Spring - InsideOutdoor Magazine

Spring - InsideOutdoor Magazine

Spring - InsideOutdoor Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

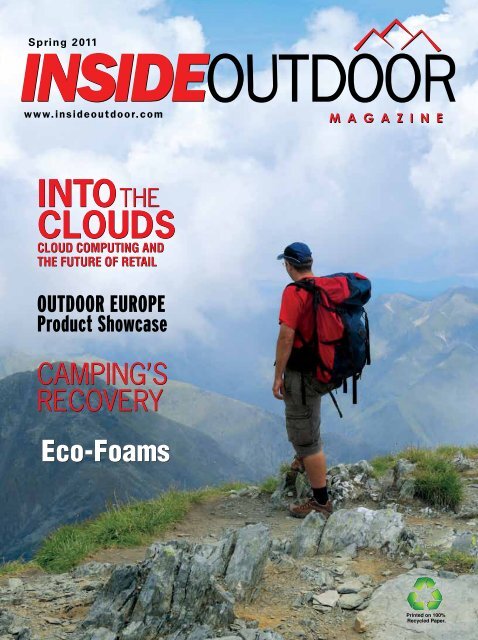

<strong>Spring</strong> 2011<br />

www.insideoutdoor.com<br />

INTO THE<br />

CLOUDS<br />

CLOUD COMPUTING AND<br />

THE FUTURE OF RETAIL<br />

OutDoor Europe<br />

Product Showcase<br />

CAMPING’S<br />

RECOVERY<br />

Eco-Foams<br />

Printed on 100%<br />

Recycled Paper

Blocks the sun, rain and<br />

snow while keeping your<br />

ears warm and allowing<br />

breathability<br />

One size fits all comfortably<br />

Seasonal styles avaliable

C O N T E N T S<br />

<strong>Spring</strong> 2011<br />

14<br />

Departments<br />

DATA POINTS<br />

8 NUMBERS WORTH NOTING<br />

Mobile’s message; social roles; ads with impact; advancing<br />

LP; cries for help; and more<br />

RETAIL TECH BYTES<br />

20 eBay in-store; Geigerrig plays tag<br />

21 Google’s big wallet; outdoor surveillance<br />

23 QR decoded; Carhartt gets SaaS<br />

24<br />

BACK OFFICE<br />

36 TAKE IT TO THE BANK<br />

Improving your banking relationship<br />

GREEN SHEETS<br />

38 MATERIAL GAINS<br />

Eco updates from NWAFMA<br />

By Ernest Shiwanov<br />

FEATURES<br />

42 THE GREEN GLOSSARY<br />

Defining the movement<br />

6 Letter from the Editor<br />

12 Rep News and Moves<br />

46 Advertiser Index<br />

14 CLOUD FORMATIONS<br />

Cloud computing provides specialty retailers with a cost-effective and<br />

infinitely scalable path to launching new capabilities and rebuilding infrastructure<br />

at a time when existing IT systems are becoming dangerously obsolete.<br />

By Martin Vilaboy<br />

24 CAMPING’S RECOVERY<br />

A rebound in camping participation wrought by a recessionary pull back leaves us<br />

with some encouraging news and a few slivers of opportunity, as well as some<br />

interesting and less-expected challenges.<br />

By Martin Vilaboy<br />

28 FRESH IN FRIEDRICHSHAFEN<br />

Whether or not you will be making the journey to Germany,<br />

here’s a small preview of what will be on display this summer<br />

at the OutDoor trade show in Friedrichshafen.<br />

4 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011

YOUR PASSION.<br />

OUR TECHNOLOGY.<br />

HIGHGEAR AXIO MAX<br />

The Axio Max is an exercise in balance; sleek design<br />

with rugged durability, relevant features with an intuitive<br />

interface. Get the most out of your altimeter with the<br />

Highgear Axio Max.<br />

+ Altimeter/Barometer<br />

+ 12 hour weather forecast icon<br />

+ Digital thermometer<br />

+ Digital Compass with adjustable declination<br />

+ 100 hour chronograph<br />

+ 10 run data storage<br />

+ Time/Day/Date<br />

+ Dual time zone<br />

+ 2 daily alarms<br />

+ 1 rest alarm<br />

+ 1 hydration alarm<br />

+ 2 altitude alarms<br />

SUMMIT SERIES<br />

ADVANCED TOOLS FOR VERTICAL PLACES<br />

WWW.HIGHGEAR.COM

Editor’s Letter<br />

Talking Tech<br />

It used to be that specialty retail owners and c-level executives could get by with<br />

minimal knowledge of retail technology systems. Sure, technology could create<br />

efficiencies and automate time-consuming processes, but it hasn’t always been<br />

inherent to a retail organization’s success or failure.<br />

If decision-makers knew their respective markets, and assuming most elements<br />

of the core business were properly managed (inventory, assortment, customer<br />

service, employee resources, balance sheet, etc.), a working knowledge of IT<br />

by and large could be left to a trusted IT department. In many cases, that simply<br />

meant a trained employee or two with some understanding of computer and POS<br />

systems. It’s one of the reasons why the retail vertical has been among the lightest<br />

spenders of technology dollars.<br />

This distant understanding among line-of-business departments was sufficient<br />

when technology, for the most part, was a back-office concern, a means to building<br />

efficiencies into existing processes rather than a driving force in revenue creation.<br />

When technology moves out of the back office and into the hands of customers,<br />

however, it suddenly becomes everyone’s business.<br />

You don’t have to be an IT consultant to know that your customers are adopting<br />

Internet protocol-based (IP) and digital technologies at unprecedented rates, and<br />

that’s fundamentally changing the way you communicate and transact with those<br />

customers, as it re-shapes their behavior and expectations. There’s little reason<br />

to believe the trend won’t continue, and as consumer technologies grow more<br />

ingrained into everyday life, retail technology no longer can be treated as an internal<br />

matter. In other words, IT investments and strategies no longer are driven by the<br />

wants and needs of IT departments. Consumers simply are moving too fast.<br />

As many readers likely are aware, the staff here at Inside Outdoor, along<br />

with covering the outdoor retail market, also produces technology titles. More<br />

specifically, we offer print and online resources for Internet, communications and<br />

other technology solutions providers. When people first here of our dual role, the<br />

typical reaction usually includes comments on how telecom and outdoor must<br />

differ dramatically or how simultaneously working in those seemingly disconnected<br />

worlds must be like exercising both sides of the brain at once.<br />

Such notions used to be easier to support. During the past few years, however,<br />

we have seen more and more crossover between these once-distinct universes.<br />

We see outdoor retailers, such as Moosejaw and REI, leading the digital commerce<br />

transformation, and we see technology solution providers increasingly focusing on<br />

the technological challenges facing retailers large and small. Consider, for example,<br />

one recent survey of mobile industry executives who were asked to name the<br />

business vertical that would be most impacted by mobility in 2011. Retail was<br />

named more than twice as often as all other choices, picked number one by nearly<br />

50 percent of respondents, show the findings from Chetan Sharma Consulting.<br />

