Spring - InsideOutdoor Magazine

Spring - InsideOutdoor Magazine

Spring - InsideOutdoor Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Back Office<br />

On the Records<br />

Remaining safely behind the corporate veil<br />

by Phil Josephson<br />

Corporation: An ingenious device for obtaining profit without<br />

individual responsibility. ~Ambrose Bierce<br />

PCV Equipment LLC and its members are sued for breach of<br />

a distribution agreement, and the court finds against PCV and its<br />

members. Outdoor Advanced Company fails to get the capital<br />

infusion it desperately needed. U.S. Outfitters & Marine Corp.<br />

comes out on the wrong end of an Internal Revenue Service<br />

audit, and the company and its shareholders have to restate<br />

financials and pay penalties. The planned acquisition of HighKing<br />

Systems is postponed, and the acquisition price is reduced.<br />

What do all of these entities and scenarios have in common?<br />

In each case, the entities and their shareholders/members<br />

failed to follow corporate formalities and failed to keep proper<br />

and thorough corporate records.<br />

Business owners choose to get into business and choose<br />

an entity form that suits their situation. The primary concern to<br />

the business owners in choosing the entity form is typically the<br />

protection from risks that a growing business may face. The key<br />

to this protection, however, is in maintaining the independent<br />

existence of that entity going forward. Failure to treat the entity<br />

properly and as an independent entity will erode the shield afforded<br />

by the entity, and personal liability can ensue. Thus, in order for<br />

any entity to preserve its special, limited liability status, it must<br />

observe certain formalities and take certain actions. Formalities<br />

include (minimally) the issuance of ownership certificates,<br />

electing officers and directors, following the company bylaws/<br />

operating agreement, maintaining proper corporate records and<br />

keeping corporate and personal funds clearly separate. If these<br />

formalities are not followed, the entity and its limited liability<br />

status are vulnerable to attack. Here are some examples.<br />

Piercing the Veil<br />

Company shareholders/members generally are insulated<br />

from personal liability for the company’s debts. This limited<br />

liability is known as the “corporate veil.” But the veil is not an<br />

absolute shield. In some cases, a court may pierce the veil and<br />

hold a shareholder/member personally liable. Piercing is most<br />

commonly done when a company is the shareholders’ “alter<br />

ego” or is used to evade creditors.<br />

In our hypothetical example above, PCV Equipment failed to<br />

observe corporate formalities and the court found that the members<br />

were treating the entity as another pocket. Thus, the corporate veil<br />

is pierced, and the three members are held responsible for the<br />

breach and associated damages. To paraphrase a leading authority,<br />

if the shareholders/members or the company disregards the legal<br />

separation or proper formalities of the company existence, then<br />

the law will likewise disregard them.<br />

Growth Plans<br />

Outdoor Advanced Company needed a capital infusion to<br />

help with some upcoming cash flow issues that they anticipated.<br />

The company was not “in trouble” but certainly needed the<br />

additional cash in order to pursue growth plans. Though OAC<br />

had a good relationship with its lenders, the company was<br />

unable to produce certain minutes and resolutions during the<br />

standard due diligence process. The lenders viewed this not<br />

as an “oversight” but rather an egregious failure to operate an<br />

entity. OAC subsequently received lending but months later<br />

from a different, less-friendly source.<br />

Audit<br />

Pursuant to a routine audit, the Internal Revenue Service<br />

came calling to Outdoor & Marine Corp. and its handful of<br />

shareholders. Outdoor & Marine Corp. was unable to timely<br />

produce necessary corporate records, was unable to show<br />

that it was following company bylaws and was unable to show<br />

loan documentation with certain shareholders. As a result, the<br />

IRS forced the shareholders and the company to restate their<br />

financial position and prior tax returns.<br />

Exit Strategies<br />

The owners of HighKing Systems were thrilled to<br />

have a suitor interested in acquiring the company.<br />

The owners stood to profit handsomely from the transaction<br />

based upon the offer price in the letter of intent.<br />

During due diligence, however, the potential acquirer found<br />

discrepancies in the corporate records and associated<br />

capitalization ledger. This led to distrust, months of follow<br />

up and a renegotiation of the purchase price. The transaction<br />

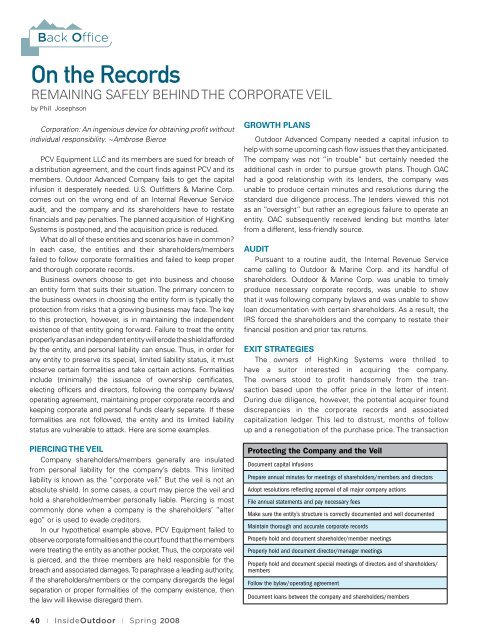

Protecting the Company and the Veil<br />

Document capital infusions<br />

Prepare annual minutes for meetings of shareholders/members and directors<br />

Adopt resolutions reflecting approval of all major company actions<br />

File annual statements and pay necessary fees<br />

Make sure the entity’s structure is correctly documented and well documented<br />

Maintain thorough and accurate corporate records<br />

Properly hold and document shareholder/member meetings<br />

Properly hold and document director/manager meetings<br />

Properly hold and document special meetings of directors and of shareholders/<br />

members<br />

Follow the bylaw/operating agreement<br />

Document loans between the company and shareholders/members<br />

40 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2008