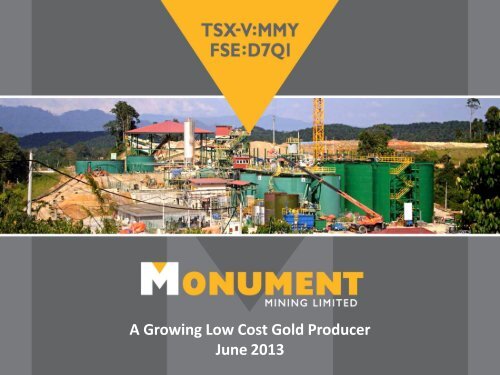

Presentation - Monument Mining Limited

Presentation - Monument Mining Limited

Presentation - Monument Mining Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A Growing Low Cost Gold Producer<br />

June 2013

Cautionary Statement<br />

This presentation includes certain estimates, projections and “forward looking<br />

statements” within the meaning of Section 21E of the Securities Exchange Act of 1934,<br />

as amended that have been provided by the Company with respect to its anticipated<br />

future performance. Such forward looking statements reflect various assumptions by<br />

the Company concerning anticipated results, which assumptions may or may not prove<br />

to be correct. No representations are made as to the accuracy of such statements,<br />

estimates or projections. These forward-looking statements are made pursuant to the<br />

“safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. While<br />

these statements are made to convey the Company's progress, business opportunities<br />

and growth prospects, such forward-looking statements represent management's<br />

opinion. Whereas management believes such representations to be true and accurate<br />

based on information and data available to the Company at this time, actual results<br />

may differ materially from those described. The Company's operations and business<br />

prospects are always subject to risks and uncertainties.<br />

Qualified Person All scientific or technical Information contained in this presentation<br />

has been approved by Todd Johnson, Vice President Exploration <strong>Monument</strong> <strong>Mining</strong><br />

<strong>Limited</strong>, who is a "qualified person" as defined in National Instrument 43-101 of the<br />

