2009 PROCEEDINGS - Public Relations Society of America

2009 PROCEEDINGS - Public Relations Society of America

2009 PROCEEDINGS - Public Relations Society of America

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

and investor behaviors explain very little <strong>of</strong> the variance in investor preferences for<br />

investing information types, qualities, and sources. Thus no meaningful conclusions can<br />

be made to answer RQ1 or RQ 2.<br />

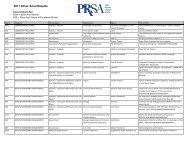

RQ 3 addressed the association between the seven investing information content<br />

types with the nine sources <strong>of</strong> investing information. Regressions to address this question<br />

were all significant, and seven <strong>of</strong> the nine regressions had R 2 values were larger than .1<br />

(see Table 2). The types <strong>of</strong> content investors seek account for 22% <strong>of</strong> the variance in<br />

seeking information from an annual report (F(13, 279) = 6.035, p < .01); 17% <strong>of</strong> the<br />

variance in seeking information from the news media (F(13, 279) = 4.428, p < .01); 15%<br />

<strong>of</strong> the variance in seeking information from an analyst report (F(13, 279) = 3.871, p <<br />

.01); and 14% <strong>of</strong> the variance in seeking information from a conference call (F(13, 279)<br />

= 3.552, p < .01) and a news release (F(13, 279) = 3.612, p < .01). Significant regression<br />

equations were also found when associating types <strong>of</strong> content with an annual meeting<br />

(F(13, 278) = 3.126, p < .01), R 2 = .128, and with corporate advertising (F(13, 277) =<br />

2.975, p < .01), R 2 = .123.<br />

Examination <strong>of</strong> part correlations provides some interesting answers to this<br />

research question. Seeking information about a company’s management is the largest<br />

portion (6.8%) <strong>of</strong> the 21.9% variance explaining when investors will seek information<br />

from annual reports; 4.3% <strong>of</strong> the 14.2% variance explaining when investors seek<br />

information from conference calls, and 6% <strong>of</strong> the 12.8% variance explaining their<br />

seeking information from annual meetings. Investors seeking information about a<br />

company’s products is more associated with their seeking information from news releases<br />

(2% <strong>of</strong> 14.4% variance explained) and the news media (1.8% <strong>of</strong> the 17.1% variance<br />

explained). However, projected performance is the variable explaining the largest part<br />

(2.8%) <strong>of</strong> the total variance explaining when investors seek out the news media as a<br />

source <strong>of</strong> investing information. Projected performance also appears to be the largest<br />

predictor (6.7% <strong>of</strong> the 15.3% variance explained) <strong>of</strong> investors seeking analyst reports.<br />

Seeking information regarding a company’s social responsibility accounts for most <strong>of</strong> the<br />

variance (2.9% <strong>of</strong> the 12.3%) explaining considering information from advertising.<br />

Investors’ concern with a company’s projected performance is more associated with their<br />

seeking information from analysts (6.7% <strong>of</strong> the 15.3% variance explained in the<br />

equation).<br />

>>Insert Table 2 here