Charterers' Liability Cover - UK P&I

Charterers' Liability Cover - UK P&I

Charterers' Liability Cover - UK P&I

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

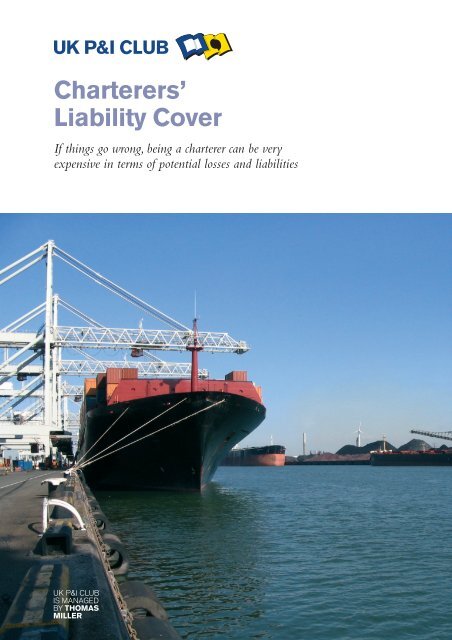

Charterers’<br />

<strong>Liability</strong> <strong>Cover</strong><br />

If things go wrong, being a charterer can be very<br />

expensive in terms of potential losses and liabilities

2<br />

Charterers’ <strong>Liability</strong> <strong>Cover</strong><br />

Risk is increasing, and not only because of aggregations of value carried<br />

on ever larger ships, and increasing commodity prices.<br />

The regulatory environment underpins claims<br />

inflation and will look at all connected parties in<br />

the event of a serious shipping accident, not just<br />

the shipowner.<br />

You may be a slot, space, voyage or time charterer.<br />

You may be a traditional chart-erer with a ship<br />

operating background, or a trading company moving<br />

raw materials or finished product, or a trader buying<br />

and selling on a scale that requires chartering.<br />

Whichever you are, you will find what you need<br />

in <strong>UK</strong> Club’s Charterers’ <strong>Liability</strong> <strong>Cover</strong> facility,<br />

which can be adapted to meet your exact needs.<br />

You certainly need insurance. It may be that the<br />

traditional product meets your needs well – and it<br />

remains available. However, increasingly charterers<br />

are seeking something specifically tailored to their<br />

particular situation – in which case the flexibility<br />

of our new product can provide what you need.<br />

• Tailored package of cover and premium<br />

• Integrates with hull and other covers<br />

• Pure liability protection for non-operational<br />

charterers<br />

• Pollution liability without sub-limit<br />

• Most extensive network support<br />

• Minimise delay due to arrest/detention<br />

• Responds to continual changes in charter fleet<br />

• Minimises administrative burden<br />

Why a <strong>UK</strong> Club cover?<br />

Financial security and service are the twin pillars upon which the <strong>UK</strong><br />

