />

(the final aggregate principal amount of all Senior Notes accepted for purchase pursuant to the Invitation<br />

being the “Senior Notes Final Acceptance Amount”).<br />

In the event that the Total Purchase Price for all Subordinated Notes validly offered pursuant to the Invitation<br />

and accepted for purchase by the Purchaser is less than €1,000,000,000, the Purchaser may, in its discretion,<br />

determine to allocate such difference towards accepting to purchase Senior Notes validly offered pursuant to<br />

the Invitation (the amount so allocated is referred to herein as the “Adjustment Amount”).<br />

In the event that valid Offers are received in respect of an aggregate principal amount of all Subordinated<br />

Notes or, as applicable, Senior Notes, that is greater than the Subordinated Notes Final Acceptance Amount<br />

or the Senior Notes Final Acceptance Amount, as applicable, the Purchaser will accept such valid Offers in<br />

the order of priority indicated in the tables above, subject to allocation of the Subordinated Notes Final<br />

Acceptance Amount between each Series of Subordinated Notes and the Senior Notes Final Acceptance<br />

Amount between each Series of Senior Notes, in each case, that rank equally in the applicable Order of<br />

Priority at the Purchaser’s discretion and the scaling of Offers (if any), all in the manner described in the<br />

section “Invitation – Final Acceptance Amount, Order of Priority and scaling of Offers” of the Invitation for<br />

Offers. The Purchaser reserves the right to accept significantly more or less (or none) of Subordinated Notes<br />

or, as applicable, Senior Notes of a Series, as compared to the other Series of Subordinated Notes or, as<br />

applicable, Senior Notes that rank equally in the applicable Order of Priority.<br />

Offer Instructions<br />

In order to offer to sell its Notes to the Purchaser pursuant to the Invitation, each Holder must validly<br />

submit an offer to sell its Notes by delivering, or arrange to have delivered on its behalf, a valid Electronic<br />

Offer Instruction to the Tender Agent before the Invitation Expiration indicated below.<br />

Electronic Offer Instructions will be irrevocable, save in the limited circumstances where revocation is<br />

permitted as indicated in the Invitation for Offers.<br />

5

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Expected Timetable of the Invitation<br />

Event<br />

Commencement of the Invitation Period<br />

Copies of the Invitation for Offers are available to Holders<br />

from the Tender Agent, subject to invitation and<br />

distribution restrictions and notice of the Invitation<br />

published through Euroclear and Clearstream.<br />

Expected Dates and Times<br />

(All times are CET)<br />

On 18 July 2012<br />

Invitation Expiration<br />

Deadline for receipt of all Electronic Offer Instructions.<br />

5.00 p.m. on 26 July 2012<br />

End of Invitation Period.<br />

FX Rate fixed by Dealer Managers from Bloomberg<br />

Screen FXC.<br />

At or around 5.00 p.m. on 26 July 2012<br />

Announcement of Invitation Results<br />

Announcement by the Purchaser of:<br />

On 27 July 2012<br />

- the FX Rate;<br />

- the Subordinated Notes Final Acceptance Amount, the<br />

Senior Notes Final Acceptance Amount and, if<br />

applicable, any Pro-Ration Factor; and<br />

- the aggregate principal amount of the Notes of each<br />

Series offered for sale by Holders and accepted by the<br />

Purchaser for purchase.<br />

Settlement Date<br />

Payment of Total Purchase Price and Accrued Amount<br />

Payment for Notes offered for sale by Holders and<br />

accepted by the Purchaser for purchase.<br />

On 2 August 2012<br />

The above times and dates are subject to the right of the Purchaser to extend, re-open, amend and/or<br />

terminate the Invitation (subject to applicable law and as provided in this Invitation for Offers in<br />

“Amendment and Termination”).<br />

Holders are advised to check with any broker, dealer, bank, custodian, trust, company, nominee or other<br />

intermediary through which they hold their Notes whether such intermediary needs to receive instructions<br />

from a Holder before the deadlines set out above in order for that Holder to be able to participate in or (in the<br />

limited circumstances in which revocation is permitted) revoke their instruction to participate in, the<br />

