press release buyback announcement intesa ... - InvestireOggi

press release buyback announcement intesa ... - InvestireOggi

press release buyback announcement intesa ... - InvestireOggi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

PRESS RELEASE<br />

BUYBACK ANNOUNCEMENT<br />

INTESA SANPAOLO ANNOUNCES AN INVITATION TO HOLDERS OF<br />

SUBORDINATED NOTES AND SENIOR NOTES TO SUBMIT OFFERS<br />

TO SELL THEIR NOTES TO INTESA SANPAOLO<br />

Milan, Turin, July 18 th 2012 – Intesa Sanpaolo S.p.A. (“Intesa Sanpaolo” or the “Purchaser”) announced<br />

today an invitation to holders (the “Holders”) of the following Subordinated Notes and Senior Notes issued<br />

(or guaranteed) by Intesa Sanpaolo (together, the “Notes”) to submit offers to sell their Notes to the<br />

Purchaser for cash at the Purchase Price (the “Invitation”).<br />

The Invitation will enable Intesa Sanpaolo to optimise the composition of its regulatory capital through the<br />

increase in its Core Tier 1 capital as a result of the capital gain arising from the purchase of Notes tendered<br />

at prices below par. Furthermore the Invitation gives the Holders the possibility to realise their investments<br />

in the Notes at prices higher than the prevailing market prices during the period prior to <strong>announcement</strong> of<br />

the Invitation.<br />

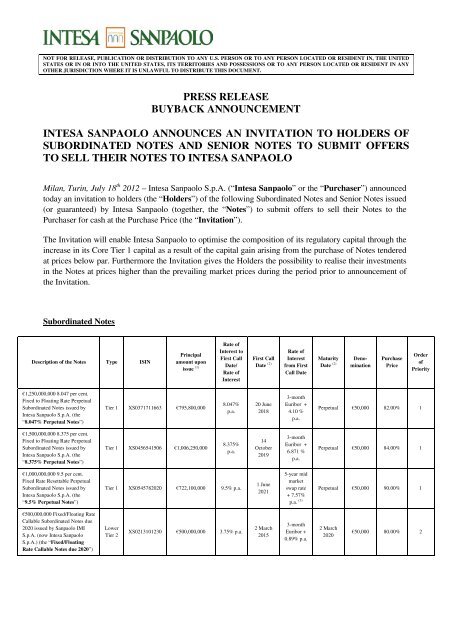

Subordinated Notes<br />

Description of the Notes Type ISIN<br />

Principal<br />

amount upon<br />

issue (1)<br />

Rate of<br />

Interest to<br />

First Call<br />

Date/<br />

Rate of<br />

Interest<br />

First Call<br />

Date (2)<br />

Rate of<br />

Interest<br />

from First<br />

Call Date<br />

Maturity<br />

Date (2)<br />

Denomination<br />

Purchase<br />

Price<br />

Order<br />

of<br />

Priority<br />

€1,250,000,000 8.047 per cent.<br />

Fixed to Floating Rate Perpetual<br />

Subordinated Notes issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“8.047% Perpetual Notes”)<br />

Tier 1 XS0371711663 €795,800,000<br />

8.047%<br />

p.a.<br />

20 June<br />

2018<br />

3-month<br />

Euribor +<br />

4.10 %<br />

p.a.<br />

Perpetual €50,000 82.00% 1<br />

€1,500,000,000 8.375 per cent.<br />

Fixed to Floating Rate Perpetual<br />

Subordinated Notes issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“8.375% Perpetual Notes”)<br />

Tier 1 XS0456541506 €1,006,250,000<br />

8.375%<br />

p.a.<br />

14<br />

October<br />

2019<br />

3-month<br />

Euribor +<br />

6.871 %<br />

p.a.<br />

Perpetual €50,000 84.00% 1<br />

€1,000,000,000 9.5 per cent.<br />

Fixed Rate Resettable Perpetual<br />

Subordinated Notes issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“9.5% Perpetual Notes”)<br />

