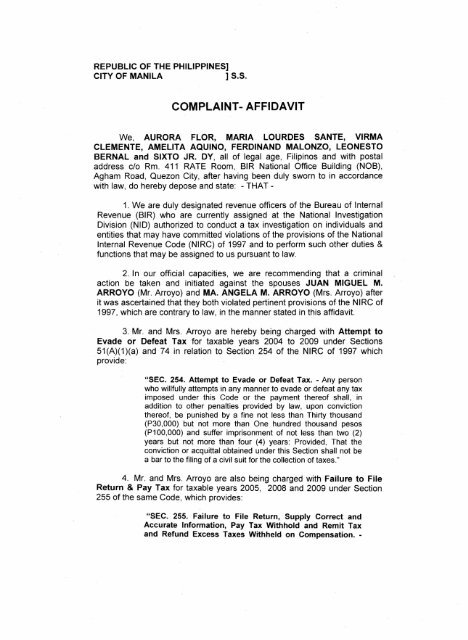

COMPLAINT- AFFIDAVIT

COMPLAINT- AFFIDAVIT

COMPLAINT- AFFIDAVIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

REPUBLIC OF THE PHILIPPINES]<br />

CITY OF MANILA ] 5.5.<br />

<strong>COMPLAINT</strong>- <strong>AFFIDAVIT</strong><br />

We, AURORA FLOR, MARIA LOURDES SANTE, VIRMA<br />

CLEMENTE, AMELITA AQUINO, FERDINAND MALONZO, LEONESTO<br />

BERNAL and SIXTO JR. DY, a" of legal age, Filipinos and with postal<br />

address c/o Rm. 411 RATE Room, BIR National Office Building (NOB),<br />

Agham Road, Quezon City, after having been duly sworn to in accordance<br />

with law, do hereby depose and state: - THAT -<br />

1. We are duly designated revenue officers of the Bureau of Internal<br />

Revenue (BIR) who are currently assigned at the National Investigation<br />

Division (NID) authorized to conduct a tax investigation on individuals and<br />

entities that may have committed violations of the provisions of the National<br />

Internal Revenue Code (NIRC) of 1997 and to perform such other duties &<br />

functions that may be assigned to us pursuant to law.<br />

2. In our official capacities, we are recommending that a criminal<br />

action be taken and initiated against the spouses JUAN MIGUEL M.<br />

ARROYO (Mr. Arroyo) and MA. ANGELA M. ARROYO (Mrs. Arroyo) after<br />

it was ascertained that they both violated pertinent provisions of the NIRC of<br />

