Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes – Marine Subsea Consolidated<br />

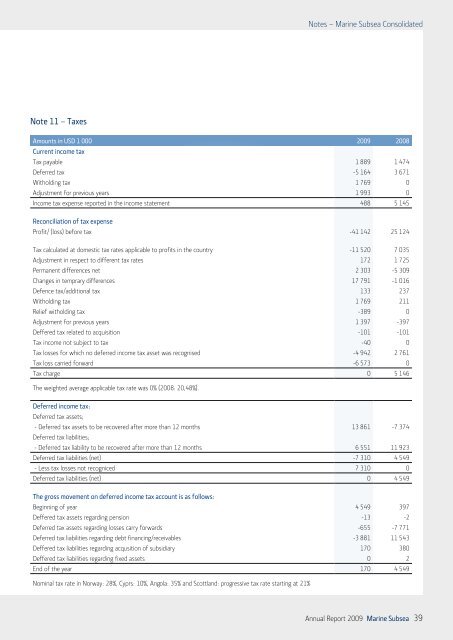

Note 11 – Taxes<br />

Amounts in USD 1 000 2009 2008<br />

Current income tax<br />

Tax payable 1 889 1 474<br />

Deferred tax -5 164 3 671<br />

Witholding tax 1 769 0<br />

Adjustment for previous years 1 993 0<br />

Income tax expense reported in the income statement 488 5 145<br />

Reconciliation of tax expense<br />

Profit/ (loss) before tax -41 142 25 124<br />

Tax calculated at domestic tax rates applicable to profits in the country -11 520 7 035<br />

Adjustment in respect to different tax rates 172 1 725<br />

Permanent differences net 2 303 -5 309<br />

Changes in temprary differences 17 791 -1 016<br />

Defence tax/additional tax 133 237<br />

Witholding tax 1 769 211<br />

Relief witholding tax -389 0<br />

Adjustment for previous years 1 397 -397<br />

Deffered tax related to acquisition -101 -101<br />

Tax income not subject to tax -40 0<br />

Tax losses for which no deferred income tax asset was recognised -4 942 2 761<br />

Tax loss carried forward -6 573 0<br />

Tax charge 0 5 146<br />

The weighted average applicable tax rate was 0% (2008: 20,48%).<br />

Deferred income tax:<br />

Deferred tax assets;<br />

- Deferred tax assets to be recovered after more than 12 months 13 861 -7 374<br />

Deferred tax liabilities;<br />

- Deferred tax liability to be recovered after more than 12 months 6 551 11 923<br />

Deferred tax liabilities (net) -7 310 4 549<br />

- Less tax losses not recogniced 7 310 0<br />

Deferred tax liabilities (net) 0 4 549<br />

The gross movement on deferred income tax account is as follows:<br />

Beginning of year 4 549 397<br />

Deffered tax assets regarding pension -13 -2<br />

Deferred tax assets regarding losses carry forwards -655 -7 771<br />

Deferred tax liabilities regarding debt financing/receivables -3 881 11 543<br />

Deffered tax liabilities regarding acqusition of subsidiary 170 380<br />

Deffered tax liabilities regarding fixed assets 0 2<br />

End of the year 170 4 549<br />

Nominal tax rate in Norway: 28%, Cyprs: 10%, Angola: 35% and Scottland: progressive tax rate starting at 21%<br />

<strong>Annual</strong> <strong>Report</strong> 2009 Marine Subsea 39