Witnessing this convergence of retail and consumer technologies first hand,<br />

it only makes sense for us to further leverage our expertise in areas such as<br />

communications and Internet applications, networking, mobility, system integration<br />

and the like into the pages of IO. So, moving forward you can expect to see<br />

increased coverage of these and other technologies as a means of assisting<br />

readers with the challenges they face in the mainstreaming of e-commerce and<br />

m-commerce and the subsequent emergence of “everywhere commerce.”<br />

It’s your customers, after all, that now are dictating the pace of your technology<br />

adoption, and we firmly believe no other publication in the outdoor market is in<br />

better position to help outdoor retail companies keep pace. –MV<br />

Martin Vilaboy<br />

Editor-in-Chief<br />

martin@bekapublishing.com<br />

Percy Zamora<br />

Art Director<br />

outdoor@bekapublishing.com<br />

Ernest Shiwanov<br />

Editor at Large<br />

ernest@bekapublishing.com<br />

Berge Kaprelian<br />

Group Publisher<br />

berge@bekapublishing.com<br />

Jennifer Vilaboy<br />

Production Director<br />

jen@bekapublishing.com<br />

Suzanne Urash<br />

Ad Creative Designer<br />

suzanne@cre8groupinc.com<br />

Beka Publishing<br />

Berge Kaprelian<br />

President and CEO<br />

Philip Josephson<br />

General Counsel<br />

Jim Bankes<br />

Business Accounting<br />

Corporate Headquarters<br />

745 N. Gilbert Road<br />

Suite 124, PMB 303<br />

Gilbert, AZ 85234<br />

Voice: 480.503.0770<br />

Fax: 480.503.0990<br />

Email: berge@bekapublishing.com<br />

© 2011 Beka Publishing, All rights reserved.<br />

Reproduction in whole or in any form or<br />

medium without express written permission<br />

of Beka Publishing, is prohibited. Inside<br />

Outdoor and the Inside Outdoor logo are<br />

trademarks of Beka Publishing<br />

6 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011

Data Points<br />

Numbers worth noting<br />

by Martin Vilaboy<br />

Mobile Experts Pick Retail<br />

Still wondering if and to what extent mobility will<br />

impact your business model? Well, the folks driving the<br />

mobile revolution seem pretty confident the change will be<br />

dramatic. When a group of mobile company executives and<br />

insiders were asked to pick the business vertical that would<br />

be most impacted by mobile technologies, retail was the<br />

overwhelming number one choice, says telecom analyst<br />

Chetan Sharma. Indeed, it was pegged for change about<br />

three times more often than the next-closest responses.<br />

Which enterprise segment will mobile<br />

impact the most?<br />

prevention equation. What’s more, “we are starting to see<br />

radio frequency (RFID) gain some traction as part of an instore<br />

LP program,” says RSR.<br />

Budgeted or Planned Loss Prevention<br />

Technology Projects<br />

Real-time alerts on POS overrides 32%<br />

Automated returns processing 29%<br />

Workforce management systems 22%<br />

Computer-based training 21%<br />

Returns and void management 20%<br />

Statistical fraud detection/analytics 18%<br />

Retail<br />

Sales<br />

Health<br />

Field Force<br />

Education<br />

Others<br />

Energy<br />

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%<br />

Source: Chetan Sharma Consulting<br />

Women are from Facebook,<br />

Men from LinkedIn<br />

According to a new Empathica study, men and women<br />

use social media differently when interacting with a retail<br />

brand through social channels, with more men citing looking<br />

for information as a primary goal (36 percent) than women<br />

(28 percent). The gender split Other among staff members those looking do to stretch<br />

less work than I do<br />

their budgets was even greater: 47 percent of women say<br />

searching for Little coupons time to help and promotions customers because is their of primary use,<br />

pressure to get other tasks completed<br />

compared with 33 percent of men. Women also are more<br />

likely to recommend Manager a is brand, not aware product of all the or service things<br />

I do during my shift<br />

through a<br />

social network, with 35 percent doing so, compared with 28<br />

Finding out I need to replenish product<br />

percent of men. after getting complaints, instead of<br />

knowing ahead of time<br />

When customers can’t find what they’re<br />

looking for, it’s hard for me to get the<br />

To Catch information a Thief I need to help them<br />

Retailers, Checking by and the large, price of are items using for the customers same familiar<br />

methods to fight shrinkage: video surveillance, audits, cash<br />

and return<br />

Inability<br />

and void<br />

to easily<br />

management,<br />

communicate<br />

etc.<br />

with<br />

But<br />

other<br />

associates or my manager to ask for<br />

analysts<br />

help<br />

at Retail<br />

Systems Research are seeing greater interest in automated<br />

Customers with smartphones who have<br />

tools as part of an more effort information to take people about products out of the loss<br />

and prices than I have<br />

8 | <strong>InsideOutdoor</strong> Boredom and<br />

|<br />

too <strong>Spring</strong> much downtime 2011<br />

Procedural reviews 15%<br />

Exception analysis reporting 13%<br />

Radio frequency shoplifting prevention systems 13%<br />

Source: Retail Systems Research<br />

During a typical shift on the retail floor, what are the biggest<br />

frustrations you experience in doing your job?<br />

TV Ads Still Worth Watching<br />

Though some prematurely have sounded its death knell,<br />

TV is still the king of all media, especially when it comes to ad<br />

messaging and purchasing influence. Deloitte found that 71<br />

percent of American’s still rate watching TV programing among<br />

their favorite media activities, while 83 percent of Americans<br />

said TV advertising still has the most impact on their buying<br />

decisions. Conversely, the ability of ads on Web sites to<br />

move traffic to other sites has dropped from 72 percent to 59<br />

percent over the past three surveys. And while on the topic of<br />

legacy media, more than half of consumers (60 percent), and<br />

even 64 percent of Millennials, claim to pay more attention<br />

to magazines ads than any form of online advertising.<br />

Advertising with Most Impact on Buying Decision<br />

Media Type<br />

TV 83%<br />

<strong>Magazine</strong>s 50%<br />

Online 47%<br />

Newspapers 44%<br />

Radio 32%<br />

Billboards/outdoor advertising 13%<br />

In-theater advertising 11%<br />

Source: Deloitte, March 2011<br />

% of Respondents

Permanent, temperature-regulating<br />

fiber technology with odor control<br />

and softness that never washes out.

Health<br />

eld Force<br />

ducation<br />

Others<br />

Data Points<br />

Field Force<br />

Education<br />

Others<br />

Energy<br />

Energy<br />

Employee Pain Points<br />

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Source: Chetan Sharma Consulting<br />

Source: Chetan Sharma Consulting<br />

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50%<br />

The Parent Trap<br />

The best way for the outdoor industry to attract a<br />

What’s bothering your staff the most? According to a<br />

survey of North American retail employees, top frustrations younger audience, it turns out, may have less to do<br />

During a typical shift on the with retail hip floor, imagery what and are urban the biggest outreach<br />

frustrations you experience programs in doing your and more job?<br />

During a typical shift on the retail floor, what are the biggest<br />

to do with Mom<br />

frustrations you experience in doing your job?<br />

and Dad. According to findings from The<br />

Other staff members do<br />

less work than I doOutdoor Foundation, three-quarters of<br />

Other staff members do<br />

children ages 6 to 12 are influenced in<br />

less work than I do<br />

Little time to help customers because of<br />

pressure to get other tasks completedtheir participation in outdoor activities by<br />

Little time to help customers because of<br />

Manager is not aware of all the things<br />

pressure to get other tasks completed<br />

their parents. As children age, of course,<br />

I do during my shift<br />

Manager is not aware of all the things<br />

Finding out I need to replenish producttheir parents’ role in their participation<br />

I do during my shift<br />

after getting complaints, instead of<br />

knowing ahead of timediminishes, and friends gain an<br />

Finding out I need to replenish product<br />

after getting complaints, instead of<br />

When customers can’t find what they’reincreasingly influential role. But why wait<br />

knowing ahead of time<br />

looking for, it’s hard for me to get the<br />

information I need to help themuntil the teenage years when distractions<br />

When customers can’t find what they’re<br />

looking for, it’s hard for me to get the<br />

Checking the price of items for customersfrom team sports, dating, text messaging<br />

information I need to help them<br />

and social networks are more abundant?<br />

Inability to easily communicate with other<br />

Checking the price of items for customers<br />

associates or my manager to ask for help<br />

Inability to easily communicate with other<br />

Customers with smartphones who have<br />

associates or my manager to ask for help<br />

more information about productsCustomer<br />

and prices than I have<br />

Customers with smartphones who have<br />

more information about products<br />

Boredom and too much downtimePain Points<br />

and prices than I have<br />

Your employees aren’t the only ones<br />

Boredom and too much downtime<br />

0% 10% 20% 30% 40% 50% 60%<br />

frustrated by time management and<br />

0% 10% 20% 30% 40% 50% 60% accountability Associate issues. When Manager asked about<br />

the impact of different aspects of the<br />

Associate<br />

Manager Source: Motorola Solutions<br />

shopping experience to overall satisfaction,<br />

Source: Motorola Solutions<br />

+7%<br />

Please rate your overall satisfaction with each of the following<br />

center on accountability and time management. Meanwhile, aspects of you shopping experience during the past four weeks.<br />

about a third Please of employees rate your feel overall they lack satisfaction the adequate with each of the following<br />