1997, which are contrary to law, in the manner stated in this affidavit.<br />

3. Mr. and Mrs. Arroyo are hereby being charged with Attempt to<br />

Evade or Defeat Tax for taxable years 2004 to 2009 under Sections<br />

51(A)(1)(a) and 74 in relation to Section 254 of the NIRC of 1997 which<br />

provide:<br />

"SEC. 254. Attempt to Evade or Defeat Tax. - Any person<br />

who willfully attempts in any manner to evade or defeat any tax<br />

imposed under this Code or the payment thereof shall, in<br />

addition to other penalties provided by law, upon conviction<br />

thereof, be punished by a fine not less than Thirty thousand<br />

(P30,OOO)but not more than One hundred thousand pesos<br />

(P100,OOO)and suffer imprisonment of not less than two (2)<br />

years but not more than four (4) years: Provided, That the<br />

conviction or acquittal obtained under this Section shall not be<br />

a bar to the filing of a civil suit for the collection of taxes."<br />

4. Mr. and Mrs. Arroyo are also being charged with Failure to File<br />

Return & Pay Tax for taxable years 2005, 2008 and 2009 under Section<br />

255 of the same Code, which provides:<br />

"SEC. 255. Failure to File Return, Supply Correct and<br />

Accurate Information, Pay Tax Withhold and Remit Tax<br />

and Refund Excess Taxes Withheld on Compensation. -

Any person required under this Code or by rules and<br />

regulations promulgated thereunder to pay any tax, make a<br />

return, keep any record, or supply such correct and accurate<br />

information, who willfully fails to pay such tax, make such<br />

return, keep such record, or supply correct and accurate<br />

information, or withhold or remit taxes withheld, or refund<br />

excess taxes withheld on compensation, at the time or times<br />

required by law or rules and regulations shall, in addition to<br />

other penalties provided by law, upon conviction thereof, be<br />

punished by a fine of not less than Ten thousand pesos<br />

(P10,000) and suffer imprisonment of not less than one (1)<br />

year but not more than ten (10) years. "<br />

5. Mr. Arroyo is a registered taxpayer of Revenue District No. 39,<br />

South Quezon City with TIN:914-841-267-000. He was the Vice-Governor<br />

of Pampanga province for the years 2001 to 2004, and was later elected as<br />

Congressman of the 2 nd District of Pampanga for two (2) consecutive terms<br />

from years 2004 to present.<br />

6. Mrs. Arroyo is a registered One Time Transaction (ONETT)<br />

taxpayer of Revenue District No. 50, South Makati with TIN:185-405-985-<br />

000. She and Mr. Arroyo were married last June 23, 2002. Both may be<br />

served with summons and other processes of this Honorable Office at the<br />

following address/es:<br />

Respondent<br />

Address/es<br />

#15 Badjao St., La Vista Subd., Katipunan Ave., a.c.<br />

Juan Miguel M. Arroyo<br />

House of Representatives<br />

Batasang Pambansa Complex, Constitution Hills,<br />

a.c.<br />

#15 Badjao St., La Vista Subd., Katipunan Ave., a.c.<br />

Ma. Angela M. Arroyo<br />

#132 Cambridge Circle, North Forbes Park Subd.<br />

Makati City<br />

7. As resident citizens of the Philippines, Mr. & Mrs Arroyo are<br />

mandated by law to declare their estimated income for each taxable year as<br />

well as to file the required tax returns and to pay the corresponding taxes

due thereon as required by Sections 24(A)(1)(a)1, 51(A)(1)(a)2 and 74(A)3 of<br />

the NIRC of 1997.<br />

Moreover, as an elected public official from years 2001 to 2010, Mr.<br />

Arroyo is mandated under R.A. No. 6713 to accomplish and annually submit<br />

declarations under' oath of his Statement of Assets, Liabilities or Networth<br />

(SALN), including that of his spouse and children under 18 years of age who<br />

are living in their household.<br />

I Section 24. Income Tax Rates.<br />

(A) Rates of Income Tax on Individual Citizen and Individual Resident Alien of the<br />

Philippines.<br />

(1) An income tax is hereby imposed:<br />

(a) On the taxable income defined in Section 31 of this Code, other than income subject to<br />

~x .<br />

under Subsections (8), (C) and (0) of this Section, derived for each taxable year from<br />

all<br />

sources within and without the Philippines be every individual citizen of the<br />

Philippines<br />

residing therein;<br />

xxx xxx xxx<br />

2 Section 51. Individual Return. -<br />

(A) Requirements. -<br />

(1) Except as provided in paragraph (2) of this Subsection, the following individuals are<br />

required to file an income tax return: .<br />

(a) Every Filipino citizen residing in the Philippines;<br />

(b) Every Filipino citizen residing outside the Philippines, on his income from sources<br />

within<br />

the Philippines;<br />

(c) Every alien residing in the Philippines, on income derived from sources within<br />

the<br />

Philippines; and<br />

(d) Every nonresident alien engaged in trade or business or in the exercise of<br />

profession<br />

in the Philippines.<br />

xxx xxx xxx<br />

3 Section 74. Declaration of Income Tax for Individuals. -<br />

(A) In General. - Except as otherwise provided in this Section, every individual subject to<br />

income tax under Sections 24 and 25(A) of this Title, who is receiving self-employment<br />

income, whether it constitutes the sole source of his income or in combination with<br />

salaries, wages and other fixed or determinable income, shall make and file a declaration<br />

of his estimated income for the current taxable year on or before April 15 of the same<br />

taxable year. In general, self-employment income consists of the earnings derived by the<br />

individual from the practice of profession or conduct of trade or business carried on by him<br />

as a sole proprietor or by a partnership of which he is a member. Non-resident Filipino<br />

citizens, with respect to income from without the Philippines, and non-resident aliens not<br />

engaged in trade or business in the Philippines, are not required to render a declaration of<br />

estimated income tax. The declaration shall contain such pertinent information as the<br />

Secretary of Finance, upon recommendation of the Commissioner, may, by rules and<br />

regulations prescribe. An individual may make amendments of a declaration filed during<br />

the taxable year under the rules and regulations prescribed by the Secretary of Finance,<br />

upon recommendation of the Commissioner.<br />

xxx xxx xxx

8. Based on the information and documents gathered during our<br />

investigation, it was disclosed that Mr. & Mrs. Arroyo were able to acquire<br />