Canadian Securities Administrators.<br />

2

Investment Opportunity<br />

CURRENT<br />

FUTURE<br />

Selinsing Gold Mine (F2012)<br />

Production: 44,585 oz Au<br />

Revenue: $61.7 million<br />

Cash Cost: $306/ oz<br />

Average Sales Price: $1,671/ oz<br />

EPS : $0.33<br />

P/E: 1.4<br />

Increased Production<br />

Mengapur Polymetallic Resource<br />

Acquired 100% in 2012 with cash on hand<br />

Historical skarn resource contains Copper,<br />

Sulfur, Gold, Silver, Molybdenum and Iron<br />

Historical PFS proposed a 23 year mine life<br />

Currently conducting mine engineering<br />

and development work<br />

Targeting near term copper production<br />

Experienced Management<br />

Demonstrated ability to quickly build profitable operations<br />

3

Peer Comparison<br />

$1,600.00<br />

Cash cost/ounce<br />

$1,400.00<br />

$1,200.00<br />

$1,000.00<br />

$800.00<br />

$600.00<br />

$400.00<br />

$200.00<br />

$0.00<br />

4

Goals<br />

Increase Gold resource to over 1 M oz<br />

Increase Selinsing Production<br />

Develop Mengapur Project in Phases<br />

Longer term goal is to be a dividend paying,<br />

mid-tier gold and metals producer<br />

5

Malaysia: Historic <strong>Mining</strong> Culture<br />

‣ British based legal system and<br />

stable, supportive government<br />

‣ Unrestricted repatriation of<br />

foreign investment<br />

‣ Low cost skilled labor and<br />

materials<br />

‣ Tax incentives (5 year tax break<br />

at Selinsing)<br />

6

Land Position<br />

‣Selinsing (100% Interest)<br />

Operating gold mine<br />

‣Buffalo Reef (100%)<br />

Adjacent Operating Oxide Gold Mine<br />

with sulfide resource<br />

‣FELDA (100%)<br />

Exploration Potential adjacent east and<br />

south of Selinsing<br />

‣Famehub (100%)<br />

Exploration projects NE of Selinsing<br />

7<br />

‣Mengapur Polymetalic Project (100%)<br />

Cu, Au, Ag, S, Fe historic resource

Project Portfolio<br />

Exploration<br />

Advanced<br />

Development<br />

Production<br />

Selinsing<br />

BR Oxide<br />

GOLD<br />

Famehub<br />

Selinsing<br />

Deep<br />

BR Sulfide<br />

POLYMETALLIC<br />

(Cu, Au, Ag, S, Fe)<br />

Mengapur<br />

8

Selinsing-Buffalo Reef Tenement<br />

9

Selinsing Gold Mine<br />

10<br />

Source: <strong>Monument</strong> <strong>Mining</strong>

Selinsing Performance<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

2000<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Gold Production<br />

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3<br />

2010 2011 2012 2013<br />

Cash Margin<br />

Cash Cost<br />

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3<br />

2010 2011 2012 2013<br />

KEY PERFORMANCE INDICATORS<br />

For Periods Ended March 31, 2013<br />

9 months<br />

F2013<br />

Since<br />

October<br />

2009<br />

Ore Mined (tonnes) 567,678 2,472,798<br />

Ore Processed (tonnes) 670,453 1,659,252<br />

Avg head grade (g/t) 2.17 3.23<br />

Calculated Gold Recovery (oz) 40,883 148,505<br />

Gold Poured (ounces) 40,679 144,624<br />

Gold Production (ounces) 40,063 142,879<br />

Gold Sold (ounces) 36,405 127,574<br />

Revenue (USD 000s) 60,770 195,422<br />

Total Cash Cost $/oz 402* 304*<br />

*Total cash cost includes production costs such as mining, processing, tailing<br />

facility maintenance and camp administration, royalties, and operating costs<br />

such as storage, temporary mine production closure, community development<br />

cost and property fees, net of by-product credits. Cash cost excludes<br />

amortization, depletion, accretion expenses, capital costs, exploration costs and<br />

corporate administration costs.<br />

11

Selinsing-Buffalo Reef Resource<br />

Selinsing-Buffalo Reef Resource as of August 31, 2012 (Practical <strong>Mining</strong>, May 23, 2013)<br />

Category OXIDE SULFIDE OXIDE + SULFIDE<br />

kTonnes g/t Au (kOz) kTonnes g/t Au (kOz) kTonnes g/t Au (kOz)<br />

Reserves (based on a USD1550/oz gold price)<br />

Proven 2,360 0.7 54.6 266 2.5 21.4 2,626 0.9 76.0<br />

Probable 496 1.7 26.7 1,768 2.1 120.2 2,264 2.0 146.9<br />

P+P 2,857 0.9 81.3 2,034 2.2 141.7 4,890 1.4 222.9<br />

Resources including Reserves (based on a USD1700/oz gold price)<br />

Measured 2,361 0.7 54.6 322 2.1 21.7 2,682 0.9 76.3<br />

Indicated 588 1.6 29.5 3,036 1.9 183.6 3,624 1.8 213.0<br />

M+I 2,949 0.9 84.1 3,358 1.9 205.3 6,307 1.4 289.4<br />

Inferred 268 1.2 10 801 1.5 38.0 1,070 1.4 48.0<br />

• Gold mineralization occurs in a 4.2 km long district along a shear zone from Selinsing to Buffalo Reef;<br />

potentially extending further north to the Famehub properties<br />

• Mineralization outside of the August 31, 2012 Mineral Resource remains open down dip below existing pits<br />

• As of May 15, 2013, three rigs continue drilling at Selinsing-Buffalo Reef<br />

• Drill results not included in this recent NI43-101 estimate (+28,000 metres as of March 31, 2013) will be<br />

incorporated into a future resource update<br />

12

Growing Forward : Mengapur<br />

Leveraging our experienced, accomplished team to succeed again<br />

‣ Acquired 70% of CASB in Feb 2012 for US$60M; remaining 30% for $16 M in Dec<br />

2012 with cash on hand<br />

‣ Acquired 100% interest in SDSB (Adjacent Prospecting Lease) in November 2011-<br />

Application for issue of mining lease filed<br />

‣ Conducting mine engineering and development work<br />

‣ Targeting near term copper production<br />

13

Mengapur: A large, multi-metal Resource<br />

Historic resource* of 224.4 million tonnes<br />

Grade<br />

Contained Metal<br />

0.25% Copper 561,000 tonnes Copper<br />

0.16 g/t Gold 1.15 million oz Gold<br />

8.86 g/t Silver 63.9 million oz Silver<br />

6.54% Sulphur 14.68 million tonnes Sulphur<br />

Plus Iron, Molybdenum<br />

unknown-being established<br />

*Historic resource (Normet, 1990) is not NI 43-101 compliant and not to be depended on. This historic<br />

resource is relevant as it provides an indication of the mineral potential of the project.<br />