% Not satisfied<br />

respondents<br />

information aspects to serve of customers. you shopping Managers, experience in particular, during feel the past four weeks.<br />

(excludes NA)<br />

Ease of finding<br />

% Not satisfied<br />

20%<br />

the pressure of out-of-stock complaints.<br />

correct prices<br />

respondents<br />

(excludes NA)<br />

Ease<br />

INTER- OR of finding<br />

INTRA-CHANNEL<br />

Availability 20% of the items<br />

I wanted in stock<br />

When most Availability people of talk the items about cross-channel retail, they Availability of information<br />

are referring to activities I wanted that in stock<br />

you could find 25% on your own<br />

cross physical and online stores.<br />

in the store<br />

But many retailers Availability increasingly of information face a cross-channel problem<br />

Time spent waiting in<br />

you could find on your own<br />

line and pay/checkout<br />

28%<br />

that lives completely in the store digital space, without touching<br />

25%<br />

28%<br />

33%<br />

stores at all, show Time spent findings waiting from in<br />

Availability of coupons<br />

RSR Research. From 2009 to<br />

line and pay/checkout<br />

and 33% discounts<br />

35%<br />

2010, the number of retailers reporting that they only operate<br />

Availability of<br />

one online site Availability fell from of coupons 45 percent to 34 percent, and the<br />

