Winter - InsideOutdoor Magazine

Winter - InsideOutdoor Magazine

Winter - InsideOutdoor Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.insideoutdoor.com<br />

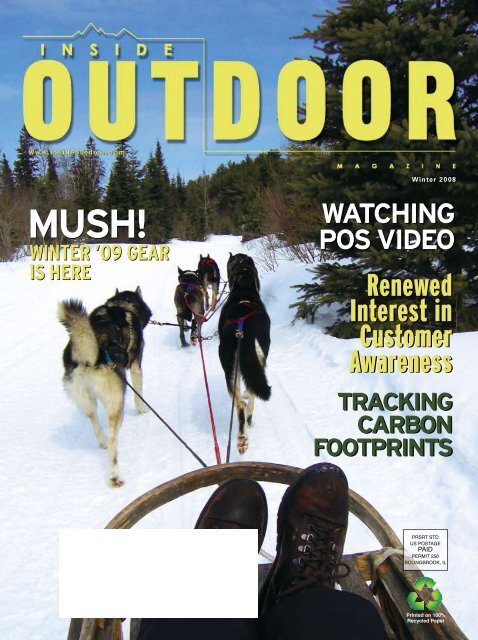

MUSH!<br />

<strong>Winter</strong> ’09 Gear<br />

is Here<br />

<strong>Winter</strong> 2008<br />

Watching<br />

POS Video<br />

Renewed<br />

Interest in<br />

Customer<br />

Awareness<br />

Tracking<br />

Carbon<br />

Footprints<br />

PRSRT STD<br />

US POSTAGE<br />

PAID<br />

PERMIT 256<br />

BOLINGBROOK, IL<br />

Printed on 100%<br />

Recycled Paper

Clearly Accurate<br />

Clear Viewpoint<br />

The new Habicht PVI-2 HIGH GRID gives hunters the opportunity for an amazing hunting<br />

experience. A selection of three innovative reticles in the second image plane, so when the<br />

magnification is changed only the target is magnified and not the reticle. The new PVI-2<br />

HIGH GRID riflescopes are all equipped with the new BE4 Digital Illumination unit, for<br />

maximum brightness during the day and finely tuned light intensity at twilight.<br />

Swarovski Optik North America, 2 Slater Road, Cranston, Rhode Island, 02920, Phone: 401 734 1800, email: info@swarovskioptik.us<br />

www.swarovskioptik.com

where will the trail take us next?<br />

From backpacks to daypacks, from hiking boots to apparel and accessories, there’s one thing the best have<br />

in common — Cordura® fabric. Its durability and versatility have been the stuff of legends for 30 years.<br />

Out on the trail. Up on the mountainside. Anywhere there’s adventure. As the journey continues, we invite<br />

you to be a part of it. Carry products made with Cordura®. If you do, your customers will carry them, too.<br />

www.cordura.com · 800-577-3733<br />

Cordura® is a registered trademark of INVISTA for durable fabrics.<br />

Celebrating 30 years of innovation.

C O N T E N T S<br />

<strong>Winter</strong> 2008<br />

Departments<br />

RETAILERS REPORT<br />

8 LET IT SNOW, PLEASE<br />

Life in the snow lane<br />

DATA POINTS<br />

12 NUMBERS WORTH NOTING<br />

Shrinking; surfing; discretionary measures;<br />

plus impressions on advertising<br />

18<br />

BACK OFFICE<br />

14 EXPANDING ON SHRINK<br />

Familiar culprits face new tactics in loss prevention<br />

FLOOR SPACE<br />

16 WINTER SURVIVAL INSTINCTS AND IMPULSES<br />

AMK comes to the rescue with new POP materials<br />

FEATURES<br />

24<br />

18 POS VIDEO GETS ATTENTION<br />

Although in-store media still is in its infancy, the power video messaging<br />

holds in persuading purchase decisions is well documented.<br />

So don’t turn away, as video now appears poised to transform the<br />

way retailers interact with their customers.<br />

By Martin Vilaboy<br />

24 BRAND PLAN 2008<br />

Faced by a tempest of technological, cultural and societal changes<br />

heading toward the turn of the decade, brand managers appear<br />

to believe that reconnecting with core customers is one<br />

way to weather the storm. The way things are blowing,<br />

it may be their only option.<br />

By Martin Vilaboy<br />

GEar<br />

34 WINTER 2009 PRODUCT SHOWCASE<br />

A sampling of the new gear and garb set to<br />

warm up this winter’s show season<br />

GREENSHEETS<br />

56 CARBON FOOTPRINT 101<br />

A greenhouse gas and LCA primer<br />

60 THE GREEN GLOSSARY<br />

Think wikipedia for the eco-minded<br />

6 Letter from the Editor<br />

54 Advertiser Index<br />

4 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

Life is aMOUNTAIN<br />

to<br />

CONQUER.<br />

Jeremy Jones, legendary big mountain snowboarder.<br />

He constantly tests his Samsonite OutLab X+ bags ;<br />

equipped to tackle the toughest of life’s adventures.<br />

samsoniteoutlab.com<br />

IO_28.indd Ad_Outlab_<strong>InsideOutdoor</strong>_10,875x8,125.indd 7<br />

1<br />

1/11/08 1/11/08 1:45:53 2:53:10 PM PM

Editor’s Letter<br />

Adapting to Your Environment<br />

Overall participation rates among legacy “outdoor” activities remain flat at best, both in<br />

number and frequency in some cases. The customer base, we’ve also been told for years,<br />

is “aging,” and participation tends to drop with age. Meanwhile, more and more gadgets<br />

and games continue to further divide consumers’ limited leisure time, and the country’s<br />

collective waistband is expanding.<br />

Yet, somehow, the outdoor industry is as healthy and vibrant as it’s been since the<br />

turn of the millennium, if not further back, the countless war stories of industry veterans,<br />

backstab wounds and “out of business” signs notwithstanding.<br />

Even so, U.S. “outdoor specialty” retail sales grew more than 11 percent in 2006, OIA<br />

tells us, greatly outpacing overall rates of annual growth seen across the total U.S. retail<br />

sector. Since 2000, outdoor specialty has experienced a “strong 6.6 percent annualized<br />

growth rate,” OIA reports. That’s more than twice the long-standing 3 percent annual<br />

growth typically assumed in the greater “sporting goods” category.<br />

One could argue that the “mainstreaming” of outdoor apparel and footwear, as well as<br />

the well-played “function meets fashion” trend largely are behind the growth, but “mainstream”<br />

and “fashion” tend to be the domain of shopping malls and mass merchants and<br />

would seem to have less of an impact on “specialty store” sales.<br />

Maybe the emergence of the Internet and e-commerce are driving growth in the face<br />

of declining participation. It’s possible, but e-commerce still represents single-digital percentages<br />

of outdoor dealers’ overall sales, and it’s unlikely all of those Internet sales, or<br />

even the vast majority, are coming from customers who wouldn’t have bought at a physical<br />

outlet otherwise.<br />

Maybe it’s the industry’s counting methods that are flawed; wouldn’t be the first time such<br />

a thing has ever happened. A more likely explanation, however, is a shift that’s taking place as<br />

to what it means to be counted as an “outdoor participant” or even as “outdoor product.”<br />

From the perspective of someone who was forced to step away from the outdoor<br />

community for just two years or so before happily returning only this past fall, the industry<br />

clearly has gone through some changes of late. Consider the wall that once existed<br />

between the “outdoor” and “hook and bullet” crowds, for example. While there remain<br />

many differences between the two segments, there’s clearly more openness nowadays<br />

to partnerships.<br />

At the same time, while walking the aisles of the Salt Lake City convention center this<br />

January, it’s not hard to find several product categories and contestants that few would<br />

have expected to see worked heavily at an Outdoor Retailer trade show as recently as 10<br />

or maybe five years ago. “Tactical” companies, jewelry, nutritional supplements, video<br />

cameras, health and beauty, financial services and Asian manufacturers could be listed<br />

among them.<br />

That’s not to suggest that crossover by any of these categories is a stretch. More<br />

to the point is the notion that who or what we define as an outdoor sale or a customer<br />

continually must be reconsidered. For instance, a specialty retailer reporting sales of “outdoor<br />

packs” now could include disk golf bags. Tallies of “outdoor footwear” increasingly<br />

include what traditionally would be considered skateboarding or walking shoes. In other<br />

words, when faced by some very discouraging trends, the outdoor retail industry so far<br />

has shown incredible levels of adaptability and acceptance of new opportunities. (Maybe<br />

all that time outdoors makes us more adaptable.)<br />

Not that there hasn’t been, or won’t continue to be, some negative consequences.<br />