Tier 1 XS0545782020 €722,100,000 9.5% p.a.<br />

1 June<br />

2021<br />

5-year mid<br />

market<br />

swap rate<br />

+ 7.57%<br />

p.a. (3) Perpetual €50,000 90.00% 1<br />

€500,000,000 Fixed/Floating Rate<br />

Callable Subordinated Notes due<br />

2020 issued by Sanpaolo IMI<br />

S.p.A. (now Intesa Sanpaolo<br />

S.p.A.) (the “Fixed/Floating<br />

Rate Callable Notes due 2020”)<br />

Lower<br />

Tier 2<br />

XS0213101230 €500,000,000 3.75% p.a.<br />

2 March<br />

2015<br />

3-month<br />

Euribor +<br />

0.89% p.a.<br />

2 March<br />

2020<br />

€50,000 80.00% 2

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

£165,000,000 Lower Tier II Fix<br />

Floater Callable Subordinated<br />

Notes due 2024 issued by<br />

Sanpaolo IMI S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “Fix<br />

Floater Callable Notes due<br />

2024”)<br />

Lower<br />

Tier 2<br />

XS0188046543 £165,000,000<br />

5.625%<br />

p.a.<br />

18 March<br />

2019<br />

3-month<br />

Sterling<br />

Libor +<br />

1.125%<br />

p.a.<br />

18 March<br />

2024<br />

£1,000 84.00% 2<br />

€1,500,000,000 5.00 per cent.<br />

Lower Tier II Subordinated Notes<br />

due 2019 issued by Intesa<br />

Sanpaolo S.p.A. (the “5.00%<br />

Notes due 2019”)<br />

Lower<br />

Tier 2<br />

XS0452166324 €1,500,000,000 5.00% p.a. n.a. n.a.<br />

23<br />

September<br />

2019<br />

€50,000 93.00% 2<br />

€1,250,000,000 5.15 per cent.<br />

Lower Tier II Subordinated Notes<br />

due 16 July 2020 issued by Intesa<br />

Sanpaolo S.p.A. (the “5.15%<br />

Notes due 2020”)<br />

Lower<br />

Tier 2<br />

XS0526326334 €1,250,000,000 5.15% p.a. n.a. n.a.<br />

16 July<br />

2020<br />

€50,000 92.50% 2<br />

€1,250,000,000 6.625 per cent.<br />

Upper Tier II Subordinated Notes<br />

due 2018 issued by Intesa<br />

Sanpaolo S.p.A. (the “6.625%<br />

Notes due 2018”)<br />

Upper<br />

Tier 2 XS0360809577 €1,250,000,000<br />

6.625%<br />

p.a.<br />

n.a.<br />

n.a.<br />

8 May<br />

2018<br />

€50,000 98.50% 2<br />

£250,000,000 Lower Tier II<br />

Subordinated Fixed to Floating<br />

Rate Notes due November 2017<br />

issued by Intesa Sanpaolo S.p.A.<br />

(the “Fixed to Floating Rate<br />

Notes due 2017”)<br />

Lower<br />

Tier 2<br />

XS0324790657 £250,000,000<br />

6.375%<br />

p.a.<br />

12<br />

November<br />

2012<br />

3-month<br />

Sterling<br />

Libor +<br />

1.35% p.a<br />

12<br />

November<br />

2017<br />

£50,000 96.50% 3<br />

€750,000,000 Floating Rate<br />

Subordinated Notes due 2018<br />

issued by Sanpaolo IMI S.p.A.<br />

(now Intesa Sanpaolo S.p.A.) (the<br />

“Floating Rate Notes due 2018”)<br />

Lower<br />

Tier 2<br />

XS0243399556 €750,000,000<br />

3-month<br />

Euribor +<br />

0.25% p.a.<br />

20<br />

February<br />

2013<br />

3-month<br />

Euribor +<br />

0.85% p.a.<br />

20<br />

February<br />

2018<br />

€50,000 (4) 86.00% 3<br />

€1,000,000,000 Lower Tier II<br />

Subordinated Fixed to Floating<br />

Rate Notes due 2018 issued by<br />

Intesa Sanpaolo S.p.A. (the<br />

“Fixed to Floating Rate Notes<br />

due 2018”)<br />

Lower<br />

Tier 2<br />

XS0365303675 €1,000,000,000 5.75% p.a<br />

28 May<br />

2013<br />

3-month<br />

Euribor +<br />

1.98% p.a.<br />

28 May<br />

2018<br />

€50,000 91.50% 3<br />

€500,000,000 Fixed/Floating Rate<br />

Callable Lower Tier II<br />

Subordinated Notes due 2018<br />

issued by Sanpaolo IMI S.p.A.<br />

(now Intesa Sanpaolo S.p.A.) (the<br />

“Fixed/Floating Rate Callable<br />

Notes due 2018”)<br />

Lower<br />

Tier 2<br />

XS0258143477 €500,000,000<br />

4.375%<br />

p.a.<br />

26 June<br />

2013<br />

3-month<br />

Euribor +<br />

1.00% p.a.<br />

26 June<br />

2018<br />

€50,000 86.50% 3<br />

(1) In the case of the Tier 1 Notes only, represents their principal amount upon issue less such Tier 1 Notes purchased and in case cancelled pursuant to<br />

their terms and conditions in the context of the cash tender offer carried out by the Purchaser in February 2012. To the best of its knowledge, the<br />