35% staff/sales<br />

37%<br />

and discounts<br />

associate help<br />

number of retailers reporting that they operate two to four<br />

Availability of<br />

sites increased from 30 percent to 40 percent.<br />

37%<br />

0% 20% 40% 60% 80% 100%<br />

staff/sales<br />

associate help<br />

Very satisfied Somewhat satisfied Does not apply/Does not matter to me<br />

0% 20% 40% 60% 80% 100% In between Somewhat dissatisfied Very dissatisfied<br />

Unique Online Sites Operated Today by Retail<br />

Very satisfied Somewhat satisfied Does not apply/Does not matter me<br />

Company, by KPI Breakdown<br />

Source: Motorola Solutions<br />

In between Somewhat dissatisfied Very dissatisfied<br />

Winner Plus Winners Average Laggards<br />

Source: Motorola Solutions<br />

More than 4 50% 11% 21% 11%<br />

consumers surveyed by Motorola Solutions similarly<br />

Two to four 13% 48% 42% 11%<br />

expressed the greatest dissatisfaction over the availability of<br />

One 25% 33% 32% 56%<br />

help from store associates. A lack of discounts and coupons,<br />

None 13% 7% 5% 22%<br />

Visitor Growth at OutDoor<br />

not surprisingly, also was high on the list.<br />

+6%<br />

Source: Retail Systems Research<br />

+12% +2%<br />

Visitor Growth at OutDoor<br />

+6%<br />

+7% +2%<br />

10 |<br />

+12% +2%<br />

<strong>InsideOutdoor</strong><br />

+2% +8% | <strong>Spring</strong> 2011<br />

itors<br />

itors<br />

itors<br />

itors<br />

itors<br />

itors

Rep moves and news<br />

Throughout the first quarter of<br />

2011, a slew of outdoor manufacturers<br />

honored their top-producing indirect<br />

sales forces with 2010 reps of the year<br />

awards. Our congratulations go to all<br />

these well-deserved road warriors.<br />

Starting in no particular order,<br />

Mountainsmith said Sanitas Group<br />

has won its 2010 Anvil Award for Agency<br />

of the Year. In a flat market, the group,<br />

headed up by industry veterans Keith<br />

Reis and Andy Anderson, led a surge<br />

in sales and market share in their Rocky<br />

Mountain territory to secure the honor.<br />

In the two years that they have been<br />

in sales with Mountainsmith, they<br />

have grown the region by 40 percent<br />

and exceeded their 2010 sales goal<br />

by nearly 30 percent. Both Reis and<br />

Anderson had held prior positions within<br />

Mountainsmith, which gave them a head<br />

start when they took over the territory,<br />

said the company.<br />

Over at Buck Knives, 2010 Sales<br />

Rep Agency of the Year went to Upper<br />

Canada Sports of Toronto, while co-<br />

Sales Reps of the Year were awarded<br />

to Al Belhumeur of Pro Line Sports<br />

in British Columbia, and Lynn Tackett<br />

of Tackett Brothers in Dallas. Upper<br />

Canada Sports, Pro Line Sports and<br />

Tackett Brothers are independent<br />

manufacturer’s representatives with<br />

long standing relationships with Buck<br />

Knives. “All of these men and women<br />

representing these groups understand<br />

the importance of providing good<br />

service before and after the sale. They<br />

truly understand what Buck Knives is all<br />

about,” said CJ Buck, president of Buck<br />

Knives.<br />

Cascade Designs, meanwhile,<br />

bestowed its 2010 Rep Agency of<br />

the Year award to Summit Sales of<br />

Bainbridge Island, Wash. Summit Sales,<br />

led by principal David Fitzgerald and<br />

including Patrick Cook, Rob Birzell,<br />

Justin McGregor, Anna Baze and Kris<br />

Stahl, has been representing Cascade<br />

Designs’ brands for 10 years. This award<br />

recognizes their consistent and growing<br />

performance, year after year, with<br />

investments made in their agency to<br />

offer outstanding support and service to<br />

their customers in Washington, Oregon,<br />

Idaho and Montana.<br />

Awards were given out at<br />

Longworth Industries, as well, the<br />

parent company of Polarmax, XGO,<br />

and AYG 365’s branded technical base<br />

layers. Robb Sports took home the<br />

Agency of the Year award, while Patti<br />

Fisher was named Rep of the Year for<br />

2010. In their first year representing<br />

Polarmax, Rob Robinson, Dan Williams<br />

and Bill Kendall of Robb Sports opened<br />

many new doors and increased sales<br />

across their Southeastern U.S. territory,<br />

while Smith set the bar high for 2011<br />

with tremendous increases in Polarmax<br />

sales in December alone. Fisher’s<br />

territory includes Southern California,<br />

Arizona and parts of Utah and Nevada.<br />

Turning for a moment to internal<br />

sales teams, Cutter & Buck recently<br />

SuperFabric<br />

material<br />

®<br />

by HDM, Inc. TM<br />

brand<br />

®<br />

HDM<br />

HDM, Inc.<br />

570 Hale Ave.<br />

Oakdale, MN 55128<br />

(651)-730-6203<br />

email: outdoor@superfabric.com<br />

www.SuperFabric.com<br />

12 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011

announced its annual sales awards<br />

with Scott Cunningham taking top<br />

honors as the 2010 Salesperson<br />

of the Year. Cunningham has<br />

been with Cutter & Buck for<br />

nearly 20 years, serving as a<br />

sales representative since 1991.<br />

He came to Cutter & Buck at the<br />

beginning of its second season and<br />

has been instrumental in building<br />

relationships with customers while<br />

bringing on new accounts, says<br />

the company. He serves as one of<br />

five team leaders within the company,<br />

“adding tremendous value as a<br />

mentor and industry veteran to his role.”<br />

Cunningham now calls Arizona home<br />

but has worked in California and other<br />

regions since joining the company.<br />

Hardware also was handed out at<br />

Chaos Headwear. Rocky Mountain<br />

region-based Best and Associates,<br />

which had taken the title for the<br />

previous two years and came in a close<br />

second last year, returns back to the<br />

top as Chaos’ Sales Agency of the Year<br />

2010. The award, based on set sales<br />

criteria such as most new accounts,<br />

From left to right: Dominic Shenelia, Chaos sales<br />

director; Mary Anne & Brent Best of Best and<br />

Associates; Gary Supple, Chaos U.S. director<br />

most pre-season orders and re-orders,<br />

co-brands, branding and merchandising,<br />

includes a monetary bonus, a plaque<br />

and one oversize check. In line for the<br />

second highest sales was last year’s<br />

winner, Sam Adams of Western<br />

States Sales Marketing, who has<br />

built the Pacific Northwest territory<br />

(Washington, Oregon, Utah, Nevada,<br />

Montana) into one of the top territories<br />

in the country for Chaos.<br />

And KNS Reps of the Rocky<br />

Mountain region had such a strong year<br />

that it was honored by two separate<br />

outdoor companies in 2010. Despite<br />

having just three representatives<br />

in the field, KNS received Rep of<br />

the Year honors from SCARPA<br />

NA, while Big Agnes named Kirk<br />

Haskell and Scott Sutton of KNS<br />

Reps as winners of its Sales Reps<br />

of the Year award. The KNS reps<br />

yielded more than a 20 percent<br />

overall growth in spring and fall of<br />

2010 for SCARPA in their region<br />

as well as a 16 percent increase<br />

in pre-season bookings for Fall 2010<br />

and a 34 percent increase for <strong>Spring</strong><br />

2011. The two KNS Reps also lead all<br />

Big Agnes sales territories in terms of<br />

highest growth percentage, pre-season<br />

participation and future commitments.<br />

They also procured the most new dealer<br />

bookings for 2010.<br />

Big Agnes also acknowledged<br />

runner-up sales agency, Three<br />

Mountain Associates Inc., including<br />

Tom McCarthy, Mike Cullerot and<br />

George Lesure, for their strong sales<br />

performance in 2010.<br />

Once again, a deserving pat on the<br />

back goes to all these winners.<br />

<strong>Spring</strong> 2011 | <strong>InsideOutdoor</strong> | 13

Cloud<br />

Form<br />

Cloud computing and<br />

the future of retail<br />

by Martin Vilaboy<br />

Partly because of the inherent complexities<br />

and partly due to overzealous<br />

marketing, any discussion of “the<br />

cloud” should probably start with a<br />

clarification of what exactly “cloud<br />

computing” means to technology decision<br />

makers. Some have said the cloud is simply a euphemism<br />

for the Internet. Others argue that it’s really<br />

nothing new but rather just a return to “centralized”<br />

versus “distributed” computing, made accessible now<br />

by the ubiquity of high-speed data networks.<br />

As much truth as there may or may not be in<br />

these oversimplifications, neither should be used as<br />

an excuse to disregard the importance of what the<br />

cloud is and can do, particularly when it comes to<br />

the retail business. As it turns out, many of the benefits<br />

wrought by moving IT components to the cloud<br />

directly address the daunting challenges and macro<br />

trends facing retail IT departments today. In fact, it’s<br />

even possible that the retail segment, at least in the<br />

short term, has more to gain from the cloud trend<br />

currently sweeping the IT world than most any other<br />

industry vertical. Indeed, many retail analysts and experts<br />

believe that a transition to the cloud could prove<br />

necessary to individual retailer’s survival long term.<br />

Getting back to the beginning, The National Institute<br />

of Standards and Technology, for its part, defines<br />

cloud computing as, “a model for enabling convenient,<br />

on-demand network access to a shared pool<br />

of configurable computing resources (e.g., networks,<br />

servers, storage, applications and services) that can be<br />

rapidly provisioned and released with minimal management<br />

effort or service provider interaction.”<br />

NIST’s definition may or may not clear things<br />

up. If not, most specialty retailers can think of cloud<br />

computing as a model by which computing and IT<br />

services and capabilities can be accessed anywhere,<br />

on any device, through the Internet. That differs<br />

from the traditional IT delivery model, whereby<br />

hardware, such as servers and storage devices, as<br />

well as software purchased through a license, would<br />

reside at the physical location at which they are being<br />

used. In the cloud, on the other hand, equipment and<br />

business applications are housed on servers in large<br />

data centers where a paid or “for-free” provider hosts<br />

14 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011

Ongoing concerns about solution<br />

vendor or service provider stability<br />

and longevity<br />

We don’t like sharing our<br />

innovations with outsiders<br />

Source: RSR Research<br />

18%<br />

5%<br />

16%<br />

9%<br />

0 10 20 30 40 50 60 70 80<br />

ations<br />

How much do each of the following factors influence how<br />

your company’s technology portfolio will change?<br />

We want to spend less time on “catch up”<br />

investments in IT, and spend more time<br />

differentiating with IT-enabled capabilities<br />

52%<br />

48%<br />

We need to shorten the lead time<br />

to customer demand fulfillment<br />

47%<br />

48%<br />

and manages the solutions, as well<br />

Rapid<br />

as<br />

consumer<br />

cloud<br />

adoption<br />

or engage<br />

of new<br />

a third-party provider at Retail Systems 47%<br />

technologies such as “smart mobile”,<br />

Research, with the<br />

the user’s experience with “social them. media”, Cloud etc. is forcing to host us and to “go manage faster” it – either on site or user having 34% no knowledge or concern of<br />

services ranging from raw infrastructure off. A private cloud provides restricted where any individual piece resides.<br />

We need to overcome an ingrained “not<br />

41%<br />

to complete business processes invented (email, here” attitude access and take to the advantage computing capabilities and “This is different than a simple hosted<br />

of what’s commercially available<br />

31%<br />

accounting, CRM, scheduling, forecasting,<br />

resources to be shared only by employ-<br />

application accessed remotely,” says RSR.<br />

as examples) are purchased and ees or external partners, such as distrib-<br />

“Parts could well reside on a local device.<br />

We need to reduce ongoing maintenance<br />

41%<br />

accessed through Web interfaces. costs associated with utors owning and manufacturers.<br />

solutions<br />

It’s completely location 45% agnostic.”<br />

That might sound a lot like how<br />

Most retailer deployments up to this<br />

we’ve come to know and use the Internet,<br />

point, suggest findings from<br />

Winners<br />

Accenture, involve<br />

OthersCut and Paste<br />

you might say. In many ways, this<br />

is precisely how routed networks based<br />

on Internet protocol (IP) work, and the<br />

pervasiveness of high-speed access is<br />

largely what makes cloud computing so<br />

powerful. But before you start cringing<br />

over the idea of placing your customer<br />

data or communications services on the<br />

either a private cloud or some type<br />

of Source: “hybrid RSR model,” Researchthe managed combination<br />

of both private and public clouds.<br />

“So, for example, low level data and<br />

access may well be suitable to go onto a<br />

public cloud infrastructure service with<br />

simple password access, whereas ultra<br />

The primary promises of the cloud<br />

include enhanced flexibility and speed<br />

at significantly lower costs, and few<br />

vertical markets need to drive such advantages<br />

out of their IT infrastructures<br />

during the next several years more than<br />

retail/wholesale.<br />

wild and open Internet, it’s first important<br />

to have an understanding of the<br />

differences between the “public cloud”<br />

The shopper is better connected to consumer information<br />

than store associates.<br />

(Percentage of responding retail employees)<br />

and a “private cloud.”<br />

According to executives at IBM, the<br />

Completely<br />

Agree<br />

Neutral Disagree Completely<br />

Agree<br />

Somewhat<br />

Somewhat Disagree<br />

infrastructure in a public cloud is owned<br />

and managed by an organization selling<br />

cloud services and is made available to<br />

the general public. In this model, computing<br />

capabilities typically are accessed<br />

17% 37.5% 26.1% 15.3% 4.1%<br />

by multiple subscribing clients on a flexible,<br />

pay-per-use basis.<br />

Most people associate the public<br />

cloud with “community-based” offerings<br />

0%<br />

Source: Motorola Solutions<br />

50% 100%<br />

accessed over the public Internet,<br />

such as Google Apps, explains Joe<br />

Corvaia, vice president of solution<br />

engineering at cloud services provider<br />

Broadview Networks.<br />

secure data may require dedicated secure<br />

servers housed in ultra-secure data centers<br />

with strong authentication required<br />

for access,” explain Accenture analysts.<br />

Cloud computing also differs somewhat<br />

For starters, the retail industry<br />

doesn’t like to spend a lot on technology.<br />

Retail IT operating budgets, as a percentage<br />

of revenue, are typically among<br />

the lowest of all the major industries,<br />

from for the Using purely the “centralized Cloud com-<br />

The infrastructure in a private Initial cloud, Opportunities<br />

and we don’t expect that many retail<br />

on the other hand, is operated solely puting” model in that pieces and parts CFOs are anxious to shake this dubious<br />

distinction. By moving IT resources<br />

for a particular user organization. Easy This of an application and its associated data<br />