Club bases all its activities. The cover and service provided to the<br />

charterer member is no exception.<br />

The <strong>UK</strong> Club’s strength as the world's largest P&I<br />

club enables it to negotiate covers offering greater<br />

scope and limit, and deliver them for a more<br />

competitive and stable price than charterers might<br />

achieve individually.<br />

The resources and economies of scale that the <strong>UK</strong><br />

Club enjoys as the world’s largest mutual P&I<br />

insurer confer considerable benefits on its owned<br />

and chartered Members including:<br />

Claims<br />

As a mutual, the Club takes a positive, co-operative<br />

attitude towards its Members’ claims. The wide<br />

spread of international offices and staff makes it<br />

sensitive to the needs of different regional and<br />

trade areas.<br />

Genuine 24 hours claims handling response<br />

The <strong>UK</strong> Club possesses the largest international<br />

office network in the P&I industry. Offices in<br />

New Jersey, San Francisco, London, Piraeus,<br />

Singapore, Hong Kong, Beijing, Shanghai and<br />

Tokyo are manned by dedicated <strong>UK</strong> Club service<br />

teams. Recruited from a variety of operational,<br />

legal and technical backgrounds, they combine<br />

in-depth expertise with awareness of commercial<br />

realities – to advise on shipping, liability and<br />

insurance issues.<br />

An unrivalled online claims support service<br />

Innovative web-based technology, including our<br />

“ClaimsTrac” system, allows you to access and<br />

analyse your claims data and loss record at your<br />

convenience – day or night.<br />

Commercial underwriting<br />

The <strong>UK</strong> P&I Club takes a flexible, individual<br />

approach to cover for all Members. Many of its<br />

underwriters have been longstanding specialists in

3<br />

particular sectors or geographical regions.<br />

Financial security<br />

The <strong>UK</strong> Club’s considerable reserves, prudent<br />

reserving policy and comprehensive reinsurance<br />

protection provide great financial security. The<br />

Club has maintained a Standard and Poors rating<br />

at the highest level of any P&I club since that<br />

agency began reporting on the mutual P&I<br />

industry.<br />

Flexible and innovative service<br />

The <strong>UK</strong> P&I Club continues to pioneer many<br />

new service initiatives such as its “value for<br />

money” system, managing the performance and<br />

costs of all parties in the claims process. Increased<br />

recent exposure of ship operators to criminal<br />

liability and media attention has been met with<br />

more developed specialist expertise and<br />

relationships with the relevant agencies.<br />

Loss prevention and advice<br />

The <strong>UK</strong> P&I Club is committed to safety. Its<br />

high-level loss prevention programme – the most<br />

extensive in the industry – aims to offset rising<br />

claims and maintain quality amongst Members.<br />

Flexible Charterers’ P&I <strong>Cover</strong><br />

<strong>UK</strong> Club charterers’ liability insurance provides<br />

the benefit of access to the broad cover described<br />

within the Club’s Rules. However, the unique<br />

position of the charterer in the maritime industry<br />

requires an enhanced and tailored cover to ensure<br />

that those exposures which go beyond those of the<br />

conventional owner-operator are addressed and<br />

financially secured.<br />

Comprehensive cover with high limits at a<br />

competitive prices<br />

The flexible charterers’ cover offers variable limits<br />

of cover up to US$750 million any one accident<br />

or occurrence.<br />

No sub-limit for pollution<br />

There are no sub-limits imposed below the overall<br />

agreed limit of the cover for either pollution risks<br />

or other exposures arising from the ship owners<br />

limitation clause.<br />

Integrates with hull and other covers<br />

The flexible charterers cover is designed to be<br />

combined with the Damage to Hull cover as well<br />

as other risks (see below)<br />

Pollution liability cover for charterer’s<br />

own cargo<br />

<strong>Cover</strong> can be extended to include cargo owner’s<br />

pollution liability where the charterer or an<br />

affiliated/associated company is also the cargo owner.<br />

Pure liability protection for non-operational<br />

charterers<br />

<strong>Cover</strong> can also be extended to include the<br />

Members’ legal liability as cargo owners and/or<br />

shippers where no charterers interest in the<br />

carrying vessel exists.<br />

Flexible range of additional tailored covers<br />

Many operators require additional specialist risks<br />

to be included to reflect the particular hazards<br />

faced by their sector or trading pattern. A review<br />

of some of the key additional covers can be found<br />

on the back page of this brochure.<br />

Damage to Hull<br />

All risks cover for charterers’ ships<br />

<strong>Cover</strong> extends to include financial loss, liability,<br />

costs or expenses arising as a direct consequence of<br />

loss of, or damage to, the entered ship.<br />

Associated costs and expenses<br />

Sue and labour and legal costs in accordance with<br />

the cover provided under the flexible charterers<br />

liability cover.<br />

General average and salvage exposure<br />

<strong>Cover</strong> includes the charterer’s general average and<br />

salvage contributions and salvage charges in<br />

respect of loss of or damage to the entered ship,<br />

charterer’s bunkers on board and the freight at risk<br />

in relation to the ship.<br />

High limits of cover<br />

The flexible charterers’ cover offers variable limits<br />

of cover up to US$750 million on any one<br />

accident or occurrence. To obtain the full limit of<br />

US$750 million, cover must be purchased on a<br />

combined basis.<br />

War Risks<br />

Standard cover includes War Risks on a worldwide<br />

trading basis.<br />

Additional covers<br />

A charterer often requires protection for loss of or<br />

damage to his bunkers arising from an incident<br />

involving his ship (see back page for additional<br />

covers).