Purchaser and its subsidiary Banca IMI S.p.A. beneficially owned, as of 17 July 2012, approximately €284,050,000 (equivalent) in aggregate<br />

principal amount of Subordinated Notes.<br />

(2) Subject to business day adjustment, in accordance with the terms and conditions of the relevant Notes.<br />

(3) Commencing on 1 June 2016, interest rate reset every five years to 5-year mid market swap rate + 7.57% p.a..<br />

(4) For so long as the Notes are represented by a Global Note, the Notes shall be tradable in minimum nominal amounts of €50,000 and integral multiples<br />

of €1,000 in addition thereto.<br />

2

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Senior Notes<br />

Description of the Notes<br />

ISIN<br />

Principal<br />

amount upon<br />

issue (1)<br />

Rate of<br />

Interest<br />

Maturity<br />

Date (2)<br />

Denomination<br />

Purchase<br />

Price<br />

Order<br />

of<br />

Priority<br />

€1,250,000,000 Floating Rate Notes due 2013<br />

issued by Sanpaolo IMI S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “FRNs due March<br />

2013)<br />

XS0246688435 €1,250,000,000<br />

3-month<br />

Euribor +<br />

0.10% p.a.<br />

15 March<br />

2013<br />

€50,000 (3) 98.45% 1<br />

€1,000,000,000 Floating Rate Notes due 2013<br />

issued by Banca Intesa S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “FRNs due April<br />

2013”)<br />

XS0249278655 €1,000,000,000<br />

3-month<br />

Euribor +<br />

0.175% p.a.<br />

11 April<br />

2013<br />

€50,000 98.30% 1<br />

€1,500,000,000 4.000 per cent. Senior Notes<br />

due 8 August 2013 issued by Intesa Sanpaolo<br />

Bank Ireland Plc and guaranteed by Intesa<br />

Sanpaolo S.p.A. (the “4.000% Notes due<br />

2013”)<br />

XS0742590739 €1,500,000,000 4.000% p.a.<br />

8 August<br />

2013<br />

€100,000 100.35% 1<br />

€800,000,000 3.5 per cent. Senior Notes due<br />

27 November 2013 issued by Intesa Sanpaolo<br />

S.p.A. (the “3.5% Notes due 2013”)<br />

XS0630360997 €800,000,000 3.5% p.a.<br />

27<br />

November<br />

2013<br />

€100,000 99.75% 1<br />

€1,250,000,000 5.375 per cent. Notes due<br />

2013 issued by Intesa Sanpaolo S.p.A. (the<br />

“5.375% Notes due 2013”)<br />

XS0405713883 €1,250,000,000 5.375% p.a.<br />

19<br />

December<br />

2013<br />

€50,000 102.25% 1<br />

€1,000,000,000 Floating Rate Notes due 2014<br />

issued by Intesa Sanpaolo S.p.A. (the “FRNs<br />

due 2014”)<br />

XS0291639440 €1,000,000,000<br />

3-month<br />

Euribor +<br />

0.12% p.a.<br />

19 March<br />

2014<br />

€50,000 94.50% 1<br />

€2,000,000,000 Floating Rate Notes due May<br />

2014 issued by Intesa Sanpaolo S.p.A. (the<br />

“FRNs due May 2014”)<br />

XS0624833421 €2,000,000,000<br />

3-month<br />

Euribor +<br />

1.10% p.a.<br />

12 May<br />

2014<br />

€100,000 94.45% 1<br />

€1,100,000,000 Floating Rate Notes due<br />

October 2014 issued by Banca Intesa S.p.A.<br />

(now Intesa Sanpaolo S.p.A.) (the “FRNs due<br />

October 2014”)<br />

XS0201271045 €1,100,000,000<br />

3-month<br />

Euribor +<br />

0.20% p.a.<br />

1 October<br />

2014<br />

€1,000 92.45% 1<br />

€1,000,000,000 3.375 per cent. Notes due 19<br />

January 2015 issued by Intesa Sanpaolo<br />

S.p.A. (the 3.375% Notes due 2015)<br />

XS0478285389 €1,000,000,000 3.375% p.a.<br />

19 January<br />

2015<br />

€50,000 97.10% 1<br />

€650,000,000 3.875% Notes due 2015 issued<br />

by Banca Intesa S.p.A. (now Intesa Sanpaolo<br />

S.p.A.) (the “3.875% Notes due 2015”)<br />

XS0215743252 €650,000,000 3.875% p.a.<br />

1 April<br />

2015<br />

€50,000 97.85% 1<br />

€500,000,000 Floating Rate Notes due 2015<br />

issued by Banca Intesa S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the FRNs due 2015)<br />