Invitation. The deadlines set by each Clearing System for the submission of Electronic Offer<br />

Instructions will be earlier than the deadlines above.<br />

Announcements in connection with the Invitation will be made, as applicable, (a) by publication on the<br />

website of the Luxembourg Stock Exchange and Irish Stock Exchange, (b) by the delivery of notices to the<br />

Clearing Systems for communication to Direct Participants, and/or (c) through the issue of a <strong>press</strong> <strong>release</strong> to<br />

a Notifying News Service, and may also be found on the relevant Reuters International Insider Screen.<br />

6

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Holders are invited to read carefully the Invitation for Offers for all the details and information on the<br />

procedures to participate in the Invitation for Offers.<br />

Banca IMI S.p.A., Goldman Sachs International, HSBC Bank plc, J.P. Morgan Securities plc and Société<br />

Générale are acting as Dealer Managers of the Invitation.<br />

Lucid Issuer Services Limited is acting as Tender Agent of the Invitation.<br />

DEALER MANAGERS<br />

Banca IMI S.p.A.<br />

Largo Mattioli, 3<br />

20121 Milan, Italy<br />

Attention: Debt Capital Markets<br />

Email: dcm.fig@bancaimi.com<br />

Tel: +39 02 7261 5362<br />

HSBC Bank plc<br />

8 Canada Square<br />

London E14 5HQ, United Kingdom<br />

Attention: Liability Management<br />

Email: liability.management@hsbcib.com<br />

Tel: +44 20 7992 6237<br />

Goldman Sachs International<br />

Peterborough Court<br />

133 Fleet Street<br />

London EC4A 2BB, United Kingdom<br />

Attention: Liability Management Team<br />

Email: liabilitymanagement.eu@gs.com<br />

Tel: +44 20 7774 4799<br />

J.P. Morgan Securities plc<br />

25 Bank Street<br />

Canary Wharf<br />

London E14 5JP, United Kingdom<br />

Attention: Liability Management<br />

Email: emea_lm@jpmorgan.com<br />

Tel: +44 20 7777 3548<br />

Société Générale<br />

41 Tower Hill<br />

London EC3N 4SG, United Kingdom<br />

Attention: Liability Management<br />

Email: liability.management@sgcib.com<br />

Tel: +44 20 7676 7579<br />

Tender Agent<br />

Lucid Issuer Services Limited<br />

Leroy House<br />

436 Essex Road<br />

London N1 3QP<br />

Attention: Sunjeeve Patel / David Shilson /<br />

Thomas Choquet / Paul Kamminga<br />

Tel: +44 (0) 20 7704 0880<br />

Email: <strong>intesa</strong>@lucid-is.com<br />

7

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

DISCLAIMER This <strong>announcement</strong> must be read in conjunction with the Invitation for Offers. This <strong>announcement</strong> and the Invitation<br />

for Offers contain important information which should be read carefully before any decision is made with respect to the Invitation. If<br />

you are in any doubt as to the contents of this <strong>announcement</strong> or the Invitation for Offers or the action you should take, you are<br />

recommended to seek your own financial and legal advice, including in respect of any tax consequences, immediately from your<br />

stockbroker, bank manager, solicitor, accountant or other independent financial or legal adviser. Any individual or company whose<br />

Notes are held on its behalf by a broker, dealer, bank, custodian, trust company or other nominee or intermediary must contact such<br />

entity if it wishes to offer for sale the Notes pursuant to the Invitation. None of the Dealer Managers, the Tender Agent or the<br />

Purchaser makes any recommendation as to whether Holders should offer Notes for sale pursuant to the Invitation.<br />

OFFER AND DISTRIBUTION RESTRICTIONS<br />

Neither this <strong>announcement</strong> nor the Invitation for Offers constitute an offer to buy or a solicitation of an offer to sell Notes in any<br />

jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such offer or solicitation under applicable<br />

securities laws or otherwise. The distribution of this <strong>announcement</strong> and the Invitation for Offers in certain jurisdictions (in particular,<br />

the United States, Italy, the United Kingdom, France and Belgium) may be restricted by law. Persons into whose possession this<br />