4<br />

What are the key charterers’ risks?<br />

Dr Chao Wu, Legal Director of Thomas Miller P&I Ltd explains the<br />

key risks to which a charterer is most commonly exposed and for which<br />

cover is available.<br />

P&I<br />

A charterer needs standard P&I cover under the<br />

Rules for the same risks as are usually insured by<br />

an owner – and will therefore have cover for his<br />

direct liabilities to third parties in respect of risks<br />

set out in Rule 2. A charterer may need to widen<br />

the scope of cover for direct liabilities if he agrees<br />

to take on contractual risks that would not fall to<br />

him as a matter of law (I).<br />

However, a Charterer also needs cover for liability<br />

to indemnify the owner for such risks, set out in<br />

Rule 2 (II).<br />

Let us look at each in turn.<br />

Charterer’s direct liability to<br />

third parties<br />

This can arise either in contract or in tort, as in<br />

the examples below.<br />

Cargo<br />

A charterer will be liable directly to the owner of<br />

damaged or lost cargo when he is the carrier<br />

under his own bill of lading, or, as may happen in<br />

some jurisdictions, if he is considered to be the<br />

carrier under an owner’s bill of lading. Less<br />

commonly, a charterer may face a claim in tort<br />

where the carriage contract is with the shipowner,<br />

especially if the claim is unsecured and the<br />

prospects of recovery from the owner are<br />

uncertain.<br />

Extended Cargo <strong>Cover</strong><br />

A charterer may need an extension to the scope of<br />

his direct P&I cover. He may for example enter<br />

into cargo service contracts that are more onerous<br />

than the Club’s standard terms, Hague-Visby. He<br />

may need cover for geographical or contractual<br />

deviations, such as dry docking with cargo on board.<br />

This extended scope of P&I can also respond to<br />

claims arising from the delivery of cargo without<br />

the production of an original bill of lading provided<br />

the charterer has taken a letter of indemnity on<br />

the standard form of wording recommended by<br />

the International Group. The policy can also cover<br />

claims arising from delivery at a port other than<br />

that mentioned in the bill of lading, ad valorem<br />

bills of lading, rare and valuable cargo, and<br />

liabilities arising from unreasonable periods of<br />

storage. There is a US$50 million limit on cover<br />

although more is available if required. The policy<br />

excludes inherent vice, delay and loss of market.<br />

This extended cargo cover is of course not just<br />

available to charterers but is also available to ship<br />

owner Members.<br />

Pollution<br />

In certain jurisdictions e.g. California, Alaska &<br />

Japan, a charterer can incur direct and even strict<br />

liability for pollution caused by the ship. This may<br />

arise in a variety of ways.<br />

First, by force of law due to the vessel’s operations.<br />

For instance, in the United States Oil Pollution<br />

Act 1990 (OPA 90) provides that “any person<br />

owning, operating or demise chartering the vessel”<br />

may be liable. Although under OPA 90 it seems<br />

that a time charterer is only liable if considered to<br />

be the operator of the vessel as well, the individual<br />

states in the US have been able to enact their own<br />

legislation and most states target, “transporter of<br />

oil”, “person having control over oil”, “person<br />

taking responsibility” so that a time charterer can<br />

be at risk. Additionally, in some states such as<br />