XS0233436731 €500,000,000<br />

3-month<br />

Euribor +<br />

0.175% p.a.<br />

27<br />

October<br />

2015<br />

€50,000 86.65% 2<br />

€1,200,000,000 4.125 per cent. Senior Notes<br />

due 14 January 2016 issued by Intesa<br />

Sanpaolo S.p.A. (the “4.125% Notes due<br />

2016”)<br />

XS0577347528 €1,200,000,000 4.125% p.a.<br />

14 January<br />

2016<br />

€100,000 97.30% 2<br />

€1,500,000,000 3.75 per cent. Notes due 23<br />

November 2016 issued by Intesa Sanpaolo<br />

S.p.A. (the “3.75% Notes due 2016”)<br />

XS0467864160 €1,500,000,000 3.75% p.a.<br />

23<br />

November<br />

2016<br />

€50,000 94.60% 2<br />

3

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

€750,000,000 Floating Rate Notes due 2016<br />

issued by Banca Intesa S.p.A. (now Intesa<br />

Sanpaolo S.p.A.) (the “FRNs due 2016”)<br />

XS0278803712 €750,000,000<br />

3-month<br />

Euribor +<br />

0.175% p.a.<br />

20<br />

December<br />

2016<br />

€50,000 82.40% 2<br />

€1,000,000,000 5.000 per cent. Senior Notes<br />

due 28 February 2017 issued by Intesa<br />

Sanpaolo S.p.A. (the “5.000% Notes due<br />

2017”)<br />

XS0750763806 €1,000,000,000 5.000% p.a.<br />

28<br />

February<br />

2017<br />

€100,000 98.95% 2<br />

€1,250,000,000 Floating Rate Notes due 2017<br />

issued by Intesa Sanpaolo S.p.A. (the “FRNs<br />

due 2017”)<br />

XS0300196879 €1,250,000,000<br />

3-month<br />

Euribor +<br />

0.15% p.a.<br />

18 May<br />

2017<br />

€50,000 80.50% 2<br />

€1,450,000,000 4.75 per cent. Notes due 2017<br />

issued by Intesa Sanpaolo S.p.A. (the “4.75%<br />

Notes due 2017”)<br />

XS0304508921 €1,450,000,000 4.75% p.a.<br />

15 June<br />

2017<br />

€50,000 97.70% 2<br />

€1,500,000,000 4.00 per cent. Senior Notes<br />

due 8 November 2018 issued by Intesa<br />

Sanpaolo S.p.A. (the “4.00% Notes due<br />

2018”)<br />

XS0555977312 €1,500,000,000 4.00 % p.a.<br />

8<br />

November<br />

2018<br />

€100,000 91.60% 2<br />

€1,500,000,000 4.125 per cent. Notes due 14<br />

April 2020 issued by Intesa Sanpaolo S.p.A.<br />

(the “4.125% Notes due 2020”)<br />

XS0500187843 €1,500,000,000 4.125 % p.a.<br />

14 April<br />

2020<br />

€50,000 89.10% 2<br />

£350,000,000 5.25 per cent. Notes due 28<br />

January 2022 issued by Intesa Sanpaolo<br />

S.p.A. (the “5.25% Notes due 2022”)<br />

XS0481342896 £350,000,000 5.25% p.a.<br />

28 January<br />

2022<br />

£50,000 84.65% 2<br />

(1) To the best of its knowledge, the Purchaser and its subsidiary Banca IMI S.p.A. beneficially owned, as of 17 July 2012, approximately €957,715,385<br />

(equivalent) in aggregate principal amount of Senior Notes.<br />

(2) Subject to business day adjustment, in accordance with the terms and conditions of the relevant Notes.<br />

(3) And integral multiples of €1,000 in addition thereto.<br />

The Invitation – already approved by the Bank of Italy in respect of the repurchase of the Subordinated<br />

Notes – is carried out in Italy as an exempt offer pursuant to article 101-bis, paragraph 3-bis, of Legislative<br />

Decree No. 58 of 24 February 1998, as amended and supplemented, and article 35-bis, paragraph 4 of<br />

CONSOB Regulation No. 11971 of 14 May 1999, as amended and supplemented.<br />

The terms and conditions of the Invitation are indicated in the invitation for offers dated 18 July 2012 (the<br />