As more and more types of users and industry segments enter the market, the outdoor<br />

community will be forced to defend many of the core principles that define it today and<br />

have throughout its history: minimal impact, sustainability, play as hard as you work and<br />

people before P&L statements, to name a few.<br />

But when considering the level of devotion, dedication and affection for a certain way<br />

of life that we’ve seen among members of our little circle, we’re fairly confident a balance<br />

can be maintained. Ultimately, there may be little choice in the matter. Grand moral principles<br />

mean little to a fossil.<br />

And there’s little evidence at this point that participation numbers will suddenly increase<br />

across multiple activities. It’s even more doubtful we’ll see growth spikes within<br />

any of the legacy activities that serve up the largest slices of outdoor retail revenues.<br />

Martin Vilaboy<br />

Editor-in-Chief<br />

martin@bekapublishing.com<br />

Percy Zamora<br />

Art Director<br />

outdoor@bekapublishing.com<br />

Ernest Shiwanov<br />

Editor at Large<br />

ernest@bekapublishing.com<br />

Editorial Contributors:<br />

R.J. Anderson<br />

Philip Josephson<br />

Berge Kaprelian<br />

Group Publisher<br />

berge@bekapublishing.com<br />

Jennifer Vilaboy<br />

Production Director<br />

jen@bekapublishing.com<br />

Suzanne Urash<br />

Ad Creative Designer<br />

suzanne@cre8groupinc.com<br />

Beka Publishing<br />

Berge Kaprelian<br />

President and CEO<br />

Philip Josephson<br />

General Counsel<br />

Jim Bankes<br />

Business Accounting<br />

Corporate Headquarters<br />

745 N. Gilbert Road<br />

Suite 124, PMB 303<br />

Gilbert, AZ 85234<br />

Voice: 480.503.0770<br />

Fax: 480.503.0990<br />

Email: berge@bekapublishing.com<br />

© 2008 Beka Publishing, All rights reserved.<br />

Reproduction in whole or in any form or<br />

medium without express written permission<br />

of Beka Publishing, is prohibited. Inside<br />

Outdoor and the Inside Outdoor logo are<br />

trademarks of Beka Publishing<br />

MV<br />

6 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008<br />

IO_28.indd 6<br />

1/11/08 6:20:10 PM<br />

Ad_Ou

Retailers Report<br />

Let it Snow, Please<br />

Compiled by R.J. Anderson<br />

This month we ask: Have the heavy snows and cold weather of December led to an increase in sales compared<br />

to December of 2006? If so, what product categories in particular are seeing a boost? Has the early snow offset<br />

your fall early sales decline? Has it at all altered your winter 2008 strategy/outlook?<br />

NORTHEAST<br />

“We had a great winter, especially in<br />

soft goods—warm clothes, gloves and<br />

boots,” says Ed Joy, store manager at<br />

Mountain Goat in Williamstown, Mass.<br />

“And we also had pretty good sales this fall,<br />

despite the weather.”<br />

When it comes to planning the store’s<br />

winter 2008 buying, Joy says his strategy will<br />

remain the same. “We’ll plan for a normal season,<br />

like we do every year, which means planning<br />

as if there will be snow.”<br />

“We had a great December across the board in nearly every<br />

category,” says Al Saracene, owner of Nordic Sports in Cortland,<br />

N.Y. This October was the warmest on record in upstate New<br />

York, a fact that negatively impacted Saracene’s sales numbers.<br />

“But having the early snows and the ski areas opening up earlier<br />

made a huge difference and certainly made up for what we<br />

lost in October,” he says.<br />

However, the snow boon of December 2007 will not change<br />

how this 30-year veteran approaches his winter 2008 preseason<br />

ordering. “We always go in with open-to-buy numbers that are<br />

based on mean statistics from our last few years. We never go<br />

in thinking it’s going to be another super year,” says Saracene.<br />

“We always leave open-to-buy dollars to go back into the market<br />

if we need to do so. Those available dollars also serve as a<br />

buffer if we’re having a lousy year.”<br />

Rich Hage, general manager, The Jersey Paddler in Brick,<br />

N.J., a shop five miles from the ocean, says his store was not<br />

really affected by the cooler temperatures of November and<br />

December. The snow the rest of the northeast experienced<br />

never made it to his community. “Because we’re so close to<br />

the ocean, we really only had rain here,” says Hage. “We’re<br />

primarily a kayak and canoe store, but we do carry winter gear<br />

and sell a lot of apparel.<br />

“Still, our December sales were on par with last year,” Hage<br />

adds. “And each category was consistent. Our winter 2008 buying<br />

plan will be about the same as it was in 2007.”<br />

“We don’t factor last year’s numbers into our strategy because<br />

it was so bad, and we wrote it off as a total loss,” says<br />

Holly Burns, store manager of the Alpine Shop in South Burlington,<br />

Vt. “But this December, our women’s sales are up over<br />

men’s compared to years past, and our ski sales are pretty<br />

much average.”<br />

The store’s September and October preseason ski sales<br />

were weak, but once the snows of early November arrived,<br />

sales picked up. “We did really well in November and December,<br />

and that made up for the fall,” says Burns.<br />

MIDWEST<br />

Bill Thompson, co-owner of Down Wind Sports<br />

in Marquette, Mich., says December 2007 was<br />

definitely more profitable than December<br />

of 2006, with the biggest statistical jumps<br />

coming in snowshoes, Nordic skis and<br />

telemark skis. Though he experienced a very<br />

healthy December, Thompson isn’t yet ready to call<br />

this winter season an overall success. “For our territory, we find<br />

those answers in the last three weeks of January,” says Thompson,<br />

who didn’t lose much business to unseasonably warm fall<br />

temperatures. “Christmas is always busy, but the telltale signs<br />

of a season’s success come in the three weeks afterward when<br />

we see if people are spending money or not. That’s when we’ll<br />

know if the early snows have had an effect.”<br />

“Our December 2007 numbers were much better than in<br />

2006,” says Becky Roethlisberger, store manager of Backcountry<br />

Outfitters in Traverse City, Mich. “We saw a big increase<br />

in snowshoe and sled sales.” Roethlisberger says her store<br />

didn’t experience a decline in fall sales, and they will approach<br />

the 2008 winter preseason ordering much the same as they<br />

did in 2007.<br />

Jessie Wormington, store manager at Backwoods Equipment<br />

Co., Omaha, Neb., says December 2007 was very healthy for<br />

her shop and a vast improvement over 2006. She says base layer<br />

clothing, specifically the Ice Breaker layering systems, have<br />

been flying off the sales floor. Wormington says a hot summer<br />

and warm early fall led to a decline in numbers for her store.<br />

However, any deficit that existed was quickly filled with the dollars<br />

that accompanied the chill of November and December.<br />

Meanwhile, Michelle Anderson, store manager at Granite<br />

Sports, Hill City, S.D., says the warm December weather of<br />

2006 actually repeated again in 2007 in her area. “We’re about<br />

45 miles from two ski areas and about 20 miles from some<br />

major snowmobiling spots, but we haven’t had any significant<br />

snowfall,” says Anderson. “It’s been very similar to last year, but<br />

this year our sales have been better. I think they can actually be<br />

attributed to the nice weather we had—it was the nice days<br />

that actually brought increased traffic.”<br />

8 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

What do you value<br />

MOST in a trade show?<br />

• The latest product innovations<br />

• The largest concentration of suppliers<br />

• A gathering of industry connections<br />

unrivaled anywhere else<br />

You’ll find it all at IFAI Expo 2008<br />

• 450 exhibits<br />

• 8,000 worldwide visitors<br />

• 100 expert speakers<br />

• The inspiring Design Exhibition—<br />

far-out innovations for health and safety<br />

• International Buyers<br />

Program designation<br />

Today’s<br />

Answers<br />

Tomorrow’s<br />

Innovations<br />

The Commercial Service logo is a registered trademark of<br />

the U.S. Department of Commerce, used with permission.<br />

Keynote Speakers<br />

LOU HOLTZ<br />

“Game Plan For Success”<br />

Coach Lou Holtz, a legendary team leader and speaker<br />

on achievement, presents a message that transcends<br />

athletics focusing on people and the values that make<br />

relationships (and organizations) excel.<br />

Tuesday, Oct. 21 – 8:30-9:30 am<br />

DORIS KEARNS GOODWIN<br />

“Leadership Lessons From Abraham Lincoln”<br />

Acclaimed Pulitzer Prize-winning historian Doris Kearns<br />

Goodwin provides object lessons in leadership, political<br />

economy and successful strategy, courtesy of one of<br />

history’s most compelling personalities. The presentation<br />

is based on her best-selling book: “Team of Rivals:<br />

The Political Genius of Abraham Lincoln.”<br />

Thursday, Oct. 23 – 8:30-9:30 am<br />

A continental breakfast will be served before each event at 8:00 am. Register<br />