Alaska, strict liability for pollution is also imposed<br />

on cargo interests, so that a charterer who owns<br />

cargo attracts liability through that route.<br />

Third Parties<br />

A charterer may incur liability directly to a<br />

stevedore, or any third party, who suffers personal<br />

injury or property damage as a result of the<br />

charterer’s negligence. How might such claims<br />

arise against the charterer? One example would be<br />

the improper description of noxious cargo,<br />

resulting in injury being caused to an unprotected<br />

stevedore. Another would be a negligent order<br />

resulting in injury to a longshoreman. In some US<br />

circuits, the NYPE clause 8 has been held to shift

5<br />

responsibility for negligence, during loading/<br />

discharging from the owner to the charterer.<br />

Fines<br />

A charterer, if falling into the definition of<br />

“carrier”, can be subject to fines e.g. if in noncompliance<br />

with the US “Automated Manifest<br />

System” Regulations (see Club Circular Ref<br />

10/04). Guidance by the US Customs & Border<br />

Patrol (CBP) advised that it views the carrier as<br />

the entity that “controls” the vessel which includes:<br />

(a) determining ports of call; (b) controlling<br />

loading and discharging cargo; (c) knowledge of<br />

cargo information; (d) issuing of bills of lading; and<br />

(e) the entity which has typically provided the CF<br />

1302 cargo declaration or the cargo information<br />

to prepare the CF 1302 to the vessel agent.<br />

Indemnification of owners<br />

A charterer will have an obligation to indemnify<br />

the owner for third party liability where this<br />

results from a breach of the charterparty by the<br />

charterer, or arises out of activities which are the<br />

charterer’s responsibility.<br />

Typical examples of situations where charterers<br />

may have to indemnify owners for P&I liability<br />

include the following.<br />

Unsafe port<br />

Most charterparties have a safe port or berth<br />

warranty. Sending the ship to an unsafe port in<br />

breach of that warranty could result in P&I<br />

liabilities such as cargo loss or damage, personal<br />

injury, pollution, or even wreck removal.<br />

Crew<br />

A charterer will rarely be liable for the owner’s<br />

crew, but may be responsible to indemnify the<br />

owner for liabilities towards stevedores and other<br />

such personnel.<br />

Dangerous goods<br />

The charterer will be liable to indemnify the<br />

owner for any property damage or personal injury<br />

arising from loading or carriage of dangerous<br />

cargo. If, as happens with increasing frequency,<br />

such cargo has not been properly declared by the<br />

shipper, the charterer will nevertheless remain<br />

liable to the owner for the consequences. Such<br />

consequences can be severe and can extend to<br />

cargo damage, death or personal injury, pollution,<br />

or wreck removal.<br />

Stowage incidents<br />

Under the unamended NYPE clause 8, the<br />

charterer is responsible for loading, stowage, etc. If<br />

as a result of a collapse of stow due to bad stowage,<br />

property damage or personal injury is caused, the<br />

charterer will be liable to indemnify the owner for<br />

such damage or injury.<br />

Bunker quality<br />

In most time charterparties, the charterer should<br />

supply bunkers to the vessel meeting agreed<br />

specifications. He will have to indemnify the<br />

owner for any damages resulting from the supply<br />

of off-specification bunkers.