“Invitation for Offers”). Copies of the Invitation for Offers are available from the Tender Agent whose<br />

contact details are indicated below.<br />

Summary details of the Invitation are set forth below.<br />

4

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Purchase Price and Accrued Amount<br />

The price to be paid by the Purchaser to each Holder who validly submits an offer to sell its Notes<br />

pursuant to the Invitation and whose Offer is – subject to application of the relevant Order of Priority and<br />

scaling of the Offers, if applicable - accepted by the Purchaser (such amount, in respect of each Series of<br />

Notes, the “Purchase Price”) is set out in the tables above.<br />

In addition, Holders whose Notes are accepted for purchase will receive, on the Settlement Date, an<br />

amount in cash equal to the accrued interest in respect of such Notes from (and including) the interest<br />

payment date immediately preceding the Settlement Date of the Invitation to (but excluding) the<br />

Settlement Date of the Invitation.<br />

Final Acceptance Amount, Order of Priority and scaling of Offers<br />

The Purchaser currently proposes to accept to purchase pursuant to the Invitation:<br />

- up to an amount to be determined taking into account the Purchase Price of the Subordinated Notes of<br />

each relevant Series, such that the Total Purchase Price to be paid by the Purchaser for all Subordinated<br />

Notes accepted for purchase by the Purchaser shall not exceed €1,000,000,000 (calculated using the<br />

Sterling equivalent, as applicable) (the final aggregate principal amount of all Subordinated Notes<br />

accepted for purchase pursuant to the Invitation being the “Subordinated Notes Final Acceptance<br />

Amount”); and<br />

- up to an amount to be determined taking into account the Purchase Price of the Senior Notes of each<br />

relevant Series, such that the Total Purchase Price to be paid by the Purchaser for all Senior Notes<br />

accepted for purchase by the Purchaser shall not exceed the sum of (a) €500,000,000 and (b) the<br />

Adjustment Amount(as defined below), if any (calculated using the Sterling equivalent, as applicable)<br />

(the final aggregate principal amount of all Senior Notes accepted for purchase pursuant to the Invitation<br />

being the “Senior Notes Final Acceptance Amount”).<br />

In the event that the Total Purchase Price for all Subordinated Notes validly offered pursuant to the Invitation<br />

and accepted for purchase by the Purchaser is less than €1,000,000,000, the Purchaser may, in its discretion,<br />

determine to allocate such difference towards accepting to purchase Senior Notes validly offered pursuant to<br />

the Invitation (the amount so allocated is referred to herein as the “Adjustment Amount”).<br />

In the event that valid Offers are received in respect of an aggregate principal amount of all Subordinated<br />

Notes or, as applicable, Senior Notes, that is greater than the Subordinated Notes Final Acceptance Amount<br />

or the Senior Notes Final Acceptance Amount, as applicable, the Purchaser will accept such valid Offers in<br />

the order of priority indicated in the tables above, subject to allocation of the Subordinated Notes Final<br />

Acceptance Amount between each Series of Subordinated Notes and the Senior Notes Final Acceptance<br />

Amount between each Series of Senior Notes, in each case, that rank equally in the applicable Order of<br />

Priority at the Purchaser’s discretion and the scaling of Offers (if any), all in the manner described in the<br />

section “Invitation – Final Acceptance Amount, Order of Priority and scaling of Offers” of the Invitation for<br />

Offers. The Purchaser reserves the right to accept significantly more or less (or none) of Subordinated Notes<br />

or, as applicable, Senior Notes of a Series, as compared to the other Series of Subordinated Notes or, as<br />

applicable, Senior Notes that rank equally in the applicable Order of Priority.<br />

Offer Instructions<br />

In order to offer to sell its Notes to the Purchaser pursuant to the Invitation, each Holder must validly<br />

submit an offer to sell its Notes by delivering, or arrange to have delivered on its behalf, a valid Electronic<br />

Offer Instruction to the Tender Agent before the Invitation Expiration indicated below.<br />

Electronic Offer Instructions will be irrevocable, save in the limited circumstances where revocation is<br />

permitted as indicated in the Invitation for Offers.<br />

5

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Expected Timetable of the Invitation<br />