14

Mengapur Geology<br />

Cu-S-Au-Ag mineralization is<br />

hosted in pyroxene and garnet<br />

skarn which surrounds the core<br />

intrusive body<br />

15

16<br />

Mengapur Activities

Capital Structure As of May 21, 2013<br />

Shares Outstanding: 275,058,030 Fully Diluted 324,648,531<br />

Warrants: 25,000,000 Market Capitalization: $103.15 million<br />

Options: 21,475,501 Share Price (as of May 21, 2013) $0.375<br />

Agent Options 3,115,000 52 Week High/Low: $0.54/$0.34<br />

17

Management Team<br />

‣ Robert Baldock – President & CEO<br />

30 years of experience raising equity and mining project finance, directing mining project development<br />

and mill construction<br />

‣ Cathy Zhai – CFO, Corporate Secretary & VP Corporate Finance<br />

16 years’ experience with publicly listed companies at CFO’s capacity or equivalent in corporate finance,<br />

public reporting and business strategic planning<br />

‣ Todd Dahlman – COO,<br />

25 years’ experience in US and International mining industry spanning engineering, technical,<br />

maintenance, business improvement and mine operations.<br />

‣ Zaidi Harun – VP Business Development<br />

18 years’ exploration experience; 11 years at Selinsing Gold project<br />

‣ Todd Johnson – VP Exploration<br />

21 years’ experience in the precious and base metal resource industry; a recognized expert in the<br />

assessment of base and precious metal systems, including gold-copper skarns<br />

‣ Charlie Northfield – General Manager, Selinsing Gold Mine<br />

A hands-on Mineral Processing Engineer with 30 years of broad experience within the mining industry in<br />

gold, metal sulphides and oxides in addition to industrial minerals processing.<br />

18

Corporate Social Responsibility<br />

‣ Created 330 Malaysian jobs to date,<br />

mostly in local communities<br />

‣ Purchase goods and services locally<br />

‣ Establishing a community support office<br />

in Maran to encourage feedback and<br />

engagement regarding the Mengapur<br />

development<br />

‣ Fund local schools for scholarships and<br />

academic and recreational activities<br />

‣ Sponsor university, job training and<br />

research opportunities<br />

‣ Assist local health clinics with free<br />

medical screening<br />

‣ A 5% gold royalty to the Malaysian<br />

government<br />

19

<strong>Monument</strong> <strong>Mining</strong><br />

A Growing Low Cost Producer<br />

‣ Selinsing is a low cost, producing<br />

gold mine with process capacity<br />

increased to 1Mt/year<br />

‣ Fast tracking Mengapur<br />

development into production in<br />

phases<br />

Target: Copper production in near term<br />

‣ Full pipeline of promising<br />

exploration projects for future<br />

growth<br />

20

Contact Us<br />

Nick Kohlmann MMY-Toronto 647-478-3594 nkohlmann@monumentmining.com<br />

Richard Cushing MMY-Vancouver 604-638-1661 rcushing@monumentmining.com<br />

Wolfgang Seybold Axino AG +49-711-2535-9240 wolfgang.seybold@axino.de<br />

21

APPENDIX SLIDES

Selinsing Gold Mine<br />

N<br />

23

24<br />

Selinsing Cross Section

Selinsing Production Data<br />

Selinsing Gold Mine Fiscal 2010 Fiscal 2011 Fiscal 2012<br />

Operating results<br />

Ore mined (tonnes) 662,330 740,909 501,882<br />

Ore processed (tonnes) 272,120 351,999 364,680<br />

Average ore head grade (g/t Au) 3.08 4.31 4.24<br />

Process recovery rate 58.70% 92.90% 93.7%<br />

Gold production (ounces) 13,793 44,438 44,585<br />

Gold sold (ounces) 13,793 40,438 36,938<br />

Financial results<br />

Gold sales (US$’000) (a) 16,316 56,627 61,709<br />

Per ounce data<br />

Cash cost per ounce 216 242 306<br />

Average spot gold price, US$/ounce 1,089 1,372 1,673<br />

Average realized gold price, US$/ounce 1,183 1,400 1,671<br />

25

Mengapur Historic Resource<br />

Total Mengapur Historic Measured and Indicated Resources<br />

within Zones A, B, and C<br />

Note: The data presented in the table have been produced at a cut-off grade of 0.336% EQV Cu reflecting<br />

the available information in 1990 commodity prices, operating costs, and plant recoveries<br />

This presentation includes historical estimates and related information, which has not been verified by <strong>Monument</strong>. Read the<br />

complete Technical Report, which is available on <strong>Monument</strong>’s SEDAR profile at www.sedar.com<br />

The information in this presentation is qualified in its entirety by the limitations described in the Technical Report.<br />

26

Famehub<br />

‣ 9 separate grassroots prospects<br />

NE of Selinsing totaling 133.5<br />

km 2 (32,000 acres)<br />

‣ Satak Serau on N-S Selinsing-<br />

Buffalo mineralized trend;<br />

Rubber Hill east of Buffalo<br />

‣ Priority targets quickly<br />

identified with AUS$40M<br />

historic exploration data<br />

27