to attend these exciting keynote presentations with a “Full Expo” registration<br />

package. Materials will be available in March 2008 at www.ifaiexpo.com.<br />

The largest specialty fabrics<br />

trade show in the Americas.<br />

For more information, contact show management<br />

at +1 651 222 2508 or e-mail ifaiexpo@ifai.com.<br />

www.ifaiexpo.com

Retailers Report<br />

Anderson says this could be due to a variety of reasons, including<br />

more focused marketing efforts. Based on two straight<br />

warm winters, Anderson says she will definitely be altering her<br />

winter 2008 buying strategy. “We’re looking at bringing more<br />

winter products in earlier, like September,” she says. “That’s<br />

when our tourists are here. We find that even though we don’t<br />

have snow, the tourists aren’t afraid to prepare for when they<br />

go home and do get it. We’re also changing the type of product<br />

we bring in and are cutting back on some of the higher-end<br />

items like expensive winter jackets.”<br />

ROCKIES<br />

“We have seen a good-sized increase<br />

over 2006,” says Loren Gibbs, floor manager<br />

at Ute Mountaineer in Aspen. “I’m<br />

not 100 percent positive it’s because of the<br />

snow, but it does appear to have helped.<br />

“Despite the success we’ve had<br />

across the board this year, we can’t really<br />

let it affect how we do our 2008 ordering,”<br />

Gibbs adds. “We’ll basically just<br />

have more open-to-buy available.”<br />

Keith Roush, owner of Pine Needle Mountaineering in Durango,<br />

Colo., says December 2007 wasn’t that much better than<br />

2006 for his store. “Last year, even though we had less snow,<br />

the cold weather started a lot earlier,” says Roush. “We had a<br />

record year last year, so I have no complaints, but it wasn’t due<br />

to selling winter goods, it was non-winter goods.”<br />

Roush says much of his store’s record-breaking performance<br />

was driven by sales of lightweight, aerobic-oriented gear such<br />

as trail runners and base layers. “Those types of sales continued<br />

right up until it start snowing,” says Roush, adding that the<br />

trend has carried over to this year. “Since the first snows of this<br />

year, we have done really well with skis and boots, but it’s been<br />

a shorter season for them this year. We’re ahead of last year,<br />

but not because of selling winter stuff.”<br />

The recent seasonal trends have caused Roush to become<br />

more conservative with his winter 2008 preseason ordering and<br />

spurred him to get more of his big orders done earlier. “We’ve<br />

made some big commitments early on,” Roush explains. “We had<br />

done half of our buying for winter 2008 the first week in January.”<br />

It was a great December at Schnee’s, Inc. downtown store<br />

in Bozeman, Mont., says general manager Curt Smith. “We’re<br />

a destination ski town, and the early snowfall brought in a lot<br />

of visitors in the last half of December,” says Smith. “Those<br />

people bought a lot boots. We saw growth across the board in<br />

accessories, socks and winter boots.”<br />

Smith says his store had a good start to their fall season,<br />

but that sales flattened out when the weather turned warm in<br />

October. “But, in general, we had a good fall, and it allowed us<br />

to get out of some of our early inventory,” Smith says.<br />

Smith says his store’s preseason ordering strategy is to buy<br />

to the numbers of each preceding season. “I don’t try to anticipate<br />

any increased growth in any categories,” he explains. “I’m<br />

typically looking to respond to the previous winter rather than<br />

buying based on an expectation for a big winter in the future.”<br />

PACIFIC NORTHWEST<br />

At Mountain Supply, a family owned<br />

shop in Bend, Ore., Aaron Hohman says December<br />

2007 sales were similar to those<br />

from 2006. “We had a really long, warm<br />

fall and did not get our cooler weather<br />

until later in the year,” says Hohman.<br />

“Our business was like a light switch<br />

when we got that first snow just after<br />

Thanksgiving. It basically tripled.”<br />

This year, however, Hohman says his store, which is owned<br />

by his mother-in-law and has been in the family for 27 years,<br />

has seen a slowdown in down and insulated outerwear sales.<br />

For their 2008 winter buying, Hohman says they’ll likely alter<br />

their buying strategy. “We’re going to re-think some things, especially<br />

in the ski department,” he says. “That probably means<br />

bringing in less inventory as well as bringing more in later.”<br />

Pepi Gerald, who has co-owned 2nd Wind Sports in Hood<br />

River, Ore. for three years, says his store experienced a fantastic<br />

December this year and that his 2007 didn’t grow quite as<br />

much as he would have liked. However, he says, the statistics<br />

should be taken with a grain of salt.<br />

“It’s important to note that due to a washed out main<br />

road, we couldn’t access Mt. Hood until the second week of<br />

December in 2006.” says Gerald. “When that road opened,<br />

people basically went crazy in spending to gear up for mountain<br />

activities.”<br />

Gerald says the snow is just as good this year as it was last<br />

year and has been since October. “Our 2007 winter numbers<br />

are a little lower,” he says. “But still it’s been a very good year.”<br />

Much of the store’s 2007 success can be attributed to an<br />

outstanding fall. “We have been hiking in the backcountry and<br />

skiing Mt. Hood top to bottom since Halloween,” says Gerald,<br />

adding that the store’s numbers for October and November are<br />

up 40 percent from last year. “Usually we do kite boarding and<br />

windsurfing all the way through September, but a week after<br />

Labor Day the temperature dropped 30 to 40 degrees and it<br />

started snowing in the mountains.”<br />

“This year, December started out a little slow, then right before<br />

Christmas it started to pick up for us,” says Andrea Wagner,<br />

store manager at Backpackers Supply in Tacoma, Wash., adding<br />

that Tacoma had a lot more snow earlier on than it did last year.<br />

“From Christmas to New Years we really saw an increase in<br />

sales and in rentals.”<br />

She says she has seen a lot of customers converting to alpine<br />

ski touring. “People are wondering how they can ski up the<br />

mountain,” says Wagner.<br />

Wagner says the store’s fall sales were very slow in 2007, but<br />

that isn’t unusual. “It’s hard to say if December made up for the<br />

fall because I haven’t worked the numbers,” she adds. “But judging<br />

it anecdotally, there’s a chance it might have.”<br />

10 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

Retailers Report<br />

Anderson says this could be due to a variety of reasons, including<br />

more focused marketing efforts. Based on two straight<br />

warm winters, Anderson says she will definitely be altering her<br />

winter 2008 buying strategy. “We’re looking at bringing more<br />

winter products in earlier, like September,” she says. “That’s<br />

when our tourists are here. We find that even though we don’t<br />

have snow, the tourists aren’t afraid to prepare for when they<br />

go home and do get it. We’re also changing the type of product<br />

we bring in and are cutting back on some of the higher-end<br />

items like expensive winter jackets.”<br />

ROCKIES<br />

“We have seen a good-sized increase<br />

over 2006,” says Loren Gibbs, floor manager<br />

at Ute Mountaineer in Aspen. “I’m<br />

not 100 percent positive it’s because of the<br />

snow, but it does appear to have helped.<br />

“Despite the success we’ve had<br />

across the board this year, we can’t really<br />

let it affect how we do our 2008 ordering,”<br />

Gibbs adds. “We’ll basically just<br />

have more open-to-buy available.”<br />

Keith Roush, owner of Pine Needle Mountaineering in Durango,<br />

Colo., says December 2007 wasn’t that much better than<br />

2006 for his store. “Last year, even though we had less snow,<br />

the cold weather started a lot earlier,” says Roush. “We had a<br />

record year last year, so I have no complaints, but it wasn’t due<br />

to selling winter goods, it was non-winter goods.”<br />

Roush says much of his store’s record-breaking performance<br />

was driven by sales of lightweight, aerobic-oriented gear such<br />

as trail runners and base layers. “Those types of sales continued<br />

right up until it start snowing,” says Roush, adding that the<br />

trend has carried over to this year. “Since the first snows of this<br />

year, we have done really well with skis and boots, but it’s been<br />

a shorter season for them this year. We’re ahead of last year,<br />

but not because of selling winter stuff.”<br />

The recent seasonal trends have caused Roush to become<br />

more conservative with his winter 2008 preseason ordering and<br />

spurred him to get more of his big orders done earlier. “We’ve<br />

made some big commitments early on,” Roush explains. “We had<br />

done half of our buying for winter 2008 the first week in January.”<br />

It was a great December at Schnee’s, Inc. downtown store<br />

in Bozeman, Mont., says general manager Curt Smith. “We’re<br />

a destination ski town, and the early snowfall brought in a lot<br />

of visitors in the last half of December,” says Smith. “Those<br />