real, personal and other properties for the years 2004 to 2009, which are<br />

worth several millions.<br />

8.1. Among those properties are residential houses in Lubao,<br />

Pampanga & La Vista Subdivision in Quezon City, motor vehicles,<br />

stock shares, jewelries, clothes and other personal effects as<br />

enumerated in the Statement of Assets, Liabilities & Net Worth<br />

(SALNs) of Mr. Arroyo as of December 310f the years 2002 to 2009.<br />

Copies of the said SALNs are hereto attached as Annexes "A" to "G".<br />

9. Verification of Mr. Arroyo's tax records with the BIR shows that he<br />

originally registered on April 18, 2001 as a One Time Transaction (ONETT)<br />

taxpayer with Revenue District No. 21 B, South Pampanga under TIN:210-<br />

543-613-000. Later, on June 19, 2002, he again registered with Revenue<br />

District No. 39, South Quezon City under TIN:914-841-267-000. Thus, on<br />

July 22, 2009, the ONETT TIN of Mr. Arroyo was ordered cancelled due to<br />

multiple TIN. A copy of the certification issued by Maria Elena A. Nuguid,<br />

Chief of the Taxpayer Service Section of Revenue District No. 21 B, South<br />

Pampanga, certifying the cancellation of the ONETT TIN of Mr. Arroyo is<br />

hereto attached as Annex "H".<br />

1O. The tax records of Mrs. Arroyo indicate that she registered as a<br />

One Time Transaction (ONETT) taxpayer of Revenue District No. 50, South<br />

Makati on September 11, 2002 under TIN:185-405-985-000, and that she<br />

failed to file any Income Tax Return. Copies of the registration of Mrs.<br />

Arroyo as ONETT taxpayer and the certification of her non-filing of any<br />

Income Tax Return are hereto attached as Annexes "I" and "J",<br />

respectively.<br />

11. Despite the receipt of. substantial amounts of income, as<br />

shown by their acquisition of numerous properties, Mr. & Mrs. Arroyo had<br />

repeatedly failed to file any Annual Income Tax Return (ITR) and to pay the<br />

corresponding taxes and for the years that Mr. and Mrs. Arroyo filed their<br />

ITRs, they understated their income.<br />

12. Verifications made with Revenue District Office No. 39, South<br />

Quezon City and Revenue District Office No. 21, Pampanga revealed that<br />

Mr. and Mrs. Arroyo did not file any ITR for the following taxable years:<br />

Taxpayerls<br />

Taxable' Yearls<br />

Juan Miquel M. Arroyo 2005, 2008 & 2009<br />

Ma. Angela M. Arroyo 2003 to 2009<br />

A copy of the Certifications issued by the said SIR Offices are<br />

hereto attached as Annexes "K" and "L", respectively.

13. The fact of non-filing of Annual ITRs by Mr. and Mrs. Arroyo<br />

for the said years is confirmed by the Certification issued by Victoria V.<br />

Santos, Assistant Commisioner for Information Operations Service of the<br />

SIR on March 22, 2011. The same Certification also shows the amount of<br />

income declared and the corresponding income taxes paid by Mr. and Mrs.<br />

Arroyo for taxable years 2004, 2006, and 2007. A copy of the Certification<br />

is hereto attached as Annex "Mil.<br />

14. Through the use of the Net Worth Method of tax investigation,<br />

it was ascertained that Mr. Arroyo had substantially underdeclared his<br />

income for taxable years 2004 to 2009.<br />

15. Using the Net Worth Method, the unreported income of Mr. &<br />

Mrs. Arroyo were established by a comparison made between their<br />

increase in net worth and the reported taxable income over time in order to<br />

determine the legitimacy of the taxpayer's reported income. A table showing<br />

the increase in the networth of the spouses is hereto attached as Annex<br />

UN".<br />

15.1. The Net Worth Method of proof is a long-established<br />

indirect method of proof regularly used in establishing taxable<br />

income in criminal tax cases. This method of proof is useful in<br />

reconstructing taxable income when the government is unable to<br />

establish income through direct evidence.<br />

15.2. The Net Worth Method was first used in the U.S. in the<br />

case of Capone v. United States. In the Philippines, the use of the<br />

said method as a way of reconstructing income was sanctioned by<br />

the Supreme Court in the cases of Eugenio Perez vs. CTA & CIR<br />

(G.R. No. L-10507 dated May 30, 1958); Jose Avelino vs. CIR (G.R.<br />

No. L-14847 dated Sept. 19, 1961 and G.R. No. L-17715 dated July<br />

31, 1963); CIR vs. William Li Yao (G.R. No. L-11875 dated<br />

December 28, 1963); and Maria S. Castro vs. CIR (G.R. No. L-12174<br />

dated April 20, 1962).<br />

15.3. This method is a re-statement of a basic accounting<br />

principle which states that assets minus liabilities equals<br />

networth. Thus, under this method, "the taxpayer's networth is<br />

determined both at the beginning and at the end of the same taxable<br />

year. The increase or decrease in networth adjusted by adding all<br />

non-deductible items and subtracting therefrom non-taxable receipts.<br />

The resultant figure is the taxable net income before statutory<br />

personal and additional exemptions. The general theory underlying<br />

this method is that the taxpayer's money and other assets in excess<br />

of liabilities and after accurate and proper adjustment of nondeductible<br />

and non-taxable items not accounted for in his tax return<br />

is deemed to be unreported income. Otherwise stated, the theory is<br />

that the unexplained increase in networth of a taxpayer is presumed.