New Busin<br />

organization can either own the private can reside anywhere, explain analysts to the cloud, retail IT departments<br />

•<br />

can<br />

Provide IT support fo<br />

Business Continuity (storage)<br />

• Extensive storage<br />

• Back up & recovery<br />

<strong>Spring</strong> 2011 | <strong>InsideOutdoor</strong> | 15<br />

Batch and data intensi<br />

• One-off applications that don’t r

We need to overcome an ingrained “not<br />

invented here” attitude and take advantage<br />

of what’s commercially available<br />

31%<br />

41%<br />

We need to reduce ongoing maintenance<br />

continue<br />

costs associated<br />

to do<br />

with<br />

more<br />

owning<br />

with<br />

solutions<br />

less by all but<br />

eliminating the cost of servers, software<br />

licenses, maintenance fees, IT labor and<br />

data center space and the electricity to<br />

Source: RSR Research<br />

power and cool them. IT cloud solutions,<br />

rather, can be purchased on-demand,<br />

only as needed, replacing large upfront<br />

investments with a monthly recurring<br />

cost or a pay-per-use operating expense.<br />

“The no-obligation, month-to-month<br />

subscription allows retailers to fine<br />

tune their IT spend,” says Jim Saffron,<br />

than store associates.<br />

president of GreenAppX, a Charlotte,<br />

N.C.-based reseller of cloud-based communications<br />

and business services.<br />

And replacing opex Completely<br />

Agree<br />

for capex is just<br />

the beginning. According to one IBM<br />

study, 70 percent of retail IT budgets, on<br />

average, is spent maintaining current<br />

infrastructures, with annual operational<br />

costs (such as power, cooling and<br />

management) of distributed systems and<br />

networking often exceeding double their<br />

acquisition costs. Source: What’s Motorola more, Solutions these<br />

costs continue to increase.<br />

In the cloud computing model,<br />

however, the management, maintenance,<br />

housing of equipment, software updates<br />

Winners<br />

41%<br />

and system upgrades all are handled 45% by<br />

the cloud provider as part of the service<br />

at a flat or Others per-use fee. In addition to<br />

eliminating variable support cost, this<br />

also allows the retailer to focus on its<br />

core business while maintaining minimal<br />

in-house staff and expertise.<br />

Then there’s the issue of utilization.<br />

Studies by IBM suggest that utilization<br />

rates of commodity servers, for example,<br />

hover around 5 percent to 15 percent.<br />

In other words, “as much as 85 percent<br />

of retail computing capacity sits idle in<br />

distributed environments,” argues Vish<br />

Ganapathy, solutions architect for the<br />

retail industry at Neutral IBM. Disagree<br />

Somewhat<br />

This is one area in particular that<br />

retailers are attacking early on through<br />

a cloud strategy, says Don Douglas, 15.3% 4.1%<br />

president and CEO of Liquid Networx,<br />

a San Antonio, Texas-based provider<br />

of network managed services and IT<br />

lifecycle management.<br />

“We see retailers using the cloud to<br />

minimize footprint at remote locations,<br />

which reduces costs, provides flexibility,<br />

speeds advances to market and usually<br />

enhances security,” says Douglas.<br />

The shopper is better connected to consumer information<br />

(Percentage of responding retail employees)<br />

Agree<br />

Somewhat<br />

17% 37.5% 26.1%<br />

0% 50% 100%<br />

“These benefits can be achieved fairly<br />

quickly by implementing a private cloud<br />

that is supported at headquarters and<br />

by having the different locations utilize<br />

those resources.”<br />

As Douglas suggests, arguably as<br />

important as the IT cost savings are the<br />

elements of “speed” and “flexibility.”<br />

While retail is not the first and only<br />

industry to feel the disruption of the<br />

digital revolution, few verticals face<br />

the types of transformational shifts that<br />

retailers face in terms of changing consumer<br />

behaviors and expectations. From<br />

smartphone-enabled shoppers, mobile<br />

Completely wallets and geo-location campaigns<br />

Disagree<br />

to Groupon and social networking to<br />

QR codes and RFID to localized assortments<br />

and personalized promotions, the<br />

move online has come to represent lots<br />

more than a new sales channel. Indeed,<br />

a pervasive Internet and its “anytime,<br />

anywhere, any device” digital technologies<br />

have ramped up the level of<br />

competition for everyone, subsequently<br />

squeezing margins and forcing retailers<br />

to re-evaluate every aspect of their businesses.<br />

Success moving forward, at least<br />

Initial Opportunities for Using the Cloud<br />

Easy<br />

Ease of Implementation<br />

Business Continuity (storage)<br />

• Extensive storage<br />

• Back up & recovery<br />

Desktop productivity<br />

• Web 2.0 applications<br />

• Workgroup applications<br />

• Office suites<br />

• Email and calendaring<br />

Software development and testing<br />

• Development and testing environment<br />

• Performance testing<br />

• Non production projects<br />

• R&D activities<br />

• Reduced time to market<br />

Geographic expansion<br />

• Replicate standard processes in new<br />

locations and branches<br />

New Business<br />

• Provide IT support for new ventures<br />

Batch and data intensive applications<br />

• One-off applications that don’t rely on real-time responses<br />

• Data and high performance intensive applications<br />

(financial risk modeling, data compression,<br />

graphic rendering, simulation, etc.)<br />

• New back office applications<br />

Peak load demands<br />

• New business activities<br />

• Applications with peak loads<br />

• Seasonal Web sites<br />

• Applications with scalability needs<br />

Hard<br />

Legacy<br />

• Specific existing infrastructure<br />

• Complex legacy systems<br />

Sensitive applications<br />

• Mission critical applications<br />

• Regulation-protected data (PCI, SOX ...)<br />

Source: Accenture Technology Labs<br />

Value to the Enterprise<br />

High Value<br />

2<br />

16 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011

as far as any trend- or fashion-based<br />

retail goes, likely will require shorter<br />

cycle times, more specialized inventory,<br />

tighter supply chain integration,<br />

faster and more effective execution of<br />

sales and marketing and more efficient<br />

resource planning.<br />

“Business conditions and cycles have<br />

sped up dramatically,” warn analysts at<br />

Retail Systems Research, “the consumer<br />

is stunningly technologically savvy, and<br />

business departments, most especially<br />

marketing, must respond.”<br />

“In general, total disclosure is available<br />

to anyone, anywhere from any<br />

device,” says Saffron. “Retailers need to<br />

use the same tools that the smart consumers<br />

use to improve infrastructure,<br />

delivery and support of their products.”<br />

Unfortunately, the IT infrastructures<br />

of most outdoor stores, and across the<br />

greater specialty retail market, simply<br />

aren’t ready to take advantage of the<br />

opportunities, and those that C aren’t will<br />

find it increasingly difficult<br />

M<br />

to compete<br />

in the consumer driven reality of omnichannel<br />

commerce and fulfillment.<br />

Y<br />

CM<br />

“IT can no longer dictate the pace,”<br />

MY<br />

say RSR researchers, “and so it has no<br />

choice but to move faster.” CY<br />

When asked to name the impediments<br />

to improving IT effectiveness,<br />

retail IT decision makers repeatedly cite<br />

slow and outdated infrastructures that<br />

aren’t able to keep up with consumer<br />

capabilities and emerging business<br />

needs, show surveys by RSR. The top<br />

technical inhibitor is ongoing maintenance<br />

of legacy infrastructures, named<br />

among the top three by 64 percent of<br />

respondents. Retail IT directors also say<br />

they must spend less time on “catch up”<br />

investments, more time differentiating<br />

with IT-enabled capabilities and need<br />

more speed to shorten the lead time to<br />

customer demand fulfillment.<br />

“We see retailers constantly exploring<br />

new business models and adding new<br />

capabilities to their application portfolios,<br />

which in turn increases the complexity of<br />

IT infrastructure and volume of data and<br />

demands more computing power,” says<br />

Ganapathy. But through the efficiencies of<br />

shared resources, automation, on-demand<br />

scalability and by leaving the development,<br />

service delivering and maintenance<br />

of solutions to the IT and communications<br />

experts, “cloud computing can reduce the<br />

IT costs of managing existing and new<br />

systems,” he continues.<br />

CMY<br />

Components of the Cloud<br />

K<br />

Although cloud computing is still an<br />

emerging model with many of the rules<br />

yet to be written, the general consensus<br />

within the IT industry is that there are three<br />

primary categories of cloud services. Below<br />