<strong>announcement</strong> or the Invitation for Offers comes are required by each of Dealer Managers, the Purchaser and the Tender Agent to<br />

inform themselves about, and to observe, any such restrictions.<br />

No action has been or will be taken in any jurisdiction in relation to the Invitation that would permit a public offering of securities.<br />

United States<br />

The Invitation is not being made, and will not be made, directly or indirectly in or into, or by use of the mail of, or by any means or<br />

instrumentality of interstate or foreign commerce of, or of any facilities of a national securities exchange of, the United States or to,<br />

for the account or benefit of, U.S. persons. This includes, but is not limited to, facsimile transmission, electronic mail, telex,<br />

telephone, the internet and other forms of electronic communication. Accordingly, copies of this <strong>announcement</strong>, the Invitation for<br />

Offers and any other documents or materials relating to the Invitation are not being, and must not be, directly or indirectly mailed or<br />

otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the<br />

United States or to U.S. persons, and the Notes cannot be offered for purchase in the Invitation by any such use, means,<br />

instrumentality or facilities or from within the United States or by U.S. persons. Any purported Offer of Notes resulting directly or<br />

indirectly from a violation of these restrictions will be invalid, and any purported Offer of Notes made by a U.S. person, a person<br />

located in the United States or any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving<br />

instructions from within the United States or for a U.S. person will be invalid and will not be accepted.<br />

Neither this <strong>announcement</strong> nor the Invitation for Offers is an offer of securities for sale in the United States or to U.S. persons. The<br />

Notes have not been, and will not be, registered under the Securities Act or the securities laws of any state or jurisdiction of the<br />

United States, and may not be offered, sold or delivered, directly or indirectly, in the United States or to, or for the account or benefit<br />

of U.S. persons. The purpose of this <strong>announcement</strong> and the Invitation for Offers is limited to the Invitation, and this <strong>announcement</strong><br />

and the Invitation for Offers may not be sent or given to any person other than in accordance with Regulation S under the Securities<br />

Act.<br />

Each Holder participating in the Invitation will represent that it is not located in the United States and is not participating in the<br />

Invitation from the United States, that it is participating in the Invitation in accordance with Regulation S under the Securities Act<br />

and that it is not a U.S. person or it is acting on a non-discretionary basis for a principal located outside the United States that is not<br />

giving an order to participate in the Invitation from the United States and is not a U.S. person.<br />

As used herein and elsewhere in this <strong>announcement</strong> and the Invitation for Offers, United States means United States of America, its<br />

territories and possessions, any state of the United States of America and the District of Columbia and "U.S. person" has the meaning<br />

given to such term in Regulation S under the Securities Act.<br />

Italy<br />

Neither this <strong>announcement</strong>, the Invitation for Offers nor any other documents or material relating to the Invitation have been or will<br />

be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (CONSOB), pursuant to applicable<br />

Italian laws and regulations.<br />

In Italy, the Invitation on each Series of Notes is being carried out as exempted offers pursuant to article 101-bis, paragraph 3-bis of<br />

Legislative Decree No. 58 of 24 February 1998, as amended and article 35-bis paragraph 4 of CONSOB Regulation No. 11971 of 14<br />

May 1999, as amended.<br />

Holders or beneficial owners of the Notes can submit offers to sell their Notes through authorised persons (such as investment firms,<br />

banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial<br />

Services Act, CONSOB Regulation No. 16190 of 29 October 2007, as amended from time to time, and Legislative Decree No. 385 of<br />

September 1, 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB<br />

or any other Italian authority.<br />

8

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in<br />

connection with the Notes or this <strong>announcement</strong> or the Invitation for Offers.<br />