Event<br />

Commencement of the Invitation Period<br />

Copies of the Invitation for Offers are available to Holders<br />

from the Tender Agent, subject to invitation and<br />

distribution restrictions and notice of the Invitation<br />

published through Euroclear and Clearstream.<br />

Expected Dates and Times<br />

(All times are CET)<br />

On 18 July 2012<br />

Invitation Expiration<br />

Deadline for receipt of all Electronic Offer Instructions.<br />

5.00 p.m. on 26 July 2012<br />

End of Invitation Period.<br />

FX Rate fixed by Dealer Managers from Bloomberg<br />

Screen FXC.<br />

At or around 5.00 p.m. on 26 July 2012<br />

Announcement of Invitation Results<br />

Announcement by the Purchaser of:<br />

On 27 July 2012<br />

- the FX Rate;<br />

- the Subordinated Notes Final Acceptance Amount, the<br />

Senior Notes Final Acceptance Amount and, if<br />

applicable, any Pro-Ration Factor; and<br />

- the aggregate principal amount of the Notes of each<br />

Series offered for sale by Holders and accepted by the<br />

Purchaser for purchase.<br />

Settlement Date<br />

Payment of Total Purchase Price and Accrued Amount<br />

Payment for Notes offered for sale by Holders and<br />

accepted by the Purchaser for purchase.<br />

On 2 August 2012<br />

The above times and dates are subject to the right of the Purchaser to extend, re-open, amend and/or<br />

terminate the Invitation (subject to applicable law and as provided in this Invitation for Offers in<br />

“Amendment and Termination”).<br />

Holders are advised to check with any broker, dealer, bank, custodian, trust, company, nominee or other<br />

intermediary through which they hold their Notes whether such intermediary needs to receive instructions<br />

from a Holder before the deadlines set out above in order for that Holder to be able to participate in or (in the<br />

limited circumstances in which revocation is permitted) revoke their instruction to participate in, the<br />

Invitation. The deadlines set by each Clearing System for the submission of Electronic Offer<br />

Instructions will be earlier than the deadlines above.<br />

Announcements in connection with the Invitation will be made, as applicable, (a) by publication on the<br />

website of the Luxembourg Stock Exchange and Irish Stock Exchange, (b) by the delivery of notices to the<br />

Clearing Systems for communication to Direct Participants, and/or (c) through the issue of a <strong>press</strong> <strong>release</strong> to<br />

a Notifying News Service, and may also be found on the relevant Reuters International Insider Screen.<br />

6

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Holders are invited to read carefully the Invitation for Offers for all the details and information on the<br />

procedures to participate in the Invitation for Offers.<br />

Banca IMI S.p.A., Goldman Sachs International, HSBC Bank plc, J.P. Morgan Securities plc and Société<br />

Générale are acting as Dealer Managers of the Invitation.<br />

Lucid Issuer Services Limited is acting as Tender Agent of the Invitation.<br />

DEALER MANAGERS<br />

Banca IMI S.p.A.<br />

Largo Mattioli, 3<br />

20121 Milan, Italy<br />

Attention: Debt Capital Markets<br />

Email: dcm.fig@bancaimi.com<br />

Tel: +39 02 7261 5362<br />

HSBC Bank plc<br />

8 Canada Square<br />

London E14 5HQ, United Kingdom<br />

Attention: Liability Management<br />

Email: liability.management@hsbcib.com<br />

Tel: +44 20 7992 6237<br />

Goldman Sachs International<br />

Peterborough Court<br />

133 Fleet Street<br />

London EC4A 2BB, United Kingdom<br />

Attention: Liability Management Team<br />

Email: liabilitymanagement.eu@gs.com<br />

Tel: +44 20 7774 4799<br />

J.P. Morgan Securities plc<br />

25 Bank Street<br />

Canary Wharf<br />

London E14 5JP, United Kingdom<br />

Attention: Liability Management<br />

Email: emea_lm@jpmorgan.com<br />

Tel: +44 20 7777 3548<br />

Société Générale<br />

41 Tower Hill<br />

London EC3N 4SG, United Kingdom<br />

Attention: Liability Management<br />

Email: liability.management@sgcib.com<br />

Tel: +44 20 7676 7579<br />

Tender Agent<br />

Lucid Issuer Services Limited<br />

Leroy House<br />

436 Essex Road<br />

London N1 3QP<br />

Attention: Sunjeeve Patel / David Shilson /<br />

Thomas Choquet / Paul Kamminga<br />

Tel: +44 (0) 20 7704 0880<br />

Email: <strong>intesa</strong>@lucid-is.com<br />

7

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

DISCLAIMER This <strong>announcement</strong> must be read in conjunction with the Invitation for Offers. This <strong>announcement</strong> and the Invitation<br />

for Offers contain important information which should be read carefully before any decision is made with respect to the Invitation. If<br />

you are in any doubt as to the contents of this <strong>announcement</strong> or the Invitation for Offers or the action you should take, you are<br />

recommended to seek your own financial and legal advice, including in respect of any tax consequences, immediately from your<br />

stockbroker, bank manager, solicitor, accountant or other independent financial or legal adviser. Any individual or company whose<br />

