Trust Board papers November 2012 - Barking Havering and ...

Trust Board papers November 2012 - Barking Havering and ...

Trust Board papers November 2012 - Barking Havering and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

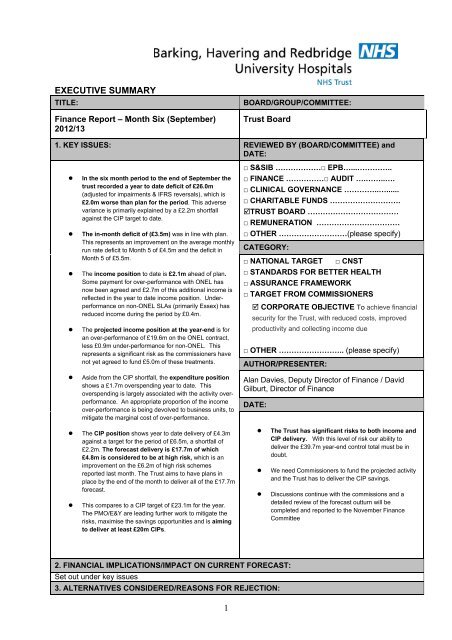

EXECUTIVE SUMMARY<br />

TITLE:<br />

Finance Report – Month Six (September)<br />

<strong>2012</strong>/13<br />

BOARD/GROUP/COMMITTEE:<br />

<strong>Trust</strong> <strong>Board</strong><br />

1. KEY ISSUES: REVIEWED BY (BOARD/COMMITTEE) <strong>and</strong><br />

DATE:<br />

• In the six month period to the end of September the<br />

trust recorded a year to date deficit of £26.0m<br />

(adjusted for impairments & IFRS reversals), which is<br />

£2.0m worse than plan for the period. This adverse<br />

variance is primarily explained by a £2.2m shortfall<br />

against the CIP target to date.<br />

• The in-month deficit of (£3.5m) was in line with plan.<br />

This represents an improvement on the average monthly<br />

run rate deficit to Month 5 of £4.5m <strong>and</strong> the deficit in<br />

Month 5 of £5.5m.<br />

• The income position to date is £2.1m ahead of plan.<br />

Some payment for over-performance with ONEL has<br />

now been agreed <strong>and</strong> £2.7m of this additional income is<br />

reflected in the year to date income position. Underperformance<br />

on non-ONEL SLAs (primarily Essex) has<br />

reduced income during the period by £0.4m.<br />

• The projected income position at the year-end is for<br />

an over-performance of £19.6m on the ONEL contract,<br />

less £0.9m under-performance for non-ONEL. This<br />

represents a significant risk as the commissioners have<br />

not yet agreed to fund £5.0m of these treatments.<br />

• Aside from the CIP shortfall, the expenditure position<br />

shows a £1.7m overspending year to date. This<br />

overspending is largely associated with the activity overperformance.<br />

An appropriate proportion of the income<br />

over-performance is being devolved to business units, to<br />

mitigate the marginal cost of over-performance.<br />

• The CIP position shows year to date delivery of £4.3m<br />

against a target for the period of £6.5m, a shortfall of<br />

£2.2m. The forecast delivery is £17.7m of which<br />

£4.8m is considered to be at high risk, which is an<br />

improvement on the £6.2m of high risk schemes<br />

reported last month. The <strong>Trust</strong> aims to have plans in<br />

place by the end of the month to deliver all of the £17.7m<br />

forecast.<br />

• This compares to a CIP target of £23.1m for the year.<br />

The PMO/E&Y are leading further work to mitigate the<br />

risks, maximise the savings opportunities <strong>and</strong> is aiming<br />

to deliver at least £20m CIPs.<br />

□ S&SIB ………………□ EPB…...…………..<br />

□ FINANCE ……………□ AUDIT ….……..….<br />

□ CLINICAL GOVERNANCE …………..…......<br />

□ CHARITABLE FUNDS ……………………….<br />

TRUST BOARD ………………………………<br />

□ REMUNERATION ……………………………<br />

□ OTHER ………………………(please specify)<br />

CATEGORY:<br />

□ NATIONAL TARGET □ CNST<br />

□ STANDARDS FOR BETTER HEALTH<br />

□ ASSURANCE FRAMEWORK<br />

□ TARGET FROM COMMISSIONERS<br />

CORPORATE OBJECTIVE To achieve financial<br />

security for the <strong>Trust</strong>, with reduced costs, improved<br />

productivity <strong>and</strong> collecting income due<br />

□ OTHER …………………….. (please specify)<br />

AUTHOR/PRESENTER:<br />

Alan Davies, Deputy Director of Finance / David<br />

Gilburt, Director of Finance<br />

DATE:<br />

• The <strong>Trust</strong> has significant risks to both income <strong>and</strong><br />

CIP delivery. With this level of risk our ability to<br />

deliver the £39.7m year-end control total must be in<br />

doubt.<br />

• We need Commissioners to fund the projected activity<br />

<strong>and</strong> the <strong>Trust</strong> has to deliver the CIP savings.<br />

• Discussions continue with the commissions <strong>and</strong> a<br />

detailed review of the forecast outturn will be<br />

completed <strong>and</strong> reported to the <strong>November</strong> Finance<br />

Committee<br />

2. FINANCIAL IMPLICATIONS/IMPACT ON CURRENT FORECAST:<br />

Set out under key issues<br />

3. ALTERNATIVES CONSIDERED/REASONS FOR REJECTION:<br />

1

![[4] Biopsy Leaflet.pub - Barking, Havering and Redbridge University ...](https://img.yumpu.com/51285530/1/190x134/4-biopsy-leafletpub-barking-havering-and-redbridge-university-.jpg?quality=85)