we provide a brief description of each one<br />

and how retailers can benefit from each,<br />

courtesy of IBM.<br />

Software<br />

as a Service<br />

Software as a service (SaaS) is the<br />

distribution of software hosted by a provider<br />

in a central and remote location and made<br />

available to consumers over a network.<br />

SaaS uses a pay-as-you-go pricing model,<br />

which decreases or increases the number<br />

of software licenses based on need, without<br />

having to procure, install or maintain<br />

software or hardware or incur ongoing<br />

maintenance costs. When retailers use<br />

the SaaS delivery model, they can access<br />

business applications, such as accounts<br />

payable and customer loyalty, virtually.<br />

Platform<br />

as a Service<br />

With platform as a service (PaaS), the complete<br />

application development and deployment<br />

platform (both hardware and software) can be<br />

delivered as a service, typically over the Internet.<br />

Developers can create, test, deploy and host<br />

applications quickly without having to bear the<br />

cost and complexity of buying and managing the<br />

underlying software and hardware. PaaS is often<br />

referred to as “cloudware.” In some cases, Web<br />

services, Web 2.0 capabilities and middleware<br />

are offered as an integrated platform on which<br />

applications can be built, assembled and run.<br />

Infrastructure<br />

as a Service<br />

Infrastructure as a service (IaaS) provides<br />

hardware components such as servers, network<br />

equipment, memory, CPUs and disk space. With<br />

IaaS, a retailer could run all operations without<br />

installing and maintaining in-house data<br />

centers. The approach to the delivery of these<br />

services varies from provider to provider.<br />

Key Ring, Carabiner,<br />

and Lanyard Included.<br />

The, Go anywhere, Write Everywhere” Pen<br />

Underwater • Upside Down<br />

In Extreme Temps (-30º F to 250º F)<br />

For Details, Call Sales at Fisher Space Pen<br />

800-634-3494<br />

®<br />

®<br />

<strong>Spring</strong> 2011 | <strong>InsideOutdoor</strong> | 17

“Cloud computing opens the door to<br />

new capabilities including new business<br />

processes and new application solutions<br />

that are retail industry specific at<br />

a price point that is remarkably lower<br />

than traditional solutions implemented<br />

only one to two years ago,” Accenture<br />

analysts concur.<br />

Whereas the development or expansion<br />

of services and applications<br />

traditionally required large upfront<br />

investments in hardware and in-house<br />

expertise, cloud customers can purchase<br />

only what they need and pay<br />

only while they need it. A company can<br />

utilize a dozen servers on Monday and<br />

a hundred on Tuesday, for example, or<br />

take advantage of a cloud provider’s<br />

free or low-cost development tools.<br />

Capabilities such as scenario modeling,<br />

forecasting, pricing optimization<br />

and real-time inventory management<br />

– which tend to be “lumpy,” time-consuming<br />

and data-intensive processes –<br />

therefore can be done more quickly and<br />

cost-effectively, say cloud proponents.<br />

At the same time, software solutions<br />

that are bought on a pay-per-use basis<br />

can be quickly and easily integrated<br />

into existing IP platforms.<br />

“A wide variety of business applications,<br />

with unified sales, support,<br />

transaction and provisioning, can<br />

be accessed under one secure single<br />

login,” says Saffron. “From this Webbased<br />

dashboard, a small business can<br />

order product, initiate a support ticket,<br />

collaborate with colleagues, lock down<br />

and protect all of their computers, back<br />

up critical data, and even manage their<br />

customer relationships all from the<br />

cloud. That type of tight technology<br />

integration ultimately increases efficiency,<br />

reduces redundancy and lowers<br />

the cost of sales.”<br />

“Think about the Y2K conundrum<br />

and how much work businesses had<br />

to do to update their systems,” says<br />

Douglas. “If those businesses were<br />

properly utilizing the cloud at that<br />

time, the scope of their projects could<br />

have been significantly reduced to<br />

the point that it may have been just a<br />

service migration project.”<br />

One area where the cloud is particularly<br />

efficient is in the handling of<br />

data. Every retailer knows that POS<br />

Maintenance of our Top legacy Three portfolio Technical Inhibitors to Improving IT<br />

64%<br />

of IT solutions prevents the company<br />

from addressing Effectiveness new needsand Responsiveness<br />

73%<br />

Past under-investment in IT infrastructure<br />

61%<br />

prevents us from moving fast enough now<br />

Maintenance of our legacy portfolio<br />

64% 73%<br />

of Our IT solutions IT development prevents methodology the companyis<br />

rigid and takes from too addressing long. Business new needs needs<br />

43%<br />

73%<br />

change by the time we get a new<br />

Past under-investment solution in IT infrastructure<br />

implemented<br />

55% 61%<br />

prevents us from moving fast enough now<br />

The company under-invests in staff<br />

34%<br />

73%<br />

Our IT development training when methodology business is or<br />

rigid and tech takes changes too long. are Business implemented needs<br />

36%<br />

43%<br />

change by the time we get a new<br />

solution implemented<br />

55%<br />

A “not invented here” mentality within IT<br />

20%<br />

The company under-invests in staff<br />

18% 34%<br />

training when business or<br />

The tech IT changes organization are implemented<br />

is resistant to<br />

20% 36% All Respondents<br />

relinquishing control of development<br />

efforts to business leaders<br />

18%<br />

A “not invented here” mentality within IT<br />

20%<br />

Revenue > 1Billion/Year<br />

Ongoing concerns about solution<br />

18%<br />

vendor or service provider stability<br />

The IT organization is and resistant longevity to 5% 20%<br />

All Respondents<br />

relinquishing control of development<br />

efforts We don’t to business like sharing leaders our<br />

16% 18%<br />

Revenue > 1Billion/Year<br />

Ongoing innovations concerns about with outsiders solution 9% 18%<br />

vendor or service provider stability<br />

and longevity 0 5% 10 20 30 40 50 60 70 80<br />

We don’t like sharing our<br />

16%<br />

innovations Source: with RSR outsiders Research<br />

9%<br />

0 10 20 30 40 50 60 70 80<br />

Source: RSR Research<br />

We want to spend less How time much on “catch do up” each of the following factors influence how 52%<br />

investments in IT, and your spend company’s more time technology portfolio will change?<br />

differentiating with IT-enabled capabilities<br />

48%<br />

We want We to need spend to less shorten time on the “catch lead time up”<br />

investments to customer in IT, and demand spend more fulfillment time<br />

differentiating with IT-enabled capabilities<br />

Rapid consumer adoption of new<br />

technologies We need to such shorten as “smart the lead mobile”, time<br />

“social media”, to customer etc. is forcing demand us to fulfillment “go faster”<br />

We need to overcome an ingrained “not<br />

invented Rapid here” attitude consumer and adoption take advantage of new<br />

technologies of what’s such commercially as “smart available mobile”,<br />

“social media”, etc. is forcing us to “go faster”<br />

We We need need to to reduce overcome ongoing an ingrained maintenance “not<br />

invented costs here” associated attitude with and owning take advantage solutions<br />

of what’s commercially available<br />

We need to reduce ongoing maintenance<br />

costs associated with owning solutions<br />

Source: RSR Research<br />

Top Three Technical Inhibitors to Improving IT<br />

Effectiveness and Responsiveness<br />

How much do each of the following factors influence how<br />

your company’s technology portfolio will change?<br />

systems and loyalty programs generate<br />

massive volumes of<br />

Source:<br />

customer<br />

RSR Research<br />

data, and<br />

the management of that data, currently<br />

vastly underutilized, will be increasingly<br />

crucial to delivering personalized<br />

that make it more timely and affordable<br />

to capture and utilize customer<br />

data. Many retail-specific cloud providers<br />

also will have the ability to<br />

track performance of products and<br />

service. Of course, real-time The shopper and actionable<br />

is better brands connected in comparison to consumer to previous information time<br />

analyses of customer than store data can associates. periods, identify trends and seasonal-<br />

require lots of time and (Percentage huge capital of responding ity components, retail employees) monitor performance<br />

and operating expenditures, The shopper often is unaffordable<br />

to retailers. than Completely store associates. Agree retailer, improving their Neutral ability Disagree to Complete<br />

better and connected provide to analytical consumer results information to the<br />