6<br />

Stevedores<br />

<strong>Liability</strong> for damage caused to the ship by<br />

stevedores. Most time charters, particularly in the<br />

bulk and general cargo trades, have a stevedore<br />

damage clause, which will make the charterer<br />

liable, in certain circumstances, for stevedore<br />

damage.<br />

Safe port<br />

<strong>Liability</strong> for damage to the ship arising from the<br />

failure to provide a safe port or berth.<br />

Marpol Annex VI has introduced restrictions on<br />

the sulphur content of fuel. As a result, a charterer<br />

will now have to supply bunkers not only of a<br />

quality to meet charterparty specifications, but also<br />

to enable the vessel to meet particular port<br />

requirements depending on whether or not the<br />

state has ratified Annex VI. Failure to do so may<br />

result in the charterer having to indemnify the<br />

owner for any resulting loss or liability – which<br />

could include liability for fines.<br />

Poor stowage<br />

Damage to the ship resulting from stowage<br />

contrary to the terms of the charter party, where<br />

the charterer is responsible for loading and<br />

stowage of cargo.<br />

Hazardous or dangerous cargo<br />

Damage to the ship caused by the nature of the<br />

cargo itself, such as where cargoes are corrosive or<br />

explosive.<br />

For example, BIMCO’s “Fuel Sulphur Content<br />

Clause for Time Charter Parties” provides for the<br />

charterer to indemnify the owner for loss or<br />

liability arising from a failure to “permit the Vessel,<br />

at all times, to meet the maximum sulphur content<br />

requirements of any emission control zone when<br />

the Vessel is trading within that zone.”<br />

Pollution<br />

Although most states outside the USA are party to<br />

the CLC (Civil <strong>Liability</strong> Convention) under<br />

which tanker pollution claims are channeled solely<br />

to the registered shipowner, if the cause of the<br />

pollution is something for which the charterer is<br />

responsible (such as in an unsafe port situation)<br />

then the charterer may be obliged to indemnify<br />

the shipowner.<br />

Damage to Hull<br />

The standard P&I cover that is provided to<br />

shipowners excludes cover for damage to the<br />

entered ship. However, for the charterer, such<br />

cover can be important because of the variety of<br />

ways in which a charterer may become liable for<br />

damage to a ship. Many of the above examples of<br />

situations which might give rise to traditional P&I<br />

liabilities are also situations where the chartered<br />

ship may be damaged and the costs thereof may be<br />

recoverable from the charterer.<br />

Bunker quality<br />

Damage to ship’s engines if inferior bunkers have<br />

been provided by the charterer. Off-spec bunkers<br />

can cause damage to the ship’s main and auxiliary<br />

engines, aside from many other difficulties such as<br />

that of finding a place to discharge off-spec fuel,<br />

diverting for new bunkers, and losses resulting<br />

from slow speeding where this is necessary.<br />

General average and salvage liability<br />

General average and salvage contributions in respect<br />

of loss or damage to the ship, Member’s freight at<br />

risk or Member’s bunkers on board the ship.

7<br />

FD&D risks<br />

As a charterer enjoying the<br />

benefits of our flexible cover, you<br />

will get the legal costs of dealing<br />

with any P&I claim included as<br />

part of the package. However,<br />

many charterers will prefer the<br />

added security of cover for freight,<br />

delay and demurrage risks<br />

(FD&D risks).<br />

The additional step of purchasing a cover from the<br />

<strong>UK</strong> Defence Club provides protection for legal<br />

and other costs of resolving a wide range of<br />

disputes about uninsured matters. These include<br />

disputes under charterparties on matters such as<br />

off hire, bunker quality, speed and performance,<br />

unsafe port or berth, laytime and demurrage.<br />

• Prompt legal and practical advice on the merits<br />

of cases<br />

• The way cases should be handled and the course<br />

they should follow<br />

• Negotiating with opponents<br />

• Finding the best lawyers and experts for each case<br />

• Clear, practical communication with you, the<br />

lawyers and the experts<br />

• Co-ordination of large cases<br />

• Monitoring of costs and fees<br />

• Advice on drafting documentation<br />

The <strong>UK</strong> Defence Club is the largest organisation<br />

of its kind and has access to the same international<br />

network of correspondents, lawyers and other<br />

experts as are used by <strong>UK</strong> P&I. The same <strong>UK</strong> P&I<br />

Club underwriting contact that provides your<br />

charterers P&I and hull risks is also able to arrange<br />

an entry with the Defence Club to protect this<br />

other important aspect of your exposure. <br />

In addition to providing cover, the Defence Club<br />

and its managers offer advice on:<br />

Keeping ships on the move<br />

The <strong>UK</strong> Club provides insurance to around 5,000 charter entries every<br />