to be derived from taxable income." [see Aban, Benjamin B., Law of<br />

Basic Taxation in the Philippines, 1994, p. 116)].<br />

16. Thus, the difference between the declared income of Mr. &<br />

Mrs. Arroyo per ITRs for taxable years 2004, 2006, and 2007 and total<br />

amount of unreported income for the same years constitute a substantial<br />

underdeclaration of more than thirty (30%) percent, and such<br />

underdeclaration is considered as prima facie evidence of a fraudulent<br />

return under Sec. 248(B) of the NIRC of 1997. The act of non-filing of ITR<br />

for taxable years 2005, 2008 and 2009 by Mr. and Mrs. Arroyo is evident of<br />

their fraudulent scheme to defeat payment of taxes. A table showing the<br />

computation of the tax liabilities of the spouses for taxable years 2004 to<br />

2009 is hereto attached as Annex "0".<br />

16.1. The tax liabilities of Mr. and Mrs. Arroyo is summarized<br />

as follows:<br />

2004 2005 2006 2007 2008 2009<br />

BASICTAX DUE 21,717,225.56 101,000.00 3,457,960.00 2,130,129.50 765,000.01 636,999.78<br />

SURCHARGE 50% 10,858,612.78 50,500.00 1,728,980.00 1,065,064.75 382,500.01 318,499.89<br />

INTEREST(UP TO<br />

APRIL 15, 2011) 26,060,670.67 101,000.00 2,766,368.00 1,278,077.70 306,000.00 127,399.96<br />

DEFICIENCY<br />

INCOME TAX 58,636,509.01 252,500.00 7,953,308.00 4,473,271.95 1,453,500 .02 1,082,899.63<br />

17. Clearly, such continuous and deliberate failure of Mr. & Mrs.<br />

Arroyo to file the mandated ITRs for several years and their substantial<br />

underdeclaration of income demonstrate their propensity and willful intent to<br />

evade the taxes due the government.<br />

18. The elements of Section 254 of the NIRC of 1997 are:<br />

a. a tax imposed under the NIRC of 1997;<br />

b. a person, natural or juridical, is liable to that tax;<br />

and<br />

c. such person willfully attempts in any manner to<br />

evade or defeat such tax.<br />

19. From the foregoing narration, it can be clearly seen that Mr.<br />

and Mrs. Arroyo were liable to pay taxes for taxable years 2004 to 2009 but<br />

managed to evade payment thereof by non-filing of ITRs for taxable years<br />

2005, 2008, and 2009, and by substantially underdeclaring their income for<br />

taxable years 2004, 2006 and 2007. Such acts of non-filing of ITR and

underdeclaration of income show a scheme calculated to willfully defeat<br />

payment of correct amount of taxes badly needed by the government.<br />

20. The elements of Section 255 of the NIRC of 1997 are:<br />

a. a person is required under the NIRC of 1997, or<br />

by rules and regulations, to pay any tax, make a return,<br />

keep any record, or supply correct and accurate<br />

information;<br />

b. at the time or times required by law or rules and<br />

regulations;<br />

c. such person willfully fails to make such return,<br />

keep such record, supply such correct and accurate<br />

information, or withhold or remit taxes withheld, or refund<br />

excess taxes withheld on compensation; and<br />

d. as a result, such person failed to pay the correct<br />

tax.<br />

21. As earlier discussed, Mr. and Mrs. Arroyo are required to file<br />

their annual income tax returns which they willfully failed to do, as<br />

evidenced by their repeated non-filing of ITR for taxable years 2005, 2008,<br />

and 2009.<br />

22. This Affidavit is being executed to attest to the truth of the<br />

foregoing, and to cause the institution of the corresponding criminal<br />

complaints against JUAN MIGUEL M. ARROYO and MA. ANGELA M.<br />

ARROYO for the aforesaid crimes defined and punished under the NIRC of<br />

1997.<br />

Affiants further say no more.<br />

City of Manila, __ day of April 2011.<br />

Affiants<br />

CERTIFICATION

Subscribed and sworn to before me this __ day of April 2011, in the<br />

City of Manila. This is to certify that the affiants personally appeared before<br />

me and verified that they executed this affidavit-complaint, has read the<br />

same and that the contents thereof are true and correct of their own<br />

knowledge and information and based on the available records.<br />

STATE PROSECUTOR