Cloud providers, (Percentage Agree<br />

on the other of hand, responding Somewhat<br />

forecast retail customer employees)<br />

Somewhat<br />

behavior. And since Disagree<br />

possess the massive computational the data is centralized and accessible<br />

power and statistical Completely modeling 17% tools Agree by 37.5% the ubiquitous Internet, Neutral 26.1% data Disagree can 15.3% 4.1% Completel<br />

Agree<br />

Somewhat<br />

Somewhat Disagree<br />

18 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011<br />

17% 37.5% 26.1% 15.3% 4.1%<br />

Winners<br />

Winners<br />

Others<br />

Others<br />

34%<br />

47%<br />

52%<br />

48%<br />

48%<br />

47%<br />

47%<br />

48%<br />

41%<br />

47%<br />

31%<br />

34%<br />

41%<br />

41%<br />

45%<br />

31%<br />

41%<br />

45%

e more easily shared among internal<br />

departments, as well as external partners<br />

and suppliers, thereby improving<br />

inventory management.<br />

Meanwhile, cloud computing helps<br />

retailer better manage the peaks and valleys<br />

of seasonal and unexpected demand.<br />

“In a typical IT environment, retailers<br />

need to scale fixed datacenter resources<br />

in advance of demand spikes,” says<br />

Fred Bentfeld, general manager of U.S.<br />

distribution and services sector at Microsoft.<br />

“This leads to wasted capacity and<br />

increased costs.”<br />

Even worse, it can mean an under<br />

supply. But by taking advantage of cloud<br />

computing, retailers can dynamically<br />

adjust to the very dynamic nature of demand,<br />

says Bentfeld. “Retailers only have<br />

to pay for the level of service they need,<br />

without the costs of unused capacity or<br />

under-supply of capacity.”<br />

Likewise, emerging technology platforms<br />

such as social media, e-commerce<br />

engines, search optimization and mobility<br />

solutions already exist “in the cloud,”<br />

so this emerging IT model “can enable a<br />

retailer to engage with its customers in<br />

unique and novel ways without the level<br />

of capital investment typically required<br />

to build and support a new channel,”<br />

say Accenture analysts.<br />

In short, cloud computing provides<br />

retailers with a cost-effective and infinitely<br />

scalable path to launching new<br />

capabilities and rebuilding architectures<br />

at a time when existing systems are<br />

becoming dangerously obsolete.<br />

Of course, moving to the cloud<br />

doesn’t have to be an all or nothing<br />

affair. IT systems and capabilities can<br />

be cherry picked for cloud adoption in<br />

order to allow existing investments to<br />

adequately run their course. Similarly,<br />

it’s understandable that retailers would<br />

be reluctant to hand over confidential<br />

customer data or POS systems to a<br />

third-party provider.<br />

With that in mind, cloud proponents<br />

and consultants recommend retailers<br />

start by migrating low-hanging<br />

fruit, such as workgroup applications<br />

or non-mission-critical, non-integrated<br />

applications. Then be ready to scale<br />

once the benefits are proven and concerns<br />

alleviated.<br />

Not that it will be easy. Ongoing integration<br />

with existing systems has proven<br />

a sticking point for some, as has security.<br />

As with most technology, overcoming<br />

these hurdles will require the expertise<br />

of a trusted advisor.<br />

“Any retailer that uses cloud-based<br />

services needs to make sure that all<br />

their vendors follow strict and contractual<br />

guidelines on privacy policy,<br />

use a secure SSL to safely access their<br />

services through public networks and<br />

have a firm policy about data ownership,”<br />

Saffron warns. “If a provider of<br />

cloud-based services is fuzzy about<br />

who owns the data and how it can be<br />

affordably moved to another vendor,<br />

move on and find another.”<br />

“The more sensitive the data, the<br />

more important it will be to validate<br />

where the data resides and how it is being<br />

protected,” Douglas concurs. “Transparency,<br />

vendor management programs<br />

and strong service level agreements<br />

(SLAs) will be paramount.”<br />

<strong>Spring</strong> 2011 | <strong>InsideOutdoor</strong> | 19

Retail Tech 2011<br />

eBay, GSI and In-Store Payments<br />

When eBay announced its intention<br />

to acquire e-commerce and interactive<br />

marketing solutions provider GSI<br />

Commerce for $2.4 billion, some industry<br />

observers saw the move as an attempt<br />

to keep pace with online giant Amazon,<br />

which boast a substantially more robust<br />

suite of retail services. It’s possible,<br />

however, that eBay’s intention isn’t to<br />

keep pace with Amazon but rather to<br />

break a barrier that so far has eluded the<br />

online giant: alternative in-store payment.<br />

For a few years now, Amazon has<br />

been courting major e-tailers to adopt its<br />

one click platform but so far has made<br />

very little in-roads, most likely due to<br />

the perceived competitive threat. In<br />

other words, “Retailers don’t want<br />

another Amazon – they want cheaper<br />

payments in-store,” argues Frank Hayes<br />

of StorefrontBacktack.com, “That’s what<br />

eBay seems to have figured out.”<br />

Consider, for example, that GSI already<br />

has long-term e-commerce services<br />

relationships with some 180 retail partners<br />

such as Toys ‘R’ Us, Dick’s Sporting Goods,<br />

Ace Hardware, Ralph Lauren, RadioShack<br />

and Sports Authority. Most of those GSI<br />

clients already use eBay’s PayPal for<br />

online transactions, Hayes points out, so<br />

backend processes and infrastructure, at<br />

least to some degree, are already in place,<br />

making the move from PayPal online to<br />

in-store more feasible. And unlike many<br />

other alternative payment schemes that<br />

have been developed, “PayPal won’t have<br />

All Geigerrig hydration packs shipping<br />

this spring will have a new hangtag,<br />

positioned front and center, that contains<br />

a toll free number offering consumers,<br />

retailers and retail sales staff a brief product<br />

tutorial for the company’s award-winning<br />

Hydration Engine, in-line filtration system<br />

and specific pack models. The purpose of<br />

the interactive hangtag is to provide further<br />

support to the growing Geigerrig dealer<br />

base by facilitating an additional opportunity<br />

20 | <strong>InsideOutdoor</strong> | <strong>Spring</strong> 2011<br />

to sell these retailers on a speculative<br />

business model or convince banks and<br />

payment-card companies to play along,”<br />

comments Hayes. PayPal has a large<br />

existing customer base and a long and<br />

reliable history.<br />

“Combined with eBay Marketplaces<br />

and PayPal, we believe GSI will enhance<br />

our position as the leading strategic<br />

global commerce partner of choice<br />

for retailers and brands of all sizes,”<br />

said eBay CEO John Donahoe, upon<br />

announcement of the acquisition.<br />

At the same time, eBay seems<br />

to have taken steps to alleviate<br />

concerns about competing with<br />

current and future retail partners.<br />

As part of the transaction, eBay will<br />

divest 100 percent of GSI’s licensed<br />

sports merchandise business and<br />

will also divest 70 percent of the<br />

consumer-facing private sale Web sites<br />

ShopRunner and Rue La La, saying<br />

these businesses are not core to its<br />

long-term growth strategy. These<br />

assets will be sold to a newly formed<br />

holding company to be led by GSI<br />

founder and CEO Michael Rubin.<br />

Not that convincing retailers to<br />

abandon traditional payments schemes<br />

will be easy, and eBay has provided<br />

little indication of how exactly it intends<br />

to move in-store. It should be noted,<br />

however, that just prior to the GSI<br />

announcement, PayPal hired prepaid<br />

gift card veteran and former Blackhawk<br />

for retailers and consumers to gain ever<br />

greater familiarity with the company and its<br />

products while still on the retail sales floor.<br />

“With all of the energy around<br />

Geigerrig and our new hydration packs,<br />

it is important to manage the pace of<br />

growth and interest in our products,”<br />

says Curt Geiger, president of Geigerrig.<br />

“Adding a brief phone-tutorial to each<br />

hydration pack will help us to keep the<br />