year. These entries have generated an average of 1,700 claims each year,<br />

which represents a considerable fund of expertise in this specialist area.<br />

The <strong>UK</strong> Club’s network of offices in Europe,<br />

Asia-Pacific and the Americas are well placed to<br />

support them. In turn, that network can call on<br />

the Club’s correspon-dency network of some 350<br />

legal, commercial and technical specialists for local<br />

support in the handling of claims.<br />

development of streamlined declaration systems to<br />

minimise the administrative burden of obtaining<br />

cover for a continually changing charter fleet. <br />

As well as direct problem solving expertise, they<br />

provide the essential support and guarantee systems<br />

that enable a ship to sail with minimum delay in<br />

the event of arrest or other legal detentions.<br />

Minimising delay means minimising costs.<br />

The <strong>UK</strong> P&I Club recognises that ease of use is<br />

essential for any charterers’ package. The volume of<br />

charter business handled by the Club has led to the

8<br />

Flexible options<br />

Charterers’ Bunkers<br />

As a charterer you risk sustaining your own losses<br />

where an accident is serious enough to cause loss<br />

of the ships bunkers. You may therefore want to<br />

include in your cover protection for loss of or<br />

damage to charterers’ bunkers reasonably attributable<br />

to fire or explosion, stranding, grounding, sinking<br />

or capsizing of the entered ship, or to collision of<br />

the entered ship with any external object.<br />

This cover is based on Institute clauses including<br />

the relevant Wars and Strikes Clauses and available<br />

up to a limit of US$2 million any accident or<br />

occurrence.<br />

Charterers’ Freight<br />

This cover is provided under the Institute Time or<br />

Voyage Clauses Freight (1.11.95) for up to US$5<br />

million any one accident or occurrence. <strong>Cover</strong> can<br />

be obtained for all risks or as total loss only, but<br />

including salvage charges and sue and labour.<br />

Blocking and Trapping<br />

If a charterer should be caught by a closure or<br />

restriction of navigation within his declared<br />

trading area, the daily time charter hire payments<br />

can be recovered under this cover.<br />

Passenger Ships Special Risks<br />

The cover available to owner Members in respect<br />

of additional risks arising from passenger can<br />

also be included in a charterer’s package.<br />

Such risks include loss of effects, liabilities to<br />

passengers arising away from the ship such as<br />

additional compensation and legal costs.<br />

Further information on special passenger<br />

related risks can be obtained from your normal<br />

underwriting contact.<br />

Causes of such delay or detention can include<br />

breakdown of locks or seaway equipment,<br />

blockage by sunken or stranded objects or ice, and<br />

strikes or stoppages by any personnel essential to<br />

the transit of a seaway. The cover can also be<br />

extended to include additional expenses incurred<br />

in re-routing ships to avoid such a delay.<br />

Further assistance<br />

The <strong>UK</strong> P&I Club will be pleased to provide you<br />

or your broker with further information on how<br />

the Club’s charterers’ covers can be tailored to the<br />

specific needs of your current charter fleet.<br />

Either you or your broker are welcome to contact<br />

the underwriting department in London directly.<br />

The direct contact details of all individual<br />

underwriters are listed in the “Making Contact”<br />

section of the <strong>UK</strong> P&I Club website –<br />

www.ukpandi.com. That website enables you to<br />

identify the individual underwriter specialising in<br />

your particular area.<br />

The underwriting department can be contacted by<br />

fax at +44 20 7621 9761 or by email at<br />

underwriting.ukclub@thomasmiller.com.<br />

Alternatively, the Club’s managers and agents can<br />

be contacted at the numbers provided at the foot<br />

of this brochure for more information.<br />

If you require more general information on the<br />

<strong>UK</strong> P&I Club, the Club’s marketing department<br />

would welcome your enquiry. Contact Nick<br />

Whitear (nick.whitear@thomasmiller.com) or<br />

Jenny Whitehead<br />

(jenny.whitehead@thomasmiller.com).<br />

Alternatively, the <strong>UK</strong> Club website is an<br />

exhaustive source of information on the Club and<br />

P&I issues in general.<br />

For more information, please contact:<br />

Thomas Miller P&I Ltd – London<br />

Tel: +44 20 7283 4646 Fax: +44 20 7283 5614<br />

Thomas Miller (Hellas) Ltd – Piraeus H1<br />

Tel: +30 210 42 91 200 Fax: +30 210 42 91 207/8<br />

Thomas Miller (Americas) Inc – New Jersey<br />

Tel: +1 201 557 7300 Fax: +1 201 946 0167<br />

Thomas Miller (Hong Kong) Ltd – Hong Kong<br />

Tel: + 852 2832 9301 Fax: + 852 2574 5025<br />

www.ukpandi.com