Real Estate Investment Funds: Financial reporting - Alfi

Real Estate Investment Funds: Financial reporting - Alfi

Real Estate Investment Funds: Financial reporting - Alfi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

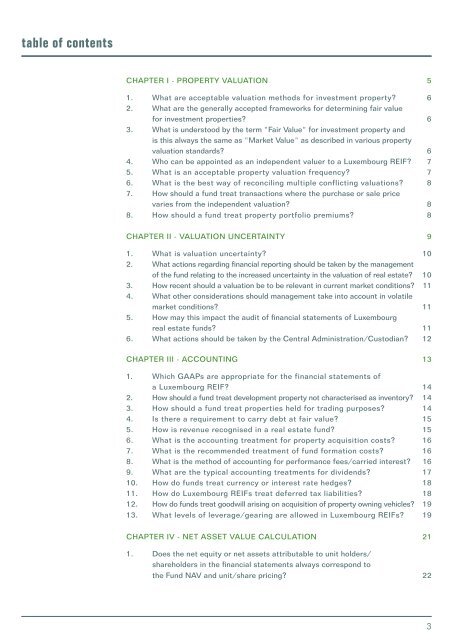

table of contents<br />

chapter I - PROPERTY VALUATION 5<br />

1. What are acceptable valuation methods for investment property? 6<br />

2. What are the generally accepted frameworks for determining fair value<br />

for investment properties? 6<br />

3. What is understood by the term "Fair Value" for investment property and<br />

is this always the same as "Market Value" as described in various property<br />

valuation standards? 6<br />

4. Who can be appointed as an independent valuer to a Luxembourg REIF? 7<br />

5. What is an acceptable property valuation frequency? 7<br />

6. What is the best way of reconciling multiple conflicting valuations? 8<br />

7. How should a fund treat transactions where the purchase or sale price<br />

varies from the independent valuation? 8<br />

8. How should a fund treat property portfolio premiums? 8<br />

chapter II - VALUATION UNCERTAINTY 9<br />

1. What is valuation uncertainty? 10<br />

2. What actions regarding financial <strong>reporting</strong> should be taken by the management<br />

of the fund relating to the increased uncertainty in the valuation of real estate? 10<br />

3. How recent should a valuation be to be relevant in current market conditions? 11<br />

4. What other considerations should management take into account in volatile<br />

market conditions? 11<br />

5. How may this impact the audit of financial statements of Luxembourg<br />

real estate funds? 11<br />

6. What actions should be taken by the Central Administration/Custodian? 12<br />

chapter III - ACCOUNTING 13<br />

1. Which GAAPs are appropriate for the financial statements of<br />

a Luxembourg REIF? 14<br />

2. How should a fund treat development property not characterised as inventory? 14<br />

3. How should a fund treat properties held for trading purposes? 14<br />

4. Is there a requirement to carry debt at fair value? 15<br />

5. How is revenue recognised in a real estate fund? 15<br />

6. What is the accounting treatment for property acquisition costs? 16<br />

7. What is the recommended treatment of fund formation costs? 16<br />

8. What is the method of accounting for performance fees/carried interest? 16<br />

9. What are the typical accounting treatments for dividends? 17<br />

10. How do funds treat currency or interest rate hedges? 18<br />

11. How do Luxembourg REIFs treat deferred tax liabilities? 18<br />

12. How do funds treat goodwill arising on acquisition of property owning vehicles? 19<br />

13. What levels of leverage/gearing are allowed in Luxembourg REIFs? 19<br />

chapter IV - NET ASSET VALUE CALCULATION 21<br />

1. Does the net equity or net assets attributable to unit holders/<br />

shareholders in the financial statements always correspond to<br />

the Fund NAV and unit/share pricing? 22<br />

3