people bought a lot boots. We saw growth across the board in<br />

accessories, socks and winter boots.”<br />

Smith says his store had a good start to their fall season,<br />

but that sales flattened out when the weather turned warm in<br />

October. “But, in general, we had a good fall, and it allowed us<br />

to get out of some of our early inventory,” Smith says.<br />

Smith says his store’s preseason ordering strategy is to buy<br />

to the numbers of each preceding season. “I don’t try to anticipate<br />

any increased growth in any categories,” he explains. “I’m<br />

typically looking to respond to the previous winter rather than<br />

buying based on an expectation for a big winter in the future.”<br />

PACIFIC NORTHWEST<br />

At Mountain Supply, a family owned<br />

shop in Bend, Ore., Aaron Hohman says December<br />

2007 sales were similar to those<br />

from 2006. “We had a really long, warm<br />

fall and did not get our cooler weather<br />

until later in the year,” says Hohman.<br />

“Our business was like a light switch<br />

when we got that first snow just after<br />

Thanksgiving. It basically tripled.”<br />

This year, however, Hohman says his store, which is owned<br />

by his mother-in-law and has been in the family for 27 years,<br />

has seen a slowdown in down and insulated outerwear sales.<br />

For their 2008 winter buying, Hohman says they’ll likely alter<br />

their buying strategy. “We’re going to re-think some things, especially<br />

in the ski department,” he says. “That probably means<br />

bringing in less inventory as well as bringing more in later.”<br />

Pepi Gerald, who has co-owned 2nd Wind Sports in Hood<br />

River, Ore. for three years, says his store experienced a fantastic<br />

December this year and that his 2007 didn’t grow quite as<br />

much as he would have liked. However, he says, the statistics<br />

should be taken with a grain of salt.<br />

“It’s important to note that due to a washed out main<br />

road, we couldn’t access Mt. Hood until the second week of<br />

December in 2006.” says Gerald. “When that road opened,<br />

people basically went crazy in spending to gear up for mountain<br />

activities.”<br />

Gerald says the snow is just as good this year as it was last<br />

year and has been since October. “Our 2007 winter numbers<br />

are a little lower,” he says. “But still it’s been a very good year.”<br />

Much of the store’s 2007 success can be attributed to an<br />

outstanding fall. “We have been hiking in the backcountry and<br />

skiing Mt. Hood top to bottom since Halloween,” says Gerald,<br />

adding that the store’s numbers for October and November are<br />

up 40 percent from last year. “Usually we do kite boarding and<br />

windsurfing all the way through September, but a week after<br />

Labor Day the temperature dropped 30 to 40 degrees and it<br />

started snowing in the mountains.”<br />

“This year, December started out a little slow, then right before<br />

Christmas it started to pick up for us,” says Andrea Wagner,<br />

store manager at Backpackers Supply in Tacoma, Wash., adding<br />

that Tacoma had a lot more snow earlier on than it did last year.<br />

“From Christmas to New Years we really saw an increase in<br />

sales and in rentals.”<br />

She says she has seen a lot of customers converting to alpine<br />

ski touring. “People are wondering how they can ski up the<br />

mountain,” says Wagner.<br />

Wagner says the store’s fall sales were very slow in 2007, but<br />

that isn’t unusual. “It’s hard to say if December made up for the<br />

fall because I haven’t worked the numbers,” she adds. “But judging<br />

it anecdotally, there’s a chance it might have.”<br />

10 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

Data Points<br />

Numbers worth noting<br />

Shrinkage Expands to $40 Billion<br />

According to an annual survey conducted by the University<br />

of Florida with funding from ADT Security Services, U.S. retailers<br />

lost $40.5 billion to theft in 2006. The number one contributor<br />

to shrinkage: employee theft, accounting for nearly half.<br />

The dollar amount per incident of employee theft is declining,<br />

but the dollar amount for shoplifting is rising, possibly due to<br />

an increase in organized retail crime, say researchers. “As in<br />

last year’s survey, retailers expect to substantially increase the<br />

amount of technology they will be using in their stores,” says<br />

University of Florida criminologist Richard Hollinger.<br />

2006 U.S. Retail Shrinkage by Cause<br />

Cause<br />

Amount<br />

Percent of<br />

Total<br />

Employee theft $19 billion 47%<br />

Shoplifting $13 billion 32%<br />

Vendor fraud/administrative error, other $8.5 billion 21%<br />

Source: ADT<br />

REI Customers Surf Hard<br />

REI customers are among the heaviest Internet users, according<br />

to a study by The Media Audit, which compared Internet usage<br />

for 50 of the top department, specialty and discount retailers<br />

across 88 U.S. markets. More than 60 percent of customers who<br />

shop REI are heavy Internet users, spending 430 minutes or more<br />

in a typical week online, or slightly more than 7 hours. Among all<br />

U.S. adults, 39.1 percent are considered heavy Internet users, a figure<br />

that has increased by more than 70 percent since 2001 when<br />

only 23 percent of U.S. adults were considered heavy users.<br />

Retail Sites with Highest % of Heavy Internet Users<br />

Site<br />

REI 60%<br />

Cost Plus World Market 56.9%<br />

Neiman Marcus 55.1%<br />

Saks Fifth Avenue 54.4%<br />

Gap 53.9%<br />

Source: The Media Audit<br />

% of Shoppers<br />

A Matter of Discretion<br />

About 73 million U.S. households now have discretionary<br />

income, up from about 57 million in 2002, according to a report<br />

by The Conference Board. But while the percentage of<br />

households with discretionary income has risen during the<br />

past several years, “purchasing power remains concentrated<br />

in the wallets of the affluent,” notes Lynn Franco, director of<br />

The Conference Board Consumer Research Center. Nearly 78<br />

percent of all discretionary income is held by households earning<br />

more than $100,000. Average discretionary income for this<br />

segment ($66,451) is 2.7 times the national average. As defined<br />

for the study, households with discretionary income are<br />

those whose spendable income exceeds that held by households<br />

with similar demographic features.<br />

12 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008<br />

By region, the wealthiest concentration of households resides<br />

in New England, where about 63 percent of households<br />

have discretionary income, with an average amount of $27,337.<br />

Household discretionary income is lowest in the West North<br />

Central region, where average household discretionary income<br />

is $20,749.<br />

Discretionary Income Households<br />

Total Households with Discretionary Income<br />

2002 52.1%<br />

2006 63.5%<br />

Discretionary Income (current dollars)<br />

2002 $1,233.4 billion<br />

2006 $1,768.7 billion<br />

Average Discretionary Income (current dollars)<br />

2002 $21,657<br />

2006 $24,335<br />

Households With Discretionary Income (by HH income)<br />

$200,000 and over 37.9%<br />

$150,000 to 200,000 16.1%<br />

$100,000 to 150,000 23.7%<br />

$50,00 to 100,000 19.4%<br />

Under $50,000 2.9%<br />

Source: The Conference Board<br />

Advertising Makes an Impression<br />

Among those outdoor specialty retailers that have enjoyed<br />

increases in retail sales of late, the factor cited most often as a<br />

reason for growth was “improved store advertising,” according<br />

to research from OIA. More than half of specialty retailers surveyed<br />

said better ads had a direct impact on improved business,<br />

with the impact of advertising particularly strong among larger<br />

operations. Eight of 10 retailers with $2 million or more in sales,<br />

for example, said better ads were a primary driver of higher<br />

sales. Meanwhile, 21 percent of all retailers surveyed also said<br />

that “more store advertising” was a key growth driver.<br />

What are the main reasons your retail business is up?<br />

Reason<br />

Total<br />

$1<br />

1 Multi Under<br />

M-$1.99<br />

Store Store $1M<br />

M<br />

+$2M<br />

Improved store ads 53% 47% 69% 50% 40% 80%<br />

Better staff training 49% 41% 69% 42% 30% 67%<br />

Existing participants<br />

needing more products<br />

47% 47% 46% 42% 40% 60%<br />

Strong economy 45% 50% 31% 50% 50% 47%<br />

Increase in new outdoor<br />

products<br />

36% 35% 38% 25% 40% 33%<br />

Better direct marketing<br />

to our customers<br />

Innovative products<br />

from manufacturers<br />

36% 32% 46% 25% 20% 53%<br />

34% 29% 46% 33% 30% 40%<br />

More store advertising 21% 21% 23% 25% 20% 27%<br />

Decreasing local<br />

competition<br />

13% 12% 15% 17% 10% 20%<br />

Source: OIA

FUZZY LOGIC<br />

Look good. Do good. Feel good.<br />

WINDSTOPPER ® Technical Fleece will change the way you think about staying<br />

comfortable and stylish. Learn more and preview the Give a Warm Fuzzy/Get a<br />

Warm Fuzzy program at Gore Booth 33041.<br />

MOUNTAIN HARDWEAR<br />

MYNX<br />

From the inventors of<br />

GORE-TEX ® products<br />

© 2008 W. L. Gore & Associaes, Inc. GORE-TEX®, WINDSTOPPER®, GORE® and designs are trademarks of W. L. Gore & Associates.