Notes are held on its behalf by a broker, dealer, bank, custodian, trust company or other nominee or intermediary must contact such<br />

entity if it wishes to offer for sale the Notes pursuant to the Invitation. None of the Dealer Managers, the Tender Agent or the<br />

Purchaser makes any recommendation as to whether Holders should offer Notes for sale pursuant to the Invitation.<br />

OFFER AND DISTRIBUTION RESTRICTIONS<br />

Neither this <strong>announcement</strong> nor the Invitation for Offers constitute an offer to buy or a solicitation of an offer to sell Notes in any<br />

jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such offer or solicitation under applicable<br />

securities laws or otherwise. The distribution of this <strong>announcement</strong> and the Invitation for Offers in certain jurisdictions (in particular,<br />

the United States, Italy, the United Kingdom, France and Belgium) may be restricted by law. Persons into whose possession this<br />

<strong>announcement</strong> or the Invitation for Offers comes are required by each of Dealer Managers, the Purchaser and the Tender Agent to<br />

inform themselves about, and to observe, any such restrictions.<br />

No action has been or will be taken in any jurisdiction in relation to the Invitation that would permit a public offering of securities.<br />

United States<br />

The Invitation is not being made, and will not be made, directly or indirectly in or into, or by use of the mail of, or by any means or<br />

instrumentality of interstate or foreign commerce of, or of any facilities of a national securities exchange of, the United States or to,<br />

for the account or benefit of, U.S. persons. This includes, but is not limited to, facsimile transmission, electronic mail, telex,<br />

telephone, the internet and other forms of electronic communication. Accordingly, copies of this <strong>announcement</strong>, the Invitation for<br />

Offers and any other documents or materials relating to the Invitation are not being, and must not be, directly or indirectly mailed or<br />

otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the<br />

United States or to U.S. persons, and the Notes cannot be offered for purchase in the Invitation by any such use, means,<br />

instrumentality or facilities or from within the United States or by U.S. persons. Any purported Offer of Notes resulting directly or<br />

indirectly from a violation of these restrictions will be invalid, and any purported Offer of Notes made by a U.S. person, a person<br />

located in the United States or any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving<br />

instructions from within the United States or for a U.S. person will be invalid and will not be accepted.<br />

Neither this <strong>announcement</strong> nor the Invitation for Offers is an offer of securities for sale in the United States or to U.S. persons. The<br />

Notes have not been, and will not be, registered under the Securities Act or the securities laws of any state or jurisdiction of the<br />

United States, and may not be offered, sold or delivered, directly or indirectly, in the United States or to, or for the account or benefit<br />

of U.S. persons. The purpose of this <strong>announcement</strong> and the Invitation for Offers is limited to the Invitation, and this <strong>announcement</strong><br />

and the Invitation for Offers may not be sent or given to any person other than in accordance with Regulation S under the Securities<br />

Act.<br />

Each Holder participating in the Invitation will represent that it is not located in the United States and is not participating in the<br />

Invitation from the United States, that it is participating in the Invitation in accordance with Regulation S under the Securities Act<br />

and that it is not a U.S. person or it is acting on a non-discretionary basis for a principal located outside the United States that is not<br />

giving an order to participate in the Invitation from the United States and is not a U.S. person.<br />

As used herein and elsewhere in this <strong>announcement</strong> and the Invitation for Offers, United States means United States of America, its<br />

territories and possessions, any state of the United States of America and the District of Columbia and "U.S. person" has the meaning<br />

given to such term in Regulation S under the Securities Act.<br />

Italy<br />

Neither this <strong>announcement</strong>, the Invitation for Offers nor any other documents or material relating to the Invitation have been or will<br />

be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (CONSOB), pursuant to applicable<br />

Italian laws and regulations.<br />

In Italy, the Invitation on each Series of Notes is being carried out as exempted offers pursuant to article 101-bis, paragraph 3-bis of<br />

Legislative Decree No. 58 of 24 February 1998, as amended and article 35-bis paragraph 4 of CONSOB Regulation No. 11971 of 14<br />

May 1999, as amended.<br />

Holders or beneficial owners of the Notes can submit offers to sell their Notes through authorised persons (such as investment firms,<br />

banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial<br />

Services Act, CONSOB Regulation No. 16190 of 29 October 2007, as amended from time to time, and Legislative Decree No. 385 of<br />

September 1, 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB<br />

or any other Italian authority.<br />

8

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON LOCATED OR RESIDENT IN, THE UNITED<br />