United Kingdom<br />

The communication of this <strong>announcement</strong>, the Invitation for Offers and any other documents or materials relating to the Invitation is<br />

not being made and such documents and/or materials have not been approved by an authorised person for the purposes of section 21<br />

of the Financial Services and Markets Act 2000. Accordingly, such documents and/or materials are not being distributed to, and<br />

must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a<br />

financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment<br />

professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the<br />

Financial Promotion Order)) or persons who are within Article 43 of the Financial Promotion Order or any other persons to whom<br />

it may otherwise lawfully be made under the Financial Promotion Order.<br />

France<br />

The Invitation is not being made, directly or indirectly, to the public in the Republic of France (France). Neither this <strong>announcement</strong>,<br />

the Invitation for Offers nor any other document or material relating to the Invitation has been or shall be distributed to the public in<br />

France and only (a) providers of investment services relating to portfolio management for the account of third parties (personnes<br />

fournissant le service d'investissement de gestion de portefeuille pour compte de tiers) and/or (b) qualified investors (investisseurs<br />

qualifiés) other than individuals, in each case acting on their own account and all as defined in, and in accordance with, Articles<br />

L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code Monétaire et Financier are eligible to participate in the Invitation.<br />

This <strong>announcement</strong> and the Invitation for Offers have not been approved by, and will not be submitted for clearance to, the Autorité<br />

des Marchés Financiers.<br />

Belgium<br />

Neither this <strong>announcement</strong>, the Invitation for Offers nor any other documents or materials relating to the Invitation have been, or will<br />

be, submitted for approval or recognition to the Financial Services and Markets Authority (Autorité des Services et Marchés<br />

Financiers / Autoreit Financiele diensten en markten) and, accordingly, the Invitation may not be made in Belgium by way of a<br />

public offering, as defined in Article 3 of the Belgian law of 1 April 2007 on public takeover bids (Loi relative aux offers publiques<br />

d’acquisition / Wet op de openbare overnamebiedingen (the Law on Public Acquisition Offers)) or as defined in Article 3 of the<br />

Belgian Law of 16 June 2006 on the public offer of placement instruments and the admission to trading of placement instruments on<br />

regulated markets (Loi relative aux offres publiques d’instruments de placement et aux admissions d’instruments de placement à la<br />

négociation sur des marchés réglementés / Wet op de openbare aanbieding van beleggingsinstrumenten en de toelating van<br />

beleggingsinstrumenten tot de verhandeling op een gereglementeerde markt (the Law on Public Offerings)), each as amended or<br />

replaced from time to time. Accordingly, the Invitation may not be advertised, and the Invitation will not be extended, and neither<br />

this <strong>announcement</strong>, the Invitation for Offers nor any other documents or materials relating to the Invitation (including any<br />

memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or<br />

indirectly, to any person in Belgium other than "qualified investors" (as referred to in Article 10 of the Law on Public Offerings and<br />

Article 6 of the Law on Public Acquisition Offers), acting on their own account. Insofar as Belgium is concerned, this <strong>announcement</strong><br />

and the Invitation for Offers have been issued only for the personal use of the above qualified investors and exclusively for the<br />

purpose of the Invitation. Accordingly, the information contained in this <strong>announcement</strong> and the Invitation for Offers may not be used<br />

for any other purpose or disclosed to any other person in Belgium.<br />

General<br />

This <strong>announcement</strong> and the Invitation for Offers do not constitute an offer to sell or buy or the solicitation of an offer to sell or buy<br />

the Notes, and Offers in respect of Notes pursuant to the Invitation will not be accepted from Holders in any circumstances in which<br />

such offer or solicitation is unlawful. In those jurisdictions where the securities, blue sky or other laws require an Invitation to be<br />

made by a licensed broker or dealer and any of the Dealer Managers or any of their respective affiliates is such a licensed broker or<br />

dealer in any such jurisdiction, the Invitation shall be deemed to be made on behalf of the Purchaser by such Dealer Manager or<br />

affiliate (as the case may be) in such jurisdiction.<br />

Investor Relations<br />

Media Relations<br />

+39.02.87943180 +39.02.87963531<br />

investor.relations@<strong>intesa</strong>sanpaolo.com<br />

stampa@<strong>intesa</strong>sanpaolo.com<br />

group.<strong>intesa</strong>sanpaolo.com<br />

9