Back Office<br />

Familiar Culprits, New Tactics for Shrink<br />

by Martin Vilaboy<br />

Crimes wrought in the underbelly by “professional” criminals<br />

-- think identity theft, credit card fraud or organized crime<br />

working on larger retailers – certainly show up more in the<br />

news and in episodes of CSI, but retailers continue to report<br />

the same, more mundane sources of shrinkage: customer and<br />

employees who steal merchandise and money and employees<br />

providing “sweetheart” deals to family and friends.<br />

Only 6 percent of respondents to a Retail Systems Research<br />

survey, for example, said worsening problems in their online<br />

presence held “a lot of influence” on loss prevention initiatives.<br />

And up to this point, banks bear most of the burden when it<br />

comes to fraudulent transactions and identity theft. That certainly<br />

could change, say RSR researchers. “Sooner or later, just<br />

as they have in Europe, the banks will start to hold retailers accountable<br />

for credit card fraud.”<br />

At present, however, 70 percent of retailers cite employee<br />

theft of merchandise as a top three source of shrink, while more<br />

than half rank customer shoplifting among the top three. Still<br />

worse, employee theft of cash (voids, post voids, etc.) rounded<br />

out the top three answers.<br />

Of the $40 billion U.S. retailers lose to theft each year, say<br />

researchers at University of Florida and ADT Security Systems,<br />

nearly half is attributed to employees. Consumer shoplifting accounts<br />

for about a third.<br />

It’s a tough predicament, indeed, when your front line force<br />

against loss prevention also is a top cause of loss. So it’s no<br />

surprise that retailers have been somewhat at a loss as to how<br />

to handle the situation.<br />

Top Three Sources of Shrink, % of Respondents<br />

Employee theft of merchandise in stores 70%<br />

Customer stealing merchandise 53%<br />

Employee theft of cash (voids, post-voids, etc.) 45%<br />

Paper shrink (missed markdown, incorrect POs, etc.) 32%<br />

Fraudulent returns 25%<br />

Organized crime rings 21%<br />

Register under-rings (sweethearting) 20%<br />

Employee theft of merchandise in distribution centers 12%<br />

Lost or stolen shipments 8%<br />

Fraudulent credit card transactions 7%<br />

Saleable merchandise used as supplies 5%<br />

Fraudulent check transactions 3%<br />

Source: Retail Systems Research<br />

For example, the most commonly used loss prevention tools<br />

are physical inventory and sales audits, say RSR findings. Problem<br />

is, these tasks mostly just measure loss and do very little to prevent<br />

it or identify specific causes in a timely manner. Meanwhile, about<br />

a third of retailers admit that their perpetual inventory systems are<br />

so flawed they really don’t know how much is being lost.<br />

Yet the problem continues to swell, even while the sources of<br />

shrink remain static. Ninety-three percent of retail respondents<br />

report that shrink has become more important or is equally important<br />

as a priority over the past two years, says RSR.<br />

In turn, winning retailers will continue to look toward new<br />

technologies that help quickly identify or even thwart theft in<br />

some cases.<br />

“As in last year’s survey, retailers expect to substantially<br />

increase the amount of technology they will be using in their<br />

stores,” says University of Florida criminologist Richard Hollinger,<br />

Ph.D., who directed the ADT study. “The types of loss<br />

prevention systems they indicate that they will be adding all<br />

involve newer, more sophisticated technology.”<br />

Leading the way are applications that provide near-real-time<br />

alerts as soon as suspicious patterns are recognized, such as<br />

point-of-sale monitoring that allows retailers to collect and analyze<br />

information on every transaction, identifying trends and unusual<br />

patterns in each store.<br />

Integrating cameras with business intelligence, loss prevention<br />

hardware and POS software is another growing trend, suggest<br />

ADT’s findings, allowing retailers to connect video images<br />

to events as they happen. If a cashier has a “no sale” transaction<br />

and opens the cash draw, for example, a camera will record<br />

the event.<br />

“These applications may still produce some ‘false positives’<br />

but are steadily improving,” say RSR researchers, “and at the<br />

very least, allow you to be proactive and know that events will<br />

receive proper attention.”<br />

Winning retailers also are achieving some success with<br />

computer-based training and the creation of videos that inform<br />

in-store staffers of the “tricks of the trade” used by merchandise<br />

thieves and alert employees to common actions and errors<br />

in judgment that make things easier for shoplifters.<br />

Best of all, computer-based training can be used to instill<br />

employees with a sense of being a “stakeholder in the company,”<br />

which RSR believes ultimately is one of the most important<br />

loss prevention tools, “even as they remain a primary source<br />

for shrink.”<br />

So while technology is a valuable enabler to improve loss<br />

prevention, “without focusing on the people that work in the<br />

retailing environment,” says the research firm, ”initiatives will<br />

be trumped and shrink will remain the same.”<br />

14 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

Floor Space<br />

<strong>Winter</strong> Survival Instincts and Impulses<br />

by Martin Vilaboy<br />

Survival, particularly winter survival, has never been further<br />

on the forefront of consumers’ minds; they might just need<br />

a bit of help remembering that. Hardly a month of the winter<br />

has gone by, in this era of ubiquitous reporting, without word<br />

of a lost hiker, snowmobiler or Christmas tree hunter scrolling<br />

across a screen crawler on a cable news network.<br />

All the while, TV shows weekly bring us tales of men battling<br />

extreme conditions solely as an exercise<br />

of basic survival. It all seems to<br />

be creating sales momentum for survival<br />

tools and kits. At Adventure<br />

Medical Kits, for example,<br />

which branched out from its<br />

roots in medical supplies to<br />

include survival items a few<br />

years back, products introduced<br />

into the survival category<br />

repeatedly meet or exceed<br />

expectations. Last year<br />

the company introduced its<br />

Heetsheet Emergency Bivvy (MSRP<br />

$15), essentially AMK’s super-compact,<br />

polyethylene Heetsheet Survival<br />

Blanket material folded up and taped to be waterproof and<br />

windproof and fit two people, and since then, “that thing has<br />

skyrocketed,” says Frank Meyer, AMK marketing director and<br />

company co-founder.<br />

Altogether, AMK saw its survival gear business spike by 40<br />

percent during the 2007 fiscal year, reports Simon Ashdown, the<br />

company’s director of public relations. The rise of the category is<br />

partly behind the company’s move to change its official tagline of<br />

20 years from “Choice of Outdoor Professionals” to “Be Safe.”<br />

Any lift off in sales, however, has come despite<br />

little assistance on the retail floor. While it’s not<br />

uncommon to find medical supplies and kits<br />

pulled together and merchandised as a category<br />

at outdoor specialty stores across the country,<br />

few retailers give survival gear and kits the<br />

same kind of treatment or prominence.<br />

Yet placement of the category on the<br />

show floor can be key, seeing how sales data<br />

from the food and drug and mass market retail<br />

segments suggest a large chunk of survival<br />

and medical kit sales are the result of<br />

impulse purchases, says Meyer.<br />

“[Consumers] didn’t drive to the<br />

store to specifically buy a first aid kit<br />

but instead were reminded of it when<br />

they saw the kits while browsing,”<br />

says Meyer.<br />

16 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008<br />

The free survival information pamphlet is a key<br />

component to AMK’s new POP program<br />

AMK’s New S.O.L Survival Pak<br />

So while somewhere in consumers’ brains they are aware<br />

and understand the importance of “always being prepared,” wellplaced<br />

reminders might be necessary to push them into action.<br />

With that in mind, AMK this winter unveiled a new merchandising<br />

program designed to increase accounts’ sales of first aid<br />

kits and survival supplies. The new point of purchase program<br />

features two key components: an “Enjoy the Outdoors Safely”<br />

pamphlet – a free takeaway that helps<br />

consumers choose the right kits<br />

based on activity – and an informational<br />

DVD.<br />

Of course, having the appropriate<br />

survival and medical<br />

equipment is only half the battle.<br />

Consumers also must possess<br />

the know-how to use the products<br />

when it matter most, during an<br />

emergency, so AMK’s new pamphlet<br />

and DVD are loaded with valuable<br />

first aid and survival tips.<br />

A versatile sales tool, the DVD can<br />

be used as in-store entertainment<br />

(broadcast on a monitor next to the<br />

AMK display, for instance), or content from it can be culled and<br />

posted on a retailer’s Web site alongside AMK product, allowing<br />

customers to see the gear demoed online. The new POP materials<br />

also can serve as training tools for existing and new floor<br />

staff, says AMK.<br />

To maximize the efficiency of AMK’s investment in POP<br />

materials and planograms, retailers should consider moving<br />

the survival category to end caps or other prominent places<br />

during the times of the year when customer consideration<br />

is highest, and AMK sales research suggest that<br />

to be primarily in the winter months between November<br />

and February, as well as during the peak summer<br />

vacation months.<br />

Ultimately, being prepared doesn’t mandate substantial<br />

effort or money. Today, consumers<br />

can find survival equipment bundled together<br />

into compact and affordable packages,<br />

such as AMK’s new S.O.L. (Survive Outdoors<br />

Longer) Survival Pak (MSRP $25),<br />

while in some cases the simple tools to<br />

start a fire can make all the difference in<br />

a search and rescue situation.<br />

Then again, customers may<br />

never know so much without some<br />

well-time reminders, such as right<br />

when those shopping instincts are<br />

kicking in.