information flowing proportionately to<br />

Network CEO Don Kingsborough as it<br />

new vice president for retail and prepaid<br />

products. Kingsborough was brought<br />

on “to help us bring PayPal offline and<br />

into traditional retail stores,” said Scott<br />

Thompson, PayPal CEO, upon the hiring.<br />

About the time of Kingsborough’s<br />

hiring, Thompson, a former Visa<br />

executive, told Reuters how PayPal’s<br />

approach in-store would involve “a<br />

whole new experience that is different<br />

than the tradition card-like experience.<br />

That requires us to rebuild the whole<br />

infrastructure around point-of-sale.”<br />

No word yet as to what that<br />

infrastructure will entail, but it’s safe to<br />

assume that retailers won’t be too hot on<br />

another POS technology sitting alongside<br />

the existing ones. And since PayPal<br />

payments still must go through a traditional<br />

payment card account, accepting PayPal<br />

simply adds another middleman to every<br />

transaction, says Hayes.<br />

“That won’t encourage retailers<br />

to make the jump beyond plastic,”<br />

he continues.<br />

“The only way for eBay to make<br />

PayPal truly worthwhile for retailers is<br />

to significantly cut the cost, and that<br />

means cutting Visa and MasterCard out<br />

of the loop,” Hayes concludes.<br />

Considering the ongoing debate<br />

between large retail groups and the<br />

major credit card companies, such a<br />

notion may actually appeal to many<br />

shopkeepers.<br />

Geigerrig Hangs Interactive Tags<br />

the aggressive flow of Geigerrig product<br />

entering the market place.<br />

“While not a silver bullet solution,<br />

this new hangtag will help alleviate<br />

some of the pressure for more and more<br />

information at every level in the supply<br />

chain,” he continued.<br />

Geigerrig hydration packs picked up a<br />

2011 IN-NEW-VATIONS Award for best new<br />

product at the most recent Outdoor Retailer<br />

Winter Market in Salt Lake City, Utah.

Google Stakes<br />

Out Mobile<br />

Payment Space<br />

Google is joining forces with<br />

MasterCard and Citigroup to embed<br />

technology in Android mobile devices<br />

that would turn those smartphones into a<br />

type of mobile wallet, according the Wall<br />

Street Journal, which cited people familiar<br />

with the matter. The payment system,<br />

which is still in early development, would<br />

allow consumers to make purchases by<br />

waving their smartphones in front of a<br />

small reader at the checkout counter, the<br />

Journal reported.<br />

According to the sources cited by<br />

WSJ, Google’s eventually updated mobile<br />

operating systems would be able to offer<br />

retailers more data about their customers<br />

and help them target ads and discount<br />

offers to mobile device users near their<br />

stores. Along with getting targeted ads<br />

and discount offers, which Google hopes<br />

to sell to local merchants, users also will<br />

be able to manage credit-card accounts<br />

and track spending through an application<br />

on their smartphones, according to reports.<br />

The venture also involves VeriFone<br />

Systems, makers of credit card readers<br />

for cash registers. VeriFone reportedly<br />

would roll out more of its contact-less<br />

devices, which enable consumers to pay<br />

with a wave of a credit or debit card.<br />

The readers also would allow people<br />

to pay by tapping their smartphones,<br />

according to the Journal. The creditcard<br />

readers involved all use near<br />

field communication technology that<br />

is already in place at thousands of<br />

merchants nationwide.<br />

“A phone is a lot smarter than a<br />

card,” Doug Bergeron, VeriFone’s chief<br />

executive told the national paper. “It<br />

opens the door to a rich experience<br />

at the point of sale that retailers<br />

really covet.”<br />

At least at this early stage,<br />

Google isn’t expected to get a cut of<br />

the transaction fees but expects to<br />

generate revenue from the targeted<br />

ads and promotions delivered to the<br />

Android-loaded phones.<br />

IP voice and video solution<br />

provider Grandstream Networks<br />

recently introduced a high-definition IP<br />

surveillance camera built specifically to<br />

stand up to any conditions that might<br />

be encountered in an outdoor storage<br />

area, boat dock, loading zone or any<br />

other outside retail space or demo area.<br />

The new weather-proof, vandalresistant<br />

and tampering-proof<br />

GXV3662_HD IP Camera features multistreaming-rate<br />

H.264 and motion JPEG<br />

(MJPEG) real-time video compression<br />

(up to HD720p resolution) and advanced<br />

megapixel CMOS sensor with wide<br />

dynamic range and high-quality lens.<br />

Other highlights include day/night mode<br />

with light sensor and mechanical IR cut,<br />

alarm input/output, audio input/output,<br />

integrated power-over-Ethernet (802.3af),<br />

built-in heater and fan and SDHC interface<br />

for local storage. Sold with three optional<br />

Retail Tech 2011<br />

Outdoor-Worthy Video Surveillance<br />

mounting kits, the GXV3662_HD also<br />

offers support for the ONVIF standard as<br />

well as HTTP API for easy integration with<br />

various video management systems.<br />

Additionally, the vandal-resistant<br />

outdoor camera offers bi-directional<br />

SIP/VoIP audio and video streaming<br />

capabilities to mobile phones and<br />

video phones, from anywhere in the<br />

world. A built-in high performance<br />

streaming server allows for more than<br />

10 simultaneous viewers. For a unified<br />

audio plus video plus surveillance<br />

solution, Grandstream’s entire family<br />

of IP video cameras is fully compatible<br />

with Grandstream’s GXE IP PBX as well<br />

as various other SIP-based IP PBXs and<br />

service provider networks.<br />

The GXV3662_HD is available<br />

immediately for purchase through<br />

Grandstream’s worldwide distribution<br />

channels at a MSRP of $499.<br />

<strong>Spring</strong> 2011 | <strong>InsideOutdoor</strong> | 21

EXPERIENCE OUTDOOR RETAILER<br />

Summer Market Trade Show and Open Air Demo • August 3-7, 2011<br />

OPEN AIR DEMO }}}<br />

Jordanelle State Park will welcome 2000+ retailers! Get hands-on testing of the latest outdoor gear with plenty of water<br />

access, off-road trails, and shelters for eating, relaxing and getting out of the sun.<br />

TRADE SHOW }}}<br />

Welcome to Summer Market 2011, where 1000+ brands will connect with over 7,000 retail buyers. Salt Lake City will<br />

open its arms to 20,000+ industry professionals at the perfect Summer Market destination!<br />

For more information check out<br />

OUTDOORRETAILER.COM<br />

OPEN AIR DEMO • AUGUST 3, 2011 Jordanelle Reservoir, UT<br />

TRADE SHOW • AUGUST 4-7, 2011 Salt Lake City, UT

Retail Tech 2011<br />

Nau Gets<br />

Behind QR Codes<br />

Urban and outdoor apparel maker Nau<br />

is proving that its progressive attitude is not<br />

limited to its sustainability initiatives. Working<br />

with mobile marketing solutions company<br />

Indigitous, the eco-brand has labeled some<br />

key styles with ExtraTags, an advanced<br />

mobile marketing solution that employs<br />

QR Codes, or two-dimensional barcodes,<br />

to store a URL on a product hangtag. After<br />

scanning the ExtraTags barcode with a<br />

smartphone, consumers will be presented<br />

with an interactive mobile display designed<br />

to motivate in-store purchasing.<br />

“Rapid advancements in mobile<br />

technology are enabling consumers to<br />

become better informed regardless of<br />

their location,” said Larry Pluimer, CEO at<br />

Indigitous, the maker of ExtraTags. “Some<br />

dramatic implications of mobile adoption<br />

are already beginning to play out in the<br />

retail environment, and we want to make<br />

that an advantage – not a liability.”<br />

ExtraTags was developed to put the<br />

brand in control of the mobile message,<br />

and give the retailer a break from<br />

competitive threats, says Pluimer. “We like<br />

to say that ExtraTags is ‘retailer-friendly’<br />

because it’s a tool that can help retailers<br />

close the sale in their store – not lure<br />

consumers online or across the street.”<br />

The dynamic content available via<br />

ExtraTags includes product details in<br />

multiple languages, brand information,<br />