STATES OR IN OR INTO THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS OR TO ANY PERSON LOCATED OR RESIDENT IN ANY<br />

OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.<br />

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in<br />

connection with the Notes or this <strong>announcement</strong> or the Invitation for Offers.<br />

United Kingdom<br />

The communication of this <strong>announcement</strong>, the Invitation for Offers and any other documents or materials relating to the Invitation is<br />

not being made and such documents and/or materials have not been approved by an authorised person for the purposes of section 21<br />

of the Financial Services and Markets Act 2000. Accordingly, such documents and/or materials are not being distributed to, and<br />

must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a<br />

financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment<br />

professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the<br />

Financial Promotion Order)) or persons who are within Article 43 of the Financial Promotion Order or any other persons to whom<br />

it may otherwise lawfully be made under the Financial Promotion Order.<br />

France<br />

The Invitation is not being made, directly or indirectly, to the public in the Republic of France (France). Neither this <strong>announcement</strong>,<br />

the Invitation for Offers nor any other document or material relating to the Invitation has been or shall be distributed to the public in<br />

France and only (a) providers of investment services relating to portfolio management for the account of third parties (personnes<br />

fournissant le service d'investissement de gestion de portefeuille pour compte de tiers) and/or (b) qualified investors (investisseurs<br />

qualifiés) other than individuals, in each case acting on their own account and all as defined in, and in accordance with, Articles<br />

L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code Monétaire et Financier are eligible to participate in the Invitation.<br />

This <strong>announcement</strong> and the Invitation for Offers have not been approved by, and will not be submitted for clearance to, the Autorité<br />

des Marchés Financiers.<br />

Belgium<br />

Neither this <strong>announcement</strong>, the Invitation for Offers nor any other documents or materials relating to the Invitation have been, or will<br />

be, submitted for approval or recognition to the Financial Services and Markets Authority (Autorité des Services et Marchés<br />

Financiers / Autoreit Financiele diensten en markten) and, accordingly, the Invitation may not be made in Belgium by way of a<br />

public offering, as defined in Article 3 of the Belgian law of 1 April 2007 on public takeover bids (Loi relative aux offers publiques<br />

d’acquisition / Wet op de openbare overnamebiedingen (the Law on Public Acquisition Offers)) or as defined in Article 3 of the<br />

Belgian Law of 16 June 2006 on the public offer of placement instruments and the admission to trading of placement instruments on<br />

regulated markets (Loi relative aux offres publiques d’instruments de placement et aux admissions d’instruments de placement à la<br />

négociation sur des marchés réglementés / Wet op de openbare aanbieding van beleggingsinstrumenten en de toelating van<br />

beleggingsinstrumenten tot de verhandeling op een gereglementeerde markt (the Law on Public Offerings)), each as amended or<br />

replaced from time to time. Accordingly, the Invitation may not be advertised, and the Invitation will not be extended, and neither<br />

this <strong>announcement</strong>, the Invitation for Offers nor any other documents or materials relating to the Invitation (including any<br />

memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or<br />

indirectly, to any person in Belgium other than "qualified investors" (as referred to in Article 10 of the Law on Public Offerings and<br />

Article 6 of the Law on Public Acquisition Offers), acting on their own account. Insofar as Belgium is concerned, this <strong>announcement</strong><br />

and the Invitation for Offers have been issued only for the personal use of the above qualified investors and exclusively for the<br />

purpose of the Invitation. Accordingly, the information contained in this <strong>announcement</strong> and the Invitation for Offers may not be used<br />

for any other purpose or disclosed to any other person in Belgium.<br />

General<br />

This <strong>announcement</strong> and the Invitation for Offers do not constitute an offer to sell or buy or the solicitation of an offer to sell or buy<br />

the Notes, and Offers in respect of Notes pursuant to the Invitation will not be accepted from Holders in any circumstances in which<br />

such offer or solicitation is unlawful. In those jurisdictions where the securities, blue sky or other laws require an Invitation to be<br />

made by a licensed broker or dealer and any of the Dealer Managers or any of their respective affiliates is such a licensed broker or<br />

dealer in any such jurisdiction, the Invitation shall be deemed to be made on behalf of the Purchaser by such Dealer Manager or<br />

affiliate (as the case may be) in such jurisdiction.<br />

Investor Relations<br />

Media Relations<br />

+39.02.87943180 +39.02.87963531<br />

investor.relations@<strong>intesa</strong>sanpaolo.com<br />

stampa@<strong>intesa</strong>sanpaolo.com<br />

group.<strong>intesa</strong>sanpaolo.com<br />

9