ACW.Manuf IO SummerShow.7x10.ind1 1<br />

1/9/08 2:16:50 PM

POS<br />

Video Gets<br />

Attention<br />

by Martin Vilaboy<br />

They started appearing randomly during<br />

the latest holiday shopping season<br />

– in the toy aisle displaying a new item,<br />

running a how-to demo on a fitness<br />

machine in sporting goods, offering instructions<br />

from a consumer electronics<br />

store end cap or pitching treats at the grocery. In all<br />

types of sizes and configurations, they suddenly started<br />

popping up with bright colors and happy voices.<br />

No, a fleet of over-productive elves from the North<br />

Pole didn’t invade retail workforces last December.<br />

Rather, it was small video screens and digital signs<br />

that made their long-anticipated impression on many<br />

retail environments. Indeed, video at retail isn’t exactly<br />

a revolutionary concept, but video now appears in<br />

position to play a much more prominent role in a technology<br />

transformation that is altering POS marketing<br />

and the way consumers engage with retailers.<br />

If you<br />

haven’t yet come<br />

across a small digital display<br />

screen perched upon a store shelf,<br />

you likely will soon, at least if you’re doing any<br />

suburban shopping in or around a major American<br />

mall. Already companies such as Premier Retail Network<br />

(PRN) have more than 200,000 digital screens<br />

in retail outlets including Wal-Mart, Cosco, Best Buy<br />

and Circuit City, reports Ben Macklin, senior analysts<br />

for eMarketer. PRN claims to deliver more than 250<br />

million gross impressions a month with average brand<br />

recall of up to 51 percent.<br />

Elsewhere, Reactrix, which installs place-based interactive<br />

advertising systems into shopping centers<br />

and movie theatres, now counts 186 locations in 30 U.S<br />

markets and claims to reach more than 22 percent of<br />

adults in those metro areas.<br />

18 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008<br />

IO_28.indd 18<br />

1/11/08 6:00:48 PM

US Outdoor Video Advertising Spending 2006-2011<br />

(billions and % change)<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

Source: eMarketer<br />

$1.0 (28.0%)<br />

$1.3 (24.8%)<br />

$1.5 (22.0%)<br />

$1.8 (18%)<br />

$2.1 (14.5%)<br />

$2.3 (8.4%)<br />

Or maybe when you stop to get gas you can check out Gas<br />

Station TV, which currently operates about 5,000 displays in<br />

300 cities around the country, while PumpTop TV is currently<br />

available on more than 2,500 screens in gas stations around Los<br />

Angeles and San Diego, with plans to expand to San Francisco,<br />

Sacramento, Phoenix, Dallas, Houston, New York, Chicago,<br />

Philadelphia and Boston over the course of this year.<br />

By the end of 2006, the total North American narrowcasting<br />

industry (a similar concept to “out-of-home video,” which typically<br />

includes video content distributed to screens in retail outlets,<br />

transit vehicles, office buildings, shopping malls, theaters,<br />

bars and restaurants, gas stations, hotels and gyms, among other<br />

places) counted about 630,000 screens at 97,000 sites across<br />

the U.S., according to figures from InfoTrends.<br />

Indeed, digital billboards and displays are the fastest-growing<br />

segment of the red-hot “alternative out-of-home” media market,<br />

reports PQ Media, with spending soaring 55.4 percent in 2006 to<br />

$233.2 million and each of the four market divisions (at-road, atretail,<br />

at-transit and at-events) expanding at accelerated rates.<br />

Such growth, in part, last year prompted both Nielsen and<br />

Arbitron to add “in-store” media measurement to their respective<br />

audience rating services.<br />

“Point-of-purchase advertising is a $19 billion dollar industry<br />

in the U.S.” says Macklin. “This type of advertising has<br />

traditionally been cardboard displays, but video networks in<br />

major retail stores are beginning to change the paradigm.”<br />

Macklin views the falling costs of flat-panel LCDs, combined<br />

with the emergence of IP and wireless technologies as key drivers<br />

of the POS video market.<br />

But there are many other forces at work, and while in-store<br />

video is still very much a nascent platform, there’s no shortage of<br />

players waiting and ready to see how the marketplace pans out.<br />

The primary objectives of a POS campaign, after all, are to<br />

capture attention and disseminate an offer or product information.<br />

So let’s think mathematically: if a picture is worth a thousand<br />

words, a video is worth an order of magnitude more.<br />

“Humans, like moths attracted to light, are attracted to video,”<br />

says Michael Jackson, a co-owner of Zeal Optics, which last<br />

summer incorporated a 7-inch video demo screen into its instore<br />

display cases.<br />

As Jackson suggests, video gives the silent salesperson a<br />

voice, pushing information in ways never before possible with<br />

print and even audio. When it comes to grabbing attention, a<br />

small video screen, possibly loaded with motion-sensor technology,<br />

possess a novelty factor, at least in the near term, which can<br />

be matched only by the cleverest of traditional POS methods.<br />

Early evidence, though still limited, seems to suggest as<br />

much. According to Nikki Baird, managing partner for Retail<br />

Systems Research (RSR), studies have shown that items promoted<br />

on an in-store video network achieve incremental lift<br />

over and above the same items in stores that don’t have an instore<br />

network in place, whether or not those items were on promotion<br />

through other means, such as circulars or signage. Sales<br />

lift benefits varied from 10 to 60 percent, says Baird.<br />

In RSR’s own in-depth study of three retail chains, respondents<br />

reported product sales lift of 20 to 30 percent directly attributable<br />

to the use of in-store video.<br />

At the same time, video displays also can serve up information<br />

and sales training to in-store employees, who simply<br />

often can avoid being exposed to the product and promotional<br />

messages. Keep in mind, 90 percent of “Retail Winners” (defined<br />

as operations that outperform national averages in “key<br />

performance indicators,” including same store sales) surveyed<br />

by RSR said their top opportunity for improving the in-store<br />

experience is through technology to empower and educate instore<br />

employees.<br />

Meanwhile, retailers aren’t the only ones anxious to take advantage<br />

of the in-store video platform. Across the entire spectrum<br />

of the marketing and advertising world, executives are faced with<br />

unprecedented levels of disruption and audience fragmentation,<br />

which we discuss in detail elsewhere in this issue.<br />

In short, their faith in reaching audiences through conventional<br />

methods is waning. Multiple emerging platforms for the<br />

consumption of entertainment and information, commercial<br />

skipping, customized information/entertainment portals and<br />

the trend of consumer multitasking while digesting media all<br />

hamper advertisers’ ability to influence consumers in the home.<br />

One upshot has been an overwhelming emphasis on finding<br />

“new and creative ways” to reach customers, several surveys of<br />

marketers and advertisers suggest.<br />

All the while, studies from Veronis Suhler Stevenson show<br />

that consumers are spending nearly twice the time away from<br />

home than they did a few decades back.<br />

The combination of these factors, says Patrick Quinn, president<br />

and CEO of research consultancy PQ Media, “are the very<br />

catalysts stimulating the tremendous growth in alternative outof-home<br />

advertising. Unlike its mass media peers, alternative<br />

out-of-home advertising is impervious to channel or Web surfing<br />

and is immune to audience fragmentation.”<br />

Where the overall advertising industry expanded 6.4 percent<br />

in 2006, says PQ Media, total out-of-home advertising increased<br />

10.6 percent, amplified by 27 percent growth in alternative outof-home<br />

video, which includes in-store video.<br />

20 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

the original warmth without bulk<br />

pioneer<br />

trailblazer<br />

3M and Thinsulate are trademarks of 3M. © 3M 2007<br />

The brand you can count on<br />

Thinsulate TM Insulation from 3M delivers proven high performance<br />

and the power of trusted, well-known brand. Add value to your<br />

products and gain meaningful differentiation where it counts:<br />

at the point of sale.<br />

To have a sales representative contact you,<br />

call 800-831-0658 or visit thinsulate.com<br />

OFFICIAL SUPPLIER

Premiere Retail Networks Largest Customers and<br />

Deployments<br />

Network<br />

Wal-Mart 3,150<br />

Best Buy 830+<br />

Circuit City 635+<br />

SAM’S CLUB 585<br />

Costco 375<br />

Albertson’s 350+<br />

Jewel-Osco 150+<br />

Acme 100+<br />

Shaw’s/Star Market 100+<br />

ShopRite 100+<br />

Pathmark 100+<br />

Source: Company Reports<br />

PRN Stores<br />

Key trends driving the expansion of alternative out-of-home<br />

video, says PQ Media, are quickly evolving technologies; data<br />

indicating that exposure to and recall of these media is growing<br />

as Americans spend more time away from their homes; research<br />

suggesting that the vast majority of consumers view alternative<br />

out-of-home media as favorable and educational; and, most<br />

importantly, the growing perception among advertisers that it<br />

provides highly engaging, targeted options with an unmatched<br />

proximity to the point-of-sale, when customers arguably are<br />

most susceptible to persuasion.<br />

“The main driver of value behind digital in-store media is<br />

the concept of ‘recency,’” agrees RSR’s Baird. In other words, it’s<br />

not just how often a consumer sees an ad (frequency) that matters;<br />

“it’s how long from when they last saw the ad to the point<br />

where they know they ‘need’ a product.”<br />

“How much more ‘primed to buy’ can a consumer be than<br />

when they are standing at the shelf?” she continues.<br />

Still, once again, POS video is an immature platform, even<br />

a bit behind digital billboards and other out of home video, so<br />

there’s much to be done in terms of business models and methods<br />

for deployment. As is the case with most retail technology<br />

investments, chief among the challenges is hardware, more<br />

specifically, its distribution, installation, system integration,<br />

maintenance and cost. According to RSR, for example, 80 percent<br />

of respondents to a survey on in-store technology ranked<br />

challenges surrounding hardware as influential to decisions on<br />

deployment, making it the highest ranked internal barrier to instore<br />

technology investment.<br />

So it appears safe to assume that retailers and their staff<br />

members will begin to really embrace the notion of attaching<br />

video displays to fixtures once low-profile, low-hassle and fairly<br />

maintenance-free setups become available.<br />

Not surprisingly, many of those aforementioned interest parties<br />

understand as much and have moved to develop the solutions.<br />

For its pioneering effort in the outdoor industry, for example,<br />

Zeal Optics has affixed a 7-inch screen, with content preloaded,<br />

to its freestanding sunglasses and goggle display cases.<br />

Dealers who order the minimum 48 units get the display at no<br />

extra cost.<br />

The unit is shipped in two pieces, top and bottom, with the<br />

screen pre-installed. To set up, retailers simply “screw the top<br />

on, screw the bottom, make sure the monitor is affixed properly,<br />

and it works great,” says Jackson.<br />

The monitors run on electricity for now, but Zeal is working<br />

with its supplier on affordable battery-powered options.<br />

The content runs from standard SD cards, the format used<br />

in most consumer digital cameras, so updating information is<br />

as easy as popping in a new disk. Down the road, it’s even conceivable<br />

for Zeal to simply include an updated SD card each<br />

time it sends out a next-season order.<br />

“Due to limited marketing dollars, we’re not able to get that<br />

impression out there,” says Jackson, “so at the very last moment,<br />

we get the customer when they are purchasing the product.”<br />

Elsewhere in other retail verticals, smaller self-contained<br />

video displays attached directly to standard shelving, some<br />

with motion sensors and powered by off-the-shelf, 6-volt batteries,<br />

now are being offered by manufacturers of toys, consumer<br />

electronics, snack food and apparel, among others. In most of<br />

these cases, any staffer or visiting rep that can turn a screw is up<br />

to handling installation.<br />

In the wider picture, the potential of POS video has many<br />

larger retailers investing in retail media networks, which deliver<br />

any type of content through a network of digital devices<br />

within a store or across a large chain of stores. Such a concept<br />

certainly is a bit out of focus for most specialty store operations,<br />

but it’s not totally out of view.<br />

At the end of last year Appia Communications, a provider<br />

of IT and telecom services for small and mid-sized business, began<br />

offering its base of resellers and system integrators a managed<br />

digital signage solution that allows end users to centrally<br />

manage video content pushed to screens across a network of<br />

stores. The Web-based service is hosted on Appia’s servers and<br />

includes a video encoder installed at a main location and a decoder<br />

at every other location to receive the content.<br />

Utilizing a Web-based interface, a user at the main location<br />

would log on to upload the content and then specify which<br />

screen or screens it’s to be deployed on. “The content can be<br />

scheduled independently and to individual screens,” says Nick<br />

Nelbourne, Appia’s marketing manager. “It’s then deployed<br />

automatically.”<br />

Even with the cost efficiencies of IP technology, however,<br />

Appia’s solution remains out of reach for most independent<br />

dealers, but a large vendor could employ the service to push<br />

video messaging out to a small group of select retail partners.<br />

Back in the present, however, there remains more questions<br />

than answers as to what types of POS video will be effective,<br />

when and where; how it provides the best ROI; who will be<br />

most receptive; and even how much it will irritate employees,<br />

and we plan to address some of the challenges in future issues.<br />

There’s plenty of time, no doubt, to figure things out. On the<br />

other hand, it’s not hard to see the writing on the wall – or the<br />

digital sign or smart cart or shelf monitor or kiosk – and words<br />

backed by sound and pictures are harder to ignore.<br />

22 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

Count on Serious Traction.<br />

serious<br />

traction<br />

gear<br />

Whatever the winter activity STABILicers provide the ice traction product you need.<br />

Quick and easy on and off and performance-designed for durability and comfort.<br />

Aggressive cleats bite into ice, rock, snow and pavement, providing unbeatable<br />

traction with every STABILicers product.<br />

800-782-2423<br />

www.32north.com

Brand<br />

Plan<br />

2008<br />

by Martin Vilaboy<br />

Getting reacquainted with customers sits atop<br />

marketing executives’ agendas as they head<br />

toward the next decade<br />

Brand managers and marketers suddenly<br />

have lots of items on their short lists of top<br />

objectivities for the coming year and into<br />

the turn of the decade. A back of the napkin<br />

issue just a few years ago for most, corporate citizenship<br />

appeared rather quickly on radar screens in 2007<br />

and is sure to attract more attention in the near term.<br />

At the same time, the fragmentation of media and<br />

entertainment, as well as consumer segments, will<br />

continue to force marketing executives to chase the<br />

long tail down multiple new media directions.<br />

But despite these expanding frontiers being faced,<br />

the number one New Year’s resolution among a large<br />

group of brand managers and senior marketing executives<br />

concerned a more familiar mission: get to<br />

know my target customer better, picked first by more<br />

than a quarter of respondents to a survey by Next<br />

Level Strategic Marketing Group.<br />

When asked what they would change if given the<br />

opportunity to go back to 2007 and redo one thing, respondents<br />

said their number one regret was a failure<br />

to invest enough time and effort into understanding<br />

what makes their customers tick. More than nine out<br />

of 10 surveyed said “understanding what motivates<br />

and influences my customers” will be of the same or<br />

a higher priority in 2008.<br />

Elsewhere, members of The Marketing Executives<br />

Networking Group last November placed customer<br />

satisfaction (75 percent) and customer retention (65<br />

percent) as the top two issues impacting strategy in the<br />

near term, ahead of several dozen “major trends.”<br />

“What is clear is that the ever-expanding universe of<br />

brands will require an informed action plan,” says Robert<br />

Passikoff, founder of consultancy Brand Keys, “one<br />

that makes sense to the people on the brand and marketing<br />

side of the equation but one that also accurately<br />

identifies and capitalizes upon what people on the consumer<br />

side really feel, really want and really believe.”<br />

Perhaps any rush to get reacquainted with customers<br />

shouldn’t come as a surprise. After all, today’s<br />

customers, from more than one angle, often don’t appear<br />

so familiar.<br />

For one thing, they are more powerful, armed<br />

with rapidly expanding capabilities to access, communicate<br />

and contribute. New technologies provide<br />

a platform for any one willing to take the stand, argue<br />

Deloitte & Touche researchers, making it possible for<br />

individuals to shape perceptions and reputations of<br />

brands and consumer companies like never before.<br />

Nearly two-thirds (62 percent) of consumers surveyed<br />

recently by Deloitte, for example, read consumer-written<br />

product reviews posted on retail sites.<br />

24 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

<strong>Winter</strong> 2008 | <strong>InsideOutdoor</strong> | 25

Woulda, Coulda, Shoulda: Executives Top “Do-Overs” for 2007<br />

marketing. Once a “guerilla tactic,” it’s now Marketers’ Key Initia<br />

a multi-billion dollar industry.<br />

“In the past, clever marketers and advertisers<br />

shaped brands,” says Pat Conroy, U.S. New innovation or lin<br />

28%<br />

group leader at Deloitte & Touche, “but now<br />

Found more creative ways<br />

New marketing initiatives (e.g. new<br />

21%<br />

to reach my target<br />

consumers are increasingly empowered; PR campaigns, loyalt<br />

Focused more effort on my core base<br />

everyone has a voice, and information and<br />

business instead of innovation<br />

17%<br />

opinions are instantly dispersed.”<br />

Reposition my brand to be more<br />

Brands that embrace the change will look<br />

competitive in marketplace<br />

8%<br />

to co-opt customers who can create value in<br />

New advertisin<br />

Product enhancement<br />

Other<br />

7%<br />

a brand or company, says Conroy, building<br />

Re<br />

bases of “brand emissaries.”<br />

Invested in more equity<br />

7%<br />

building activities<br />

Incidentally, other key factors that influence<br />

Packa<br />

consumers’ decisions to purchase a new<br />

Launched a new advertising campaign<br />

5%<br />

to keep brand’s message fresh<br />

Brand architecture initiative to clar<br />

product or brand among the Deloitte consumer<br />

survey include “better for you” in-<br />

and define characteristics of<br />

Fought harder to secure<br />

or keep A&P dollars 4%<br />

Product line and/or bran<br />

gredients or components, eco-friendly usage<br />

Focused more effort on innovation 4%<br />

versus building the base business<br />

and product sourcing, each cited by about Major brand relaunch (new p<br />

Redesigned<br />

40 percent of respondents. Eco-friendly production<br />

and/or packaging was named by 35<br />

new advertising, packagin<br />

1%<br />

my packaging<br />

percent.<br />

Source: Next Level SMG<br />

Source: Next Level SMG<br />

All the while, marketers and their brands<br />

are encountering customers and consumer<br />

Among those, more than eight of 10 say their eventual<br />

purchase decisions have been directly influenced<br />

by the reviews, either confirming original purchase<br />

intent or influencing to buy something else.<br />

And while the percentages were slightly higher<br />

among younger generations, all groups are reading<br />

and reacting to consumer reviews at significant rates,<br />

say Deloitte researchers.<br />

Reach isn’t limited to online user, either, as 69 percent<br />

of consumers who read reviews share them with<br />

friends or colleagues, “thus amplifying their impact,”<br />

says the research firm. Consider “word of mouth”<br />

segments in new and unusual places. Indeed, the<br />

myriad of emerging media platforms and access devices<br />

are enough to make a marketer’s head spin.<br />

Compounding matters further, consumers still are<br />

figuring out for themselves how and when they want<br />

to be touched on different platforms, or if they want<br />

to be touched at certain places at all.<br />

“Senior marketers are facing an increasingly complex<br />

world with new technologies and new market<br />

segments rising to the fore” says Chandra Chaterji,<br />

a member of The Marketing Executives Networking<br />

Group board of directors.<br />

That partly explains why “take more risks”<br />

Marketers’ Key Initiatives to Build their Businesses in 2008 with strategies and “find more creative ways<br />

New innovation or line extension<br />

64%<br />

to reach my target” were the second and third<br />

most popular 2008 resolutions in the Next<br />

Level survey.<br />

New marketing initiatives (e.g. new promotion,<br />

“Marketers’ ingenuity will continue to<br />

63%<br />

PR campaigns, loyalty programs)<br />

expand as the competitive marketplace challenges<br />

New advertising campaign<br />

53%<br />

brands to devise ways to reach their<br />

audiences online and via other ‘out-of-thebox’<br />

Product enhancement or redesign<br />

38%<br />

avenues,” states Bob Liodice, president<br />

and CEO of the Association of National Advertisers.<br />

Repositioning<br />

Package redesign<br />

30%<br />

28%<br />

“Targeting consumers using uncon-<br />

ventional methods in creative places will be<br />

the gold standard for outstanding creative.<br />

“Marketers won’t run away from traditional<br />

media,” he continues, “but will lever-<br />

Brand architecture initiative to clarify the role<br />

21%<br />

and define characteristics of each brand<br />

Product line and/or brand reduction<br />

Major brand relaunch (new positioning,<br />

new advertising, packaging, product)<br />

Source: Next Level SMG<br />

18%<br />

17%<br />

age technology and new media to accentuate<br />

message delivery to consumers and customers.”<br />

In order to navigate this dynamic landscape<br />

and deliver marketing messages where<br />

and when consumers will be most receptive,<br />

Invested more effort in understanding what<br />

motivates and influences my target consumer<br />

26 | <strong>InsideOutdoor</strong> | <strong>Winter</strong> 2008

dri-release microblend performance fabric<br />

Faster Releasing=Greater Comfort<br />

FreshGuard keeps garments fresh<br />

Lasting quality, wash after wash<br />

Dri-release is<br />

RELEASE<br />

FACTOR a real speed<br />

4<br />

demon when<br />

it comes to<br />

liters per hour<br />

moisture<br />

transport —<br />